Summary:

- Abbott Laboratories will announce its Q2 2023 earnings this Thursday, 20th July.

- Last quarter, the stock price enjoyed a ~15% gain post earnings, although the spike was short-lived – shares are now +3% since Q1 2023 earnings were released.

- The company has endured some high profile setbacks such as issues with its baby powder formula and problems with its flagship glucose monitoring product FreeStyle Libre.

- With that said, the company expects Freestyle to break >$10bn in annual sales within 5 years, which can help offset the loss of COVID test revenues.

- I am expecting broadly positive Q2 ’23 earnings. Abbott’s stock is showing resilience in a bearish period for healthcare – the share price growth prospects are not compelling, however.

JHVEPhoto

Investment Overview – Q2 2023 Earnings Preview

Recap – Abbott’s Long-Term Outperformance Plateaus

When I profiled Abbott Laboratories (NYSE:ABT) for Seeking Alpha ahead of its Q1 2023 earnings release, I noted that the investment case for the company that had been so fundamentally strong between 2012 – when it opted to spin out its Pharmaceuticals division into a new company, AbbVie (ABBV) – and 2021 was becoming less and less convincing.

I made the point that of the 10 largest listed healthcare companies by market cap valuation, Abbott stock was the worst performing over a 3-year period – up only 8% – and the second worst performing over a 1-year and 3-month period – -11%, and -8%, respectively. Between 2013 and December 2021, its share price had risen from ~$35, to a peak of $141 – a >300% gain.

I also highlighted some specific problems at the pharmaceutical giant. Within its pediatric nutritional division, for example – infant powder formula products manufactured at Abbott’s facility in Sturgis, Michigan were linked to 2 infant deaths, from cronobacter infections, and Abbott remains under investigation by the Securities and Exchange Commission (“SEC”), Federal Trade Commission (“FTC”), and Department of Justice (“DoJ”) owing to the factory’s “shocking” and “egregiously unsanitary” conditions, according to FDA commissioner Robert Califf.

Abbott’s diagnostics divisions enjoyed a substantial revenues boost – Rapid diagnostics revenues were $4.4bn in 2020, $8.6bn in 2021, and >$10bn in 2020 – thanks to COVID testing, but revenues are now falling as fewer tests are required. In Q1 ’23, the diagnostics division revenues fell by 47% year-on-year, from $5.3bn to $2.7bn.

Finally, Abbott’s Freestyle Libre continuous glucose monitoring (“GGM”) device – arguably its most important single product, driving revenues of $4.3bn in 2020, up >20% year-on-year – ran into some issues, as Abbott was forced to issue a recall of >4m FreeStyle Libre, Libre 14 day, and Libre 2 Flash Glucose Management Systems’ reader devices, due to concerns around their lithium-ion batteries catching on fire.

Because of these issues, I felt that investors would likely sell Abbott stock if Q1 ’23 earnings were anything other than very strong.

Recap On Q1 ’23 Results

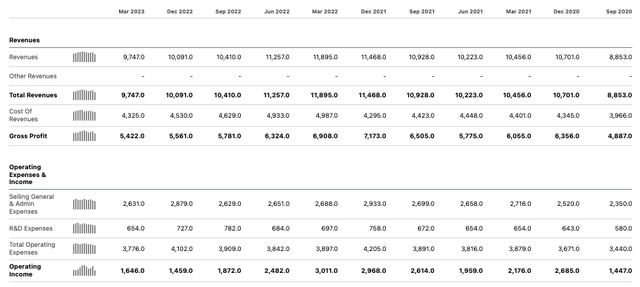

Abbott’s earnings by quarter – historical (Seeking Alpha)

I’ll have to admit that I was mistaken in that assumption – investors celebrated Abbott’s Q1 ’23 earnings, sending the stock price up from ~$104, to ~$112 after earnings were released, although the gains were short-lived – by early June, shares barely traded >$100, before a mini bull run has seen them climb to $108 at the time of writing.

Although, as we can see above, revenues fell sequentially by ~3.4%, and by 18% year-on-year, it should be noted that ex-COVID testing revenues, Abbott’s underlying base business grew 10% on an organic basis.

COVID testing revenues added ~$8bn per annum to Abbott’s top line in 2021 and 2022 – total revenues between 2020 and 2021 jumped from $34.6bn, to $43.1bn – but inevitably, the end of the global pandemic has seen demand plummet and the forecast for 2023 COVID testing sales was downgraded in Q1 ’23, from $2bn, to $1.5bn.

