Summary:

- Texas Instruments reported Q2 earnings this week, and they were bad as expected.

- Management has been transparent in what inventory and Capex would do, but many investors seem surprised.

- Investors seem to be losing their patience, and that’s good news for long-term shareholders. We explain why.

metamorworks

Introduction

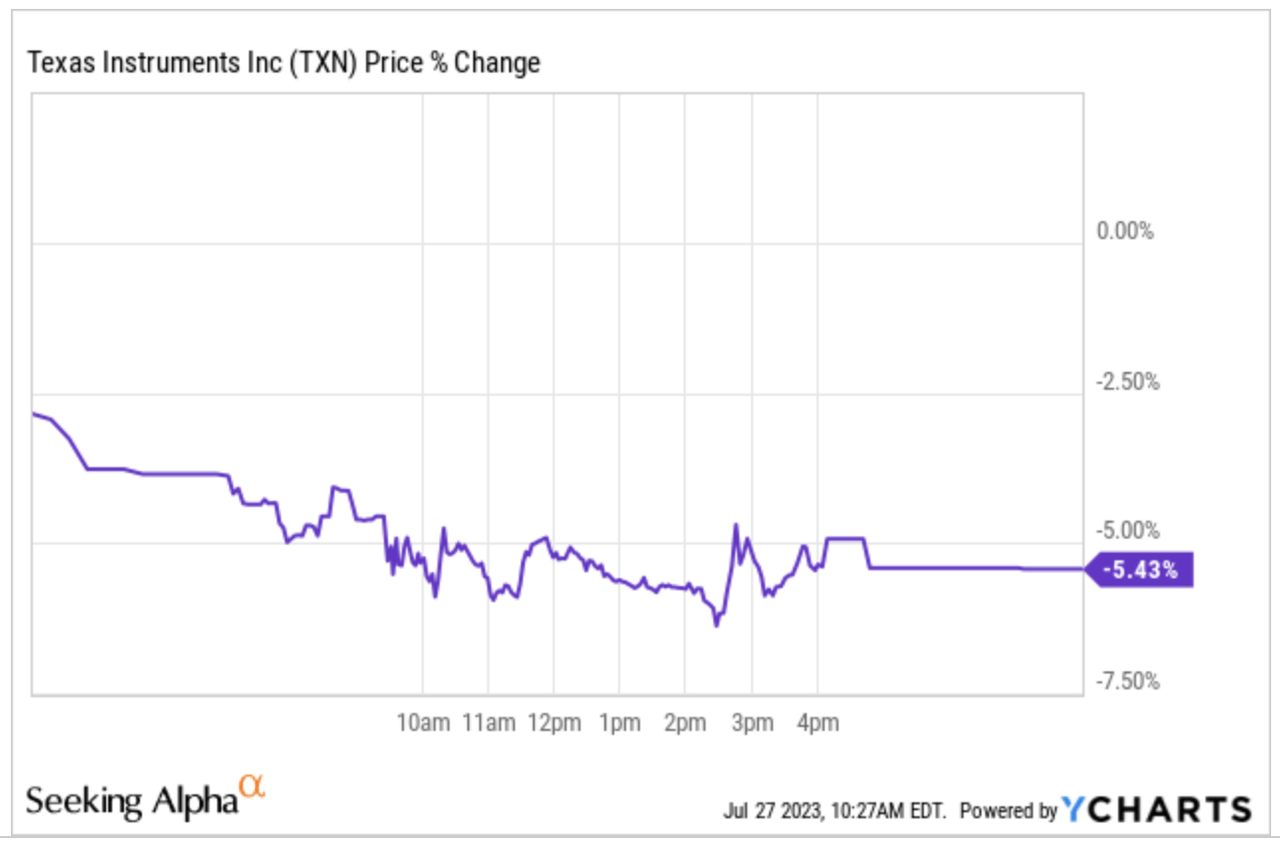

Texas Instruments Incorporated (NASDAQ:TXN) reported its Q2 earnings last week, and the market did not seem to like the results. The stock dropped almost 6% the following day:

YCharts

A 6% drop is a pretty significant move for such a low-volatility company as Texas Instruments. In fact, it was the company’s second most significant one-day drop of the past 3 years:

YCharts

So, what happened? Were earnings bad? The truth is that little has changed for Texas Instruments, although there’s an essential takeaway from this quarter that strikes us as very positive as a long-term investor. We’ll share it in the qualitative highlights.

So, without further ado, let’s get on with it.

The TXN Numbers

The headline results

Last quarter, we titled our article for subscribers “Signs of bottoming?” due to the company’s guidance, which called for a sequential increase in revenue after a couple of quarters of sequential decreases. We already knew Texas Instruments is a cyclical company currently immersed in a downturn, so such upbeat guidance seemed like a pretty good sign of a cycle turn.

