Summary:

- Healthcare investing provides opportunities with wide moats and long-term potential in companies like Abbott Laboratories.

- ABT’s four major segments, including Medical Devices and Diagnostic Products, address key health issues and show impressive organic sales growth.

- With a positive earnings outlook and attractive valuation, ABT offers the potential for long-term outperforming returns in the healthcare industry.

Nudphon Phuengsuwan/iStock via Getty Images

Introduction

I love to invest in companies that make life better/are critical parts of our modern economies. Not only are companies more likely to survive, but they also tend to come with wide moats, which is somewhat related, except that it also indicates strong pricing power and other issues that benefit shareholders.

These companies include railroads, real estate, energy, aerospace, and healthcare. Especially healthcare has become one of my favorite sectors, as it caters to increasingly complex problems.

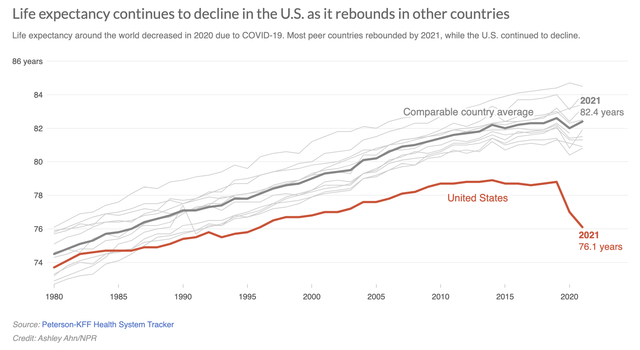

Earlier this year, NPR published an article titled Live free and die? The sad state of US life expectancy. In its article, it used a chart I have used in prior articles as well.

Peterson-KFF Health System Tracker

The chart shows a steep decline in the US life expectancy consisting of two consecutive annual declines – the steepest in modern history.

According to NPR, factors include not only individual behaviors like poor diets and lack of exercise but also social factors like poverty, racial segregation, and social isolation.

Access to healthcare and the physical environment, including city design affecting food access, were also found to be significant contributors.

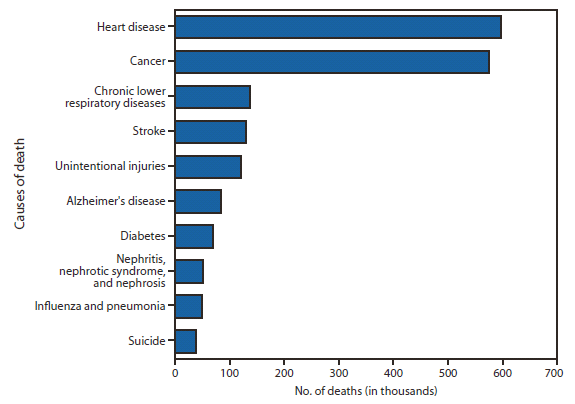

Having said that, if we look at the leading causes of death (in 2019), we see that heart disease and cancer are the bigger factors, followed by chronic lower respiratory diseases, strokes, injuries, and diabetes.

CDC

I like to focus on companies that address these health issues. This includes Abbott Laboratories (NYSE:ABT), the star of this article.

What Makes Abbott So Special

I have become a huge fan of Abbott. The stock is a part of my watchlist and a holding of a number of portfolios that I advise.

With a market cap of $196 billion, this Illinois-based company is a giant in the medical devices industry.

It operates four major segments, each responsible for more than $4.9 billion in annual revenues.

| USD in Million | 2021 | Weight | 2022 | Weight |

|---|---|---|---|---|

|

Diagnostic Products |

15,644 | 36.3 % | 16,584 | 38.0 % |

|

Medical Devices |

14,367 | 33.4 % | 14,687 | 33.6 % |

|

Nutritional Products |

8,294 | 19.3 % | 7,459 | 17.1 % |

|

Established Pharmaceutical Products |

4,718 | 11.0 % | 4,912 | 11.3 % |

|

Other |

52 | 0.1 % | 11 | 0.0 % |

- The Diagnostic Products segment at Abbott offers a significant number of diagnostic systems and tests that are distributed globally. These products cater to blood banks, hospitals, laboratories, clinics, physicians’ offices, and other healthcare facilities. Key products in this segment include core laboratory and transfusion medicine systems, molecular diagnostics polymerase chain reaction instruments, point-of-care systems, rapid diagnostics for infectious diseases, and informatics and automation solutions. I’m bringing this up because these products are key in the modern healthcare system, as they offer solutions to major problems that I listed in the introduction of this article.

