Robert Daly/OJO Images via Getty Images

While the earnings season got off to a rough start for the “Magnificent 7” when Tesla missed quarterly earnings estimates, let’s take a look at how the group fared in Q2, as they continue to weather a wave of volatility.

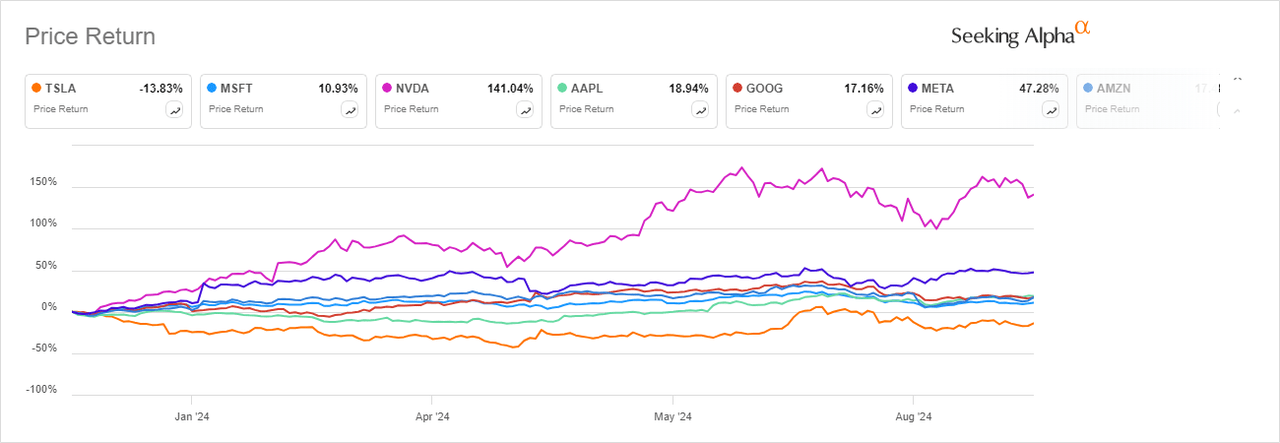

In terms of stock performance, all but one of the Magnificent Seven stocks are in positive territory for the year, with Tesla being the outlier.

Amazon (NASDAQ:NASDAQ:AMZN) shares skidded more than 9% as worries about consumer spending have cropped up. And while much of the attention was focused on the health of the consumer, Amazon Web Services grew 19% during the second quarter, accounting for $26.3B in revenue, well above the Wall Street consensus of 17.6%.

That re-acceleration after last year’s headwinds could be a boost for the tech giant, RBC analysts said.

Google-parent Alphabet’s (NASDAQ:GOOG) stock fell despite the company posting better-than-expected growth in revenues and profits. Second quarter revenue rose 14% to $84.74 billion, as cloud revenue surpassed $10 billion for the first time. The tech giant also reported a profit of $1.89 per share, compared to a profit of $0.45 per share during the comparable period a year ago.

Microsoft’s (NASDAQ:NASDAQ:MSFT) fiscal fourth-quarter results and guidance for the next quarter had Wall Street debating on whether there was enough to keep the artificial intelligence-inspired gravy train running, or whether it may be losing steam.

Meanwhile, Apple’s (NASDAQ:AAPL) quarterly results and early outlook for the coming quarter received praise, with several brokerages pointing out the potential for the next iPhone and the tech giant’s artificial intelligence strategy.

Tesla (TSLA) shares fell after reporting lower EPS and operating income than anticipated. The company reported that revenue was up 2.3% year-over-year in the second quarter to $25.50 billion; however, profits fell by $0.52 per share compared to $0.91 per share a year ago. Tesla also warned of margin pressures on its Cybertruck and Model 3 from tariffs on raw materials and finished goods.

Turning to social media giant Meta Platforms (NASDAQ:META), the company reported strong results and issued forecasts above expectations, pushing top Wall Street analysts to maintain their bullish view. Shares of the company rose as much as 11% to a session high of $527.17. The stock is up about 47% so far this year.

JPM thinks Meta is showing signs of progress across three key areas of its broader AI strategy: 1) core FoA improvements; 2) new opportunities & experiences; & 3) scaling the Metaverse.

Nvidia (NASDAQ:NVDA) reported second-quarter results and guidance that topped estimates, leading to much praise from Wall Street firms that seem to be running out of ways to praise the Jensen Huang-led company. The semiconductor giant said it sees no slowdown in the artificial intelligence spending boom that has powered it to a near $3T valuation.