Summary:

- Meta Platforms, Inc.’s Threads app is making headlines as a Twitter rival to be reckoned with.

- But my main concern is the headwind it’ll create as users spend more time on an unmonetized product, just as Reels ads gain momentum.

- Overall, Threads should be a long-term winner able to compete successfully with Twitter, but the path there may cause expected but untimely bumps on the revenue growth recovery road.

Justin Sullivan/Getty Images News

By now, you’ve heard of Threads – the first Meta Platforms, Inc. (NASDAQ:META) homegrown app of significance since the likes of Facebook. Threads is noteworthy on several levels, not the least of which is the competitive factor against its rival Twitter. But what isn’t largely talked about is the competitive aspect it has within its own family of apps. No, not because everyone will leave Instagram for Threads, but because more time spent on a new app is less time spent on another. But in the long term, Twitter and other apps should suffer, crowning Meta Platforms the ultimate winner.

There’s been plenty of talk about a fight between Mark Zuckerberg and Elon Musk, a throw down cage match of physical and mixed-martial arts prowess. But what I find extremely interesting is that the same level of cage match intensity is happening on a technological level with both CEOs’ apps.

It’s hard to make this up, and I’m sure if Hollywood wasn’t on a full-on strike, they’d try hard to write something approaching reality. Nonetheless, here we are, two CEOs ready to throw down while their two apps throw down in the virtual world, appo a appo.

Is Threads Real Competition?

The first question to answer is whether this is even worth talking about. If Threads isn’t a threat to Twitter, then it’s nothing but a flash in the pan, and Meta will toss it in the garbage pile along with Slingshot and Flash, its failures from years past. And if Threads isn’t a factor to Twitter, it certainly won’t be a factor in spreading Meta’s massive user base on its other mature apps too thin.

But so far, the numbers position Threads into the record books, even if it’s not heard from again tomorrow. Considering Threads broke the most recent record of the fastest-growing app, reaching 100M users in only five days, there’s something here. This compares to ChatGPTs run to 100M in two months, the record set just at the beginning of the year. For reference, within Meta’s domain, it took Instagram a little over two years to reach 100M users.

Now, even though the dust is settling and the app downloads have slowed, and perhaps Google searches have lessened, it’s nothing more than just that: dust settling. Some are quick to point out how it rocketed to 100M user signs, but DAUs (daily active users) have backed off by about 20%. I mean, no one expects an app to launch and keep exponential or even linear momentum growth forever. And when growth does wane, it doesn’t detract from the massive user base it formed.

It’s merely the next stage of user growth and doesn’t force me to say Threads has failed or isn’t the competitive app it was expected to be. The initial stage was so fast and large that the next stage would be significant in absolute terms but small relative to the blistering move to 100M.

It’s all relative.

But the less tangible yet more impactful answer to the competitive question is the need for the app. And here, I’m talking about the free user market deciding which of the two – Twitter or Threads – should be the place where they stay. Because of the volatility around Twitter and its rapid changes to processes and rules, users have been itching to find a more “stable” environment to share thoughts.

In the free market world, the customer (in this case, the user) will go to where the best value (in this case, the best app experience) is. The network effect is secondary and comes later; it’s the staying power, not the initial draw.

And since Twitter’s current direction is to change direction without warning (take its recent no-warning decision to require logging in to read tweets), a more stable app from a company with other stable apps is comforting to a user.

This doesn’t mean Threads is the de facto answer to Twitter; plenty of experience factors are still to be proven to retain users on Threads. But so far, any stable entrant into the ring will likely get a go when the alternative is a hard and fast run app like Twitter.

Threads is a serious enough competitor; the sheer number of users signed up in a very short amount of time proves my point. Meanwhile, its competitor is on its back foot, reeling from many policy changes. So, yes, Threads is worth talking about.

Internal Competitive Pressure

My near-term concern is the headwind it’ll create for Meta’s revenue workhorse Instagram as it continues to monetize Reels. Threads’ success can counter the success of other ad products currently being matured.

Since Threads uses the user’s Instagram account to sign up and has features to cross-post from Threads to Instagram, I’m interested in the impact, if any. The idea should be to supplant Instagram users from going to Twitter throughout their day, which it should accomplish. But an overcorrection means users go to Threads more than they were going to Twitter, which means “time spent” has to come from another place. The first natural victim is the app it’s connected to – Instagram.

This isn’t an unknown, by the way. Any time Meta pushes out a new product within its apps, like Reels or Stories, it lessens the revenue it sees overall from the app as users spend more time on the newly un-or-under-monetized product. It takes several quarters to build ad demand to meet the fresh expansion of ad inventory (not to mention ad product tuning). This is a typical and repeated cycle from Meta, but it eventually proves wildly successful; it’s the transition that hurts.

