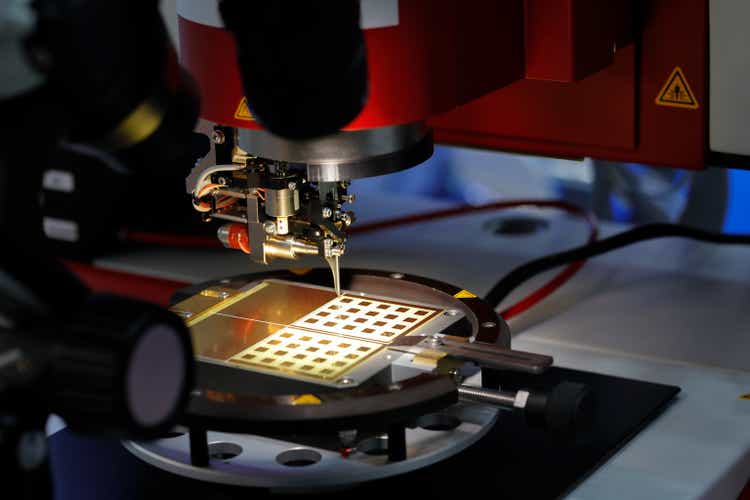

genkur/iStock via Getty Images

Kulicke and Soffa Industries’ (NASDAQ:KLIC) stock climbed about 3% on Friday after Needham upgraded the stock to Buy from Hold.

The firm has set a price target of $55 on the shares of the semiconductor equipment maker.

Analysts led by Charles Shi said they upgraded the stock because they think Kulicke’s Thermo-Compression Bonding, or TCB, business win at a leading foundry [which the analysts think is likely Taiwan Semiconductor Manufacturing (TSM)] is the first major breakthrough for the company since winning Intel (INTC) TCB in 2021 and may finally add a secular tailwind to this historically cyclical name.

The analysts also believe Kulicke’s wire bonding business, following nearly three years of correction, may have finally reached the bottom and will start to turn positive in 2025.

In addition, Shi and his team view China as an upside driver rather than downside because the massive front-end capacity buildout in China will eventually lead to back-end capacity investments in the country, which has been falling (rather than rising) for three consecutive years.

The analysts noted that they believe the risk-reward has turned positive.