Summary:

- Tilray’s beverage alcohol business grew 33% and made 14% of Tilray’s total revenue in FY23 after it had acquired Montauk.

- Tilray expects to triple its beverage alcohol business revenue after it has acquired eight beer and beverage brands from Anheuser-Busch.

- International cannabis revenue made 20% of Tilray’s total cannabis revenue, which may increase as more European countries are working on legalizing adult-use cannabis.

- There is still no clear timeline regarding the review of how marijuana is scheduled under federal law, despite most Americans being in favor of legalizing cannabis at least on a medical use level.

Morsa Images

Thesis

While the US legalizing marijuana would be huge news for Tilray Brands, Inc. (NASDAQ:TLRY) and other cannabis companies, I think investors are missing important aspects of Tilray’s business. With its latest acquisition of Montauk, the company has increased its beverage alcohol revenue to almost 15% of its total revenue, up from 11% last year, and expects a further increase after acquiring eight beverage and beer brands from Anheuser-Busch (BUD). Furthermore, the European movement to legalize cannabis can increase the company’s revenue, since it already has facilities in Europe that it can use to flood the European market in case cannabis gets legalized in countries like the Netherlands, Czech Republic, and Portugal, which is why I give Tilray a buy rating.

Tilray’s Alcohol Business

Tilray’s beverage alcohol business revenue increased more than 33% YoY in FY ’23 and made almost 15% of its overall revenues, compared to only 11% in FY ’22. The increase in beverage alcohol revenue was due to the company expanding its alcohol business with the acquisition of Montauk, one of the most famous craft breweries in metropolitan New York. I believe Tilray’s success will be determined by its ability to grow its beverage alcohol business, especially since its beverage alcohol gross margin is nearly double its cannabis margins.

|

Tilray’s FY ’23 Revenue Distribution |

||||

|

Business |

Revenue |

Cost of Revenue |

Gross Profit |

Gross Margin |

|

Cannabis |

220 |

163 |

57 |

25.91% |

|

Beverage Alcohol |

95 |

49 |

46 |

48.42% |

|

Distribution |

259 |

231 |

28 |

10.81% |

|

Wellness |

53 |

37 |

16 |

30.19% |

|

Total |

627 |

480 |

147 |

23.44% |

In my opinion, that is the reason for Tilray’s latest deal with Anheuser-Busch to acquire eight beer and beverage brands from the beer giant. With these acquisitions, Tilray expects to triple its beer and beverage revenue and production to $300 million and 12 million cases annually, respectively.

If we assume that Tilray’s other revenues stayed flat in FY ’24 for the sake of simplicity, that would see Tilray’s total gross margin increase to around 30% compared to 23% in FY ’23.

