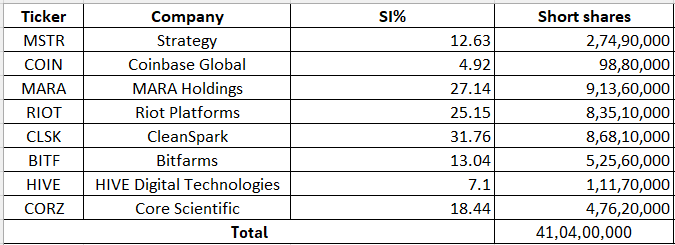

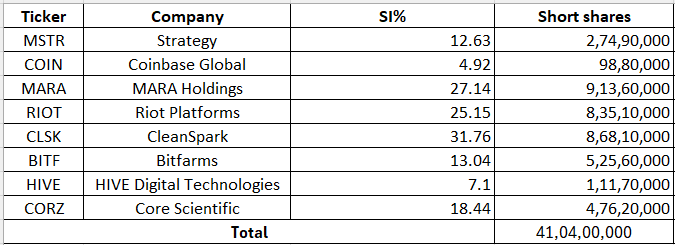

Crypto-related stocks saw a mixed response from short sellers in April with five out of eight stocks witnessing a decline in short interest while the remaining three saw a rise.

Among those that saw a decline were Strategy (NASDAQ:MSTR) where short interest declined to 12.63% from 13.41% in the previous month. MARA Holdings (NASDAQ:MARA), Riot Platforms (NASDAQ:RIOT), CleanSpark (NASDAQ:CLSK) and Bitfarms (NASDAQ:BITF) also saw short interest fall to 27.14%, 25.15%, 31.76% and 13.04% respectively.

Core Scientific (NASDAQ:CORZ) saw the highest rise in short interest in April to 18.44% from 16.87% in March. HIVE Digital (NASDAQ:HIVE) and Coinbase (NASDAQ:COIN) also saw short interest increase to 7.1% and 4.92%.

In April, Bitcoin (BTC-USD) rebounded to reclaim the $90,000 mark showing its resilience during a wobbly economic period triggered by tariff concerns. In March, the cryptocurrency had briefly fallen below the $75,000 mark.

“Bitcoin has been trading more as a safe haven during the recent selloff as the US dollar depreciated,” said Seeking Alpha analyst Damir Tokic.

In May so far, it has already climbed above the $100K mark. According to Standard Chartered, Bitcoin could reach new all-time highs of around $120K in Q2, don the back of a broad asset reallocation away from U.S. assets as well as several technical indicators.