While major tobacco companies began exploring alternative nicotine products as early as the 1950s, a shift in regulations, public attitudes, and technological advancements has dramatically altered the industry landscape in the last fifteen years following breakthroughs with heated tobacco products, e-cigarettes, and nicotine pouches.

Today, major tobacco firms generate significant revenue from alternative nicotine products. Philip Morris International (NYSE:PM) leads the charge with its alternative nicotine segment now representing 41% of global revenue, largely driven by IQOS heated tobacco and ZYN nicotine pouches. British American Tobacco’s (NYSE:BTI) smokeless segment (vapes, pouches, and heated tobacco) accounts for 18.2% of total revenue, a mark that is forecast to increase every year. Meanwhile, Altria’s alternative segment accounts for about 14% of the company’s total revenue, derived mostly from oral nicotine products. Japan Tobacco (OTCPK:JAPAY) and Imperial Brands (OTCQX:IMBBY) are also selling next-generation alternative products, but those businesses account for under 10% of their revenue.

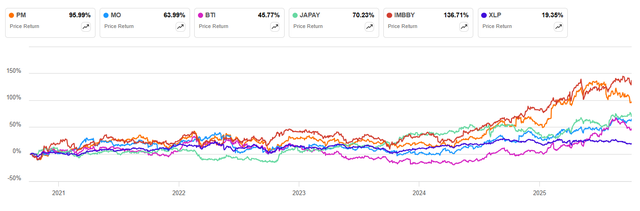

The tobacco sector in general has earned high marks from analysts for the measured approach to the alternative nicotine transition. Investors have not had too much to complain about either, since Philip Morris International (NYSE:PM), Altria (NYSE:MO), British American Tobacco (NYSE:BTI), Japan Tobacco (OTCPK:JAPAY), and Imperial Brands (OTCQX:IMBBY) have all outperformed broad consumer staples averages over the last five years.

Seeking Alpha

Looking ahead to Q3 earnings season, Bank of America tipped that management guidance updates on downtrading, nicotine pouch progress, and insights on consumer reactions to changing economic conditions will be a major focus of earnings conference calls. BofA has a Buy rating in place on Philip Morris (PM), Altria (NYSE:MO), and British American Tobacco (BTI).