Summary:

- Google Cloud is experiencing growth and profitability, it will continue being a substantial revenue generator for Alphabet.

- YouTube is dominating the streaming industry, rivaling Netflix in terms of valuation and having untapped potential for growth.

- Alphabet has substantial growth potential in various sectors, including Google Cloud, YouTube, and its “Other Bets” like Waymo, making it an attractive investment for long-term holders.

Umnat Seebuaphan/iStock via Getty Images

It’s been some time since I last delved into Alphabet (NASDAQ:GOOG) (NASDAQ:GOOGL) on Seeking Alpha. What brings me back today? The recent earnings, of course! There are a plethora of positive aspects that deserve our attention, so without further ado, let’s delve into them.

Growing Google Cloud

We must begin with the glaringly apparent: Google Cloud’s growth and profitability.

This marks the segment’s second quarter of profitability on an operational basis. Depending on your sources, this might position Google Cloud as the second-largest cloud platform based on operating income.

For those hesitant to click the link above, a leaked Google document indicated that Azure supposedly concluded 2022 with an operating loss of $3B. The document further suggests that Microsoft’s alternative has sales and marketing costs nearing $10 billion.

While these claims could hold water, Microsoft (MSFT) doesn’t disclose Azure’s individual figures, rendering any interpretation about Microsoft’s cloud strategy merely conjecture.

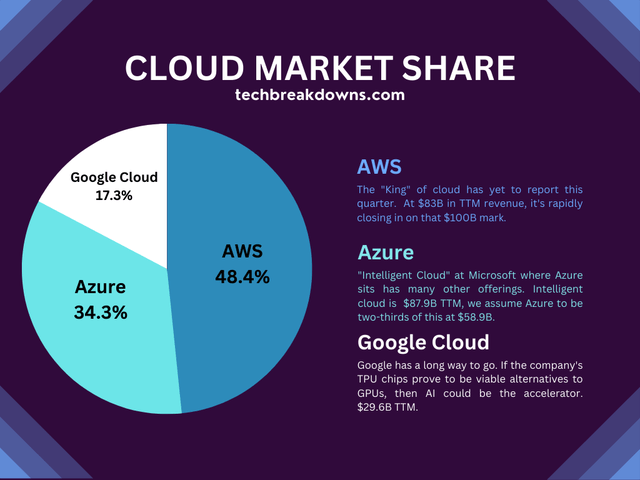

On the topic of conjecture, here’s my own estimate of the proportion of the market each of the three tech giants currently controls (note: Amazon’s (AMZN) earnings for this quarter are yet to be reported).

Cloud Market Share (Author created, company filings)

As illustrated, AWS remains the largest and could edge back towards 50% following its earnings announcement next week. To ascertain Azure’s share, I considered it to be two-thirds of Microsoft’s “Intelligent Cloud” segment. This is projected to grow over time, and hopefully, by FY2024, Microsoft will begin to disclose this segment separately, simplifying our analysis.

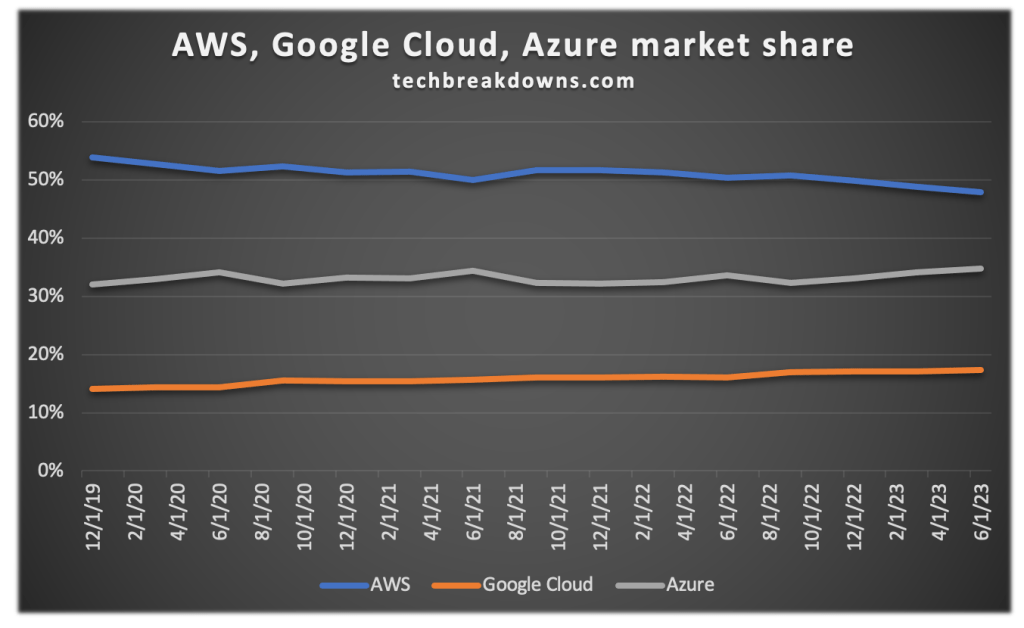

Cloud market share on a quarterly basis (Author created, company filings)

