Summary:

- 2U’s share price is down 83% from its highs in February 2021.

- The company’s revenue has grown at an incredible 22% over the same period.

- The growth in the online education market is expected to act as a tailwind for the company.

- 2U recently finalized the acquisition of edX, a leader in online degrees. Partners include leading universities such as Harvard, Berkeley and even MIT.

- The company is undervalued both in my relative and intrinsic valuation models.

Prostock-Studio/iStock via Getty Images

2U (NASDAQ:TWOU) is the market leader in online education and degrees. They work with over 80 Universities, including top tier colleges such as Harvard, Cambridge and even MIT.

The company’s share price is down 83% from its highs in February 2021. However, revenue has grown by 22% over the same period. The decline in share price is mainly due to the macroeconomic issues, such as record high inflation and rising treasury yields; these factors impact the valuation of all growth stocks.

However, from a fundamental perspective, the company is undervalued on both a relative & intrinsic basis. In addition, 2U is poised to take advantage of the growing market in online education, which has only expanded since the lockdown of 2020.

In this post, we’re going to delve into the business model, plans for future growth and most importantly the valuation. Let’s dive in.

The online education market is expanding

The E-Learning market hit USD 250 billion in 2020 and is estimated to grow at an incredible 21% CAGR between 2021 and 2027, according to GM Insights.

The global lockdown of 2020 further accelerated this growth. According to UNESCO, over 1.2 billion students in 186 countries were affected by school closures during the March 2020 lockdown. These factors have highlighted the importance of online education as not just an option, but a necessity. These macro trends should act as a catalyst behind the growth of online education companies, such as 2U and Coursera (COUR). As the old saying goes, a rising tide lifts all boats.

Technology trends are accelerating

The acceleration toward digital technologies should act as a further growth catalyst. We already see over 90.8% of the US has high speed internet. Technologies such as Elon Musk’s Starlink & 5G will enable high speed internet to even the most remote regions globally.

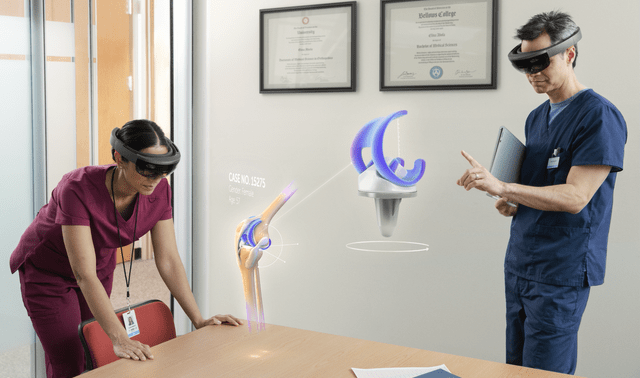

Then we have the growth of cloud based Learning Management Systems (LMS) and even Artificial Intelligence & Virtual Reality. These technologies could further enhance the learning experience with smart tailored content, and real time questioning programs. For example, Microsoft (MSFT) has recently announced a mixed reality curriculum with leading education provider Pearson.

Microsoft Hololens. Learning with VR (Microsoft)

2U acquires edX

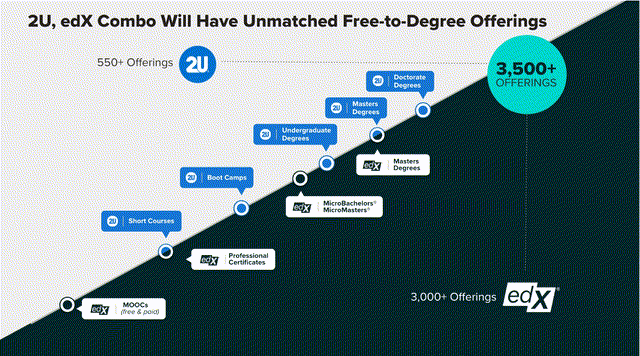

2U recently acquired the online education platform edX for a whopping $800 million. This provides synergies for the platforms to offer their “Free to Degree” programs. 2U now has access to over 40 million users worldwide and an extra 500 university partners.