The market was clearly impressed by the ex-COVID performance, and by the normalized earnings per share (“EPS”) figure of $1.03, and GAAP EPS of $0.75, both of which outperformed analysts’ expectations, as did the top line revenues figure. On the Q1 ’23 earnings call, Abbott CEO Robert Ford told analysts:

As you’ll recall, back in January, I expressed some optimism that the headwinds Abbott and other companies faced over the last few years were starting to peak, and in some cases, ease a bit. As we move through the first part of the year, that’s exactly what we continue to see.

Most notably, the impact of COVID has rapidly and significantly lessened. As part of this transition, certain behavioral shifts have been evident across society. One simple illustrative example has been a significant increase in travel and tourism we’ve all seen, heard about or experienced first-hand.

A much more relevant and important behavioral shift that we’re seeing in healthcare globally has been the increased priority people are putting on getting healthy and staying healthy. And for our businesses, the impacts have been increased routine diagnostic testing volumes, improved medical device procedure trends and strong demand for consumer-based health products. The net result this past quarter was strong broad-based growth across our portfolio.

In other words, you could frame Q1 ’23 earnings as the quarter that drew a line in the sand between the COVID era – which hurt the core operating business but more than offset any lost revenues with sales of test kits – and the post-COVID era, in which the core business looks set fair owing to a growing public focus on “getting healthy and staying healthy.”

In such a scenario, the market could cheer results despite an 18% annual decline in top line revenues, and a decline in net income from $2.45bn in Q1 ’22, to $1.32bn in Q1 ’23. Throughout the last year of the COVID pandemic period Abbott’s share price performance was strongly negative compared to what had come before. Despite the increase in revenues in 2021 and 2022, the market now seems to be welcoming the renewed focus on “business as usual” (“BAU”) operations.

Finally, in Q1 ’23, Abbott upheld its FY23 adjusted EPS guidance figure of $4.3 – $4.5, which works out at a forward price to earnings ratio – based on current traded share price – of ~24x, which is a healthy ratio, if slightly on the higher side. On the earnings call, Chief Financial Officer (“CFO”) promised:

organic sales growth excluding COVID testing sales to be at least high single-digits.

With COVID sales of $1.5bn forecast, the total revenue figure for FY23 ought to come in at just over $40bn, by my calculation. A final positive feature of Q1 ’23 earnings was the increase in net profit margin, from ~10% in Q4 ’22, to ~13.5%.

Granted, during the COVID period net profit margin climbed as high as 21%, in Q1 ’22, but such performance was always likely to be unsustainable. In 2019 and 2020, net profit margins were ~8% and 12%, so by historical standards, post-COVID Abbott looks like it become more profitable than the pre-COVID version, which drove excellent share price growth.

What to Expect From Q2 ’23 Earnings

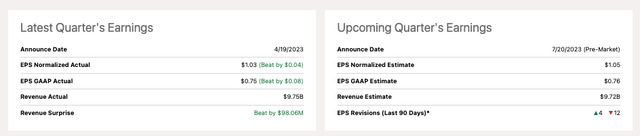

Expectations for Q2 ’23 earnings (Seeking Alpha)

As we can see above expectations for Q2 2023 are for revenues of $9.72bn – a little lower than the prior quarter, presumably based on organic base business growth just failing to offset COVID revenue declines – EPS normalized of $1.05, and EPS GAAP of $0.76.

If management expects to hit EPS of $4.3 – $4.5 in FY23, then Q2 ’23 EPS is likely to outperform expectations, in my view, perhaps even matching the $1.15 posted in Q2 ’22. Net income will also have to match or exceed Q1 ’23, if the FY23 income margin is to exceed 13%, as it did last quarter, across the full year.

One of the more important aspects of the Q1 ’23 earnings was the return to form of the nutritional division, and specifically the pediatric nutritional segment. In FY22, thanks to the recall of Similac, EleCare and Alimentum products manufactured at the Sturgis plant, pediatric nutritionals revenues fell from $2.2bn in FY21, to $1.56bn in FY22 – down 29% year-on-year.

In Q1 ’23, however, pediatric nutritionals revenues were $924m, compared to $847m in the prior year quarter, and on track to significantly outperform 2022. The Sturgis plant restarted partial production in July last year, although the product was also manufactured and shipped from Abbott’s factories in Ireland, Ohio, and Arizona according to the company’s 2022 10-K submission.