The above visual representation displays the quarterly trends from 2019. We can observe the big three potentially moving towards equal market share, but Amazon still has the upper hand and likely will for some time.

Should this trend towards convergence persist, Alphabet stands to gain significantly. This rapidly expanding sector could potentially transform Google Cloud into a substantial revenue generator.

YouTube is Dominating Streaming

YouTube, despite being a substantial business entity, is often relegated to a mere footnote in the vast Alphabet universe. Search, AI, and Google Cloud usually take the spotlight, leaving the world’s largest streaming platform somewhat overlooked.

The lack of recognition is somewhat perplexing, considering that if YouTube were an independent company, it would rival Netflix (NFLX) in terms of valuation in my opinion.

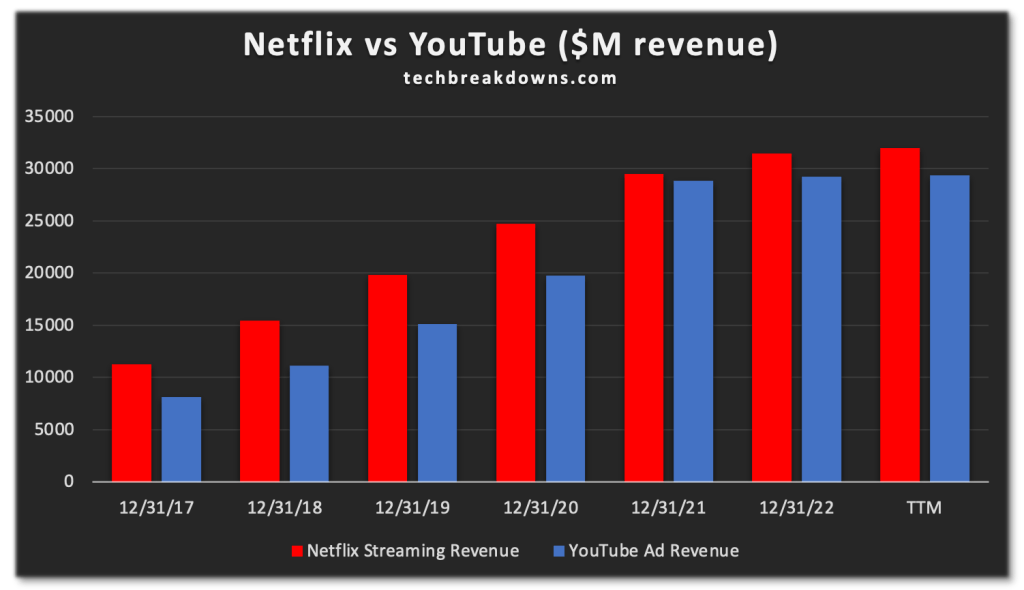

YouTube vs Netflix revenue (Author created, company filings)

Looking for evidence? Check out the chart above. YouTube matches Netflix’s revenue from advertising alone. The chart doesn’t include YouTube Premium or YouTube TV’s revenues. With these components factored in, YouTube clearly stands as the reigning champ in the streaming industry.

Another noteworthy point is YouTube’s untapped potential. Amidst ongoing strikes in the entertainment world, it’s probable that content creators will shift more projects to this platform. This likelihood increases the longer the strikes persist.

If the situation hasn’t improved in six months, Netflix, Max, Hulu, and Disney+ could face significant customer churn, with YouTube potentially reaping the benefits. It may remain one of the few platforms still receiving fresh, long-form entertainment content.

Will the quality be lower? Absolutely. But for those in search of quick entertainment solutions, I believe YouTube is perfectly positioned to fill that gap.

The Future

At the time of writing, Alphabet stands as a $1.7T company. While soaring higher might seem unlikely, it’s my conviction that big tech will reign supreme in the impending AI landscape. Those harnessing massive proprietary data sets could even evolve into $5-10T entities in my opinion.

Could Alphabet be one of them? It’s a possibility. When it comes to proprietary data, few companies have as comprehensive an understanding of people as Alphabet. They know your search habits, the emails you receive, your purchasing behavior, and so much more.

