Summary:

- Tilray Brands has reached an agreement to purchase eight beer and beverage brands from Anheuser-Busch InBev for $85 million.

- The acquisition is not material to Anheuser-Busch but is significant for Tilray Brands, potentially boosting its performance.

- However, the company still faces challenges, making it a risky investment.

Kar-Tr

The past couple of days have been incredibly volatile for shares of cannabis producer Tilray Brands (NASDAQ:TLRY). After news broke that the company had reached an agreement to buy eight different beer and beverage brands from Anheuser-Busch InBev (BUD), the stock closed up 36% on August 8th. This was followed up on August 9th by a decline of 5.3%, likely in a move by the market to adjust for what was an overreaction on the upside. Details are still sparse. But on the whole, I would argue that this deal does increase the chance of the company performing better in the future. This does not mean, however, that shares are worth buying into. Many of the same concerns that I expressed in an article published on Seeking Alpha in May of this year still apply. And because of that, investors who are looking to get into the stock should be very cautious.

An interesting purchase

On August 7th, after the market closed, the management team at Tilray Brands issued a press release detailing that the company had decided to purchase eight beer and beverage brands from beer giant Anheuser-Busch. The press release does not provide any details on how much is being paid. But when I first saw the transaction come across my feed, I knew it had to be fairly small given that Tilray Brands has a market capitalization of only $2.01 billion. Sure enough, a copy of the agreement was made available, dated August 7th, that clarified that the cannabis company would be paying $85 million for the eight brands in question. There could be some adjustments made to these terms based on things like working capital. But the price should be around that level. In addition to this, Tilray Brands will also receive additional kegs associated with these purchases at the time of the deals closing. They will number 70,500 in all and will cost the company another $1.5 million. That values them at about $21.28 per keg.

Tilray Brands

Based on these terms, it is fairly obvious that this transaction is not material to Anheuser-Busch. Because of that, I will not really involve it too much further in this assessment. After all, in the most recent quarter that management just reported, the beer giant generated revenue of $15.12 billion. So this kind of deal quite literally is a rounding error for it. For Tilray Brands, however, the opposite is true. This is quite a sizable transaction that will help the company in a couple of ways.

Before we get into that though, we should touch on the specific brands that the company is acquiring. The first of these is called Shock Top. It’s a Belgian style wheat ale that incorporates citrus that was originally introduced in 2006. Belgian White is the primary product under this brand. Blue Point Brewing Co is a bit older, dating back to 1998. Under its brand name, several different drinks are offered, including creative concepts like Toasted Lager and Hoptical Illusion. Even older is Breckenridge Brewery, dating back to 1990. According to management, it is one of the leading craft brands in Colorado. In fact, in that market, it boasts a 13% share of the craft space. 10 Barrel Brewing Co was founded in 2006 and boasts a 16% share of the craft market in Oregon.

Next in line, we have three brands under the Portland Brewery umbrella. Two of these, Redhook and Widmer, are some of the oldest and most respected craft beers still on the market. Square Mile, meanwhile, is a crafted canned cider brand also produced from the Portland Brewery. And lastly, we have Hiball Energy. Its name is suitable since it is the oddball of the group. As opposed to being a craft beer, Hiball Energy is, as you might have guessed, a clean energy seltzer with zero sugar, zero calories, and organic caffeine. This should actually play well into the wellness operations that Tilray Brands currently has.

Tilray Brands

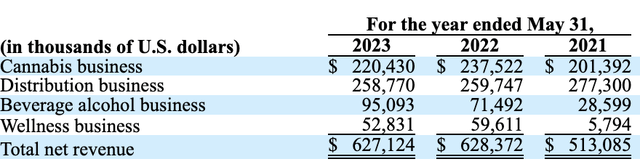

Even though Tilray Brands is often characterized as a cannabis company, it actually has four different operating segments under its belt. Using data from the most recent completed fiscal year, sales involving its cannabis operations accounted for only $220.4 million. That’s about 35% of overall revenue. Even larger than this is the distribution business. With revenue of $258.8 million, it accounts for 41% of sales. For those who may not know, the distribution business purchases and resells pharmaceutical and wellness products. The smallest of the operating segments that Tilray Brands has is its wellness business. This is responsible for the production and sale of hemp-based food and other wellness offerings. During the most recent fiscal year, it accounted for only $52.8 million, or 9%, of the company’s overall revenue.

The problem with all of these segments is that they have been faced with challenges in recent years. The cannabis business has seen revenue remain in a very narrow range over the past three years, with no clear trend insight. The wellness operation actually did see a spike in sales from $5.8 million in 2021 to $59.6 million in 2022. But in 2023, sales had fallen to $52.8 million, with that decline driven by a change in inventory management by one of the company’s customers and by less demand as a result of higher pricing aimed at protecting the company’s margin during this inflationary cycle. Even worse was the distribution portion of the firm. Revenue fell consistently year over year, dropping from $277.3 million in 2021 to $258.8 million in 2023. Though to be fair, had it not been for foreign currency fluctuations, sales in the most recent fiscal year would have been $285.1 million.

