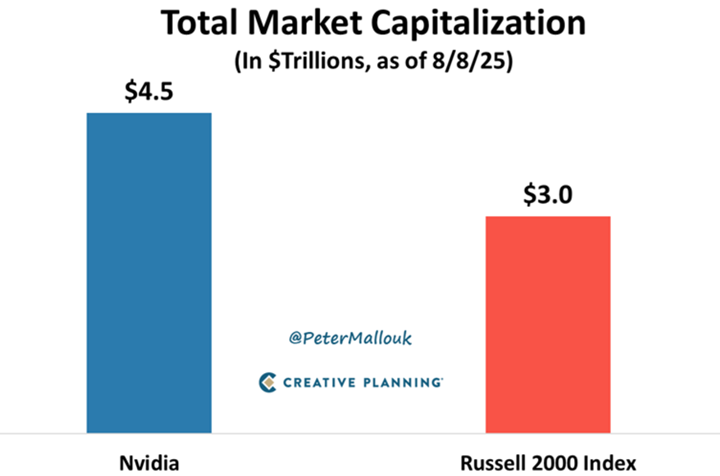

Nvidia’s (NASDAQ:NVDA) market power continues to expand, underscoring its place among the most dominant forces in global finance. The semiconductor leader now commands a market capitalization of $4.5 trillion, a level that places it firmly ahead of its corporate peers.

To put that in perspective, Nvidia’s valuation is about $1.5 trillion higher than the combined market caps of all 2,000 companies in the Russell 2000 index (RTY). The comparison highlights not only the company’s staggering size, but also the widening divide between mega-cap technology firms and the broader small-cap universe.

See the below visual chart provided by Creative Planning:

Nvidia vs. Russell 2000 (Creative Planning)

Nvidia’s footprint extends well beyond individual investors and stock indxes. The company is currently included in 667 exchange traded funds, reflecting how deeply it has been woven into both active and passive investment strategies.

Together, those ETFs control roughly 3.6 billion shares of the California-based chipmaker, making it one of the most widely held positions across global portfolios.

For investors seeking concentrated exposure, a handful of ETFs stand out as particularly Nvidia-heavy. The five funds with the largest weightings toward the stock are:

No. 1: ProShares Ultra Semiconductors (NYSEARCA:USD) at 27.6%.

No. 2:GraniteShares 2x Long NVDA Daily ETF (NASDAQ:NVDL) at 26.38%.

No. 3:Strive U.S. Semiconductor ETF (NYSE:SHOC) at 24.47%.

No. 4:Global X PureCap MSCI Information Technology ETF (NYSEARCA:GXPT), at 23.09%.

No. 5:VanEck Semiconductor ETF (SMH) at 22.19%.