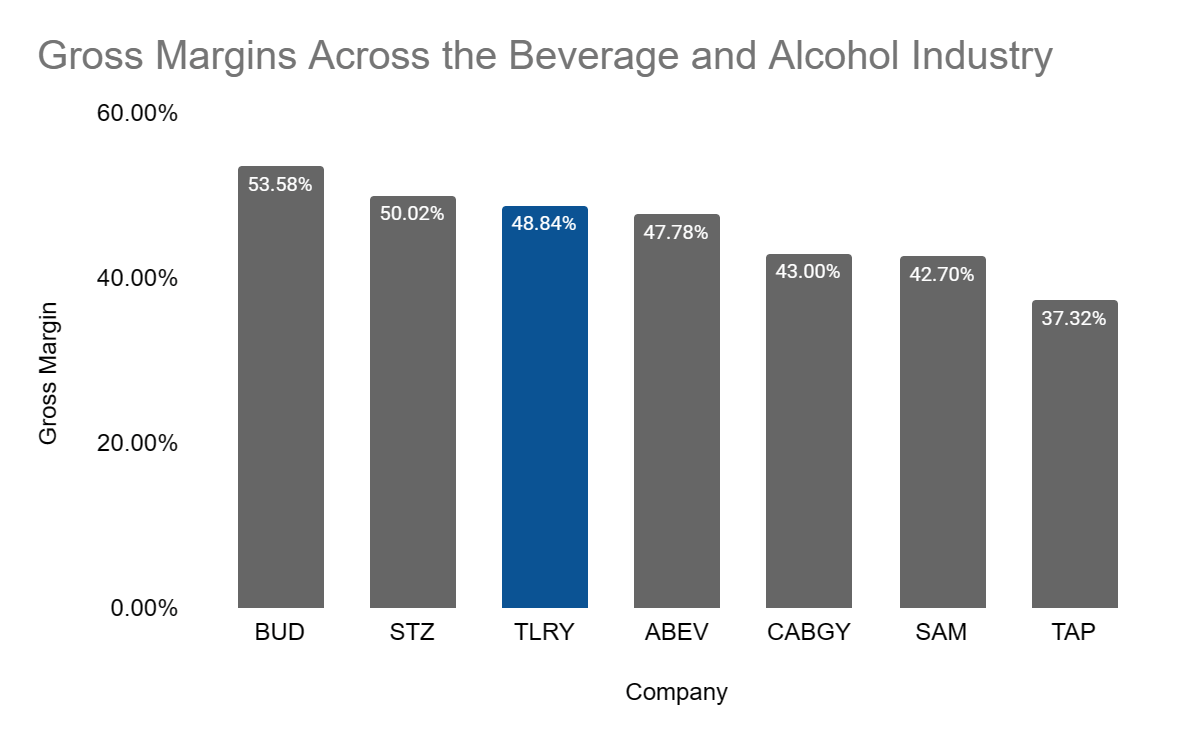

Tilray is also positioned nicely in the beverage and alcohol industry compared to other companies in the industry. We can also assume that the company scaling its production and adding more skilled workers will improve its margins even further.

Quarterly Earnings Per Company

Additionally, This deal will also see Tilray become the fifth-largest craft beer brewer in the U.S. with a 5% market share. Even if we ignore the higher gross margin, I believe the company expanding its beverage and beer business is a smart move since cannabis legalization is still a work in progress in a lot of places while beverages and beer can be sold almost anywhere.

European Cannabis Market

20% of Tilray’s cannabis revenue came from the international market, which largely consists of European countries. That said, almost all of this revenue came from medical cannabis since adult-use cannabis sales are illegal in most European countries or can be legal only through non-profit cannabis clubs. That could change soon since multiple European countries are working to legalize adult-use cannabis, like the Netherlands and Switzerland, which have launched pilot programs to study the effects of legalizing cannabis sales.

Additionally, Portugal is expected to legalize the recreational use of cannabis this year, which can be a great market opportunity for Tilray. This is due to the company already having a production facility in Portugal that will enable it to provide consistent and sustainable cannabis products for the adult-use market. There are also countries like Germany and the Czech Republic that are expected to legalize adult-use cannabis, but it isn’t clear yet whether they will allow the commercial sale of cannabis or not.

In my opinion, the European market will be key for Tilray’s future as more countries work to legalize cannabis for recreational use, since if we look at Canada we can see that the adult-use market is much bigger than the medical cannabis market.

|

Revenue from Canadian medical cannabis (millions) |

$25 |

|

Revenue from Canadian adult-use cannabis (millions) |

$214 |

U.S. Legalization Still Up in The Air

Despite the fact that President Biden asked the Secretary of Health and Human Services and the Attorney General to begin the administrative process to immediately review how marijuana is scheduled under federal law in October 2022, there is still no clear timeline or update on the matter. That said, the consensus in the US is in favor of legalizing cannabis, with 85% of Republican voters being pro-cannabis legalization and 95% of Democrats believing Congress should end the prohibition on cannabis, and almost 90% of Americans being in favor of legalizing cannabis.

While de-scheduling cannabis is the best-case scenario for Tilray, if cannabis gets rescheduled, it will still be a win for the Canadian company, since it will be legal for medical use across the US. It is also worth mentioning that the US is the biggest market for cannabis in the world, despite it being illegal on a federal level.

