Arctic-Images/DigitalVision via Getty Images

Short interest for healthcare stocks in S&P 500 increased during August end vs. last month, with Moderna being most shorted for the second consecutive time.

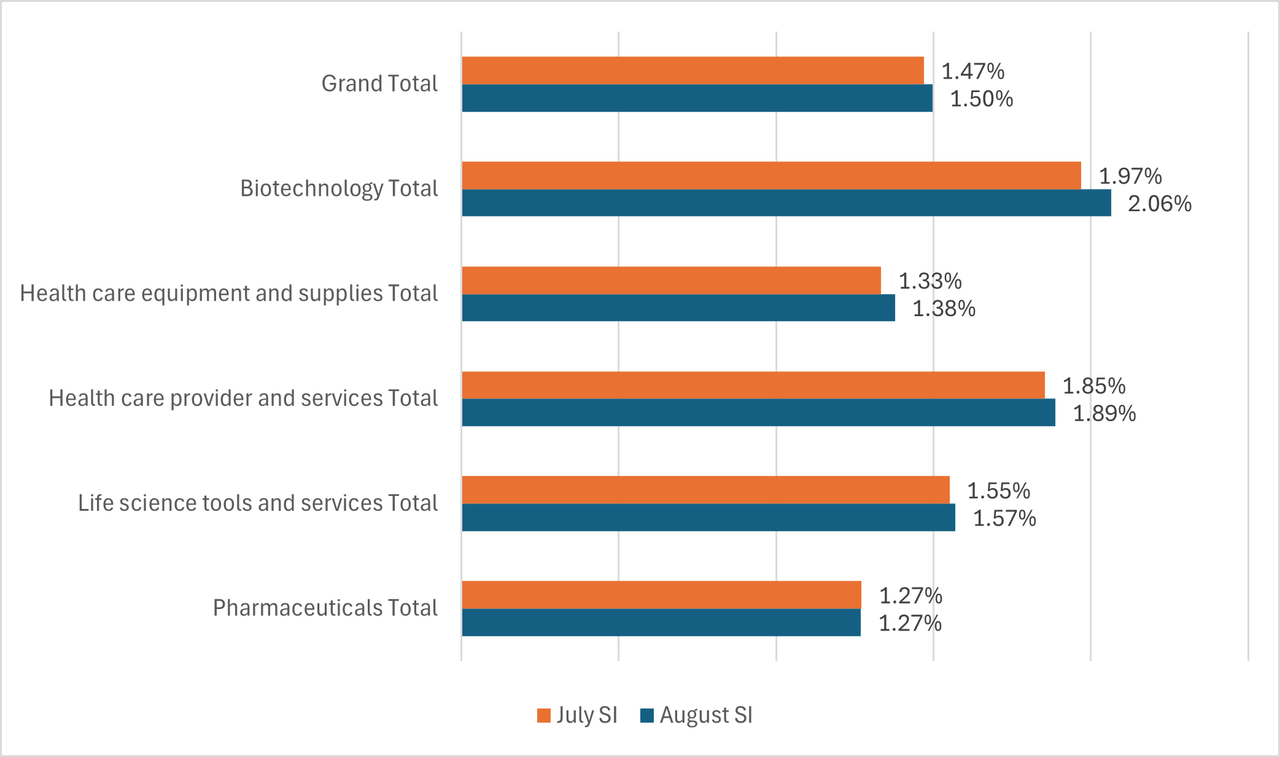

The average short interest for S&P 500 Health Care Index Sector (NYSEARCA:XLV) went up just 3 basis points to 1.50% in August, from 1.47% in July.

XLV, which has a 12.12% weightage in the broader S&P 500 index, gained 3.14% in the last month, trading behind the S&P 500 index’s (SP500) gain of 3.53%.

Industry analysis:

Average short Interest as percentage of floating shares

Biotechnology was the most shorted industry in the healthcare index in August for the fifth time in a row. Short interest in this sub-sector rose to 2.06% from 1.97% in July.

Healthcare provider and services sector climbed to the second position with short interest at 1.89% in August end.

Pharmaceuticals industry continued to be the least shorted sub-sector with 1.27% short percentage of float, same as last month.

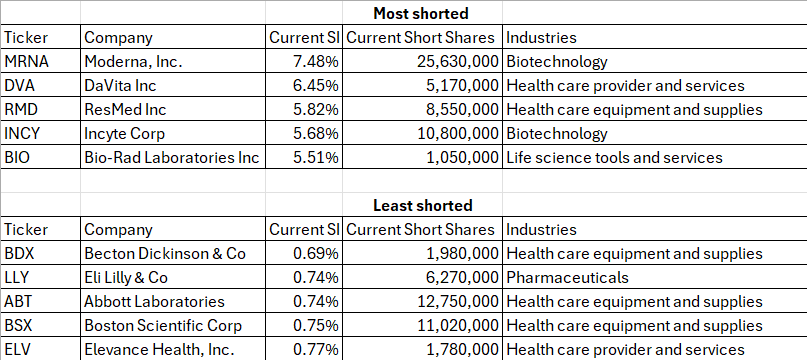

Stocks with highest and lowest short positions

Ranked by short interest as a percentage of shares float

Moderna (MRNA)—most shorted—saw short interest rise to 7.48% from 6.69% in July. DaVita (DVA) came in second with a short interest of 6.45%, followed by ResMed (RMD) with a short interest of 5.82%.

Becton Dickinson (BDX) was the least shorted stock in August, with a short interest of 0.69%. Eli Lilly (LLY), which has the highest weightage in the XLV index, was the second least shorted stock in the month at 0.74% short percentage of float.

Abbott Laboratory (ABT) was the third least shorted company in the month of August, with a short percentage of 0.74%, same as the previous month.