Summary:

- Online education platform 2U reported disappointing Q4 revenues and declining enrollments, while also issuing a going concern warning.

- Guidance for Q1 and full year 2024 was extremely disappointing.

- TWOU faces significant near-term debt maturities, raising the possibility of bankruptcy and adding to ARK Invest’s poor recent investments.

ALLVISIONN

Back in October, I detailed how online education platform 2U (NASDAQ:TWOU) was in need of a serious restructuring. The company has a significant amount of debt on the balance sheet coming due by the end of January 2025, while it is also facing significant revenue and profit headwinds. Since my article, shares have lost more than half of their value, but there are still plenty of downsides possible, as the equity here may end up being worthless.

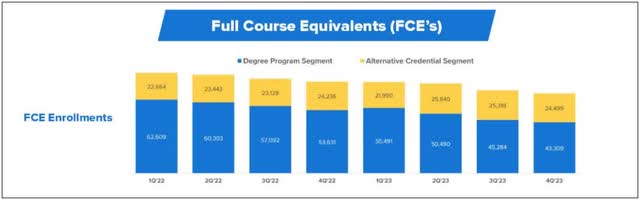

Monday after the bell, 2U reported its fourth quarter results for the December 2023 period. The company announced revenues of $255.7 million, which was 8.3% growth over the prior year period. This number badly missed street estimates, which were calling for top line growth of nearly 20% to over $281 million. This huge miss also meant that the full-year number showed a 1.7% decline, whereas analyst hopes were calling for a small increase. As the company showed in its earnings presentation, enrollments continue to decline quarter after quarter.

2U Enrollment (Q4 Earnings Presentation)

Unfortunately, this wasn’t just a miss for revenues at the end of last year. The company guided to Q1 revenues of $195 million to $198 million, well below street estimates for more than $208 million. For the full year, management is expecting revenue of $805 million to $815 million. The street was looking for $870 million, which means the top line is going to drop by double digits this year, even after considering that last year’s total number came in extremely light. Adjusted EBITDA was guided to be in a range from $120 million to $125 million for 2024, which would be a significant decline from the $170.8 million figure reported for full year 2023.

The big news on Monday, however, was that the company issued a going concern warning. My previous article detailed the more than $750 million in debt that’s coming due by early 2025. Management stated it needs to either refinance these borrowings rather soon or raise equity to continue its operations. At the end of last year, 2U had cash and restricted cash of just $73 million, compared to total debt of nearly $905 million. The financial situation here is so bad that 2U had to take the following action last month to raise some short-term capital.

In January 2024, the company entered into a receivables factoring transaction with Morgan Stanley Senior Funding (“Morgan Stanley”) whereby Morgan Stanley has committed to purchase up to $86.2 million of receivables owing to the company related to portfolio management activities at a purchase rate of 88%.

Shares of 2U finished Monday at 92 cents per share, giving the company a market cap of about $65 million, and that was before shares dropped 25% after the Q4 report. It’s extremely hard to see them being able to raise hundreds of millions through equity sales, which is why bankruptcy is becoming an increasing option here. The terrible financial state is a major reason why 2U shares trade at about 0.06 times expected 2024 revenue, a very small fraction of the 3.71 times that a comparable name like Coursera (COUR) goes for.

Until the company can make some major changes to its business model, I will continue to rate the stock as a sell. Management has restructured a bit already and cut a number of employees, but there is a lot of work left to do. 2U did report a small operating profit for 2023 when excluding impairment and restructuring charges, but that number was dwarfed by interest costs of nearly $75 million, which are only getting larger as borrowings increase. The stock could even face a delisting process if a reverse split doesn’t take place to get the share price back above a dollar.

At this point, the biggest risk for bears is a potential buyout. Another player in this space might believe they can generate enough synergies to make a deal work. Perhaps a private equity player can wipe out some debts here because slashing interest costs would be a way to flip the profit and cash flow picture to a more favorable one. Alternatively, should 2U be able to spin off part of its business or generate some meaningful capital from selling non-core assets or perhaps some intellectual property, the increased financial flexibility could help me inch closer to a neutral rating.

Last week, Cathie Wood’s firm sold almost all of its Invitae (OTC:NVTA) holding for just a few pennies per share, recording a nearly 100% loss. We could see a similar situation here with 2U. ARK Invest has been a major holder of 2U in recent years, owning over 8.17 million shares of the company at the end of the last week, which is a little more than 10% of the entire name. 2U is held in the flagship ARK Innovation ETF (ARKK), as well as the ARK Autonomous Technology & Robotics ETF (ARKQ), and the ARK Next Generation Internet ETF (ARKW). Most of Ark Invest’s ETFs have been hit hard in recent years thanks to a number of poor investments in names with collapsing growth stories or terrible financials, with 2U being a prime example.

In the end, 2U may be the second-high profile bust for the flagship Ark Invest portfolio, with the online education platform issuing a going concern warning on Monday. The company reported Q4 revenues that badly missed street estimates while providing terrible guidance for Q1 and all of 2024. With a debt pile that’s more than 10 times what the equity here is worth, management is already taking drastic actions like a receivables factoring transaction to raise funds. 2U has a very tough road ahead of it, and it will take a massive effort for me to change my bearish stance.

Editor’s Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Investors are always reminded that before making any investment, you should do your own proper due diligence on any name directly or indirectly mentioned in this article. Investors should also consider seeking advice from a broker or financial adviser before making any investment decisions. Any material in this article should be considered general information, and not relied on as a formal investment recommendation.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.