Unsurprisingly, Threads doesn’t appear to have a near or medium-term focus on monetization. Monetization may come sooner than later if the app grows to Twitter’s last calculated 259M daily active users over the next few months, but for now, Threads will likely become a headwind to Instagram’s ad products via less time spent on the 500M (daily active) user platform.

Winning The Market

Given the growth of the app and the easy transition Instagram users have, Meta has created an app with an easy-to-get-to and wide on-ramp. In the past, new apps from Meta wouldn’t gain traction – one, because they weren’t connected to their current apps or users, and, two, because there wasn’t a market looking to break away.

But now, with Twitter ruffling more than just a few feathers, there’s a swath of people willing to defect for good to go to a shiny new platform. This may ultimately be the first Twitter rival to stick at scale; if it does, Meta may have added another arrow to its platform quiver.

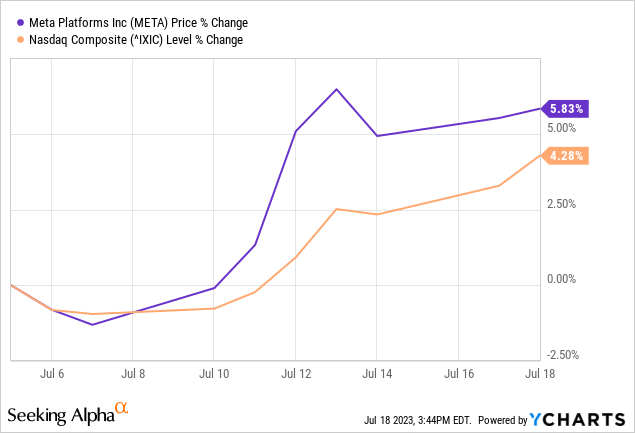

The stock has only approved of the developments of Threads, as it has outperformed the broader Nasdaq (COMP.IND, QQQ) index since its launch.

And the reason is likely due to the market projecting a larger overall market share for Meta’s apps and extrapolating revenue over the next two years for the newly minted app regardless of the near-term headwinds. In short, whatever ad revenue is either going to Twitter or has gone to the sidelines over the last year may be redirected to Meta’s coffers.

However, here’s the risk. Suppose the market share gain winds up coming at the cost of Instagram’s revenue growth and profitability, as I described in the typical new product cycle earlier. In that case, the market may reclaim the valuation it’s granting it. And this repossession won’t happen until an unexpected deterioration in the earnings report prints.

The risk looms large if things don’t play out just right.

This is my most significant concern and the biggest risk to the stock. Since advertising revenue was otherwise heading back into positive growth territory, any change in this trajectory would not satisfy the market.

Overall, A Winner, But At What Cost?

Threads looks to be a winner for Meta, which likely requires relatively few resources to maintain and enhance, considering the app is built on open source code base ActivityPub with Instagram APIs linked throughout. This means much of the app development is mature since it uses already mature and supported modules and dev kits. Therefore, the time and materials spent maintaining this app are incremental to what Meta already does.

But, the success of Threads threatens its other apps in terms of time spent on those apps, meaning fewer ads seen, at least until Threads begins monetizing. Knowing Meta, it’ll wait a while before starting this process as it did with its prior apps and products. This headwind could exist for a shorter period than prior app ad product developments, but the headwind will exist nonetheless.

I’m interested to hear what management says on its earnings call mid-next week about its monetization plans for Threads and what, if any, headwinds may exist. Overall, Threads has vast potential to be another enormous app in Meta’s domain. If it’s half as successful as Instagram, the revenue growth could be just what Meta needed to supplement its Metaverse endeavors and achieve the goal Mark Zuckerberg set out a year ago.

…over the next several years, our goal from a financial perspective is to generate sufficient operating income growth from Family of Apps to fund the growth of investment in Reality Labs while still growing our overall profitability.

Mark Zuckerberg, CEO, Q1 ’22 Earnings Call

Analyst’s Disclosure: I/we have a beneficial long position in the shares of META either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Decrypt The Cash In Tech With Tech Cache

Do two things to further your tech portfolio. First, click the ‘Follow’ button below next to my name. Second, become one of my subscribers risk-free with a free trial, where you’ll be able to hear my thoughts as events unfold instead of reading my public articles weeks later only containing a subset of information. In fact, I provide four times more content (earnings, best ideas, trades, etc.) each month than what you read for free here. Plus, you’ll get ongoing discussions among intelligent investors and traders in my chat room.