Tarcisio Schnaider/iStock Editorial via Getty Images

Boeing (NYSE:BA) shareholders this week have been left to speculate about how a strike by its biggest worker union is going to affect the company’s stock value. There may be clues in the 2008 strike that lasted about eight weeks.

After about 27,000 members of the International Association of Machinists and Aerospace Workers walked off the job in September 2008, Boeing (BA) experienced a 60% reduction in deliveries of commercial planes between end of the second and fourth quarters of that year, according to analysts at financial-services firm Citi.

“We assume a similar pattern this time too,” Jason Gursky, analyst at Citi, said in a Sept. 15 report. “Where things might be different this time is the pace of the recovery on the other side of the work stoppage.”

| Citi: Boeing deliveries and operating cash flows (2007-09) | ||||||||

| Four quarters before strike | Four quarters after strike | |||||||

| Q3 2007 | Q4 2007 | Q1 2008 | Q2 2008 | Q3 2008 | Q4 2008 | Q1 2009 | Q2 2009 | |

| Deliveries | 109 | 111 | 115 | 126 | 84 | 50 | 121 | 125 |

| Q/Q % | -4.4% | 1.8% | 3.6% | 9.6% | -33.3% | -40.5% | 142.0% | 3.3% |

| Y/Y % | 9.0% | 6.7% | 8.5% | 10.5% | -22.9% | -55.0% | 5.2% | -0.8% |

| Operating Cash Flow ($m) | $3,329 | $1,893 | $1,933 | -$251 | -$442 | -$1,641 | $193 | $4,406 |

| Q/Q % | -8.4% | -43.1% | 2.1% | -113.0% | -276.1% | -471.3% | -88.2% | 2182.9% |

| Y/Y % | 494.5% | -22.4% | 165.5% | -106.9% | -113.3% | -186.7% | -90.0% | 1655.4% |

| Source: Company reports, Citi, Cirium | ||||||||

About 33,000 workers went on strike on Friday after they voted to reject a contract that offered them a 25% raise over four years along with other compensation. Union leaders are set to meet with Boeing (BA) executives on Tuesday in the presence of a federal mediator.

Boeing (BA) might face greater difficulties in ramping up production because its workforce is less seasoned than it used to be. During the pandemic slump, the company lost about 19,000 workers including experienced employees who retired early or took buyouts.

Many veteran engineers retired in 2022 to receive bigger pension payments tied to interest rates, according to the Society of Professional Engineering Employees in Aerospace union. More than 1,700 of its members left Boeing (BA) that year, compared with 1,000 a year earlier. The average tenure of those departing workers was 23 years at the company.

“Importantly, we do not expect a long, drawn-out strike,” Gursky said. “Union members have been working on a contract negotiated 10 years ago and are lagging peers and cost of living in Seattle as a result. They appear to have a lot of incentive to get a deal done to help restore earnings power.”

Boeing (BA) also has plenty of incentive to get a deal done to restore cash flow, Gursky said. Around the time of the 2008 strike, the company’s cash flow turned negative for three straight quarters before rebounding.

With about $60 billion in debt, Boeing (BA) is arguably in a weaker financial position than it was during the 2008 strike. The company’s plane output in the past five years has been interrupted because of safety concerns and pandemic lockdowns.

After two fatal crashes of a 737 Max in 2018 and 2019, many countries worldwide grounded the best-selling plane for safety inspections. In 2020, the pandemic led many airlines to stop taking deliveries of new planes, and Boeing (BA) took on debt to help ride out the health crisis.

Liquidity Raise

Because the 2008 and 1995 strikes lasted about two months, analysts at financial-services firm UBS see the possibility that Boeing (BA) will need to raise money.

“Based on our conversations with investors, we believe a roughly $10 billion liquidity raise is expected,” Gavin Parsons, analyst at UBS, said in a Sept. 15 report.

Market Turmoil

Evaluating the possible effect of the 2008 strike on Boeing’s (BA) share price is complicated by a variety of external factors, such as the Great Financial Crisis that triggered a broad market selloff and a recession.

After Boeing’s (BA) stock bottomed in 2009, it steadily advanced to a record high by March 2019. A year later, the pandemic led to a steep drop in value.

The price recovered somewhat with the rebound in air travel, but Boeing (BA) was dogged by supply-chain constraints and product-quality issues that hampered deliveries. In January, Boeing’s (BA) stock nosedived after a mid-flight accident on a 737 Max led the Federal Aviation Administration to cap the company’s output of the plane.

As in 2008, Boeing (BA) this year is poised for a strong production ramp after the strike ends.

“The 2008 strike is likely still fresh in many’s mind as it came at the beginning of a bull market for deliveries,” Sheila Kahyaoglu, analyst at financial-services firm Jefferies, said in a Sept. 13 report. The last strike came “at the beginning of an expansionary period.”

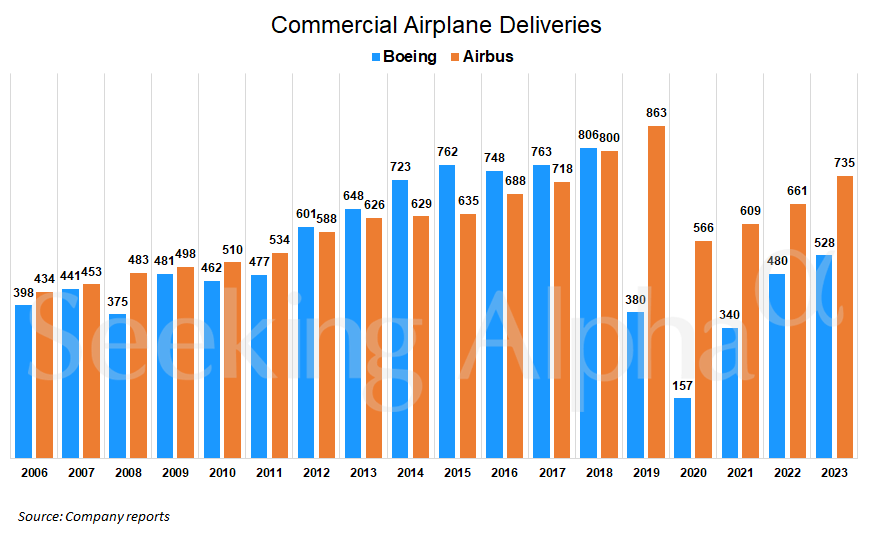

Boeing’s (BA) plane deliveries slumped from 432 in 2007 to 364 in 2008 because of the strike, but then soared to more than 800 by 2018 before the 737 Max was grounded.

“There are also some similarities [to 2008] as there are pinch points across the supply chain and any reset could be used as a chance to catch up,” Kahyaoglu said. “There can be a reset on any work stoppage, which can be more disruptive at a time of expanding rates.”

| Bank of America: IAM 751 & 70 strikes history at Boeing | |||

| Years | Union | Location | Total strike days |

| 1948 | IAM 751 & 70 | Seattle/Wichita | 145 |

| 1965 | IAM 751 & 71 | Seattle/Wichita | 19 |

| 1977 | IAM 751 & 72 | Seattle/Wichita | 45 |

| 1989 | IAM 751 & 73 | Seattle/Wichita | 48 |

| 1996 | IAM 751 & 74 | Seattle/Wichita | 69 |

| 2005 | IAM 751 & 75 | Seattle/Wichita | 24 |

| 2008 | IAM 751 & 76 | Seattle/Wichita | 58 |

| Average | 58 | ||

| Source: Boeing, Bank of America | |||