Summary:

- Berkshire Hathaway has significantly reduced its exposure to Activision Blizzard as Microsoft nears completing its acquisition of the gaming giant.

- Despite shares of Activision Blizzard rising by 14.2% since June, the potential upside for investors is limited with the risk of a potentially painful downside.

- While the acquisition is expected to go through, the only remaining obstacle is UK regulators, with a potential solution being the sale of some or all of their cloud gaming rights in the UK.

- Investors would be wise to play the picture more cautiously, given how the risk profile has changed relative to what upside is left.

Scott Olson

As Microsoft (NASDAQ:MSFT) is inching near to completing its acquisition of gaming giant Activision Blizzard (NASDAQ:ATVI), a lot of interesting developments are taking place. We’re seeing changes on the regulatory front that, for the most part, should bode well for those hoping the deal will be completed. But we’re also seeing some changes when it comes to who’s betting on what and to what extent. The greatest example here involves Berkshire Hathaway (BRK.A) (BRK.B) and its investment in Activision Blizzard. The short version of the story is that, with a deal almost ready to close, Warren Buffett’s conglomerate has decided to significantly reduce its exposure to the video game giant. Based on my own understanding of the facts at hand, I believe that this is a smart move that other investors should consider making.

My opinion has changed

The last time I wrote an article involving the pending marriage between Microsoft and Activision Blizzard was back in the middle of June of this year. In that article, I talked about how shares of the video game giant plunged because of heightened concerns that Microsoft might not be able to complete its purchase of the company for an estimated $69 billion. At that time, I argued, downside for shareholders of Activision Blizzard would likely be limited and, if not, short lived, should the deal not ultimately be consummated. This was based on how strong the fundamental performance of Activision Blizzard had been up to that point, particularly with its most recent launch of a game called Diablo IV.

Since then, a lot has changed. And as an investor, it’s important to change your opinion as the facts change. For starters, Activision Blizzard has gotten far more expensive. Since the publication of that article, shares of the company have shot up 14.2%. That compares to the 4.2% increase seen by the S&P 500 over the same window of time. Now the spread between the $95 that shares are supposed to be bought out for and the $92.74 that the stock is currently trading for implies a spread of only 2.4%. This is rather limited.

Likely understanding that the merger arbitrage opportunity has narrowed substantially and that there is still a non-zero chance of the deal falling through, Warren Buffett, or at least his conglomerate Berkshire Hathaway, has decided to substantially reduce exposure to Activision Blizzard. When Berkshire Hathaway last filed a form 13 detailing the ownership stake that the company had in the gaming giant in May, it boasted control of 49.4 million shares. That translated to 6.24% ownership over the enterprise. Well, on July 17, a new filing was made that showed a reduction to 14.66 million shares. All combined, that’s about 1.85% ownership over the company.

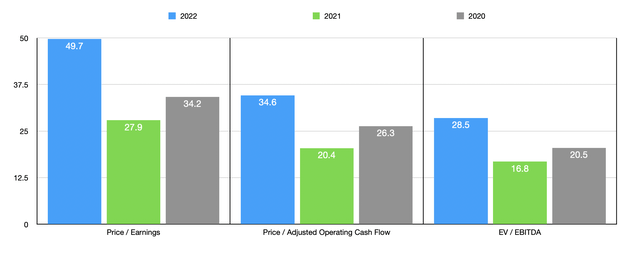

Investors should not construe this to mean that Berkshire Hathaway expects the deal to fall through. Even though that’s a possibility that’s in their mind, it’s more likely that they view the risk profile as having changed. Now, instead of limited downside with significant upside, the deal has transformed to be limited upside with potentially painful downside. This is especially true when you consider how pricey shares of Activision Blizzard have become. In the chart below, you can see how shares are priced (assuming the $95 buyout price) using data from 2020, 2021, and 2022.

Of course, those who still believe in the transaction going through and those who like the idea that this basically gives them the ability to buy shares of Microsoft at a discount of about 2.4% compared to what the stock is trading for, picking up units of the company could still make sense. I, myself, am of the opinion that the transaction probably will be completed. After all, in just the past couple of days, it became clear that the company would almost certainly succeed in muscling through the regulatory process in the US. On Tuesday of last week, for instance, the Federal Trade Commission was denied a request by a federal judge in San Francisco for a preliminary injunction aimed at blocking the transaction. And on Friday of last week, the 9th Circuit Court of Appeals denied their request to halt the deal why are the FTC goes through the appeals process.

Technically, regulators here in the US could try to continue the fight. But given how successful Microsoft has been in the courts, it’s highly probable they will not succeed in any meaningful way to stop the deal. This is especially true after Microsoft announced that it would make its most popular game franchise, Call of Duty, available on Sony’s (SONY) PlayStation for at least the next 10 years. And on July 18, the US Supreme Court denied a request by a collective of gamers that hoped to stop or at least slow down the acquisition.