Although manufacturing and supply issues may on the path to full resolution, Abbott’s stock took a hit in late May when it was announced that the Federal Trade Commission (“FTC”) would launch a probe into whether baby formula manufacturers had colluded on bids for state contracts. Although a federal Judge in Chicago recently dismissed a court case brought by parents who claimed their baby had been harmed by Abbott’s, there are likely to be more probes, more lawsuits, and enquiries into the baby powder shortage caused by the problems at Sturgis.

Management did not provide much in the way of updates on its last earnings call or in its Q1 ’23 10-Q, but any updates or news could certainly impact the way Abbott’s Q2 ’23 earnings are interpreted – investors should keep their ears to the ground.

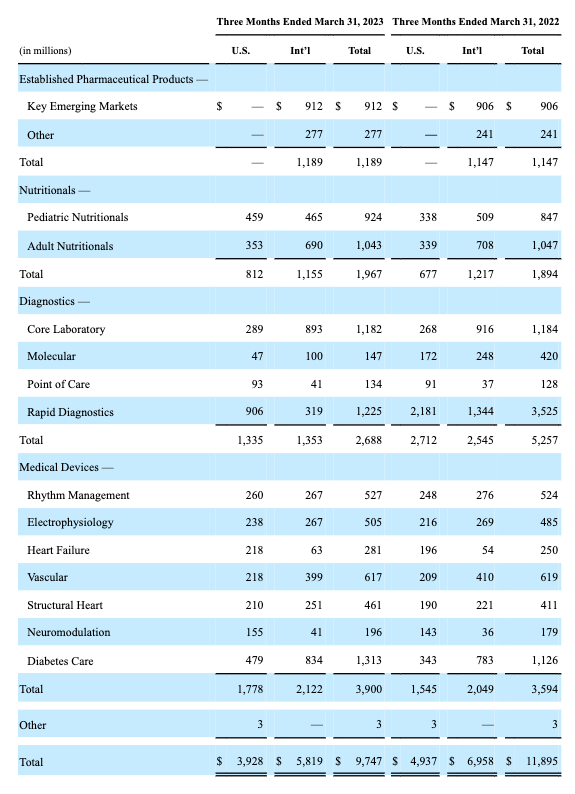

Abbott Q1 ’23 earnings by segment (Abbott Q1 ’23 10-Q submission)

As we can see above from Abbotts’ Q1 ’23 10-Q submission, nutritionals drove $1.97bn of the company total revenues of $9.75bn, so it is important not to overplay the importance of one division versus the other 3 – Established Pharmaceuticals, Diagnostics and Medical Devices – even if the baby powder issues can disproportionately affect Abbott’s share price owing to the reputational damage caused.

Established Pharmaceuticals is a solid if unspectacular performer, although the revenue growth between Q1 ’22 and Q1 ’23 was only 4%, when this division delivered double-digit growth in FY21 and FY22. As such, it may not be surprising to see better growth in Q2 ’23 versus Q1 ’23, which could be good for the share price.

Within diagnostics, obviously falling COVID test revenues are negatively impacting its revenue contribution, but a further concern could be a lack of genuinely exciting new products, and a “softness” in sales in China. The most significant product in this division is now Alinity, which provides services including immunoassay, clinical chemistry, point of care, hematology, blood and plasma screening, and molecular diagnostics.

These types of systems are reliant on hospitals and research centers finding the budget to buy them and use them, however, and although Abbott says this market is beginning to open up again post-COVID, it is not expecting double-digit annual revenue growth from this source, and my experience covering companies selling life sciences / research products such as these is that this can be a tricky, sluggish market, with an old fashioned “razor and blade” business model that doesn’t always pay off.

Finally, the biggest single contributor to revenues is the medical device division. This division drove annual growth of ~8.5% last quarter, and Abbott has some strong products driving growth of >20% per annum, such as pulmonary artery pressure monitoring system CardioMEMS, which posted a third straight quarter of >25% gains last quarter. In May, Abbott released data from a study suggesting the device led to a 44% reduction in heart failure-related hospitalizations among chronic heart failure patients, with improvements in quality of life also observed.

The most important product within this division is Abbott’s Freestyle Libre CGM device, used by diabetics to ensure their glucose levels are kept “in range” and prevent hyperglycemic or hypoglycemic adverse events. On the Q1 ’23 earnings call, CEO Ford updated analysts as follows:

In Diabetes Care, sales of FreeStyle Libre grew more than 25% on an organic basis in the quarter, including approximately 50% growth in the US and mid-teens internationally.

During the quarter, Libre received US FDA clearance for connectivity with automated insulin delivery systems. We’re working with leading insulin pump manufacturers to integrate their systems with both Libre 2 and Libre 3 as soon as possible.