This allows the company to expand its offering of professional certificates, short courses and degrees. The company also offers corporate training and has over 1200 enterprise clients. edX started in 2012, as a non-profit which received investments from MIT and Harvard and became a pioneer in MOOC (Massive, open, online courses). The sale of a non profit to a public company did cause some controversy, but the company was losing money and Harvard & MIT saw a nice return on their investment.

According to the CEO Chip Paucek in their earnings call:

edX will create a flywheel in our enterprise business. More courses means more learners means more companies means more jobs for students, which means a bigger, better, business opportunity.

2U acquires edX (2U investor Relations report)

2U’s Marketing Plan

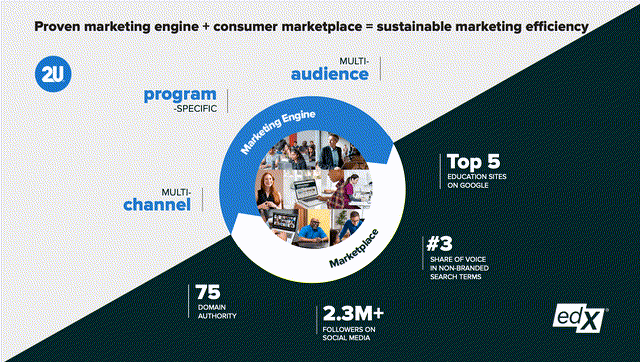

2U’s plan is to try and convert just 0.03% of the 39 million registered edX learners into its premium offerings, using their “proven marketing engine”. The idea behind this is to help lower the cost of student acquisition from a sky high $3900 to $3500. This is a reduction of between 10% to 15% for the cost of student acquisition and according to the company could save between $40 and $60 million.

However, an issue with this model is 80% of edX learners are outside of the US, in countries with a lower average income such as India. Whereas, the majority of 2U’s premium customers are from the US. Thus to achieve the same cost saving the company would require a higher conversion rate than estimated on the smaller US based audience. Therefore, I have took these details into account in my valuation model, which I will get onto later.

2U Marketing Plan (2U investor relations)

Experienced Management

The company’s CEO is the founder Chris Paucek who has been a serial entrepreneur in the education industry since the early 1990’s. He founded his first company in 1993 Cerebellum Corporation, which produced education television programs. After which he served as the CEO of Smarterville Inc. before starting 2U.

I utilize the same investing strategy as the legendary hedge fund manager Nick Sleep. A key part of this strategy is to invest into founder led companies, as they tend to create more shareholder value long term. Just think of Jeff Bezos (Amazon (AMZN)), Mark Zuckerberg (Facebook (FB)) etc. Now, although 2U is founder led, I was disappointed to see he only owns 0.56% of the company’s shares. I would ideally prefer to see more “skin in the game”, before making a large investment into the company.

2U vs. Coursera

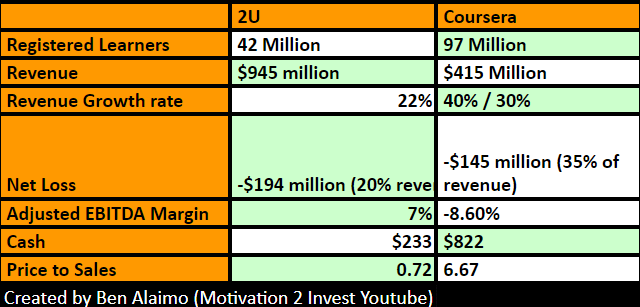

The acquisition of edX now allows 2U to compete head to head with their main rival Coursera. Coursera has a greater number of registered users at 97 million, which is much greater than 2U’s 39 to 42 Million. However, it looks like the value of 2U’s users is much greater having generated over $500 million more in revenue at a better 7% EBITDA margin.

This is because 2U has focused more on premium online degree programs and used a series of lead generating websites, followed up by a phone call sales process to entice student enrolments.

2U vs Coursera comparison Table (Created by author)

2U (& edX) also offers a better selection of premium universities such as Harvard, Cambridge, Oxford and MIT. Whereas the best Coursera has is Stanford (the company was founded by a Stanford professor). However, Coursera is growing revenue faster on a percentage basis, 40%, compared to 22% for 2U since the prior year.

