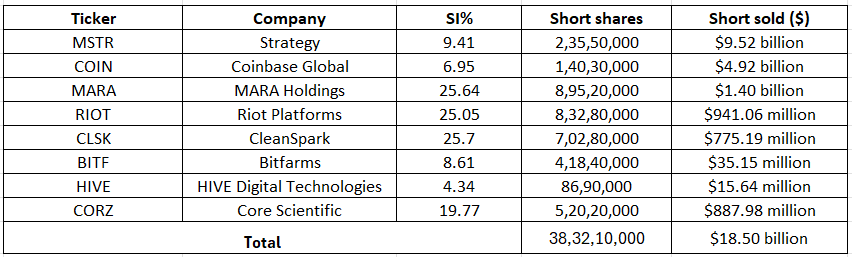

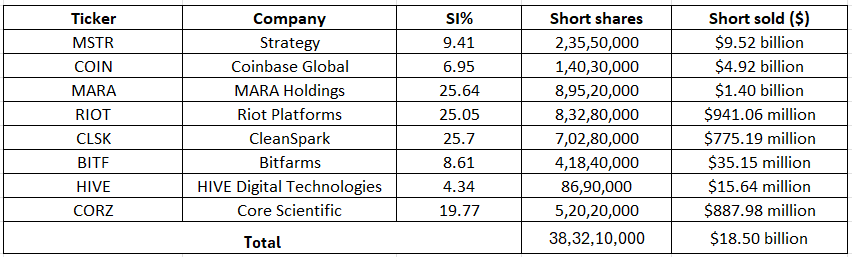

Crypto short interest declined for the third straight month in June. The majority of the crypto stocks saw a decrease in short interest in the month with only Coinbase Global (NASDAQ:COIN) and Core Scientific (NASDAQ:CORZ) seeing a slight uptick.

Short interest in Bitfarms (NASDAQ:BITF) saw the steepest fall of nearly three percentage points to 8.61%. Strategy (NASDAQ:MSTR) and HIVE Digital Technologies (NASDAQ:HIVE) were among other companies that saw short interest decline. It fell to 9.41% and 4.34% for the companies respectively.

Meanwhile, Coinbase Global (COIN) and Core Scientific (CORZ) short interest rose to 6.95% and 19.77% respectively.

Overall, about 383M shares were sold short in the crypto sector in June, a dip from 388M in the month of May.

According to short interest data as of June 30, the short dollar volume in the crypto stocks was $18.50B, compared to $14.7B the previous month. Of these, Strategy, Coinbase and MARA Holdings continued to attract the most interest from short sellers, accounting for $15.84B or 85.62% of the total bets.

Bitcoin (BTC-USD) prices remained wobbly throughout July due to tensions in the Middle East, but despite that, it managed to stay above the $100K mark.

However, the cryptocurrency has been showing swift recovery in July with its prices notching new record highs. Bitcoin surged past the $120K mark for the first time on June 15 amid growing optimism over regulatory advancements and increased institutional interest.

More on Crypto

- Rethinking CONY As Coinbase Rallies – Tactical Use, Not Income Plan

- Strategy: Still Sticking With Series A Preferreds

- Strategy Stock: A Leveraged Way To Play Bitcoin

- Coinbase’s Deribit launches rewards program for USDC holders

- Coinbase gets new Buy rating from Argus as growth trajectory is poised to continue