Summary:

- Tilray’s fiscal 2023 fourth-quarter earnings saw revenue grow by 20% over its year-ago comp as its adjusted gross profit margin moved up to 37%.

- The company’s double-digit short interest has been set against an improved stock market appetite for risk.

- Guidance for positive free cash flow next year and its strong cash and equivalents positions could help support further stock price gains.

kulagina/iStock via Getty Images

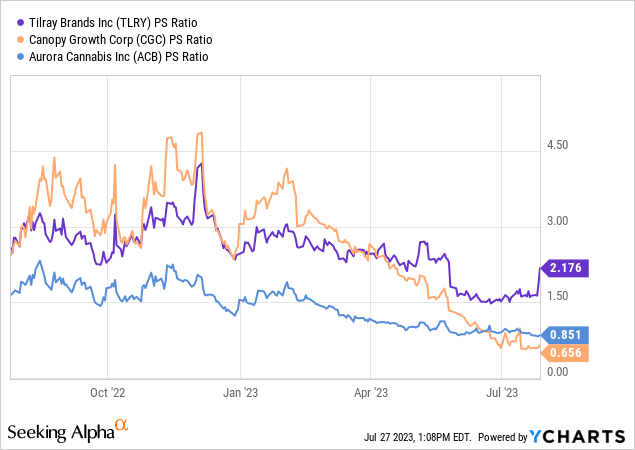

Tilray’s (NASDAQ:TLRY) surge is not surprising against a stock market appetite for risk that has been building up ever since the June CPI print came in lower than market expectations. The company would move up double-digits following the release of its fiscal 2023 fourth-quarter earnings, building on a broad rally that has lifted its common shares by around 50% from all-time lows. Whilst Tilray is operating in a sector beset by structural headwinds, the company has managed to build one of the largest cannabis companies in the space with a market cap of $1.28 billion more than the combined market caps of peers Aurora Cannabis (ACB) and Canopy Growth (CGC). These are currently trading at $180 million and $288 million, respectively.

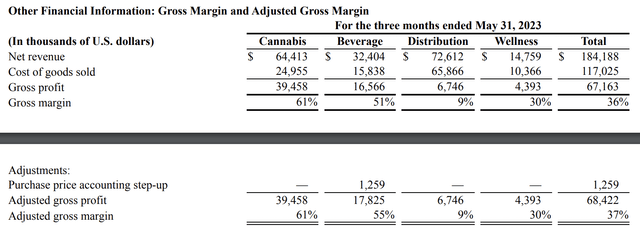

At the core of this outperformance is the valuation disparity between all three firms, with Tilray currently sporting a 2.18x price to sales multiple versus a 0.8x multiple for Aurora and an even lower 0.66x multiple for Canopy Growth. To be clear here, the market is valuing every dollar of revenue earned by Tilray as just over two dollars in market cap gains whilst translating each dollar in revenue earned by Canopy at around 66 cents. Why is this happening? Balance sheet strength combined with a healthy free cash flow profile. Tilray recently published its fourth-quarter earnings, which placed its cash and equivalents at $448.5 million as of the end of the quarter.

Revenue Surges Ahead And Beats Consensus

Tilray’s post-earnings surge needs to be contextualized against the 12% short interest in its common shares. Ten consecutive interest rate hikes helped catalyze broad risk-off sentiment through 2022 that drove Tilray’s shares to record lows. Hence, with the most recent July FOMC 25 basis point rate hike likely set to become the final if inflation continues to moderate, the revenue beat during the fourth quarter has been aggregated with an improving macro backdrop. The market finally sees the end of the current monetary tightening cycle possible and this is driving sentiment to improve, a tailwind that should continue to support the commons through 2023. Tilray reported revenue of $184.19 million, an increase of 20.1% over its year-ago comp and a beat of $30.23 million on consensus estimates.

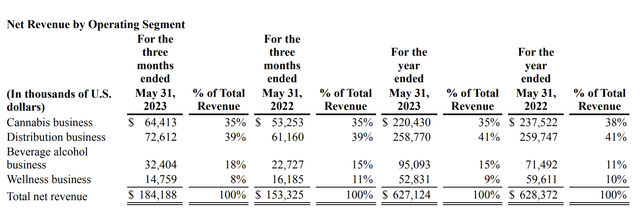

Tilray realized growth across three of its four operating segments, with cannabis, beverage alcohol, and distribution all seeing year-over-year revenue growth of roughly $10 million. Wellness did see revenue decline by around $1.4 million over its year-ago comp as beverage alcohol increased its percent of total revenue by 300 basis points to 18%. Critically, Tilray’s adjusted gross profit was $68 million for an adjusted gross margin of 37%. This was a huge ramp from margins of 33% in the year-ago quarter and drove the company to realize an operating loss of $18 million, down from a loss of $95.4 million in the year-ago period.

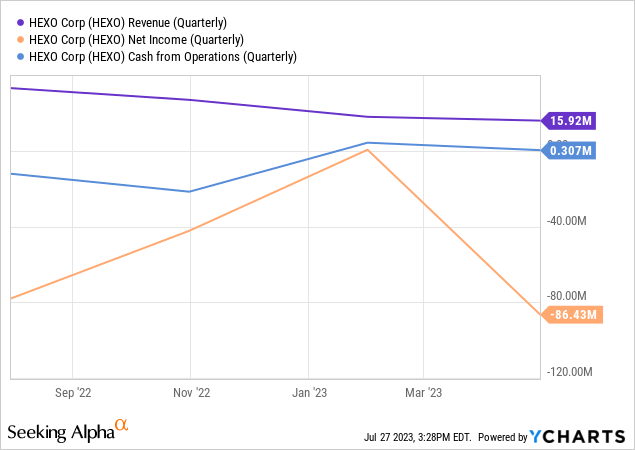

The company continues to chase growth, recently launching a new line of THC-infused sparkling drinks under its RIFF brand. It also closed on its acquisition of HEXO to power the next stage of its journey. This will see Tilray’s market share of the Canadian cannabis market grow to 13% and will see revenue ramp up, with HEXO last reporting quarterly revenue of $15.9 million. Bears would be right to flag the HEXO buyout as raising the specter of risks stalking Tilray. Quebec-based HEXO realized a 50% year-over-year decline in revenue for its last reported quarter, with a net loss of $86.5 million.

HEXO Acquisition Close Creates Opportunities And Risk As Market Sentiment Moves Up

Consolidation across the Canadian cannabis space has been the consequence of a market that’s highly regulated and taxed whilst competing against a relatively buoyant black market. This black market still accounts for C$4 in every C$10 spent on cannabis in Canada. Tilray provided guidance for its fiscal year 2024 and expects to achieve adjusted EBITDA of $68 million to $78 million, a growth of 11% to 27% versus its fiscal year 2023. The company is also guiding for positive free cash flow next year versus an outflow of $12.9 million in fiscal 2023.

Hence, the sales multiple disparity with its peers is likely set to remain sticky. Canopy Growth, for example, faces a dwindling cash position, auditor turnover, and higher cash burn. Both companies of course still face an uncertain backdrop for US federal cannabis legalization. Tilray’s surge has more legs to run, especially if the macro backdrop continues to improve and the company maintains differentiation from its competitors through its earnings. It will be interesting to see how the HEXO synergies play out, but the current financials of the Quebec firm throw up risks even as it ramps up Tilray’s market share. I remain on the sidelines.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.