Libre 3 was recently granted reimbursement in the French market, and management has previously stated its expectation that the product will achieve double-digit billion sales within the next 5 years.

Freestyle Libre 3 is not without its issues however – including the product recall I mentioned earlier. A couple of days ago, several news outlets in the UK carried the story that the app used with the device (that interprets results of the monitoring) had stopped working, and had been withdrawn from the Apple Store.

A product with such an important role, that may soon be attached to an insulin pump, will inevitably suffer if its technology shows any signs of malfunctioning. The Freestyle Libre competes for market share with similar products manufactured and sold by Dexcom (DXCM) and Medtronic (MDT) – Abbott’s is the cheapest, but in this kind of market, if cheapness becomes associated with poor quality of performance, then market share is likely to be significantly impacted.

Furthermore, the emergence of new diabetes and weight loss medicines developed by Novo Nordisk (NVO) and Eli Lilly (LLY) -semaglutide, marketed and sold as Wegovy / Ozempic, and tirzepatide – marketed and sold as Mounjaro – could be viewed as a major threat to a product such as Freestyle Libre – after all, would you rather wear a device, use an insulin pump, and require an app to monitor it, or use an injectable device once or twice per day after meals? Wegovy and Mounjaro are expected to become all-time best-selling drugs, and that may have an impact on the revenues that Freestyle can generate.

Concluding Thoughts – Abbot Resolved Some Key Issues In Q1 ’23 & Shares Rose – Q2 ’23 May Uncover Others

Am I optimistic that Abbott’s Q2 ’23 earnings will result in a ~15% share price spike, similar to that triggered by Q1 ’23 earnings?

There are certainly reasons to believe in such a scenario – management’s guidance for close to double-digit ex-COVID revenue growth will certainly help, and as discussed above, I think analysts expectations for Q2 may be a little low, given management’s FY23 guidance, which could help the company show better-than-expected performance, rewarded with another spike.

With that said, it was the extra $8bn per annum of COVID test revenues that enabled Abbott to reach its all-time high share price of >$140 in December 2021, and we now know that these revenues were a one-off bonus highly unlikely to be replicated in the foreseeable future.

The growth in Established Pharmaceuticals is encouraging, but not necessarily valuation-upside driving on its own, at ~4% last quarter, and there seems to be few reasons why this segment will surprise to the upside when Abbott announces its Q2 ’23 earnings pre-market on Thursday, July 20.

The recovery with Nutritional is a positive, although investors should beware of any potential setbacks, such as litigation, and the outcome of investigations, including the latest one surrounding potential price collusion.

Finally, medical devices, the segment arguably singled out by management to be the main growth and valuation driver, ought to continue to drive some good growth, which may be enough to lift the share price needle, but again, negative publicity threatens the status of FreeStyle Libre as a potential $10bn selling asset, as does – in my view – the emergence of Novo Nordisk’s Semaglutide, and Eli Lilly’s Tirzepatide.

Abbott’s fundamentals – a price to sales ratio of ~4/5x, and forward price to earnings ratio of ~25x, do not make a strong case that the company is undervalued at a market cap of ~$186bn, although the increase in net profit margin in Q1 ’23 was encouraging, and if it is sustained in Q2 ’23, the market may reward Abbott.

As such, I would not be too surprised to see Abbott stock enjoy a small spike on Q2 ’23 earnings as the company can continue to show it can shake off the loss of COVID testing revenues, and put its manufacturing issues behind it.

Longer term, however, I am not sure investors will be entirely satisfied with some sluggish top line growth, and there are doubts around whether some of Abbott’s top-performing products can realize their full potential based on the new competitive threats they face.

Abbott has recently raised its dividend to $0.51 per quarter, which provides a current yield of ~1.9%, and its share price has proven resistant to the bear market affecting the pharmaceutical sector as a whole – across the last 3 months its share price is +3%, the only member of the Top 10 largest listed healthcare stocks to post a gain, besides Eli Lilly’s growth of +21%.

In summary, I would not necessarily rush to buy shares of Abbott Laboratories ahead of Q2 ’23 earnings. However, if I were holding Abbott stock, I would not necessarily be selling in the current bear market either. This is a perfectly adequate defensive stock to own, but it lacks upside impetus and the upcoming earnings are unlikely to alter that fact, in my view.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

If you like what you have just read and want to receive at least 4 exclusive stock tips every week focused on Pharma, Biotech and Healthcare, then join me at my marketplace channel, Haggerston BioHealth. Invest alongside the model portfolio or simply access the investment bank-grade financial models and research. I hope to see you there.