The same goes for the next segment.

- Abbott’s Medical Devices segment specializes in rhythm management, electrophysiology, heart failure, vascular, structural heart devices, diabetes care products, and neuromodulation devices. In other words, it services the number one cause of death in the US and other developed nations.

The next segment is less device-focused, yet not less important.

- Abbott’s Nutritional Products segment encompasses a wide range of pediatric and adult nutritional products that are distributed worldwide. These products include infant formulas, adult nutritional supplements, and enteral feeding products used in healthcare institutions.

Lastly, while his segment accounts for just 11% of total revenue, it’s still a segment that caters to the segments that I mostly care about – it also compliments the company’s largest two segments.

- Abbott’s Established Pharmaceutical Products segment covers a wide range of branded generic pharmaceuticals sold outside the United States in emerging markets. These medications cater to multiple therapeutic areas, including gastroenterology, women’s health, cardiovascular, pain management, and respiratory health.

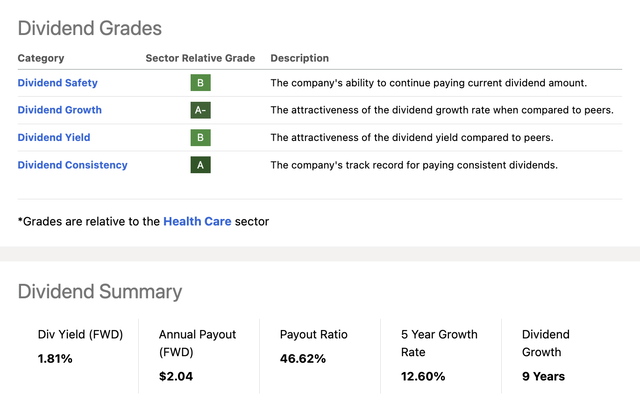

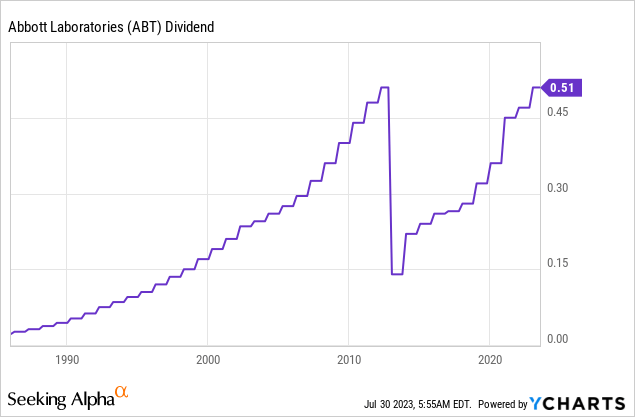

It also needs to be said that the company isn’t just enjoying high growth, as we’ll discuss in this article, but it’s also a dividend king with more than 50 consecutive annual dividend hikes.

- The stock has a 1.8% yield. This may not be a lot. However, it is backed by high growth.

- Over the past five years, the average annual dividend growth rate was 12.6%.

- The dividend coverage ratio is 47%.

Please bear in mind that the dividend history shows a steep decline. This is caused by the AbbVie (ABBV) spin-off. Investors who held ABBV did not see a decline in total dividend payments. Hence, it technically does not count as a dividend cut.

That said, the just-released 2Q23 earnings were good, despite the ongoing struggle with the post-pandemic decline in COVID-related sales, which is hurting a lot of companies that benefited from the pandemic.

Excellent Results & Strong Guidance

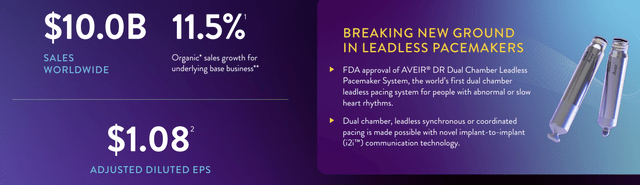

In the second quarter of 2023, ABT reported adjusted earnings per share of $1.08, which reflects an acceleration in the contribution from the underlying base business, which is exactly what investors were looking for.