With regulators here at home pretty much out of the way, the only roadblock for the company are regulators in the UK. This kind of transaction falls under the purview of the CMA (the Competition and Markets Authority). A positive development regarding this has also come in the past couple of days. On July 17, a judge in the UK stated that the Competition Appeal Tribunal will allow the CMA’s challenge to the deal to be “paused” while regulators and the two firms in question talk about a potential settlement. Nothing has been set in stone yet. But reports have said that the two companies are considering a scenario where they might sell some or all of their cloud gaming rights in the UK in order to appease regulators.

It’s really interesting that the regulatory hang up here involves what’s currently a very small market segment in the gaming industry. For those who don’t know, the cloud gaming market basically involves the ability to play video games with very little to no data actually being hosted on the server or servers of the individuals playing it. A great example could involve the Game Pass subscription offering provided by Xbox, which is a property of Microsoft, that allows users, for a fee, to play around 100 different games without having to acquire them. Globally, Game Pass had about 25 million subscribers in January of 2022. We don’t know what that number has grown to since then, but it most certainly is larger than it was back then.

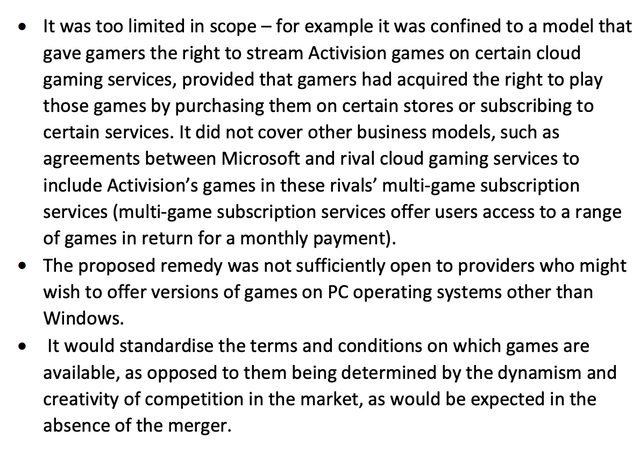

The concerns offered up by the CMA center around the fact that, by their estimates at least, Microsoft already has a 60% to 70% share of the cloud gaming market in the UK. By acquiring a major video game publisher that produces what they refer to as “AAA” games, the fear is that anti-competitive forces would develop because either Microsoft will be able to deny other gaming platforms access to these games and/or that it would be able to charge exorbitant fees for access to them. Microsoft has offered up its own proposal on how these matters should be addressed. But according to the CMA, it’s proposal was too limited in scope, and there were other issues that could create potential anti-competitive forces moving forward. In the image below, you can see the three points that the CMA pushed back on.

Competition and Markets Authority

As I mentioned already, the cloud gaming market is incredibly small. If the CMA is correct in its assessment, the space could grow to $13.7 billion globally by 2026. But by that time, its size in the UK will only be around $1.25 billion. To put this in perspective, that was the size of the recorded music industry in that country in 2021. And with a total value of $6.25 billion today, the gaming space is the largest entertainment industry in the UK. So it would be understandable for them to have concerns when Microsoft already controls so much in that sphere.

Personally, I don’t think the transaction between Microsoft and Activision Blizzard will fall through. The worst case scenario is that Microsoft decides to divest itself of its cloud gaming business. Immediately, that would translate to only a few hundred million dollars’ worth of revenue being lost. But in exchange, they get to pick up the video game behemoth with all the benefits that it will offer. Even if the company had to make some other concessions, there could be an opportunity there. We don’t know how much revenue Microsoft’s video gaming operations generate from the UK. But we do know that, in the most recent fiscal year, only about 11%, or $828 million, of the revenue generated by Activision Blizzard came from there.

Takeaway

The way I see it, things are getting rather interesting. As I type this on July 18, the two companies are supposedly negotiating an extension in terms of when the deal must close before otherwise falling apart entirely. Because technically, the deal faces a July 18 deadline. Obviously, a failure to follow through on the transaction would justify shares of Activision Blizzard falling from here. But there is also some non-zero probability that the deal could fail in the event that an extension is agreed upon. I view this probability is incredibly small. But when you consider the limited upside that still exists for shareholders should the deal be completed, and consider that a failure of the deal going through would probably result in downside of 10% to 20%, I understand why Berkshire Hathaway decided to reduce its exposure to Activision Blizzard. I myself have decided to downgrade the company given these circumstances from a “buy” to a “hold” to reflect the change in risk that’s now on the table relative to the potential upside that remains.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Crude Value Insights offers you an investing service and community focused on oil and natural gas. We focus on cash flow and the companies that generate it, leading to value and growth prospects with real potential.

Subscribers get to use a 50+ stock model account, in-depth cash flow analyses of E&P firms, and live chat discussion of the sector.

Sign up today for your two-week free trial and get a new lease on oil & gas!