Antonio Bordunovi

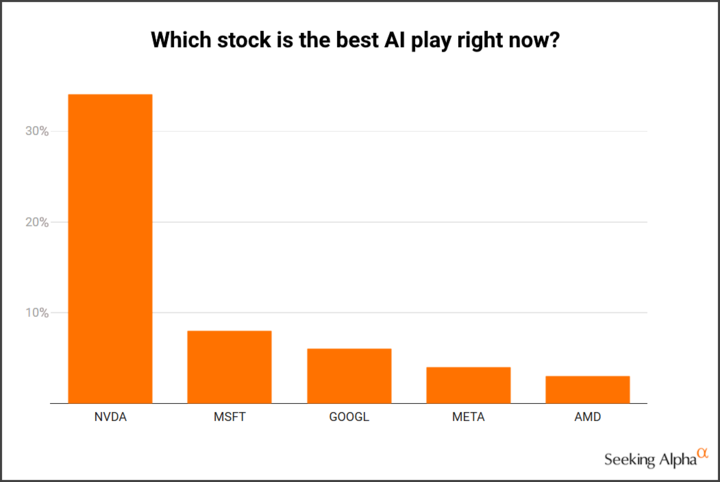

In a recent survey, we asked Seeking Alpha readers what the best AI stock play is right now.

Of the 515 who participated, 34% chose Nvidia (NASDAQ:NVDA), followed by Microsoft (NASDAQ:MSFT) with 8%, Alphabet (NASDAQ:GOOG) (NASDAQ:GOOGL) with 6%, Meta (NASDAQ:META) with 4%, and Advanced Micro Devices (NASDAQ:AMD) with 3%.

Seeking Alpha readers’ poll on AI stock plays (Seeking Alpha)

We asked Seeking Alpha analysts Jack Bowman and Rick Orford for their top picks and which stocks investors should keep an eye on in the space.

What’s the best AI play right now?

Jack Bowman: I’ve been a long-time shareholder of Palantir (NASDAQ:PLTR); I first bought shares at the direct public offering a few years ago, essentially the first moment I was able to. This is a company I feel is “doing AI right” and not trying to bill it as a cure-all for businesses, especially those who just want to use it to downsize headcount. Instead, they are using it very tactically and building full systems around their AI programs. If firms want to outsource, they are just buying access to an LLM like Microsoft’s (NASDAQ:MSFT) Co-Pilot, but they have to buy into the PLTR (NASDAQ:PLTR) system itself.

One of the things that has impressed me is PLTR’s understanding that the best use of AI isn’t for creative tasks but analytical ones. Using AI to spot patterns in data sets larger than any person or even small team could pore over is incredibly valuable in our modern world; data is ubiquitous in essentially all businesses now, and there will be no shortage of customers in the B2B space in all industries. We cannot go back to a world with less data; our future is always likely to contain more data. The firms that make analysis of data, especially at scale, are going to be the biggest winners in the AI race.

Of course, much of this is priced in, and so risks remain, especially in valuation. That goes for so much of the AI industry at this point. It’s a risk investors must accept to invest in AI-related firms in 2025.

Rick Orford: If I think back to the ’90s and early 2000s, Advanced Micro Devices (NASDAQ:AMD) was the “cheaper alternative” to Intel (INTC) chips, whether it be for PCs or servers. Cheaper, but not at the expense of quality.

Today, AMD’s (NASDAQ:AMD) success is a result of it now going neck and neck against Nvidia (NASDAQ:NVDA), which I think is smart. The question is: will the hyperscalers buy AMD’s vision? While companies like Microsoft (NASDAQ:MSFT), Alphabet (NASDAQ:GOOG) (NASDAQ:GOOGL) and Meta (NASDAQ:META) have near-unlimited funds for AI, shareholders demand free cash flow.

If AMD (AMD) can prove their products work “nearly as well as Nvidia” at a cheaper price, it wouldn’t surprise me if these hyperscalers continued to buy. Actually, it wouldn’t be a stretch to say that smaller AI developers might also prefer a cheaper model to complete their work. One only needs to look at China and how they are actually promoting the development of AI apps.

Considering Nvidia’s (NASDAQ:NVDA) revenue is about 5.35x that of AMD, I see any movement in AMD’s (AMD) revenue to have a leveraged effect on AMD’s stock, which is why it’s my favorite AI stock of 2025.

In a recent survey, SA readers named NVDA as the best AI play, followed by MSFT, GOOGL, META and AMD. Do you think they’re the best AI plays, or are there better ones out there?

