Summary:

- Netflix, Inc.’s recent Q2 earnings report showed a significant slowdown in revenue growth, barely in line with the rate of inflation, suggesting the company is becoming more like a utility stock.

- The company’s growth is now largely driven by price hikes, similar to utility companies, and it is struggling to find new avenues for expansion as its service gets commoditized.

- If Netflix continues to show signs of becoming a utility company, its valuation may need to be reassessed, posing a risk for investors.

hocus-focus

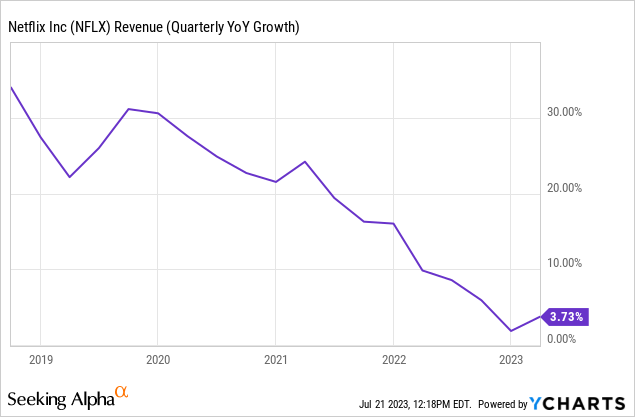

Earlier this week, Netflix, Inc. (NASDAQ:NFLX) announced its quarterly earnings. They didn’t impress investors and triggered a selloff in the company’s shares. One thing I particularly found interesting in the earnings report was the drastic slowdown in the company’s revenue growth in recent years. This is also telling me that the company is running out of growth avenues and turning into some sort of commodity or utility stock. After enjoying 20-30% annual revenue growth rates for many years (not to mention during a non-inflationary environment), the company’s growth rate for the last couple years has been about the same as the rate of inflation, meaning it posted very little, if any, growth after inflation.

Utility companies provide basic services for a monthly fee. They typically enjoy low margins, high infrastructure and maintenance costs, and enjoy a minimal growth rate above the inflation rate mostly driven by population growth and price hikes. Utility companies are typically seen as stable companies that enjoy predictable revenues and earnings year after year, but also no growth. Of course, utility companies also share majority of their profits with investors in terms of dividends, which Netflix lacks, but that’s another story.

Based on last quarter’s results (as well as the last several quarters), I am inclined to believe that Netflix is slowly turning from a growth stock to a utility stock. First, it appears that the company is running out of avenues to fuel further growth, especially at rates investors expect them to grow. Investors are paying Netflix a P/E of 47 because they expect the company to continue growing in double digits, but where will that growth even come from?

The company already has expanded into almost every market it can, and everyone has already become aware of the service. Anyone who wants to become a member and can afford to do so is probably already a member (just like utility companies). For years, Netflix enjoyed an almost monopoly status in streaming, but now that competition is coming, it’s not able to sustain those growth rates anymore.

Most technology companies can rely on the Chinese market to fuel their further growth when their growth rate slows down in Western countries, but Netflix hasn’t been able to enter China at all. This limits the company’s future growth potential tremendously.

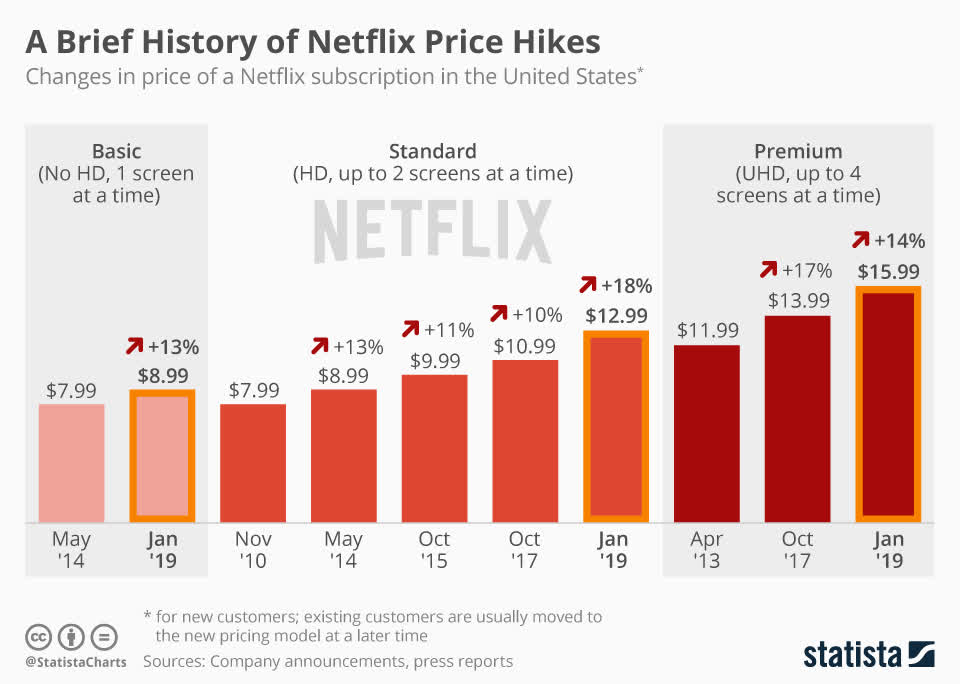

Lately, Netflix has been more aggressive about raising its prices, partly due to effects of inflation, but this is nothing new. The company has hiked its prices before, many times even in double digits.

