Summary:

- The chip war between the US and China has claimed another victim, potentially impacting MU’s top line by $3.31B or the equivalent of 10.7% of its FY2022 revenues.

- Interestingly, the management announced plans to invest $600M in Xian, China, over the next few years, an odd decision given the volatile situation.

- Due to the ongoing memory chip correction, MU’s balance sheet has also deteriorated, with inventory levels still not moderating.

- We have also observed a similar situation in South Korea, with MU expecting a normalized profitability only by 2025.

- Therefore, given the overly optimistic rally thus far, we believe the stock may retrace from these levels in the near term.

Fahroni

The MU Investment Thesis Is No Longer Attractive Here

We previously covered Micron Technology (NASDAQ:MU) in April 2023, suggesting the stock’s overly optimistic support levels, despite the double misses in the FQ2’23 earnings call and underwhelming FQ3’23 guidance. The stock had also rallied tremendously since our December 2022 buy article, implying a reduced margin of safety to our price target.

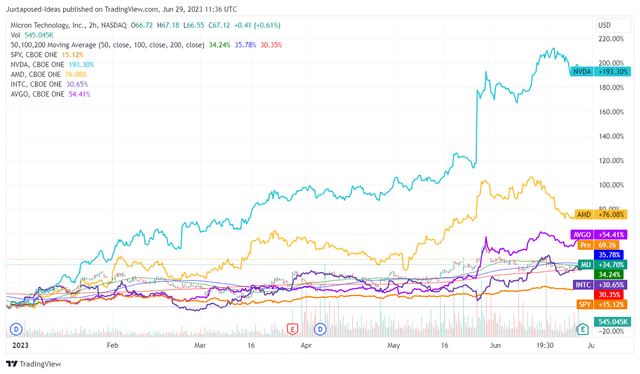

MU 6M Stock Price

Well, it appeared that the stock market had bottomed in December 2022, with the generative AI hype similarly boosting the recovery of most chips stock, including the SPY over the past six months.

This cadence is likely boosted by MU’s double beats in the FQ3’23 earnings call as well, with revenues of $3.75B (+1.6% QoQ/ -56.5% YoY) and adj EPS of -$1.43 (+25.1% QoQ/ -155.2% YoY). This is on top of the narrowing gross margins of -17.8% (+14.9 points QoQ/ -28.9 YoY) and rationalization in its capital expenditure to $1.56B (-29% QoQ/ -39.2% YoY) to preserve cash flow.

In addition, the chip company also guided FQ4’23 revenues of $3.9B (+4% QoQ/ -41.2% YoY) and adj EPS of -$1.19 (+16.7% QoQ/ -182% YoY) at the midpoint, suggesting that the worst of the chip inventory correction may be over, as similarly iterated by Sanjay Mehrotra, the CEO of MU:

The ongoing improvement of customer inventories and memory content growth are driving higher industry demand, while production cuts across the industry continue to help reduce excess supply… Our technology leadership and strengthening product portfolio position us well across diverse growth markets, including AI and memory-centric computing. (Seeking Alpha)

However, it is not all roses here, since MU still faces great uncertainties from the deepening Chips war between the US and China. Thanks to the trade war, China has banned the use of its memory chips, after supposedly failing to pass cybersecurity reviews and potentially impacting national security.

With several of the chip company’s customers already contacted by the Chinese government, it appears that the latter is serious about enforcing the ban, naturally impacting its top and bottom line ahead.

Assuming an outright ban throughout the whole Chinese territory (Taiwan, Mainland China, and Hong Kong), we are looking at a tremendous impact of up to $11.15B (-4.1% YoY) or the equivalent of 36.2% (-5.7 points YoY) of its FY2022 revenues of $30.75B (+11% YoY).

Otherwise, we are likely looking at the Mainland China only, comprising $3.31B (+35.1% YoY) or the equivalent of 10.7% (-1.9 points YoY) of its FY2022 revenues.

Interestingly, despite the uncertainties, the MU management appears to double down on its China ambition, by announcing $600M of planned investments in its operations in Xi’an over the next few years. This includes purchasing more assembly equipment while expanding its footprint. We are uncertain about the odd choice indeed, given the volatility of the developing situation and the uncertain resolution ahead.

While Nvidia (NVDA), AMD (AMD), and ASML (ASML) have been affected one way or another, we believe their impact may not be as severe as it may be for MU, since China has outright banned the use of the latter’s memory chips for now. This contrasted tremendously with the US government’s selective ban on high performance cloud/ AI chips and the EUV equipment.

In addition, with profit margins likely to remain negative for the next two or three quarters, MU’s balance sheet may continue to deteriorate. By FQ3’23, it reports growing net debts of $2.63B (-839.2% QoQ from $0.28B/ -162.7% YoY from -$4.19B) and elevated inventory levels of $8.23B (+1.3% QoQ/ -46.4% YoY).

The South Korean companies also reported impacted semiconductor exports at -36.2% YoY for May 2023, with inventory similarly expanding by +83% YoY in April 2023. With Samsung (OTCPK:SSNLF) and SK Hynix similarly expected to report massive losses in 2023, it is too early for the MU stock to rally, since the latter also guides “normalized levels of profitability” only by calendar year 2025.

Therefore, we believe MU’s execution and top/ bottom-line recovery remains highly uncertain. This may be further worsened if South Korea chooses to backfill MU’s export to boost its impacted economy, with the country already increasing exports to China at an average daily sum of $490M in May 2023, a new record since October 2022. Only time may tell.

So, Is MU Stock A Buy, Sell, or Hold?

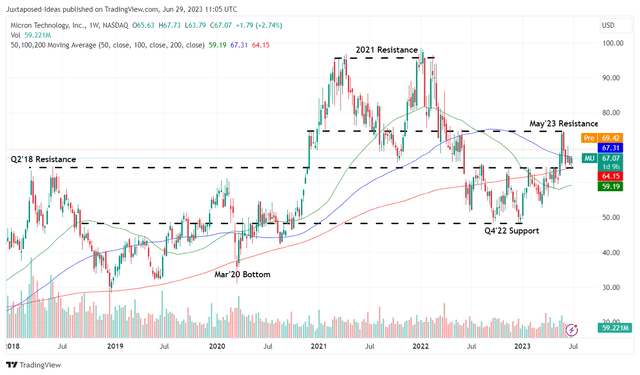

MU 5Y Stock Price

Based on the market analysts’ FY2025 adj EPS projection of $4.94 and MU’s normalized pre-pandemic P/E mean of 14.87x, we are looking at a price target of $73.45. This number suggests a minimal upside potential from current levels, due to the tremendous rally since December 2022.

With all the optimism already baked-in, we prefer to rate the MU stock as a Hold here, since adding here will only increase our dollar cost averages. Anyone who has yet to establish a position may consider doing so if the stock retraces to below $50s, due to the excellent support levels there.

Due to the reduced margin of safety, we do not recommend anyone to chase this rally.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of MU, NVDA, AMD, ASML either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The analysis is provided exclusively for informational purposes and should not be considered professional investment advice. Before investing, please conduct personal in-depth research and utmost due diligence, as there are many risks associated with the trade, including capital loss.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.