The stock market’s biggest winners this year aren’t flashy AI start-ups but decades-old hardware makers. Seagate Technology (NASDAQ:STX) has surged 156% in 2025, making it the top performer in the S&P 500. Western Digital (NASDAQ:WDC) ranks third with a 137% gain, while Micron Technology (NASDAQ:MU) is up 93% after a record run of consecutive daily gains, Bloomberg News reported Sunday.

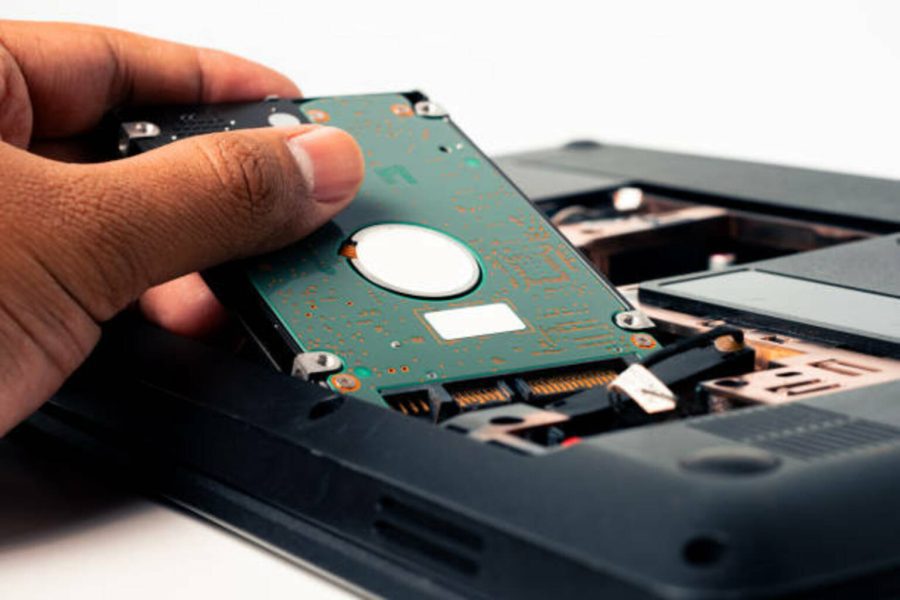

The rally underscores how the rush to build AI infrastructure, powered by billions in annual spending from Microsoft, Alphabet, and other tech giants, is spilling into older corners of the industry. Hard drives and memory chips, once overlooked, are now vital for training large language models that require massive data storage and ultra-fast processing.

Analysts are divided. Some see the surge as evidence of a bubble, noting investors are piling into secondary plays as AI leaders like Nvidia (NVDA) and TSMC (TSM) (OTC:TSMWF) become expensive. Others argue valuations remain modest: Seagate (NASDAQ:STX) trades at about 20 times projected earnings, Western Digital (NASDAQ:WDC) at less than that, and Micron (NASDAQ:MU) at a discount to the broader S&P 500’s (SP500) multiple of 23.

Seagate’s revenue is forecast to climb 39% in fiscal 2025 before slowing to 16% in 2026, while Micron’s sales are expected to jump nearly 50% this year. Western Digital (WDC) is also recovering after a steep downturn. Analysts have been raising targets, though prices have already run past consensus estimates.

Still, market veterans warn that storage and memory are cyclical businesses, and such rapid gains could mark a late stage of the rally. For now, however, companies once seen as mundane are among Wall Street’s hottest AI beneficiaries, Bloomberg News reported.