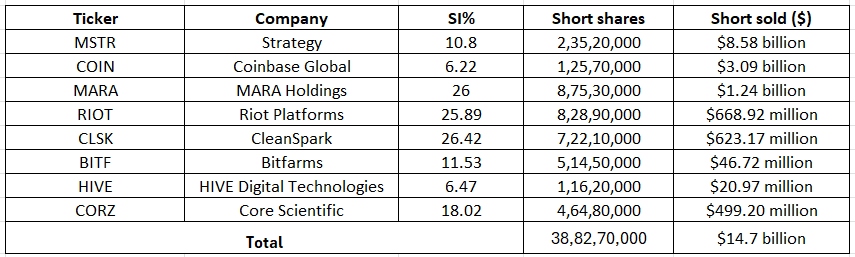

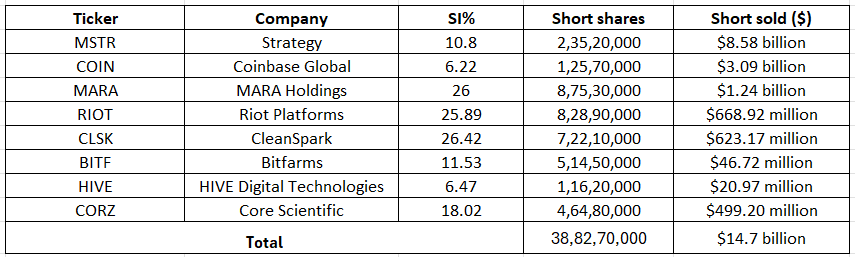

Short interest in crypto stocks declined on average in May with six out of eight crypto stocks seeing a fall while two witnessed a rise.

Strategy (NASDAQ:MSTR), CleanSpark (NASDAQ:CLSK) and Bitfarms (NASDAQ:BITF) were among the companies that saw the highest decline in short interest to 10.8%, 26.42% and 11.53%. Short interest in MARA Holdings (NASDAQ:MARA), HIVE Digital Technologies (NASDAQ:HIVE) and Core Scientific (NASDAQ:CORZ) fell to 26%, 6.47% and 18.02%.

Coinbase Global (NASDAQ:COIN) and Riot Platforms (NASDAQ:RIOT) were the only companies that saw short interest inch up in May to 6.22% and 25.89%.

Overall, about 388M shares were sold short in the crypto sector in May, a dip from 410M in the month of April. According to short interest data as of May 31, the short dollar volume in the crypto stocks was $14.7 billion.

Bitcoin (BTC-USD) prices took off in the first week of May going beyond the $100K mark after Donald Trump announced a “breakthrough trade deal” with the U.K. It hovered around the same mark for the rest of the month.

In June so far, it has maintained a similar momentum. Last week, however, it dipped after Israel launched airstrikes on Iran. The digital asset fell by as much as 3% on June 13, briefly dipping below $103,000 before paring back some of its losses.

More on Crypto

- Strategy: Don’t Bet On A U.S. Dollar Crisis, As It’s Highly Unlikely (Upgrade)

- HIVE Digital: Great Seasonality And A Bullish Chart Setup

- Strategy: Debt Is Now Unsustainable (Rating Downgrade)

- Strategy acquired $1.05B worth of bitcoin last week

- Stablecoins could reshape banking, but not without disruptions