master1305

The kickoff of the 2024 NFL season will take place tonight as the reigning Super Bowl LVIII champions, the Kansas City Chiefs, host the Baltimore Ravens. It’s the second straight year in which opening night will take place at Arrowhead Stadium, and it’ll also mark a rematch of the prior season’s AFC Championship game. Football is by far the most popular sport in the U.S., which is having big ramifications for the sports betting market and its publicly traded industry players.

What’s the spread? Sports betting is now legal in 38 states, including newcomers like Maine, Vermont and North Carolina. Much of the trading is done via smartphone apps, with a sportsbook now available in the pockets of many Americans everywhere. There is also no league as important as the NFL, especially with increasing bets that extend beyond the outcome of games, and into player props, touchdown and yardage bets and even next team odds.

American adults are projected to legally wager $35B throughout this NFL season, according to the American Gaming Association, which would represent a whopping growth of 30% Y/Y. Data also shows that public support for the industry continues to grow amid commitments to responsible gaming and consumer protection. Football fans are encouraged to set a budget, keep it social, know the odds, and only play with legal and regulated operators.

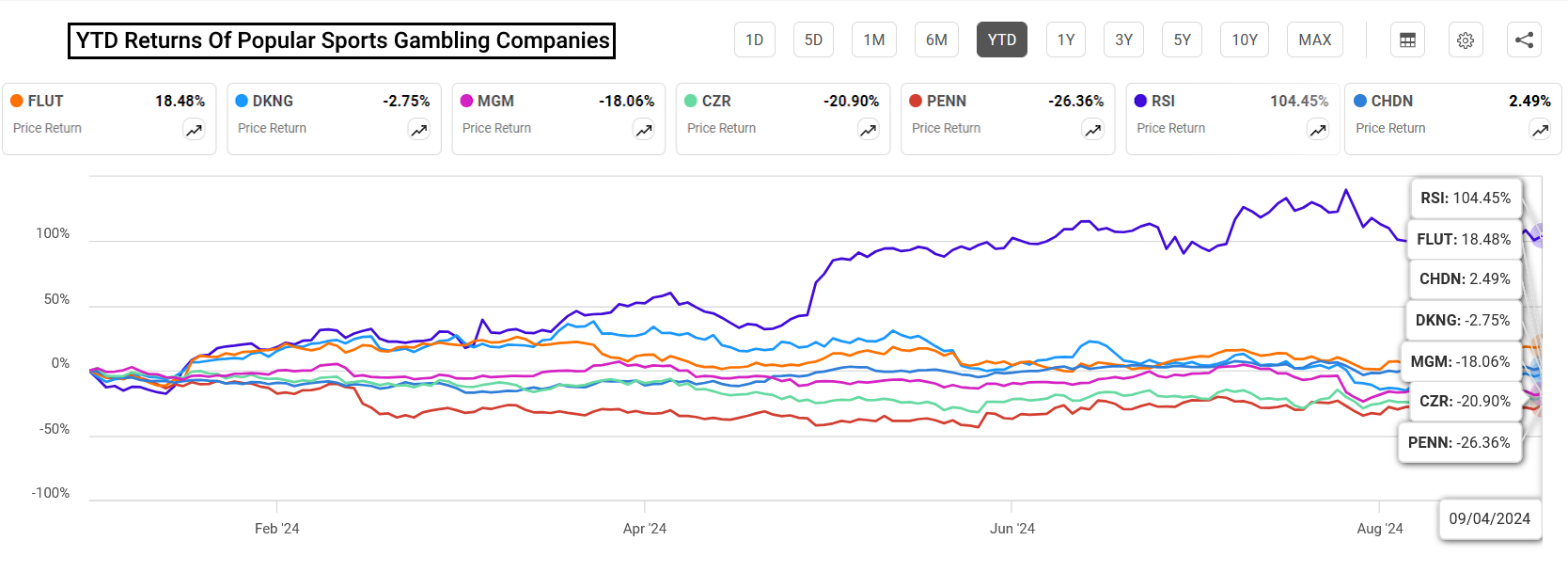

By the numbers: Bank of America estimates that two platforms control the majority of total money bet across the country, with FanDuel (NYSE:FLUT) at 42% and DraftKings (NASDAQ:DKNG) at 34%. The online sports betting handles of smaller players include a 7% share for BetMGM (NYSE:MGM) (OTCPK:GMVHF), 5% for Caesars Sportsbook (NASDAQ:CZR), and 3% for ESPN Bet (NASDAQ:PENN). While the latter just launched online sports betting in New York in an expansion push, others are also hoping to boost their national market share, like Fanatics and Rush Street Interactive (NYSE:RSI). See more analyst commentary here.