Jack Bowman: I get why readers would vote for NVDA (NVDA) as the best AI play. As the saying goes, “When there’s a gold rush, don’t invest in gold mines or gold miners, invest in the firms selling picks and shovels.” Most gold miners won’t strike gold. Some do, and they are generously rewarded. However, all of them have to buy equipment.

NVDA (NVDA) operates much like that, as the largest seller of GPUs, the hardware that AI models are trained and run on. However, I’ll posit that an undervalued name in this space is ASML (NASDAQ:ASML), which produces the machines that Taiwan Semiconductor (TSM) uses to produce NVDA (NVDA) GPUs. This is like investing in the firms that make the components of the picks and shovels, which NVDA (NVDA) is assembling and selling.

ASML’s (NASDAQ:ASML) largest advantage is that it is the only firm in the world capable of producing the lithography machines that TSM (TSM) uses. It effectively has a monopoly on the making of these components. That moat gives me confidence that ASML (NASDAQ:ASML) is an underappreciated opportunity in the space.

Rick Orford: There’s no denying that Nvidia (NVDA) steals the thunder when it comes to AI. The issue? They’ve got terrific products and a development platform that makes it harder for clients to switch – brilliant. The problem? Nvidia (NVDA) is, and always has been, expensive.

Meta (NASDAQ:META) is also interesting in that it has the opportunity to monetize Llama, but I still see them as a company (and, as an extension, their stock price) dependent on ads. And yes, ad revenue is exciting, but as strictly an AI play, I don’t see it.

Alphabet (NASDAQ:GOOGL) (NASDAQ:GOOG) is another interesting company. It’s the cheapest among the Magnificent Seven and has been for some time. The stock trades at just 20.52x trailing twelve-month earnings, but I also don’t see AI being its primary revenue source. Rather, I think, like Amazon Web Services (AMZN) and Microsoft’s (MSFT) Azure, cloud sales will be the new revenue drivers for these companies moving forward. However, I think for the reasons already given, AMD (AMD) has the “most legs” in 2025.

Which “up-and-coming” AI or AI-adjacent stocks should investors keep an eye on in 2025?

Jack Bowman: I love looking at mid-cap firms because of the potential for incredible success, but I don’t always love owning them because of the potential for big losses. It’s far easier to double the market cap of a firm like my pick for up-and-coming AI stock, Nebius (NASDAQ:NBIS), valued at $12 billion, than it will be to double NVDA’s (NVDA) $4 trillion, but that doesn’t, on its own, mean it will be a good stock to own.

Nebius (NASDAQ:NBIS) is a data center and cloud operator based out of the Netherlands (shoutout to ASML as well), but operating globally. The firm has a storied past as part of Yandex, “Russia’s Google,” but that’s behind it now. It operates with a strategic partnership with NVDA (NVDA) to deploy GPU clusters, providing necessary AI infrastructure to businesses that cannot build out their own or who only need limited capacity. This is also akin to the “picks and shovels” commentary, as cloud and AI infrastructure will be more and more important as we see the rise of AI software firms competing with bigger players that are building their own data centers and infrastructure.

As the demand for outsourced AI hardware grows, especially as access to it is more decentralized, Nebius (NASDAQ:NBIS) stands to gain significantly as a leader in the space. There is a significant risk that the company will be outcompeted by firms with deeper pockets who can sustain losses in the AI field longer, but the gain one stands to make is also tremendous. This is a stock I’d consider if you are interested in investing in AI firms, especially smaller, lesser-known companies, but also one I’d consider managing the risk with smart position sizing.

Rick Orford: In terms of performance, I think we also need to think beyond hardware. Eventually, we’ll reach an “iPhone” moment where the hyperscalers all have the chips they need without needing to spend $100+ billion a year on AI capex. With that, I’d be looking at the ones using AI, like Palantir (NASDAQ:PLTR), or even a smaller player like BigBear.ai (NYSE:BBAI). The point is the developers are the ones we need to be considering for explosive growth.

- Trending AI Stocks

- Top Semiconductor Stocks

- Top Interactive Media Stocks

- Top Systems Software Stocks

More on NVIDIA, Advanced Micro Devices, etc.

- Palantir: Q2 Preview, Government Contract Risk (Rating Downgrade)

- Microsoft: Don’t Get Too Excited About Future Returns

- Nebius Q2 Preview: Get Your Cash Ready And Hold The Line To Strike

- Adobe, Amazon and Johnson Controls stand out amid surge in AI adoption: Morgan Stanley

- Zuckerberg targets post-iPhone era with AI-powered glasses vision