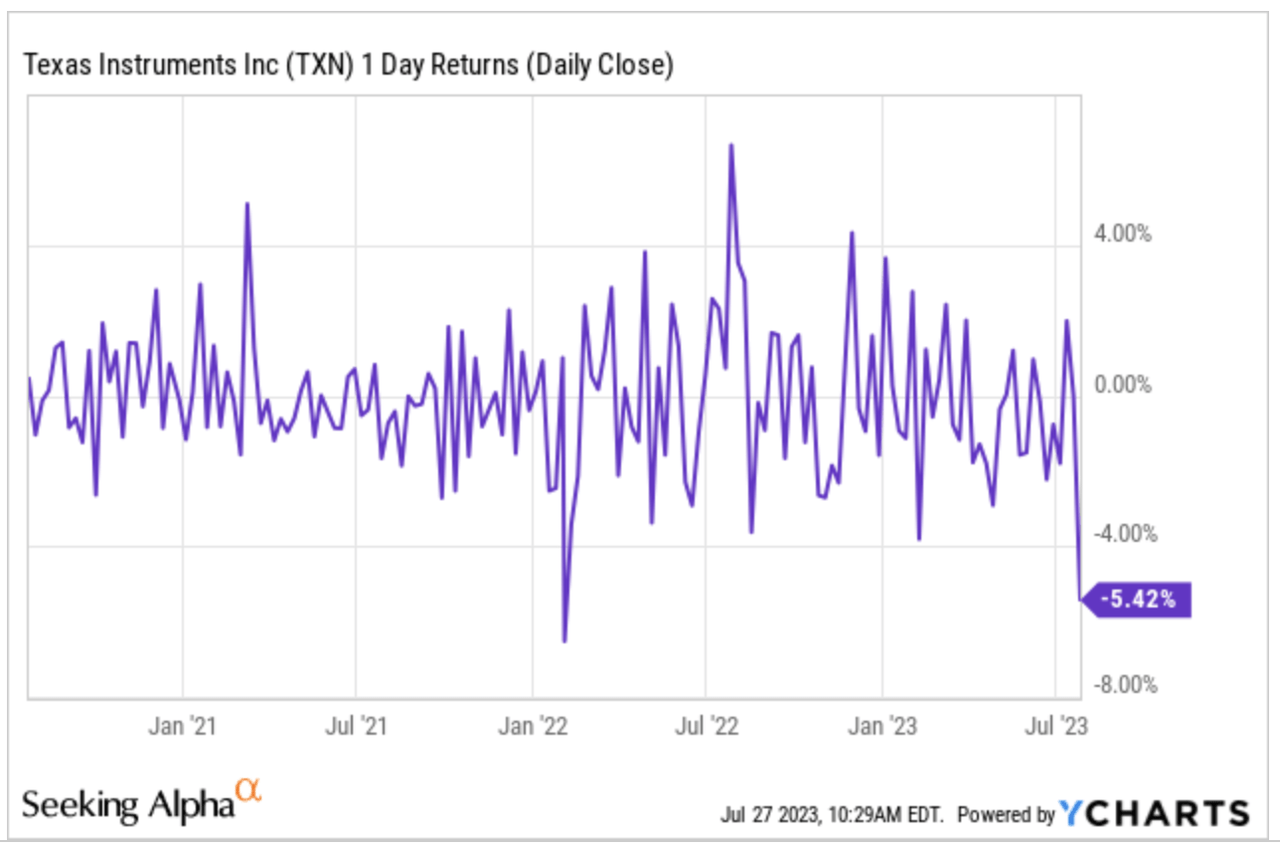

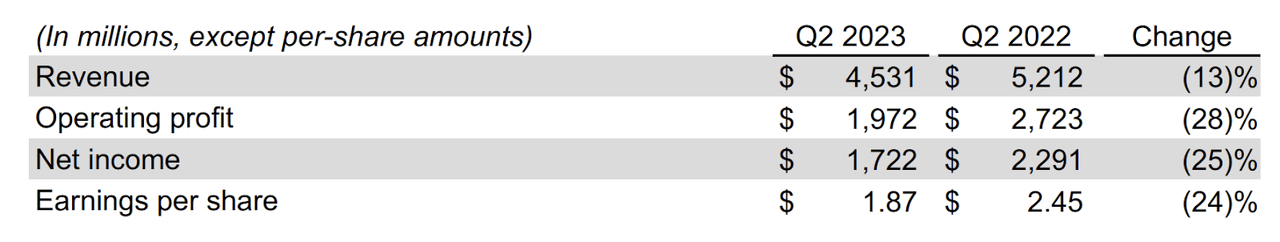

Well, management delivered in Q2 and posted $4.53 billion in revenue and net income of $1.72 billion, comfortably beating analyst expectations:

