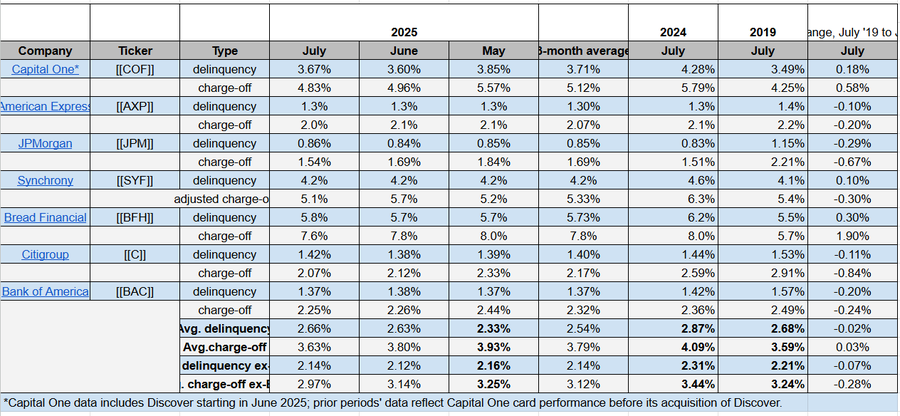

U.S. credit card metrics were mixed in July, with delinquencies rising and net charge-offs falling.

The average delinquency rate advanced to 2.66% in July from 2.63% in June, but slid from 2.87% a year earlier and 2.68% in July 2019, before the pandemic hit, according to Seeking Alpha’s compilation of credit card metrics.

Meanwhile, the average net charge-off rate retreated to 3.63% in July from 3.80% in the prior month and 4.09% in July 2024. It still exceeded the July 2019 rate of 3.59%.

Delinquencies track late payments, while net charge-offs track debts that are written off as uncollectible.

Excluding Bread Financial’s (NYSE:BFH) outsized rates, delinquencies still edged higher and net charge-offs remained lower.

Note that Capital One (NYSE:COF) data include Discover Financial Services starting in June 2025; previous periods’ data reflect Capital One card performance before its acquisition of Discover.

July 2025 credit card delinquencies, net charge-offs ((Company filings, press releases))