That said, I want to reiterate that I don’t believe that the US legalizing cannabis is crucial for Tilray, and growing its beverage business and its presence in the European market, which has a clearer picture of the future of cannabis, are the more important metrics to look at.

Risks

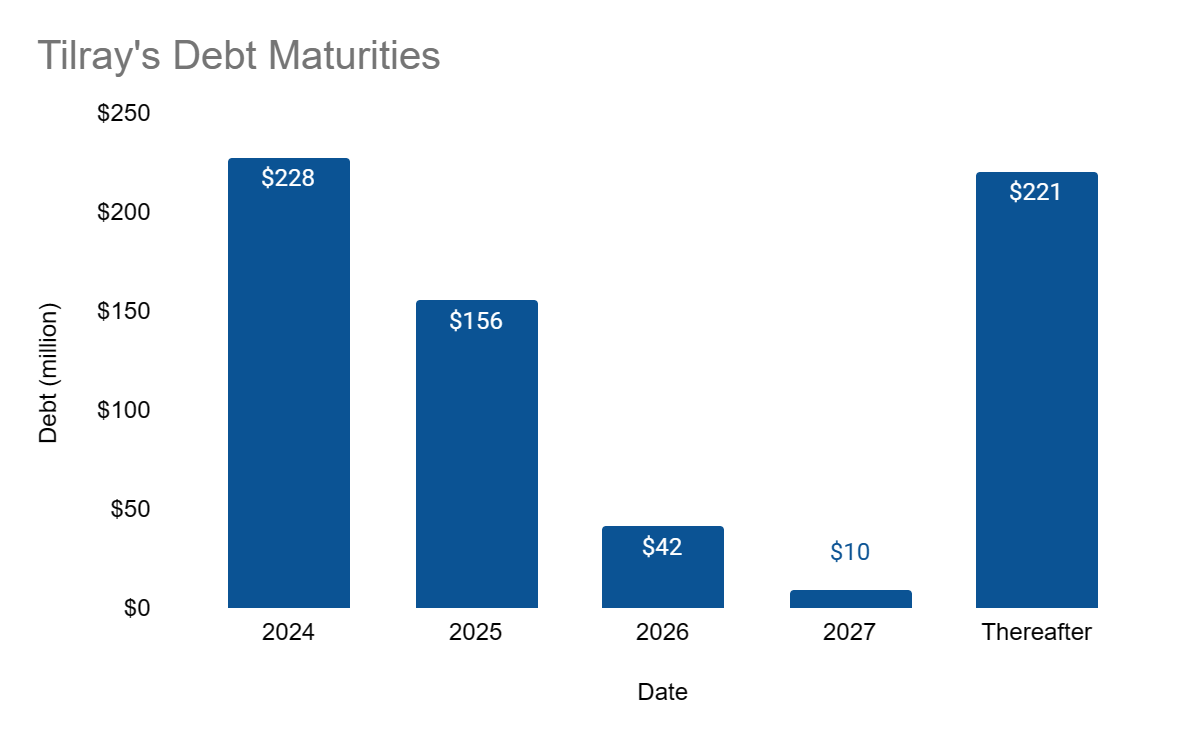

Tilray has almost $660 million in debt, with $437.4 million maturing throughout the next four years. With almost $450 million in liquidity, the company is equipped to pay its debt for the next four years. But that means that it has to maintain its positive cash flow for the next few years, which I believe it can do, but the majority of cash being tied to debt repayment will limit its ability to expand without diluting its shareholders like it did with the HEXO acquisition or adding more debt.