Seeking Alpha

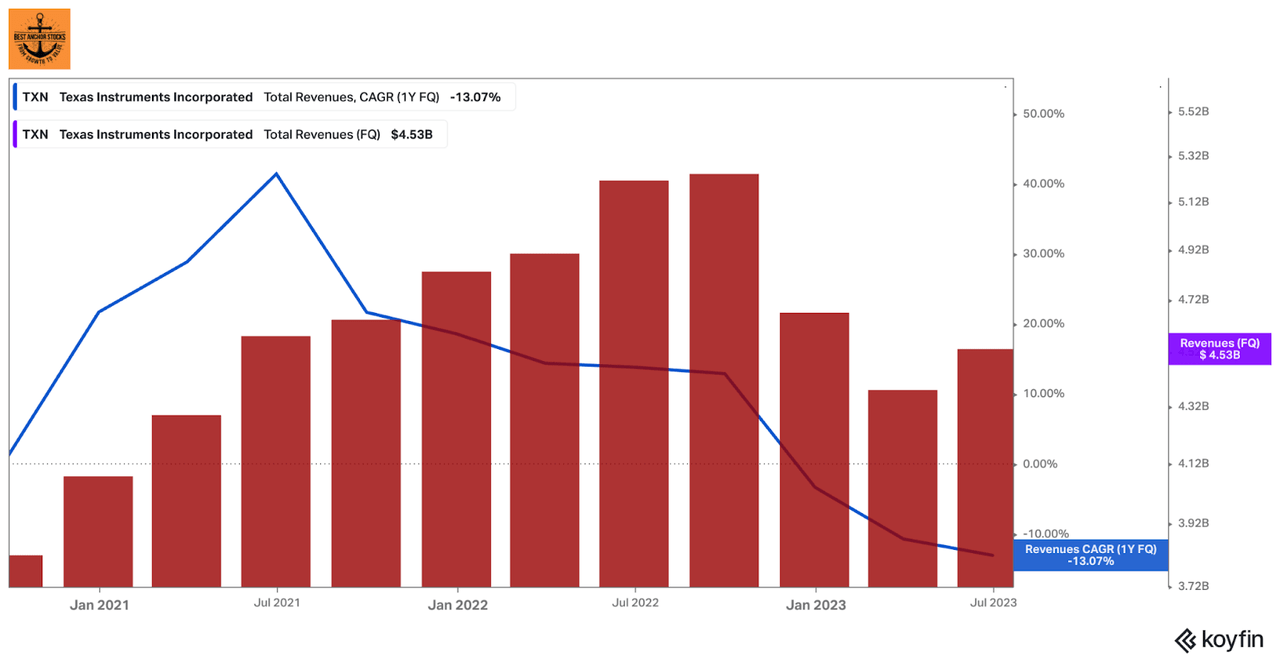

If we look at the quarterly revenue chart, we can see that revenue fell by 13% year-over-year but increased by 3% sequentially. Of course, the year-over-year metric is always important, but for companies suffering from cyclicality it might be a better idea to look at the financials sequentially to judge the current state of demand:

Koyfin

This sequential improvement is no doubt good news, but are we past the bottom of the downturn? Well, there are nuances.

The different moving parts

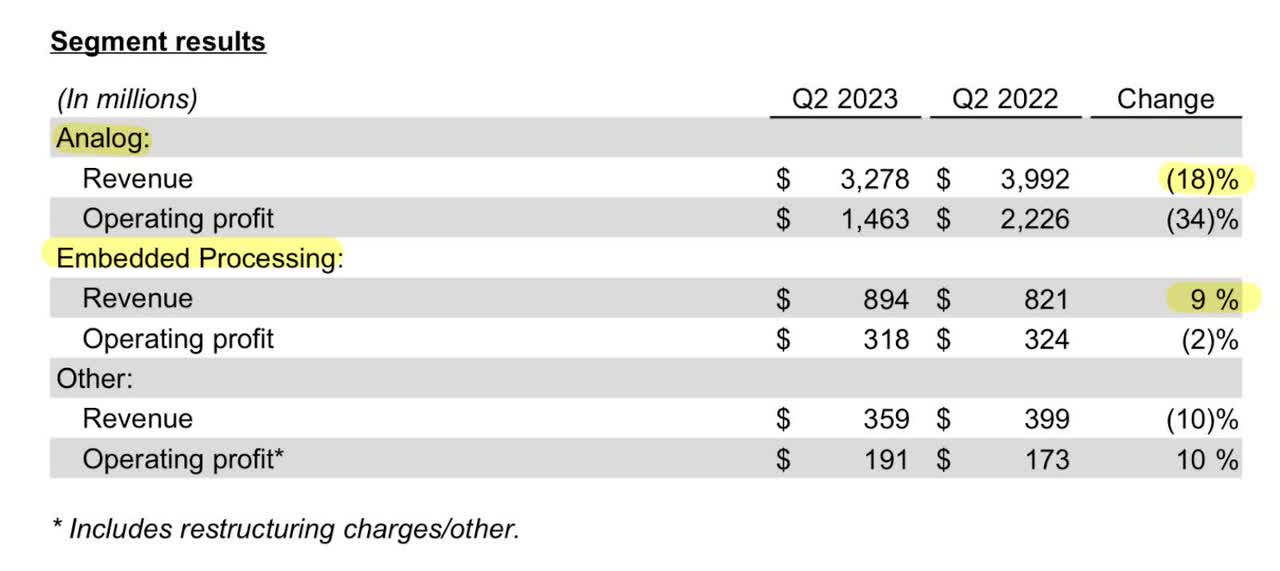

Performance across the company’s two segments continued the trend we had seen in prior quarters. Analog continued weakening, but Embedded grew again:

Texas Instruments’ Q2 Earnings Release

It’s pretty clear that Analog is suffering the impact of the downcycle, but why isn’t embedding suffering it too? There are a couple of reasons, the most important being that the segment is experiencing a turnaround after a period of underperformance:

I would say at a top level, the changes that we have made to our product portfolio, the design in that and the customer response to those products as we’ve put them out in the marketplace continues to be very strong.

Our confidence that that business will grow and gain market share over the long term is extremely high, based on that. And as we’ve talked about before, we’re putting in place to be able to support that growth for embedded internally, and that is a position that we haven’t been in quite some time.

Near term, I would say, besides things stabilizing, we’ve experienced greater supply constraints over the last two years is embedded, has previously had to rely on foundries to supply that demand. And so those constraints are alleviating.

Source: Dave Pahl, Head of Investor Relations, during the Q2 2023 earnings call (emphasis added).

Analog’s performance has gotten quite a bit of criticism from several analysts because Texas Instruments lost share yet another quarter. This might sound terrible, but there are several explanations, most of which are well-encompassed here:

Share doesn’t move quickly inside of our markets. I think that depending on the peer you’re comparing to, oftentimes the market exposure can explain a good portion of it.

There’s other factors like how much distribution is someone using. As you know, we’ve transitioned from mostly using distribution to mostly having revenue come direct. So there is inventory that needed to be burned out of the channel as we made that transition.

So there’s multiple factors. I think going forward, our confidence in being able to continue to gain share is extremely high.

Source: Dave Pahl, Head of Investor Relations, during the Q2 2023 earnings call (emphasis added).

To this, we would add that Texas Instruments gained quite a bit of market share during the pandemic because it was the only company willing to build up its inventories in advance of the demand surge. These inventories were key to support customers when the semiconductor shortage started.

So, we think that market share loss is not worrying currently, and we should look at it over the long term.

