JHVEPhoto

Following yesterday’s decline that wiped out nearly $300B in market cap, Nvidia (NASDAQ:NVDA) is now in bear territory, Goldman Sachs’s trading desk said in a research note.

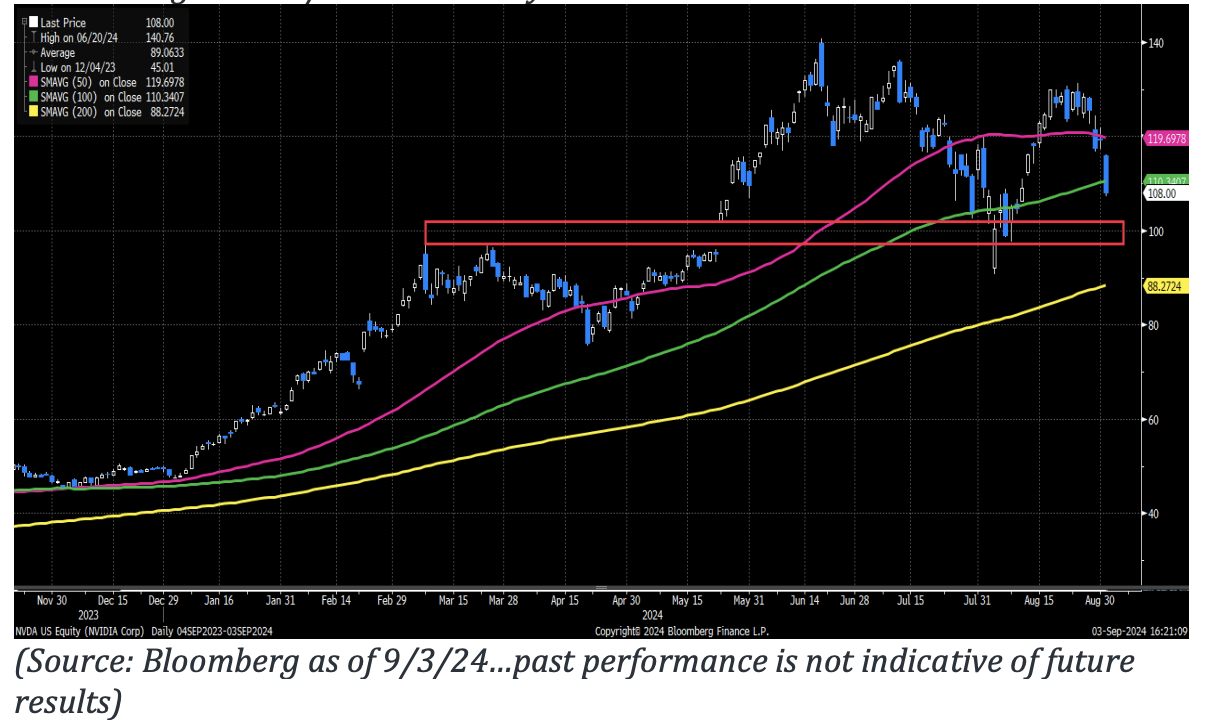

Nvidia shares have declined 23% from their intraday-high set on June 20 and went through both its 50 and 100-day moving averages, Goldman Sachs explained.

The research firm added that the near 10% decline was the result of several reasons, including:

- “Residual earnings-related supply in NVDA as investors get back into their seats following the holiday week.”

- Negative seasonality, as semiconductors have traded lower every September since 2020.

- Reports that OpenAI is developing new in-house chips.

- And traders and portfolio managers reshuffling their books ahead of several data points, including Broadcom’s (AVGO) earnings later this week.

Nvidia also reportedly received a subpoena from the Dept. of Justice related to its ongoing antitrust probe, which Goldman Sachs added will not help sentiment.

Goldman is slated to host its annual Tech & Communacopia conference next week, where Nvidia Chief Executive Officer Jensen Huang is set to speak on Wednesday.