This EPS result also beat estimates by $0.03.

Organic sales, excluding COVID testing, experienced low double-digit growth for the second consecutive quarter.

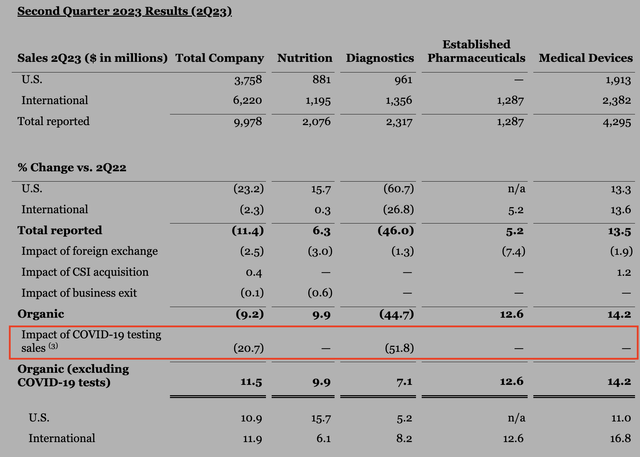

Looking at the overview below, we see the impact of COVID testing, which only impacts the Diagnostics segment.

Abbott Laboratories (Author Annotations)

Before I continue, I have to say that adjusting certain numbers is sometimes frowned upon. After all, it’s done to make certain numbers look better.

In the case of COVID, it’s fully warranted. The decline in COVID-related sales was expected as the pandemic is now endemic. Adjusting sales for COVID helps us to assess the strength of the underlying business, which is important, as ABT has never been a pure-play COVID stock.

That said, we see that even adjusting for COVID, the company saw strong organic sales in every single segment, which 11.5% total organic sales growth.

Growth was led by mid-teens growth in medical devices, along with double-digit growth in Established Pharmaceuticals and Nutrition.

During its earnings call, the company highlighted improving underlying demand trends across its institutional and consumer-facing businesses.

Furthermore, healthcare systems globally have been expanding their capacity to provide healthcare services, leading to increased demand for ABT’s products.

Essentially, while COVID sales are down, the fact that healthcare is going back to pre-pandemic demand allows the company to sell more of its other core products, which shows its successful diversification.

Also, in the consumer-facing segment, consumers have been prioritizing spending on healthcare products, further driving demand for ABT’s offerings in the US and international markets.

Having said that, I want to briefly focus on its second biggest segment, Medical Devices, which shows tremendous strength in the areas that I care most about.

As we just saw, this segment had more than 14% organic growth, which was provided by a few strong tailwinds.

- Within Diabetes Care, Freestyle Libre sales exceeded $1.3 billion in the quarter, growing by 25% on an organic basis. ABT also achieved a significant milestone as Libre became the first and only continuous glucose monitoring system to be nationally reimbursed in France for all people with diabetes who use insulin.

- In Cardiovascular Devices, sales grew by more than 10%, led by double-digit growth in electrophysiology and structural heart. In Structural Heart, MitraClip sales grew by roughly 10%, and ABT submitted TriClip, a minimally invasive tricuspid valve repair device, for FDA approval. The Rhythm Management segment achieved growth of 8%, led by Aveir, a recently launched leadless pacemaker.

- ABT also received FDA approval for its dual-chamber leadless pacemaker, which is a first-of-its-kind technology that allows for two pacemaker devices to communicate with each other inside the body.

Regarding the company’s outlook for the full year, ABT forecasted total underlying base business organic sales growth, excluding COVID testing sales, to be in the low double-digits.

However, they revised their forecast for COVID testing-related sales to around $1.3 billion, which is below their previous full-year estimate of around $1.5 billion provided in April.

This adjustment is attributed to current testing dynamics, including lower demand for testing following the end of the public health emergency in May.

The good news is that ABT’s full-year adjusted EPS guidance was unchanged at $4.30 to $4.50, which shows that the core business is a bit stronger than expected.