Through Alphabet’s “Other Bets,” they can even track vehicle ordering patterns in certain parts of Arizona. If you use Nest, they’re aware of your preferred thermostat settings, and there’s a good chance they know the cost of your last power bill.

I could keep listing examples, but I think my point is clear. Except maybe for Apple, Google possesses the most extensive proprietary dataset about consumers one can imagine, and I think they’ll put it to good use. Investors should consider this as they contemplate Alphabet’s future.

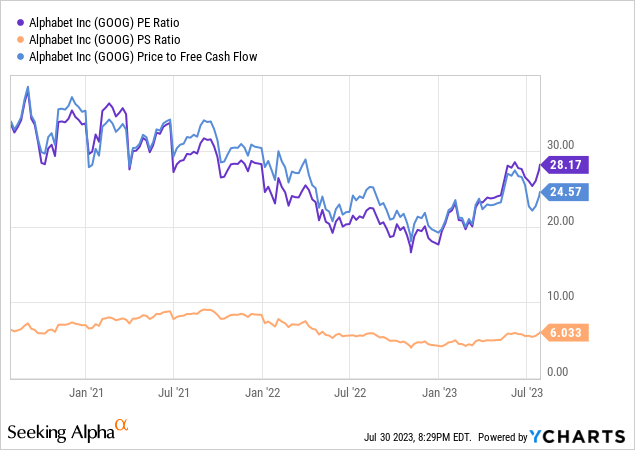

A glance at historical pricing metrics indicates that Alphabet is not overvalued today. In fact, based on PE, PS, and PFCF, the company has become cheaper over time.

Many might still regard this as a high-priced name at 28x earnings and 6x sales, but I am convinced Alphabet still harbors substantial growth potential.

This “substantial growth” will come from various sectors, predominantly powered by AI and its uptake.

Firstly, we can expect to see accelerated growth in Google Cloud. The entire industry has significant potential for expansion, and Google Cloud is one of three companies positioned to capture a large share of this growth. As per McKinsey, approximately $3T in added EBITDA is up for grabs.

Next is YouTube. As previously noted, it’s a significant player in the streaming space, and it’s set to grow even bigger. Younger generations are dedicated YouTube viewers, and with figures like Mr. Beast accruing 50 million views per day, the platform’s vitality is apparent.

As mentioned earlier, the longer the Hollywood strike continues, the more viewers will migrate to YouTube in my view. At $13/month for ad-free content, it’s a bargain compared to the $15+ monthly fees charged by other streaming services.

Lastly, we have Alphabet’s other bets. Waymo operates tens of thousands of rides monthly and could likely compete with Cruise to mainstream autonomous taxis. A recent partnership with Uber (UBER) aims to further simplify ride-hailing. And it’s commercially viable, too, with projected revenues of $4T by 2027.

The $4T figure might seem lofty, especially four years down the line (personally I think it’s more like 6-7 years out), but it isn’t unreasonable to suggest that Waymo could evolve into a $1T company if it pioneers mass adoption. This is a big “if,” but even assigning a 25% chance values Waymo alone at $250B.

Boasting massive datasets, Google Cloud, self-driving vehicles, YouTube, and the revenue powerhouse that is Google Search, this company has plenty of growth potential left for long-term holders.

Potential Risks

The greatest risk associated with Alphabet lies in its hefty valuation. There is a potential, and we’ve seen recent instances, of the market re-evaluating these colossal tech corporations. If such a re-rate were to occur again, it could result in a significant waiting period to recover losses.

Another considerable risk for the company lies in its core profit engine, Search. With AI poised to revolutionize the way users access information, and younger generations gravitating towards platforms like TikTok for their searches, Alphabet needs to innovate to ensure Google Search maintains its dominance.

However, Alphabet is not standing still. The company is introducing features like AI answers to Google Search, demonstrating adaptability. Despite these proactive measures, the risk persists.

Closing Thoughts

I’ll reaffirm my previous assertion: Alphabet, equipped with immense datasets, Google Cloud, self-driving vehicles, YouTube, and the revenue powerhouse that is Google Search, still offers substantial growth opportunities for long-term investors.

Can Alphabet’s returns surge by 100% from the current level? Given 2-3 years, I think so. Will it be a smooth journey? Likely not. There will be fluctuations along the way, but considering the numerous opportunities this company has in rapidly expanding sectors, I believe Alphabet’s growth prospects are still formidable. Consequently, I’ll continue to augment my holdings during significant market pullbacks.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of GOOG either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.