What about the end markets?

Analog and Embedded are the company’s two operating segments, but Texas Instruments caters to many end markets like automotive, industrial (which, by the way, is sub-segmented in many markets), personal electronics, etc.

Similarly to last quarter, automotive was the bright spot:

First, the Industrial market was about flat. Next, the automotive market was up low-single digits. Personal Electronics was up low-single digits after several quarters of sequential declines. And next, communications equipment was down mid-teens, and finally, Enterprise Systems was down mid-single digits.

Source: Dave Pahl, Head of Investor Relations, during the Q2 2023 earnings call (emphasis added).

This end-market diversity helps the company remain resilient, especially when the downturn is asynchronous. One of the keys to the company’s resiliency is automotive, which has held strong despite the tough comps. Many investors have been claiming that automotive is close to turning, the only problem is they have been saying this for several quarters already. Texas Instruments management believes this fall will happen, but they don’t know when. The good news for us is that when that happens, maybe the other end markets will be performing better, helping the company weather the automotive drop.

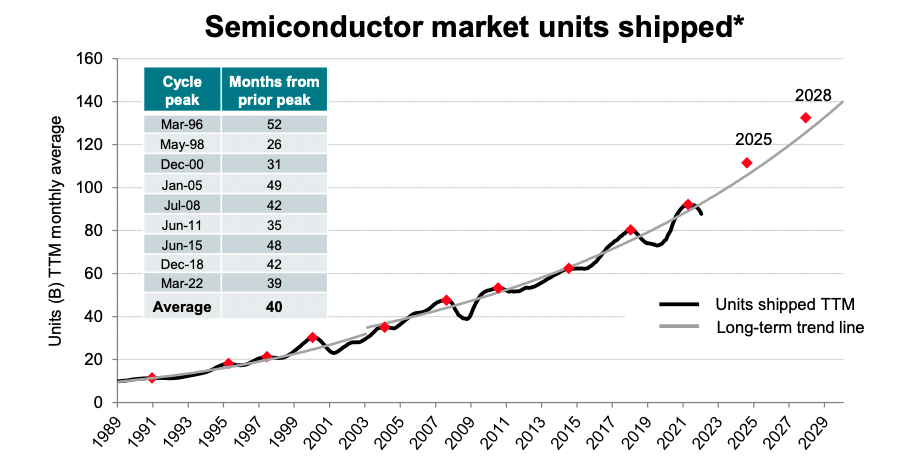

As we said before, there’s no denying that Texas Instruments is a cyclical company, but that doesn’t mean that it does not enjoy secular tailwinds. Even if automotive and industrial roll over in the coming quarters, the trend of increasing semiconductor content in both markets is clear. The bottom of the next downcycle does not matter much if the peak of the next upcycle is higher than the peak of the last one. This is well illustrated in the following slide:

Texas Instruments Capital Management Update

Inventories continue climbing

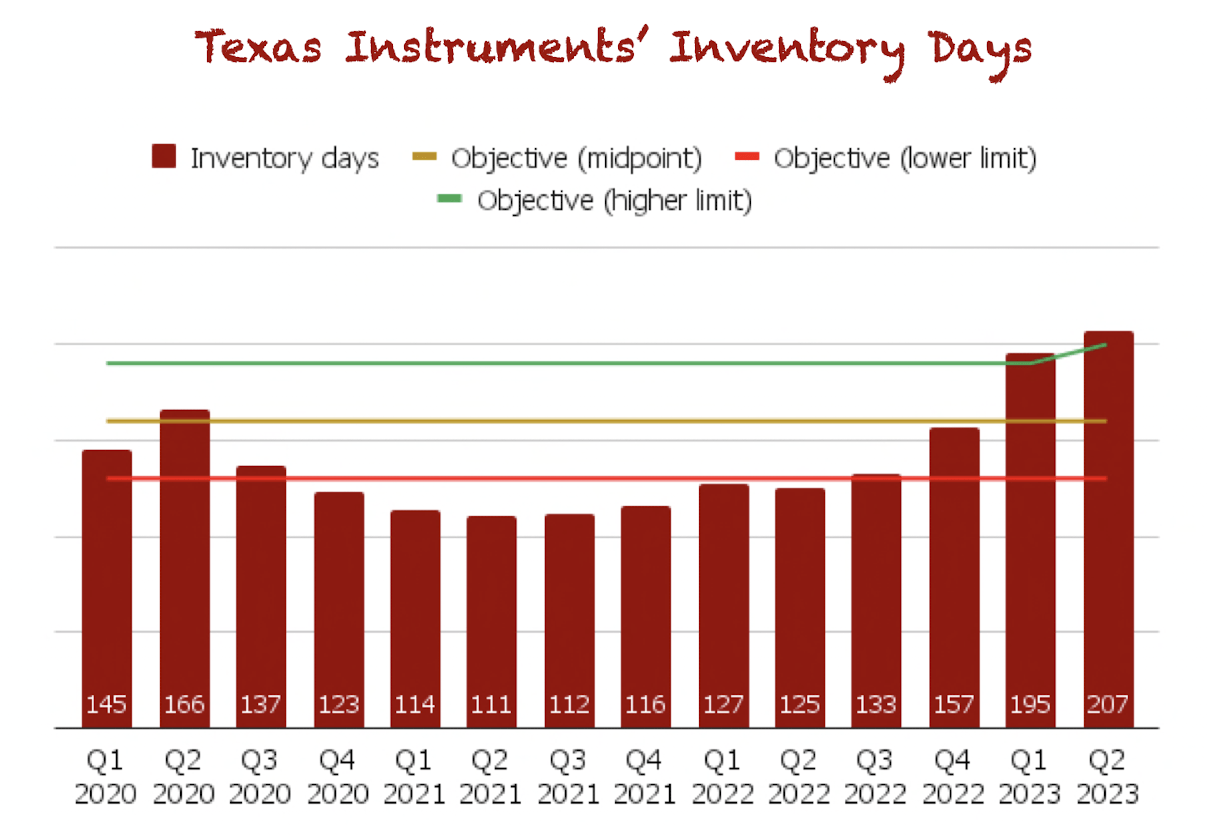

Texas Instruments’ management has been very vocal about staying at high utilization rates to build inventory. The reason is straightforward: the inventory has low obsolescence risk, and management believes it will help them gain share in the coming upturn, just as it happened coming out of the pandemic.

