The short interest on 24 out of 37 consumer staple stocks—part of the Consumer Staples Select Sector SPDR Fund (NYSEARCA:XLP)—rose in August vs. the previous month, while short interest for the remaining 13 stocks saw a fall in their short interest.

The S&P 500’s consumer staples sector ETF (NYSEARCA:XLP) saw a marginal gain of 0.77%, compared to the broader S&P 500 ETF Trust (NYSEARCA:SPY) gain of 3.56%.

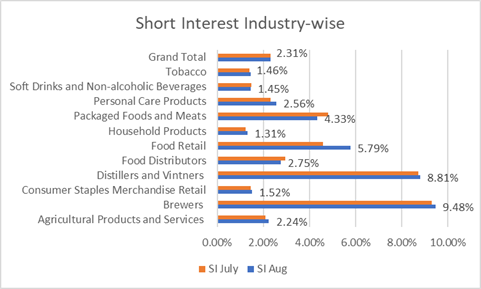

Overall, short bets rose for 8 out of 11 industries in the consumer staples sector; however, the average grand total short interest marginally dropped to 2.31% from 2.32% last month.

Industry Analysis:

In the consumer defensive/staples sector, Brewers remained the most shorted industry, with an average short interest of 9.48% vs. the previous month’s 9.29%. Distillers and Vintners were the second-most shorted industry and had the second-highest short interest of 8.81% in August, vs. 8.73% last month.

Short interest in Household Products segment was lowest at 1.31% vs. 1.22% prior. Followed by Soft Drinks and Non-alcoholic Beverages segment, which was the second-lowest segment, with a short interest of 1.45% vs. 1.48%. Tobacco had a short interest of 1.46% vs. 1.39%.

Short interest for consumer staples in August (Seeking Alpha)

Short interest, which could potentially be an indicator of pessimism, calculates the number of shares sold against the company’s float. (Short Interest % = Number of Shares Sold Short ÷ Stock Float). To note, consumer staples often underperform in rising markets but beat the falls.

Let us now look at the consumer defensive names that were most and least shorted in August.

Least shorted stocks:

- Philip Morris International (NYSE:PM): 0.72% vs. 0.75% last month

- Procter & Gamble (NYSE:PG): 0.74% vs. 0.72%

- Coca-Cola (NYSE:KO): 0.86% vs. 0.83%.

- Walmart (NYSE:WMT): 0.90% vs. 0.85%

- Colgate-Palmolive (NYSE:CL): 1.44% vs. 1.46%

Most shorted stocks:

- Campbell Soup (NASDAQ:CPB): 13.68% vs. 13.59%

- Brown-Forman (NYSE:BF.B): 10.73% vs. 10.47%

- Molson Coors Beverage (NYSE:TAP): 9.48% vs. 8.14%

- Dollar Tree (NASDAQ:DLTR): 7.60% vs. 7.61%

- General Mills (NYSE:GIS): 6.18% vs. 6.22%

ETFs to tab consumer staples: (NYSEARCA:VDC), (NYSEARCA:IYK), (NYSEARCA:FSTA), (NYSEARCA:KXI), (NYSEARCA:FXG), (NYSEARCA:RSPS)