Inside Eli Lilly’s Strategic Investment In Sigilon: An Opportunity Overlooked

Summary:

- Pharmaceutical company Eli Lilly and Company is purchasing biotech firm Sigilon Therapeutics, Inc. for $14.92 per share, with shares trading at $21.28 due to a contingent value right from Eli Lilly (potentially).

- The acquisition, expected to conclude in Q3 2023, values Sigilon at roughly $35M.

- A clinical trial application for SIG-002 could start as soon as 2024 and would de-risk this investment to an important degree.

- The potential to achieve a multi-bagger return over many years represents an attractive investment opportunity, despite potential risks and volatility.

jetcityimage

Pharma giant Eli Lilly and Company (NYSE:LLY) is buying the tiny biotech Sigilon Therapeutics, Inc. (NASDAQ:SGTX) for $14.92 per share in cash. The shares are trading at $21.28 due to a contingent value right ((CVR)) from Eli Lilly, potentially worth as much as $111.64 per share. Eli Lilly and Sigilon worked together on cell therapies for type 1 diabetes on Sigilon’s lead asset SIG-002. Presumably, Eli Lilly is very well informed about the asset it is acquiring. I’ve written about this deal previously here.

The deal is expected to close in Q3 2023. The takeout price values the company its assets at approximately $35M. At first glance, it seems peculiar that shares would be trading as low as $21.28.

The difference is because of the contingent value rights. The SIG-002, lead asset, could start a clinical trial application in 2024. I expect the failure rate of this deal to be extremely low for three reasons: 1) The parties are already cooperating; and 2) the acquirer is very familiar with the company; 3) the acquisition is less than a rounding error to the giant acquirer; and 4) most of the money only has to be paid if things turn out quite well for the acquiring party.

The terms of the CVR (note these aren’t tradable) are described as follows:

Each CVR represents a right to receive the following cash payments, without interest and less any applicable tax withholding (the “Milestone Payments”) if the following Milestones are achieved:

● First Dosing Milestone: $4.06 per CVR, payable upon the occurrence of the first human being patient being dosed with a product in a Phase I clinical trial prior to July 31, 2027;

● First Registration Purposes: Dosing Milestone $26.39 per CVR, payable upon the occurrence of the first patient being dosed with a product in a pivotal trial prior to the December 31, 2028; and

● Marketing Authorization Milestone: $81.19 per CVR, payable upon the occurrence of marketing authorization for a product in (A) the United States, (B) Japan or (C) three of France, the United Kingdom, Italy, Spain and German prior to December 31, 2031.

Effectively (assuming a 100% closure rate, which is likely a slight stretch) at $22.50 per share, we are currently laying out $6.36 to have a shot at $111.64. This would be a 1655% return, although it would only be achieved over 8 years. The returns (if any) would come in lumps based on the milestones). We’d also see a 45% loss on invested capital (in case only the 1st milestone is achieved) or a 306% return if the 1st and 2nd milestones are achieved but the 3rd one isn’t.

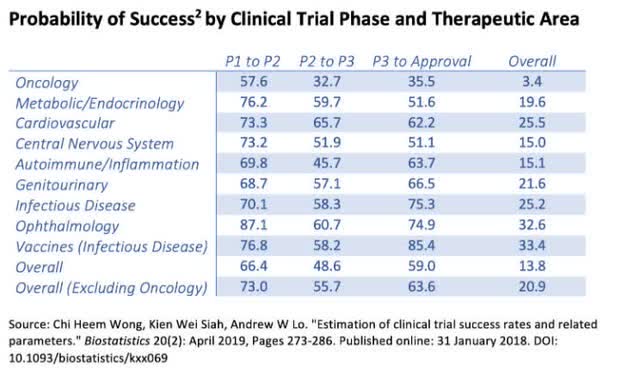

I don’t know the exact odds of achieving any of these milestones, and I don’t know anything about the therapy being worked on here. It seems to me that the 1st milestone is highly achievable because it isn’t dependable on an independently judged success. The company has to set up a phase 1 trial. These tend to be the least expensive, and the company will be more than sufficiently bankrolled. Why would Eli Lilly buy this company if it didn’t intend to pursue a phase 1 trial? It seems reasonable enough to put the odds at 90%+ this will happen. A rough estimate of the other milestones can be derived from academic research into the probability of success by the clinical trial phase:

Statistics of trial success rates (Oxford University Press)

This leads me to believe the 2nd milestone has around a 42% chance of being met. The third milestone has around a 26% chance of being achieved. These are rough guestimates and could be significantly off, but I’d argue they are accurate enough to illustrate that this is an interesting investment opportunity.

If I multiply the odds by the dollar values of each milestone and do not take the time value of money into the equation, the expected value of the CVR is around $35 per share. That’s a huge difference to the ~$6 of value the CVR is being assigned by the market. Even if I would consider the time value of money, credit risk (not too bad given the status of the acquirer), and decreased odds quite a bit, this would still look reasonable.

At the same time, the most likely outcome seems for investors to lose around 45% here. The outcome is very binary, path-dependent, and often bad. It will be an uncorrelated but highly volatile position.

However, if I could take this bet 1000x times and see results a thousand times, it would turn out quite profitable. This leads me to believe buying a few Sigilon Therapeutics, Inc. shares is attractive before this deal closes. I don’t think many other market participants are very interested in this type of setup and holding significant exposure to these illiquid long-term assets. It is quite possible for the shares to continue to sell off from the spike on the announcement. I started establishing quite a small position at around $22, and I’m building on that position today at around $21. I don’t mind taking my time to establish the position unless it starts trading quite differently.

Editor’s Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of SGTX either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.