Regardless of the rationalizations behind each of these segments, the fact remains that the only real growth part of the company has been its beverage alcohol business. Revenue went from $28.6 million in 2021 to $95.1 million in 2023. The jump in revenue from $71.5 million in 2022 to $95.1 million in the most recent fiscal year was driven largely by the company’s acquisition of Montauk in November of last year. This is not as good as achieving it by organically growing, but any sort of growth is likely positive.

The rationale that management had likely involved the thought process that continued acquisitions, at reasonable prices, can help the company achieve scale more rapidly. That should, in theory, accelerate its transition from generating net losses and cash outflows to becoming breakeven or better. Following the completion of this transaction, Tilray Brands expects to generate around $300 million per year in revenue from what is currently its US beverage alcohol portfolio. That will include $250 million coming from craft beer.

Tilray Brands

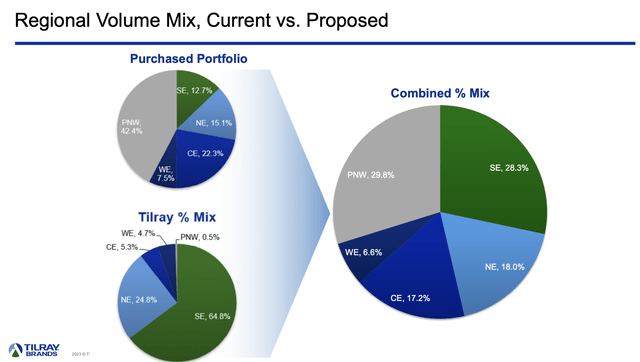

One of the really great things about this kind of transaction is that it is unlikely to result in much cannibalization of the company’s products. This is in part because the geographic profile of the purchased brands is meaningfully different than it is for the beverage brands currently offered by the acquirer. In the image above, you can see how this purchase helps to even out the firm’s geographic exposure. While this is beneficial in some ways, we do need to be aware that this likely means less of an opportunity to generate synergies. A lot of synergies that can be produced come from cutting out duplicative operations that become redundant. I have no doubt that some synergies will be had from this transaction. But they may not be as large as some investors might think.

Tilray Brands

Prior to the purchase of these brands, Tilray Brands was estimated to be the 18th largest Brewing Company in the US. It was also the 9th largest of the craft brewing firms. After the transaction is completed, the company will become the 5th largest craft beer brewer in the nation, boasting a roughly 5% stake in the US market. While I have no doubt that this transaction will go a long way toward helping the company, it does not change my prior assessment that the stock looks overvalued.

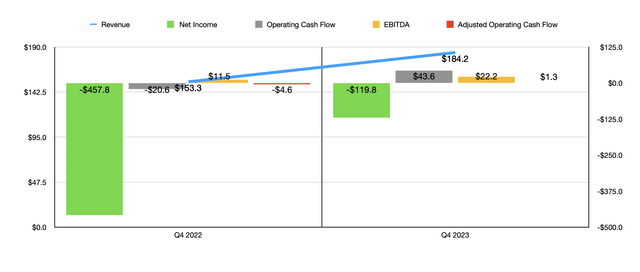

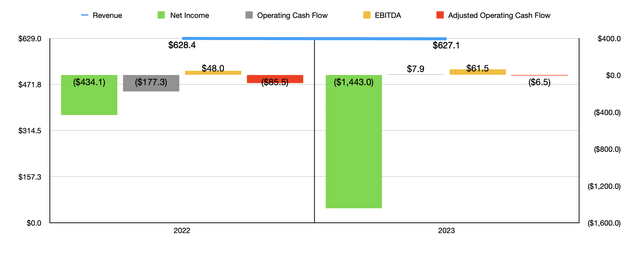

Author – SEC EDGAR Data

Yes, as you can see in the chart above and in the chart below, recent financial performance for the enterprise has shown signs of improvement. The final quarter of 2023 was particularly bullish from a revenue, profit, and cash flow perspective. When management announced financial results covering the final quarter of 2023, they said that EBITDA in 2024 should be between $68 million and $78 million. Management has not offered an update as to how this purchase will impact that. But even if we take the midpoint and double it, the firm would be trading at an EV to EBITDA multiple of 14.8. If the enterprise were growing rapidly from an organic perspective, or if it had other significantly positive attributes, that might make it more or less fairly valued. But there is no guarantee that organic growth will be impressive and there’s no guarantee that EBITDA will come even close to doubling. Absent something big and unexpected coming out of the woodwork from a cash flow perspective, the stock just looks overpriced at this moment.

Author – SEC EDGAR Data

Takeaway

As a whole, I would argue that the purchase of brands by Tilray Brands from Anheuser-Busch was a wise decision. We clearly don’t know how profitable those brands will be for the acquirer. But they probably will help sales, profits, and cash flows, to some degree. It is unlikely, however, that they will have any real impact that would be of the extent as to changing my previous bearish stance on the enterprise. Because of this, I’ve decided to keep the company rated a ‘sell’ for now.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Crude Value Insights offers you an investing service and community focused on oil and natural gas. We focus on cash flow and the companies that generate it, leading to value and growth prospects with real potential.

Subscribers get to use a 50+ stock model account, in-depth cash flow analyses of E&P firms, and live chat discussion of the sector.

Sign up today for your two-week free trial and get a new lease on oil & gas!