As the demand environment has been weak, the company’s inventory days are climbing. They were up to 207 days this quarter, a 12-day sequential increase. This is a significant increase, but lower than what we had seen in the previous two quarters:

Made by Best Anchor Stocks

Of course, the company incurs costs when building the inventory, penalizing margins. Still, we must not forget that Texas Instruments follows a fixed-cost model, so staying at high utilization if one is confident it will sell those products at good margins makes quite a bit of sense.

For those of you wondering what “207 days of inventory” means, Rafael Lizardi told us this quarter (emphasis added):

200 days is about a couple of quarters’ worth of inventory in various stages of finish.

Profitability still impacted by several things

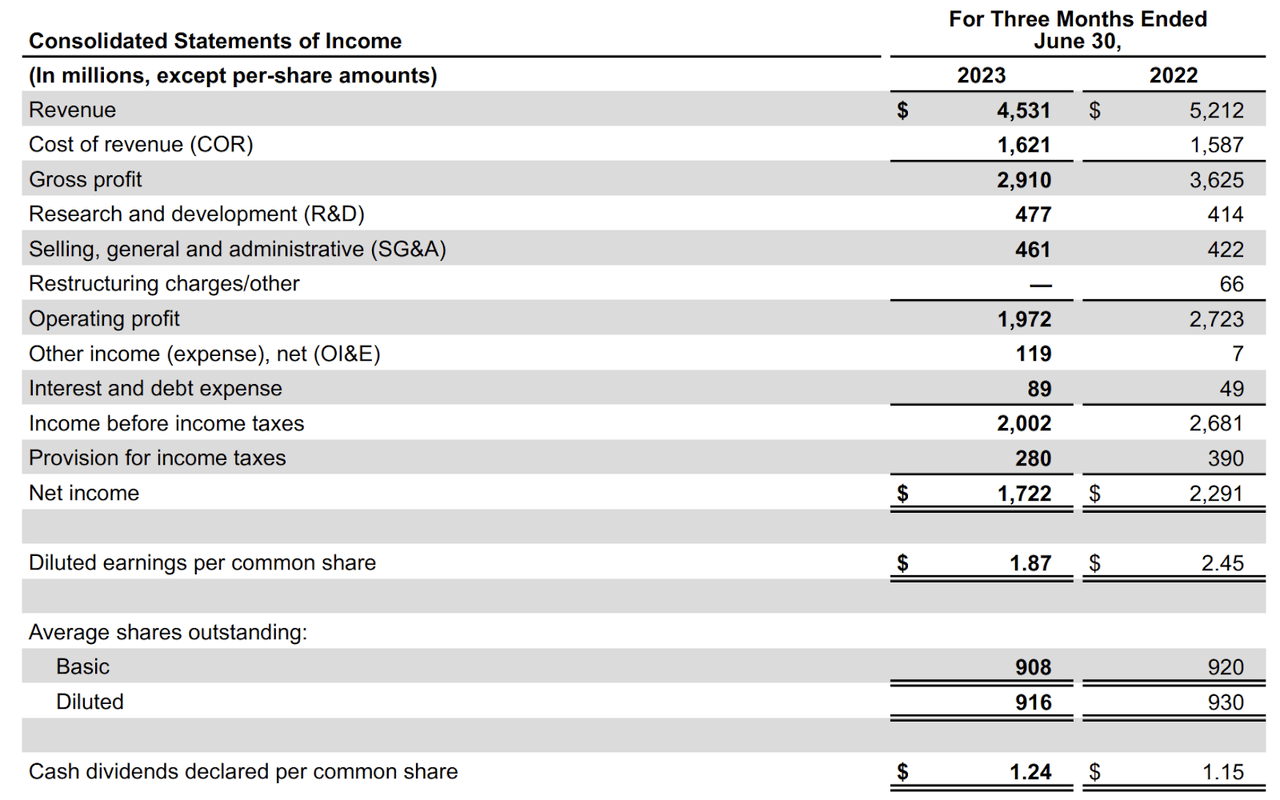

This fixed-cost model means that it makes sense to remain at high utilizations, but of course, when the demand is not there, margins suffer. This was the case in Q2:

Texas Instruments’ Q2 earnings release

Are we worried? Not really. For starters, this operating deleverage will transform into leverage when the demand is back, so we’ll most likely see margins expand significantly then. Consider that Texas Instruments is now incurring production costs to produce chips that it will sell in future quarters.

Also, management continues to invest in the future irrespective of current demand; gross margin is not the only line that has contracted. Both SG&A and R&D increased year-over-year despite the drop in revenue:

Texas Instruments’ Q2 Earnings Release

What we found strange is several people calling Texas Instruments a “dinosaur” because it’s not investing in R&D. Is this true? Well, the company definitely spends a low portion of its revenue on R&D (around 11%), but what about its competitors? Analog Devices (ADI) (also a great company), considered much more innovative, spends around 13% of revenue in R&D. This is marginally above Texas Instruments’ investment.