When compared to the initial guidance given in January, ABT has raised its underlying base business earnings forecast by more than $0.15, which offsets the aforementioned lower contribution from COVID testing as initially predicted.

Valuation

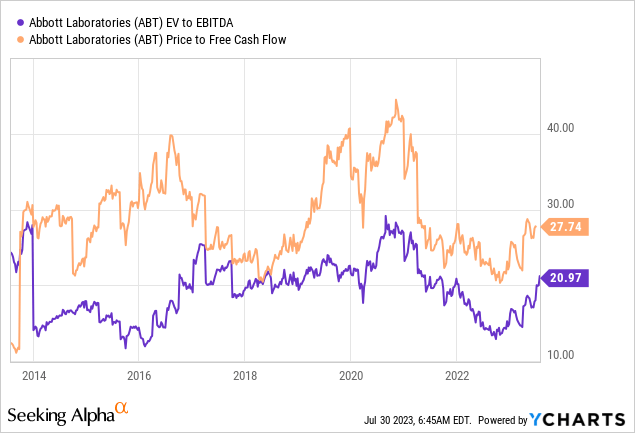

ABT has done well. The stock is now 21% above its 52-week low and up 5% over the past four weeks.

The valuation remains attractive, as the company is trading at 18.3x 2024E EBITDA. This gives the stock roughly 10% upside to what I believe is its fair value. The same goes for free cash flow. ABT has the ability to generate roughly $9 billion in annual free cash flow in the next two years, which translates to a 22x free cash flow multiple, which is close to the lower bound of the longer-term range. This also supports the company’s historical double-digit dividend growth rates.

The current consensus price target is $125, which is 11% above the current price. Hence, in this case, my own target aligns with the consensus.

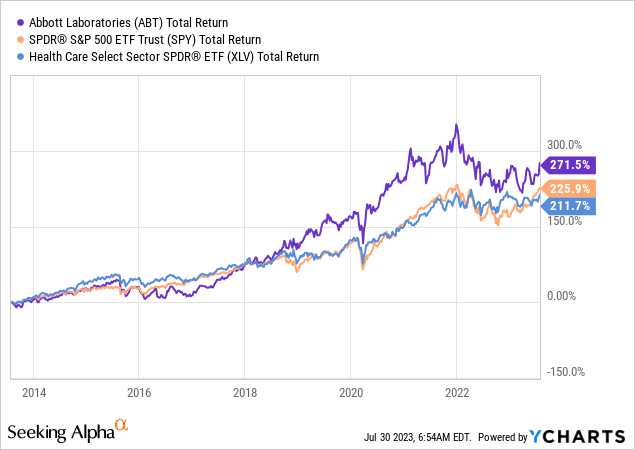

Beyond 2024, I expect ABT to generate outperforming returns for many more years to come.

Having said that, ABT is on my watchlist. If I get a good buying opportunity, I will make the stock a core holding.

Takeaway

As an investor focused on companies with wide moats in value-adding industries, ABT ticks all the right boxes.

With a diverse portfolio covering diagnostic products, medical devices, nutritional products, and established pharmaceuticals, ABT addresses key health issues, including heart disease and respiratory diseases, among others.

The recent 2Q23 earnings report confirmed the company’s strength and resilience, with impressive organic sales growth in every segment. Despite the decline in COVID-related sales, ABT’s core business remains robust, indicating successful diversification.

The stock’s attractive valuation and a solid outlook for the future make it an appealing long-term investment option.

Needless to say, I’m impressed with ABT’s contributions to the industry and its potential for outperforming returns beyond 2024. ABT has earned a spot on my watchlist, and if the right opportunity arises, it will become a core holding in my investment portfolio.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of ABBV either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Test Drive iREIT© on Alpha For FREE (for 2 Weeks)

Join iREIT on Alpha today to get the most in-depth research that includes REITs, mREITs, Preferreds, BDCs, MLPs, ETFs, and other income alternatives. 438 testimonials and most are 5 stars. Nothing to lose with our FREE 2-week trial.

And this offer includes a 2-Week FREE TRIAL plus Brad Thomas’ FREE book.