Summary:

- CCL is no longer a buy at these inflated levels, with the stock similarly recording massive recoveries since our previous article.

- This cadence is likely attributed to the excellent expansion in consumer deposits and bookings through 2024, with the management also guiding a return to positive adj EPS by FQ3’23.

- However, the elevated interest rate environment remains a headwind to its profitability, thanks to the pre-pandemic induced long-term debts.

- Given its guidance of minimal FCF generation over the next few years, it remains to be seen if we may see CCL achieve its ambitious target of 3.5x in debt to EBITDA ratio.

- Combined with CCL offering underwhelming 5Y and 10Y returns compared to RCL and SPY, the stock is neither a viable high growth stock nor an income stock.

heyengel/iStock via Getty Images

Investment Thesis

We previously covered Carnival Corporation & plc (NYSE:CCL) in July 2022, suggesting the stock’s potential volatility due to its inflated debts, net losses, and peak recessionary fears then. Then again, we also expected cruise bookings to improve by 2023, triggering a speculative buy rating for investors with higher risk tolerance, due to its compressed stock prices at that time.

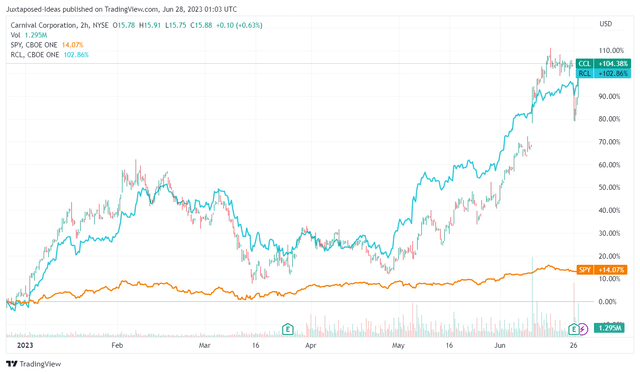

CCL 6M Stock Returns

True enough, CCL has already rallied by +104.38% since the December 2022 bottom, more impressive than Royal Caribbean Cruises’ (NYSE:RCL) recovery of +102.86% and the SPY at +14.07% at the time of writing.

While this cadence may usually delight shareholders that have added to the recent bottom, it remains to be seen how the former may perform moving forward, especially due to the mixed FQ2’23 results thus far.

CCL recorded excellent revenues of $4.91B (+10.8% QoQ/ +104.5% YoY), but elevated operating expenses of $2.2B (+8.3% QoQ/ +12.2% YoY) by the latest quarter.

This is on top of the cruise liner’s expanding interest expenses of $542M (inline QoQ/ +46.4% YoY), thanks to the hyper-pandemic-induced long-term debts of $31.92B (-2.3% QoQ/ +9% YoY), compared to FY2019 levels of $9.68B.

CCL’s Free Cash Flow generation remains underwhelming at $625M (+334% QoQ/ +228.3% YoY) by the latest quarter, due to its growing capital expenditure of $697M (-35.1% QoQ/ +41.9% YoY), as new fleets are delivered through 2025. Therefore, it remains to be seen when the company may deleverage its balance sheet, due to its underwhelming cash/ short-term investments of $4.46B (-18.1% QoQ/ -38% YoY).

With $1.78B of long-term debts due over the next twelve months, we may see the cruise liner further draw down its revolving credit agreement of $3.2B, potentially expanding its interest expenses in the near term. Then again, investors need not fear any share dilution from capital raise ahead, as iterated by the management in the previous FQ1’23 earnings call.

In addition, more consumers have already pre-booked their trips with CCL, resulting in total customer deposits of $7.2B (+26.3% QoQ/ +44% YoY) and the management’s excellent guidance of 100% in FY2023 occupancy rate.

Due to the promising updates in its cancellation policy, it appears that the cruise liner’s top and bottom-line expansion may be secured for now, with the management already guiding FQ3’23 adj EPS of $0.73 (+ 345.1% QoQ/ +146.3% YoY) at the midpoint.

However, with the Fed guiding two more rate hikes in 2023 and a slower-than-expected fight toward a 2% inflation rate, we may see discretionary spending further tighten through 2023, if not 2024. The elevated interest rate environment may also put further downward pressure on CCL’s profitability in the intermediate term.

While the cruise liner’s management has guided robust 2024 booking levels and growing consumer deposits, it remains to be seen if this optimistic cadence may be sustained over the next few quarters, as similarly experienced by RCL thus far:

The fact that demand for the coming nine months is so much stronger than our already robust expectations says a lot about the strength of the consumer and the strength of our brands [RCL]. The acceleration of demand, coupled with our team’s incredible execution is also translating into higher revenue and earnings expectations for the full year. (Source: Seeking Alpha)

For now, CCL has guided an annual cash flow from operations of $5B through 2026, while pausing its new build commitments, once 2025 deliveries are completed. This may have resulted in the management’s guidance of $3B in annual FCF generation over the next few years.

Then again, it remains to be seen if the cruise liner may achieve its target of 3.5x debt to EBITDA ratio by 2026, which we believe to be a rather lofty goal due to its current ratio of 11.4x and end-of-year approximate of 7.64x, based on its FY2023 projection of $4.175B in adj EBITDA and long-term debts of $31.92B.

Only time may tell.

So, Is CCL Stock A Buy, Sell, or Hold?

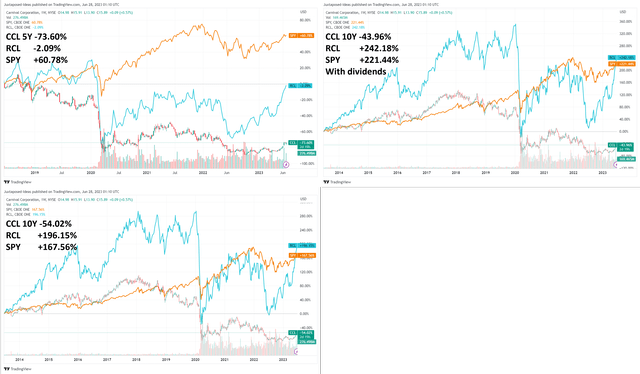

CCL 5Y & 10Y Stock Price

Unfortunately, the answer to the question will be no. While past performance may not be indicative of future results, CCL has historically underperformed with 5Y stock returns of -73.60%, against the RCL at -2.09% and SPY at +60.78%.

The same has been observed since 2013, with CCL generating 10Y stock returns of -54.02%, against the RCL at +196.15% and SPY at +167.56%, without dividends. Since dividends are unlikely to be reinstated in the near term, the stock is neither high growth nor income stock, with it likely being a value play for now.

Therefore, long-term shareholders that have dollar cost averaged at lower levels may consider monitoring its performance through the upcoming bull run.

As for those who have yet to establish a position, we do not recommend adding the CCL stock here, due to the reduced margin of safety to our price target of $18.00. This is based on its 3Y pre-pandemic mean of 13.75x and the market analysts’ FY2025 EPS projection of $1.31. Do not chase this rally.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The analysis is provided exclusively for informational purposes and should not be considered professional investment advice. Before investing, please conduct personal in-depth research and utmost due diligence, as there are many risks associated with the trade, including capital loss.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.