Overall, the companies are close in metrics and have slightly different business strategies, but given 2U’s lower price to sales ratio and higher margins, the relative valuation is better for 2U.

Is the Stock Undervalued?

As a value investor, I have completed an intrinsic valuation of 2U using the discounted cash flow model of valuation. This takes into account the financials from their recent full year earnings report for 2021.

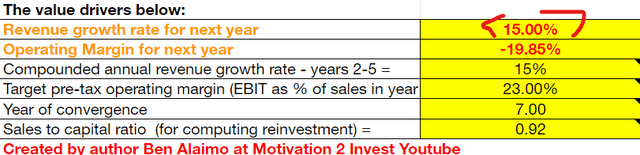

2U Stock analysis and Valuation Model (Created by author Ben Alaimo at Motivation 2 Invest YouTube)

I have been very conservative with my revenue growth estimates at just 15% for the next 5 years, the company grew revenues at 20% the prior year. I have predicted margins to increase substantially to 23%, but over a long 7 year period. This would be as the company plans to drive down customer acquisition costs and thus has to spend less on marketing.

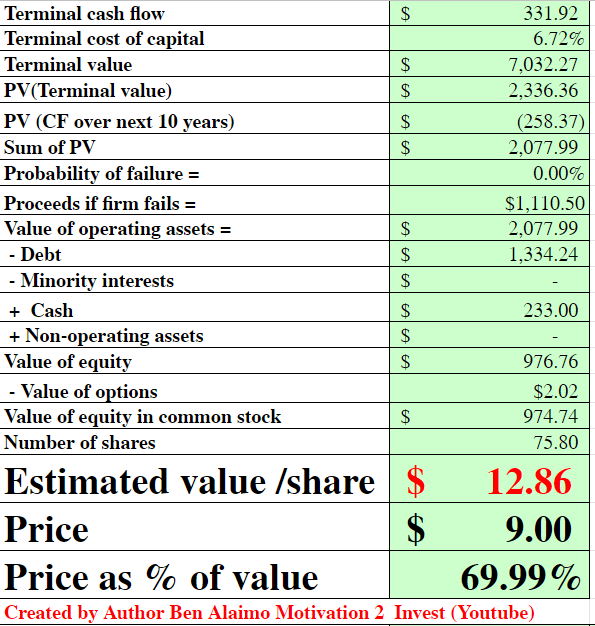

2U stock analysis/Valuation Model (Created by author)

Plugging the financials & my growth estimates, I get a valuation of $12/share which means the stock is currently 30% undervalued at the $9 share price.

Risks

Competition is Fierce

The online education market is a battle ground of companies with very similar offerings. The two main players in this market are 2U with 42 Million registered learners and Coursera which has a greater number of registered learners, 97 million. Then there are other players offering very cost effective programs such as Udemy and even many free online degree courses such as MIT’s OpenCourseWare. Thus expect profits to be squeezed as companies compete on price, in order to entice users in.

Rising Interest Rates

The macro trend of high inflation & rising interest rates are negatively affecting the valuation of growth stocks more generally. Goldman Sachs has forecasted seven interest rate hikes by the Fed in 2022. Fears of higher Interest rates mean higher bond yields and thus a higher discount rate which affects the valuation of all stocks negatively.

This is because the value of any company is the value of its expected future cash flows. With growth stocks, the value is disproportionally weighted toward future and thus these types of stocks are affected to a greater extent.

Therefore, I expect the majority of growth stocks to stay depressed until inflation begins to subside. Therefore, anyone holding 2U stock, will need to be aware of this macro factor and adjust their strategy accordingly.

Final Thoughts

2U is one of the two main players in the online education market. The company is expected to benefit from the rapidly expanding E-Learning Market.

Their recent acquisition of edX and strategy of “free to degree” seems like a great tactic moving forward. 2U is burning cash right now and the key number to watch will be their cost of customer acquisition, which they need to reduce to improve margins. The company is currently undervalued, both intrinsically and relative to competitors, so to me this looks like a great long-term investment into the online education market.

Disclosure: I/we have a beneficial long position in the shares of TWOU either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: This is not a recommendation to buy or sell any stock, or financial advice.