Netflix price hikes (Statista)

The problem is that in the past years, price hikes accounted for a small percentage of the company’s revenue growth. If the company hiked prices 10% every 3 years, that’s 3% revenue hike per year compared to 20-30% revenue growth, so it was safe to say that most of Netflix’s growth didn’t come from price hikes. Now, almost all of the company’s growth comes from price hikes. For example, last year the company hiked its prices by an average of 10% and its revenue growth also came at 10%. This means almost all of its growth came from price hikes, which is what you see in utility stocks.

As Netflix’s growth rate is slowing down to match the rate of inflation, the company is trying to find new ways to fuel growth such as introducing ad-supported basic plans and cracking down on password sharing. These moves can definitely fuel some growth in the short term, but they are temporary solutions at best. The biggest problem in front of Netflix seems to be high saturation. It already enjoys very high market share in most of the countries it serves, and competition is becoming more aggressive.

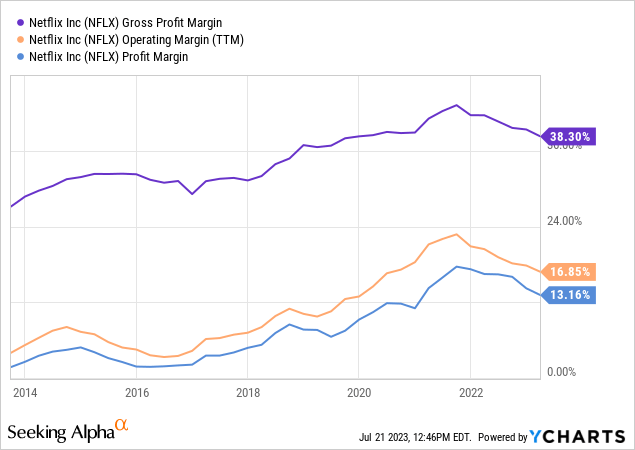

Another thing I noticed in the company’s latest earnings report is that its margins might have peaked sometime last year. If margins continue declining, this could further put the company into commodity/utility category because declining margins are usually a sign of commoditization of a company’s business.

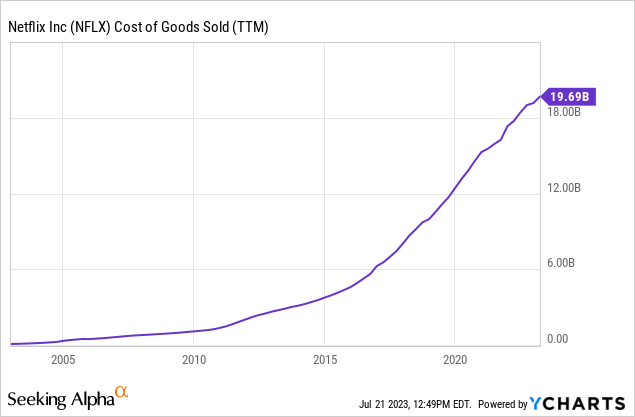

Just like an electric company constantly has to produce and distribute electricity or a gas company constantly has to produce and distribute gas, Netflix has to constantly produce and distribute new content. Over the years, Netflix’s production costs increased tremendously as it’s producing more and more of its content. Not only is Netflix producing more content in quantity, but also it is producing more expensive productions overall, putting more money into each movie and TV series it produces. This reminds me of how utility companies have to keep spending more and more money to upkeep and maintain their infrastructure so that they can keep delivering electricity, gas, water, Internet, and other services to people’s homes.

One thing utility companies have to keep an eye on is labor unions and employee strikes, because a large portion of utility employees are unionized. While Netflix doesn’t exactly have this problem in terms of its office workers, it might have a similar problem with its content creators, as we currently are witnessing a possible strike in Hollywood. These days content is the king, and no streaming service can thrive or even survive for long without constant addition of new content.

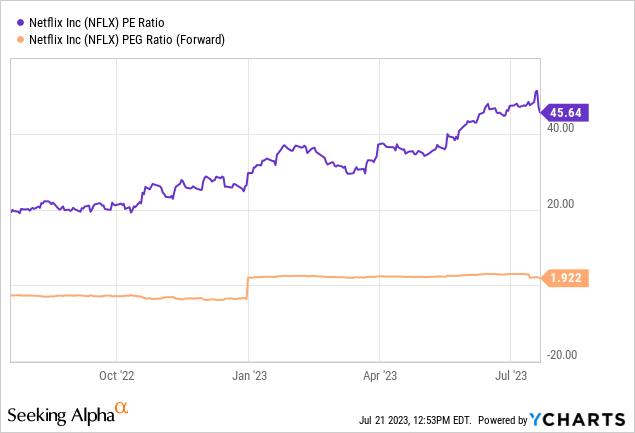

If Netflix is becoming a commoditized service and enjoys similar growth rates and margins as a utility company, then it should also be priced like one. Yet the company is trading at a P/E of 47 and PEG ratio of 1.9. For those that don’t know, a PEG ratio of a company measures its P/E ratio adjusted for its growth rate. Technically, this ratio can go from 0 to infinity, but most of the time it will range from 0 to 2. A PEG ratio below 1.0 means a company is cheap compared to its growth rate. A PEG ratio of exactly 1.0 means it is fairly valued as compared to its growth rate. A PEG ratio above 1.0 means it’s trading at a higher valuation than its growth rate warrants. Currently, Netflix seems to trade at a PEG premium of 92% above what its growth rate warrants.

I am not saying that Netflix, Inc. is a utility company, but the last few earnings reports are pointing in a direction where it shows many signs of becoming one in the near future if the company doesn’t find new ways to fuel its growth. If this becomes true, the company’s valuation will need to receive a reset and it might be viewed the same way Verizon Communications (VZ) or AT&T (T) are now seen. This would pose a pretty big risk for investors because it would mean that the current valuation isn’t sustainable in the long run if the company’s services become a commodity and its growth rate is tied to price hikes and inflation alone.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.