Summary:

- The proposed merger between Microsoft Corporation and Activision Blizzard, Inc. has faced regulatory challenges, particularly from the UK’s Competition and Markets Authority.

- Microsoft remains persistently committed to the deal and pledges to keep Activision games on other platforms.

- Despite these assurances, the odds of the merger completion are still relatively low (but the payoff is substantial) due to the recent CMA decision.

- Downside risk appears limited, especially as the gaming company’s financial outlook is positive with strong sales from recently launched Diablo IV.

- Given the $10 per share potential upside if the merger goes through and the FTC hearing is positive, the recommendation is to remain long on Activision, but be mindful of the potential for a significant stock price drop if the CMA decision holds.

Loren Elliott/Getty Images News

Activision Blizzard, Inc. (NASDAQ:ATVI) and Microsoft Corporation’s (MSFT) proposed merger has faced several regulatory complications since its announcement. Most importantly, the UK’s Competition and Markets Authority (CMA) expressed concerns over Microsoft’s foothold in the cloud gaming industry. It doesn’t make much sense to me, as I explained here. However, Microsoft has not wavered and remains dedicated to the deal, appealing the Competition Appeal Tribunal (CAT) and concurrently battling the FTC. The FTC hearing concluded today, and it hasn’t gone particularly well for the agency. Fellow contributors Andrew Walker and Chris DeMuth shared their entertaining – if nothing else – takes here.

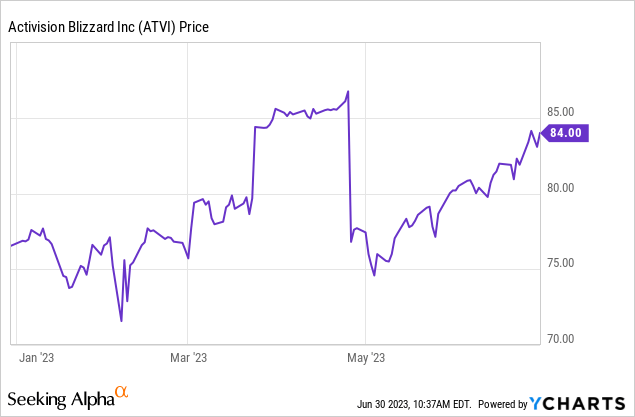

ATVI’s share price has been on a tear lately recovering from the blow of the U.K. block. However, the prospects of a successful CMA appeal (this is the U.K. agency) are statistically low, with the majority of CMA decisions holding up when challenged. The core of the CMA’s worry lies in Microsoft’s potential monopolistic dominance in the emergent cloud gaming market. Again, it makes no sense to me (because cloud gaming is a very narrow and nascent market where anything can still happen). Still, historically, the CMA decisions aren’t easy to successfully appeal and that’s an important baseline to be mindful of. Meanwhile, the court did deny the CMA’s request for a hearing delay, maintaining a more favorable timetable for the merging parties.

In the FTC hearing, Microsoft CEO Satya Nadella and Activision CEO Bobby Kotick have both given testimonies. Nadella emphasized the desire to expand Microsoft’s content across multiple platforms. As per Bloomberg:

Nadella said he would “100%” commit to keeping the Call of Duty shooter game on Sony’s gaming platforms. Last week, Phil Spencer, who heads Microsoft Gaming, also vowed under oath not to exclude the title from PlayStation consoles.

The promises were made to US District Judge Jacqueline Scott Corley, who must decide whether to halt the Microsoft deal – which has a July 18 closure deadline – while the FTC’s legal challenge to the blockbuster transaction plays out.

This has both been a consistent line out of Microsoft and is in line with Microsoft’s policy under Nadella.

The odds of the merger completing are still on the low side for a merger. Admittedly, the spread is still very wide as well, with ten dollars of upside per share left. Even though I believe the odds did increase (per my June 6 note here) once it appeared, ATVI was potentially willing to get out of the UK to get it done.

One important part of the Activision deal (that I mostly favored until the CMA block) is that downside risk appeared somewhat limited. Microsoft scooped up Activision opportunistically after a scandal and in a weak tech market. Most recently, investment firm Baird raised its bookings and earnings estimates for Activision following the robust launch of Diablo IV. Admittedly, I haven’t played it myself yet but I’m hearing mostly good things. In the June note, I wrote:

The next news I expect is for Microsoft and Activision to extend the deal by 3 months beyond the July 18 termination date. It is possible (but at the same time unlikely that Activision will negotiate some price increase). The reason I’m mentioning this at all is because Diablo IV sales appear to be very, very strong. Blizzard has come out and called it its fastest-selling game ever. Pre-launch unit sales came in at record levels on both consoles and PC. Reviews are very positive as well.

Baird’s analyst said that initial sales data and recent checks bode well for Activision. Activision isn’t exactly dependent on Diablo IV. It’s not a make-or-break thing to me. However, most of the product news since the deal announcement has been better than I would have hoped for. Baird revised its projected sales data upwards and other analysts may follow. This matters if the deal continues to be stuck on the U.K. block and it increases the odds of a Microsoft having to add a few dollars to its bid if the July 16 deadline passes.

I shifted my position back to long Activision on June 6. For now, with the FTC hearing concluding and developing so favorably, I think that’s still the right position. The $10 upside means there is still a 11.7% return to picked up here. Theoretically, that could be achieved by August. At the same time, the downside can be realized very quickly as well if the CMA’s decision holds. The stock should fall to the $60 – $70 area in a big painful drop. However, there is also a small probability Microsoft will be compelled to close the deal at over $96 per share because it has to renegotiate extensions with Activision. Taking everything into account, I think Activision Blizzard, Inc. is still a long.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of ATVI either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.