Still, thanks to its scale, Texas Instruments spends more in absolute dollars than Analog Devices ($477 million vs. $415 million in the most recent quarter). So, does Texas Instruments spend less as a percentage of revenue on R&D than Analog Devices? Sure thing, but in absolute terms, the company invests more. This, by the way, is one of the competitive advantages we quoted in one of our articles (emphasis added):

On the R&D side, Texas Instruments can spend less on Research and Development as a percentage of revenue while investing more than competitors in absolute terms. For example, Analog Devices spent $1.3 billion in R&D in 2021, while Texas Instruments spent $1.5 billion. These numbers are pretty similar, but there is a significant difference when calculated over revenue. Analog Devices spent 18% of its revenue on R&D, while Texas Instruments spent “only” 8% of revenue.

Of course, spending more on R&D does not mean spending better, but we highly doubt the people who claim that Texas Instruments is a “dinosaur that doesn’t spend on R&D” have visibility into the company’s R&D projects.

So, profitability was not great, but that was something expected.

Cash flows – Weak but also expected

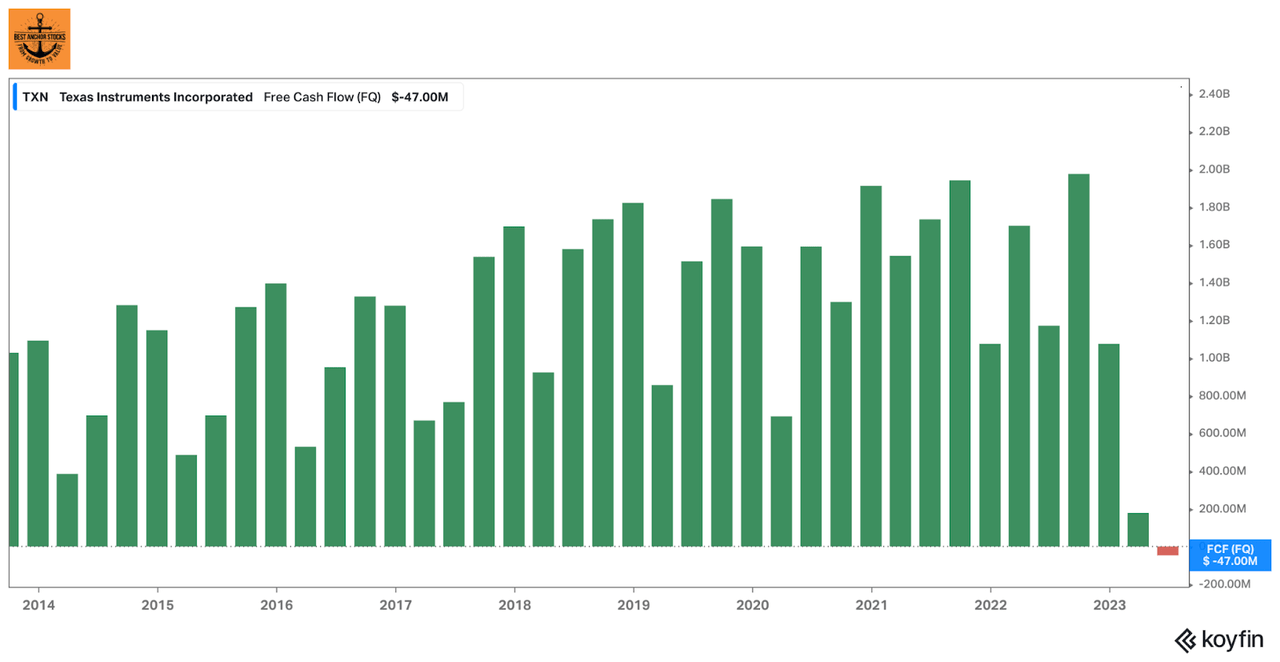

The landscape in cash flows was not great, but it wasn’t unexpected either. The company reported negative quarterly free cash flow for the first time in more than a decade, wow:

Koyfin

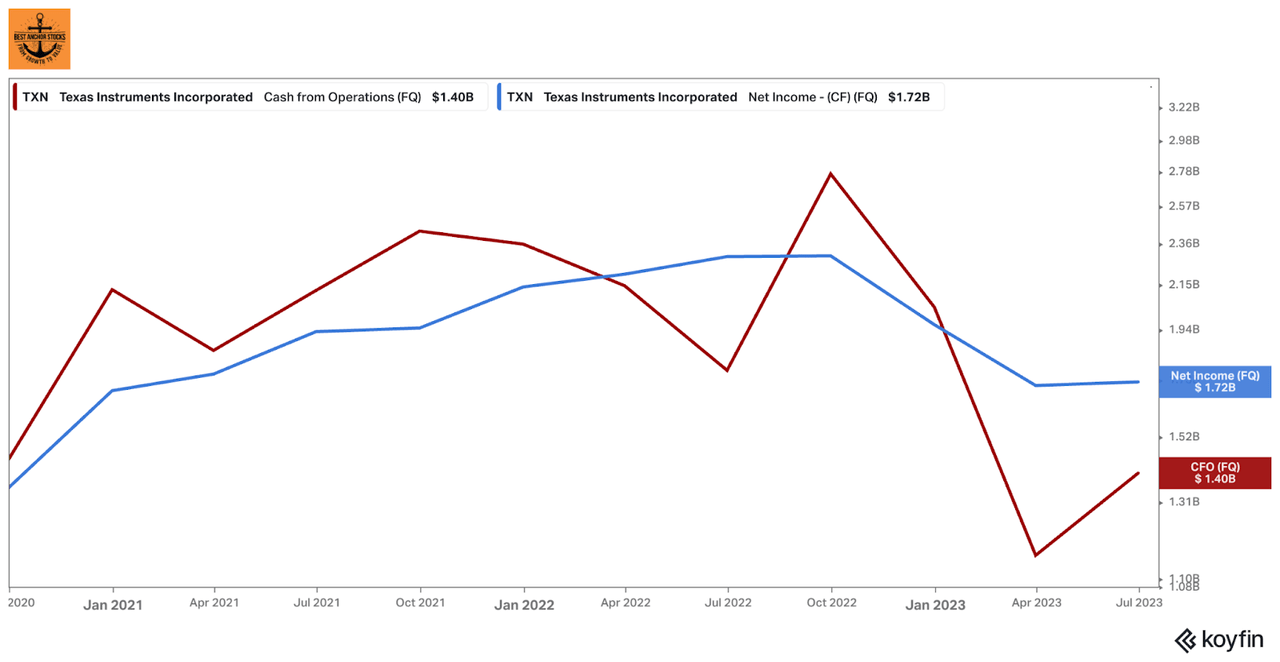

Of course, the negative free cash flow is a self-inflicted wound, both in operating cash flow and Capex. As the company continues to build inventory, cash conversion is worsening, leading to lower Operating Cash Flow. The gap between net income and operating cash flow has widened significantly:

Koyfin

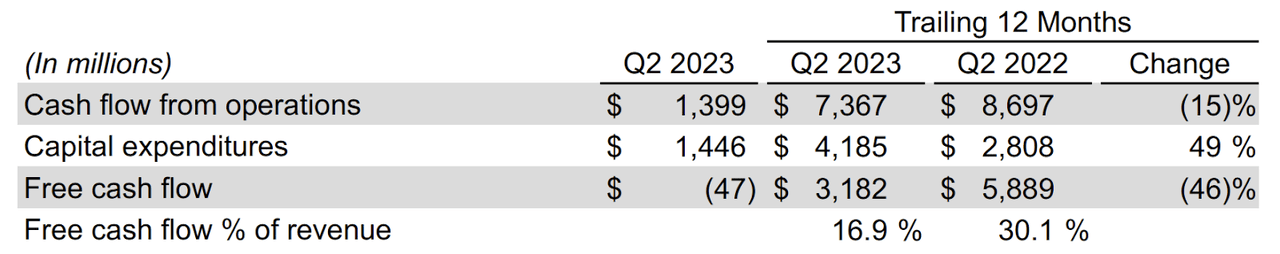

Capex is up 49% on a trailing 12-month basis, and free cash flow is down 46%:

Texas Instruments Q2 Earnings Release

The lower cash conversion will “fix itself” when the cycle turns and inventory winds down. As for Capex, we shouldn’t expect to see it come down at least until 2026:

And that’s why we’re making this investment on CapEx, in particular, about $5 billion per year for the next four years, and we are committed to those investments.

We’re excited to making those investments regardless of the short-term fluctuations of revenue and of course lower revenue means lower operating cash, which now with the CapEx, that’s why you’re seeing on the free cash flow is not unexpected.

Source: Rafael Lizardi, Texas Instruments CFO, during the Q2 2023 earnings call (emphasis added).

Strong balance sheet and continued buyback cooldown

Texas Instruments added $1 billion in debt sequentially, but its cash position remained strong at $9.5 billion. This yielded the company a net debt position of around $1.7 billion. Considering that Texas Instruments could be a cash-generation machine tomorrow if it wished to, we don’t think this is worrying at all.

Also note that the company’s interest expense is pretty low thanks to its quality, enabling it to cover its financial obligations even through tough times. The company’s debt has an average coupon of 3.5%, meaning it might be paying a good portion of its interest expense with the interest income of its short-term investments.

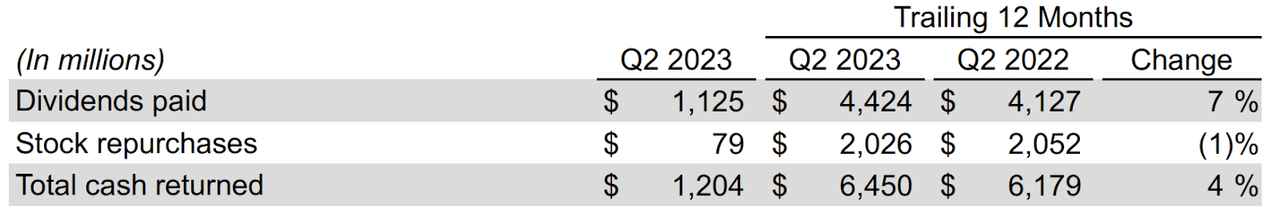

Just like last quarter, management returned $1.2 billion to shareholders, heavily skewed to dividends:

Texas Instruments Q2 Earnings Release

The company made some buybacks last year, but it has put on the brakes. This is normal, considering the stock is not obviously cheap and they need that money for the capex expansion plan. We should expect dividends to weigh much more heavily in the capital return for shareholders through such periods.

The qualitative highlights

The first qualitative highlight you will read in this section is, in our opinion, this quarter’s most important takeaway.

