Summary:

- We recap Meta Platforms’ Q4 earnings, highlighted by the impressive financial momentum over the past year.

- The challenge for META is attempting to diversify beyond advertising, while its metaverse ventures face an uncertain future.

- META stock benefits from overall solid fundamentals, but shares appear near fair value relative to a peer group of mega-cap tech peers.

NurPhoto/NurPhoto via Getty Images

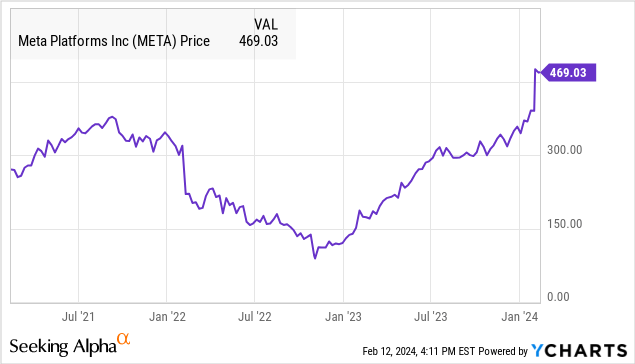

It’s been just over two weeks since Meta Platforms (NASDAQ:META) blew away Q4 earnings, sending shares 20% higher on the report. A dividend initiation was likely the big surprise, which worked to project confidence in the long-term outlook while cementing the company’s status as a cash flow juggernaut.

We last covered the stock nearly one year ago, highlighting the strength of the social media ecosystem with a sense that there are significant untapped monetization opportunities. That said, our update goes in a different direction, taking a more critical view following what has been a spectacular rally.

For all the strong points in META’s fundamentals, our knock here is that the company largely remains a one-trick pony, singularly dependent on online advertising. While objectively a pretty good trick, this cyclical profile is in contrast to other mega-cap tech leaders that have built a more proven diversified business. That dynamic supports the view that shares face a structural valuation discount relative to peers.

Separately, what hasn’t received much attention is the ongoing failure at META to succeed with its “Metaverse” ambitions. Questions over the commercial viability of its VR headset program add a layer of uncertainty.

Ultimately, the company is fine, but we believe caution is warranted when looking at the stock at the current level with many of the positives baked in. Our expectation is for some renewed volatility going forward.

META Financials Recap

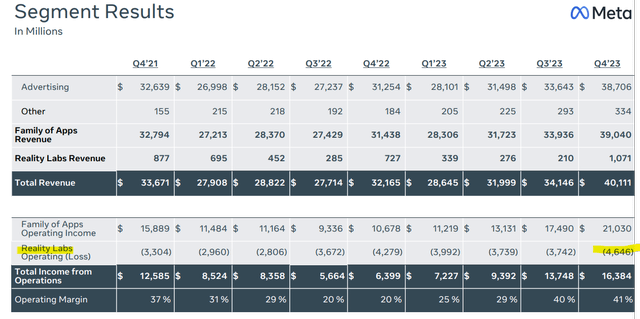

META Q4 EPS of $5.33 came in $0.39 ahead of the consensus and up 203% from $1.76 in the period last year. Revenue of $40.1 billion, was an impressive $940 million above the consensus, up 25% year-over-year increase.

The context of the ramp-up in profitability considers that costs and expenses declined by -8% y/y, driving a sharply higher operating margin to 41% from 20% in Q4 2022. Steps CEO Mark Zuckerberg took during the “Year of Efficiency”, which included reducing the total headcount and efforts to streamline the operation, appear to have paid off.

Operationally, a key indicator here is the solid 6% y/y climb in monthly active people (MAP) to 3.98 billion, reflecting global users across its social media ecosystem. Meta has also managed to drive a 17% increase in family average revenue per person (ARPP) to $10.10. Within that amount, Meta is generating $68.44 per user of Facebook in the U.S. and Canada as a global benchmark, still capturing climbing rates in all regions.

Comments during the earnings conference call pointed to not only improved ad rates but also internal efforts to support conversions with new formats like “click to message” and “shop ads” as well as momentum in new tools for advertisers to connect with their marketing data. Meta is also touting the momentum of AI features intended to improve ad performance in intended target demographics.

As it relates to the dividend initiation, Meta is set to distribute $0.50 per share as a quarterly amount, which yields approximately 0.4% on a forward basis. The annualized payout represents around $5.1 billion in cash back to shareholders, which is well-supported considering the company generated $43 billion in free cash flow over the past year.

Meta has also announced an increase to its share repurchasing authorization by $50 billion on top of the $31 billion existing authorization. All this is covered by a net cash balance sheet position reported at $47 billion.

What’s Next For META?

Overall, it’s clear the company is firing on all cylinders and has effectively turned the page compared to the period of weak growth and falling earnings around 2022.

In terms of guidance, 2024 is expected to largely be a continuation of recent trends, although operating margins may come up against moderately higher expenses into the second half of the year with management making a new investment spending push.

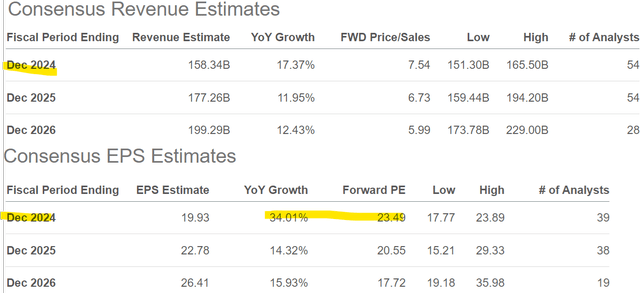

According to consensus, META is forecast to see 17% revenue growth, while EPS may climb 34% towards $19.93. The earnings level implies shares are trading at a forward P/E of 24x. Looking ahead, the market sees growth above double-digits with an otherwise strong outlook.