2023 Annual Report

Technical Analysis

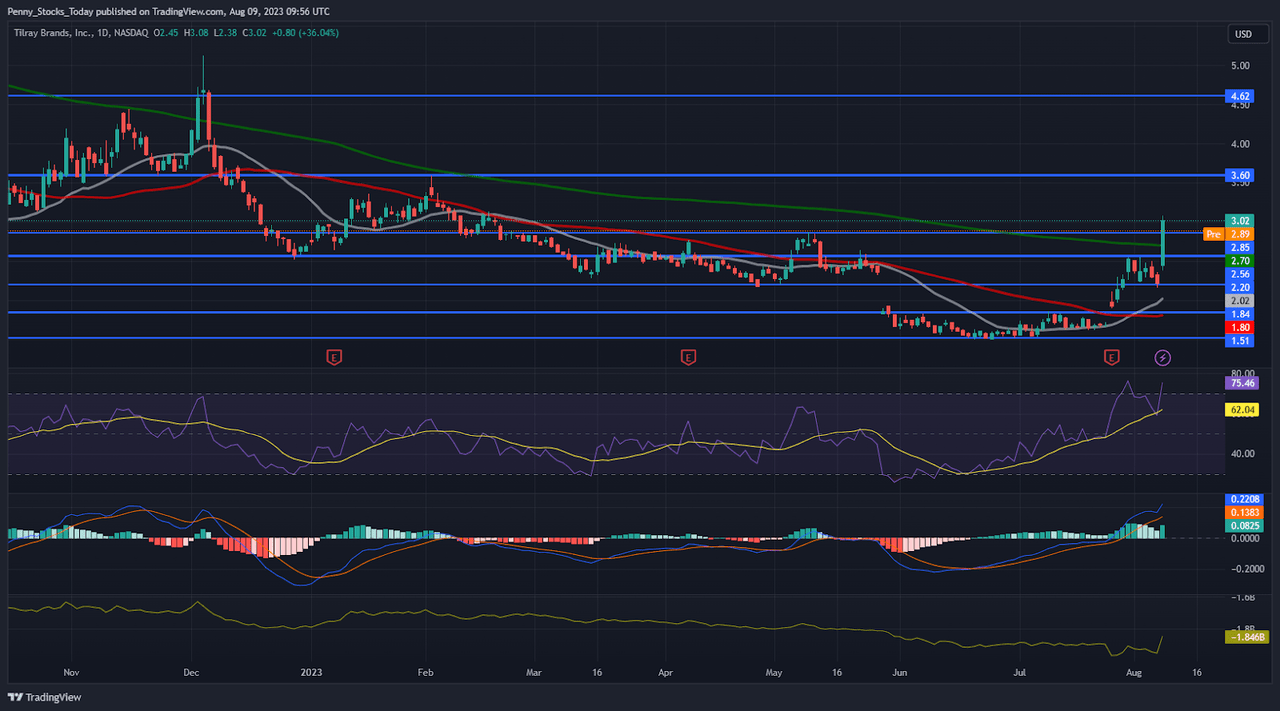

Looking at the daily chart, TLRY stock is in a neutral trend as it recently entered a sideways channel between $2.17 and $2.57. But it is worth mentioning that TLRY has recently broken from its channel on the news that Tilray is going to acquire eight beverage and beer brands from Anheuser-Busch and is yet to consolidate. Looking at the indicators, the stock is trading above the 200, 50, and 21 MAs, which is a bullish indication. Meanwhile, the RSI is approaching overbought at 63, and the MACD is approaching a bearish crossover.

Since TLRY jumped more than 36% and broke its current channel after it announced that it would buy eight brands from Anheuser-Busch, I believe investors should wait for the pullback to $2.56 before adding more shares.

Conclusion

Legalizing cannabis in the US is still up in the air with no definitive indication of where it is going, despite the majority of Americans being in favor of legalizing it. While the US can be considered the biggest market for cannabis, I don’t believe it is necessary for Tilray’s growth. The company has been expanding its beverage alcohol business, which currently makes up almost 15% of its revenues, and has recently doubled down on this expansion with the purchase of eight beverage and beer brands from Anheuser-Busch. Moreover, multiple European countries are currently working on legalizing medical cannabis and adult-use cannabis, opening new markets for the company in Europe, which is why I’m reiterating my buy rating on Tilray.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.