Investors are losing their patience, but management is standing strong

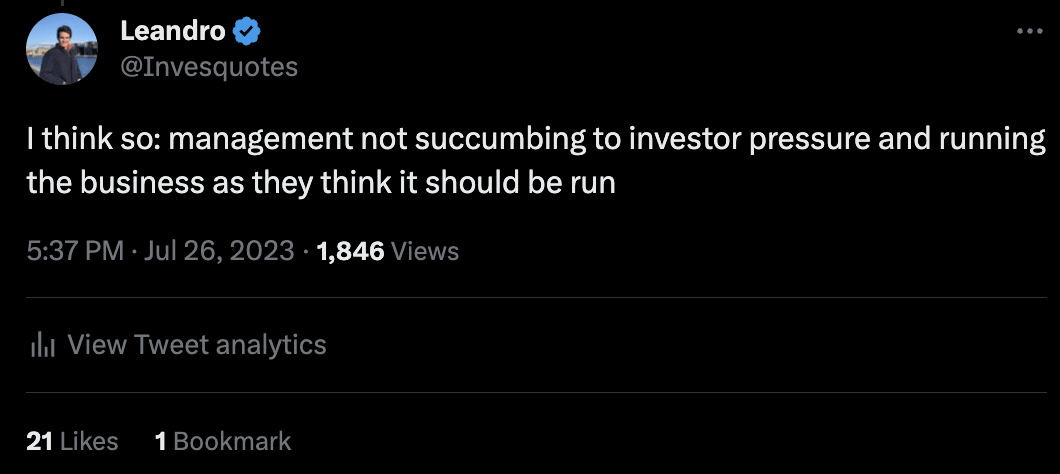

We saw a tweet where someone asked if investors can take something positive from Texas Instruments’ quarter, and it made us think. This was my reply:

Twitter

It seemed pretty evident in this quarter’s earnings call that many sell-side analysts are losing their patience, which is ironic considering that Texas Instruments’ management has been very transparent with what would happen. Nothing was unexpected in the earnings, but maybe analysts expected management to turn the ship. Take a look at how they framed some of their questions (emphasis added):

So I understand that obviously you’re not optimizing the model for just one year, but now we have seen just consistent decline in free cash flow per share, which is your preferred metric. So at what point should we start to see free cash flow get back to historical trends?

TI had the same strategy two or three years ago also, but we saw sales grow worse than peers last year and sales are again growing worse than peers this year, so it’s not one quarter or two quarter phenomena, sales have been undergrowing your peer growth for almost two years now and CapEx is growing while sales are declining. So that’s why I’m questioning whether the strategy is still right whether the results are actually justifying the strategy.

But at what point do you think you need to cut production or cut utilization rates and start to manage down the inventory? Are you still comfortable with where things are today?

These are just some examples because we don’t want to flood the article with analyst quotes, but we think the tone is pretty clear. Analysts want results, and they want them now. The good news for long-term shareholders is that Texas Instruments management is not succumbing to analysts’ pressures. They continue to do what they think should be done, not what analysts think should be done.

This, in our opinion, was the most important takeaway of the release. This ability to swim against the current is one of the most important traits to look for in a management team. Being publicly traded is great because we get to participate in the successes of great businesses, but it also brings challenges because the market’s short-termism might make managers succumb to the short-term game, a game that we are not interested in playing. We aim to own publicly traded companies that can be run as private companies. A company can achieve this in two ways:

-

Gaining investor confidence after outstanding performance: Texas Instruments, Constellation Software (CSU:CA, OTCPK:CNSWF), and Copart, Inc. (CPRT) are great examples here.

-

Having a long-term owner with a significant stake: all of the above (except Texas Instruments) are also good examples here.

The fact that there’s overlap between companies in #2 and #1 is no coincidence. The long-term owners have allowed their company to operate as a private company in public markets, which has benefited the company’s performance. Note that when we invest in a company, we ultimately trust management to make good use of our capital. This means that if we are uncomfortable with what they are doing, we should take our money out rather than trying to change their strategy. We judged they were good operators before investing, and we personally don’t believe we could run Texas Instruments better than a management team that has an excellent track record.

Be careful with the depreciation expense

Another thing that not many people consider is that Texas Instruments’ income statement might not portray economic reality, especially when the company is in the midst of a capacity expansion plan. The reason lies in the useful life given to the systems for depreciation purposes and their true useful life:

Yes. Just — what I would tell you is depreciation, the way we depreciate equipment is over five years. Buildings are much longer, usually they average about 30 years or so. But consider that that equipment lasts a lot longer than five years, right?

We have factories today that are running on 50 years-plus. And some of that has upgraded equipment. But — but broadly speaking, that equipment lasts for decades, not the five years where we depreciate it. So it’s probably an unfair comparison to try to put the 300 benefit next to the depreciation and expect an offset in the short-term.

Source: Rafael Lizardi, Texas Instruments CFO, during the Q2 2023 earnings call (emphasis added).

This is one of the reasons why the company earns such high ROICs and margins. The equipment is depreciated fast but then continues to contribute meaningfully to profits.

Guidance

Management guided for Q3 revenue of $4.55 and EPS of $1.8 at the midpoint. This missed analyst expectations, but we must consider that Texas Instruments is typically conservative with guidance. According to the company’s guidance, Q3 will remain essentially unchanged compared to Q2, showing more signs of stability.

We have no clue of when the cycle will turn, but we think it’s pretty likely it will turn sooner or later. For Q3, Texas Instruments Incorporated management expects the end markets will remain at similar levels to Q2.

Conclusion

We hope this article helped you understand Texas Instruments’ Q2 and what was, in our opinion, the most important takeaway of the release: management did not succumb to investor pressures and continues to run the business how they think it should be run.

In the meantime, keep growing!

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of TXN, CPRT, CSU:CA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Best Anchor Stocks helps you find the best growth stocks to outperform the market with the lowest volatility. They can anchor your portfolio on the stormy market sea, still allowing you to outperform.

Best Anchor Stocks have a long track record of revenue growth combined with below-average volatility. The first pick is up 16,000% from its IPO but has never been down 30%, not even during in 2008-2009.

Best Anchor Stocks can serve several purposes: stabilize your high-growth portfolio, or add low-volatility growth to your index, dividend or value investing.

There’s a 2-week free trial, so don’t hesitate to join Best Anchor Stocks now!