Weaknesses In META’s Outlook

Recognizing what is an objectively solid setup, it’s worth taking a deeper look at what could be some areas of weakness for META.

We mentioned the company’s “Metaverse” experiment has largely been a dead end over the last several years. Going back to the Q4 results, the “Reality Labs” segment, despite contributing less than 3% of total revenues, generated a -$4.6 billion operating loss during the quarter or approximately $33 billion over the past two years.

As good as the core advertising business has been, Reality Labs has been a major drag on earnings, with comments within the 2024 guidance expecting a widening operating loss this year.

From the earnings conference call, the message from CEO Mark Zuckerberg is that the company still views the Metaverse as an application of AI to represent a long-term vision. It’s fair to give the group some benefit of the doubt, but the question becomes how much longer the experiment will go until the market begins to demand some results.

The elephant in the room is the recent launch by Apple (AAPL) of its Vision Pro headset, which the company calls a “spatial computer”. The early reviews have been very positive, with reports suggesting Apple has made a superior and technically more advanced product compared to META’s “Oculus Quest 3”.

While the Quest’s lower price point is intended for more casual gaming, the big advantage we see from the Vision Pro is that it completely integrates into the existing Apple operating system, carrying over not only a familiar design language but compatibility with a universe of 3rd party apps.

The point we’re getting at here is that the success of the Vision Pro from Apple represents a major blow to META, where it is now forced to play catch up against a global leader in consumer hardware. That can translate into a need to significantly ramp up spending, with the lingering risk that any product META launches simply fails to catch on.

So when we look at META, the name of the game right now is advertising, which it does very well, but it will need more to drive higher growth in the next decade.

Into 2024, a major market theme is that “everyone” is doing advertising, including Apple as well as Amazon (AMZN), and even with new players across various new channels covering streaming video services to even the ride-sharing giant Uber Technologies (UBER).

The problem is not so much that it’s an ever-crowded field competing for what can sometimes be the same advertising dollars, but the concept that the growth trends are exposed to high-level macro influences. In the same way that there was a slowdown in ad rates and demand in 2022, META is particularly exposed to future headwinds in what is an uncertain and fast-changing online landscape.

Is META Undervalued?

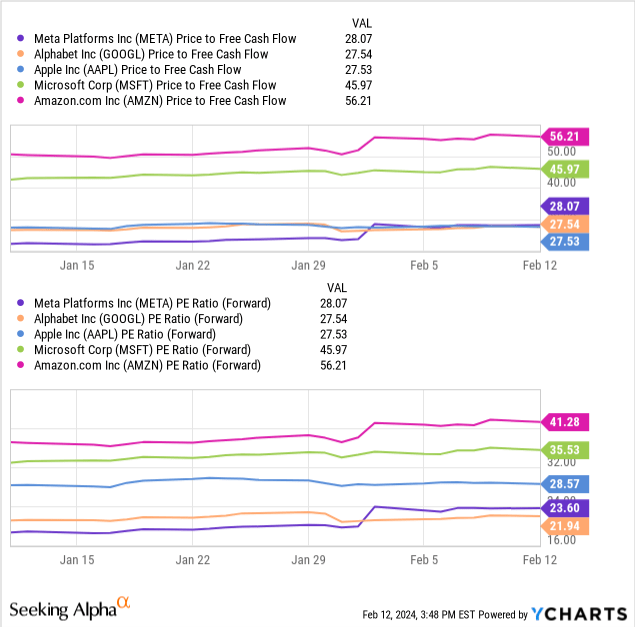

All this simply adds to the risk for META compared to the rest of “MAG 7” stocks, where advertising is more of a side business. Even Alphabet Inc. (GOOGL) with its core strength in Google search advertising, the ecosystem has a major video streaming platform, YouTube, and separate Google Cloud services.

Beyond the higher level of growth Meta is generating today, we’d say Apple has a stronger long-term competitive moat overall, while Alphabet is better positioned to leverage AI opportunities. No stock is perfect, but we can nitpick plenty of chinks in META’s armor.

This plays into our take that META’s current valuation is capped in the context of the current growth premium for GOOGL and AAPL. In our view, it’s more likely that META shares are near fair value at a forward P/E of around 25x, or 20x into fiscal 2025, than to believe the stock has room to climb towards a 30x multiple.

Considering the size and scale of the operation, the challenge for the bull case with META is to significantly outperform what are already high growth expectations.

On the other hand, a true bearish thesis for the stock could bring up a scenario where platform MAPs top out and ARRP growth begins to stall. Failure to make Quest and Reality Labs work could open the door for a consequentially large write-off for the segment down the line.

Final Thoughts

We rate META as a hold, which implies a neutral view on the stock price from the current level over the next 6-months to a year. While we won’t be surprised to see shares go through a correction, we reserve a sell rating for when we believe a stock has more than 20% downside and is unlikely to recover.

In this case, META is fine, but investors just looking at the stock today likely missed the boat in our opinion, with many of the positives priced in. In our view, there are better opportunities in the market with more upside potential. Long-time shareholders should have some patience with the possibility of adding to a position at lower prices down the line.

Over the next few quarters, it will be important for the company to maintain that operating momentum with key metrics like the MAP and ARPP. The main risk the stock faces is likely on the macro side, with a deterioration of economic conditions opening the door for a reset of earnings expectations. Looking ahead, we want to see more indications that the Metaverse projects will translate into a commercially significant opportunity.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Add some conviction to your trading! Take a look at our exclusive stock picks. Join a winning team that gets it right. Click for a two-week free trial.