Summary:

- AECOM’s revenues should benefit from the recent infrastructure law as well its new initiatives to gain market share.

- The company’s margin should also continue to improve.

- There is further room for its valuation multiple to expand which coupled with EPS growth prospects make it a good buy.

JHVEPhoto/iStock Editorial via Getty Images

Investment thesis

AECOM’s (NYSE:ACM) growth is likely to be supported by current industry trends, and new business initiatives will help them gain market share. ACM’s state and local clients are experiencing record revenue and budget surpluses, which will assist the company in the short term, and the implementation of the Bipartisan Infrastructure Law in the United States will aid them in the long run. Despite the fact that the company is yet to see benefits from the infrastructure law, AECOM has seen improvement in new orders in the U.S. last quarter. We believe the order growth will further accelerate once the funding under this law is disbursed. Internationally, investments in infrastructure and ESG initiatives will present ACM with significant growth prospects.

Q1 22 Earnings Analysis

AECOM’s revenue for the first quarter of FY2022 was $3.26 billion (down 1% Y/Y) , missing the consensus estimates of $3.45 billion. However, net service revenue (NSR), which is a much more relevant indicator for AECOM, increased ~5% Y/Y with the International segment increasing by ~7% Y/Y and the Americas segment growing by ~3% Y/Y. The adjusted EPS for the quarter at $0.89 (up 43.9% Y/Y) was 12 cents better than consensus estimates. NSR growth, operational performance, and a share repurchase programme all contributed to the quarter’s strong EPS growth. The company’s adjusted segment margins also grew 60 basis points to 13.7% as a result of ACM’s continuing investments in productivity and digital transformation initiatives.

Strong order backlog and pipeline growth

ACM reported a book to burn ratio of 1.4x in the Americas design business and 1.2x in the entire design business in Q1 2022, contributing to a 5% increase in total design backlog. The company’s total design pipeline also grew by ~10%. Despite the fact that the Bipartisan Infrastructure Law (BIL) has yet to benefit ACM considerably, the company was able to achieve these results. The $1.2 trillion BIL investment in the United States will help ACM’s clients obtain funding for their projects. Once this funding starts getting disbursed, we will likely see further acceleration in new orders and backlog growth.

Advisory business to help gain share

ACM has been investing in their advisory and program management businesses in order to grow and gain market share. This advisory business complements its design business, resulting in an early engagement with clients. This helps in lowering the company’s associated overhead expenses and improving margins. The recent shift by private corporations toward sustainable business practices through ESG investments is helping AECOM in developing long-term advisory ties with them.

Digital Transformation

In FY 2020, ACM unveiled its Think and Act worldwide strategy, with one of the primary components being to develop its design process digitally and solve clients’ challenges with digital solutions. The company’s investment in a digital AECOM strategy has led to a better client engagement. The PlanEngage platform, which was announced in Q4 2021, is expected to transform ACM’s infrastructure business and is a move toward digital transformation. This digital transition will enable ACM to achieve operational efficiency and improve margins in the long run.

Margin improvement

In Q1 2022, ACM reported an adjusted segment operating margin of 13.7% which was a ~60 bps improvement over the last year. I believe the company can continue to see margin expansion despite rising inflation as the company will pass through these inflationary costs to clients. Also, as mentioned before, for the past two years the company has been investing in its advisory business and digital Aecom initiative which has resulted in improved margins. I believe these improvements will continue in the near future. Management has given adjusted segment margin guidance of ~14.1% for FY22 which seems reasonable.

Capital Allocation

With the buying of $213 million of stock in the first quarter of 2022, ACM has repurchased $1.2 billion of stock since September 2020 or ~14 per cent of shares outstanding. This capital allocation strategy has benefited both ACM shareholders and contributed to the growth in the company’s EPS. In addition to its share repurchase program, the company began paying dividends in Q1 2022, with yearly increases estimated to be in the double digits.

Valuation

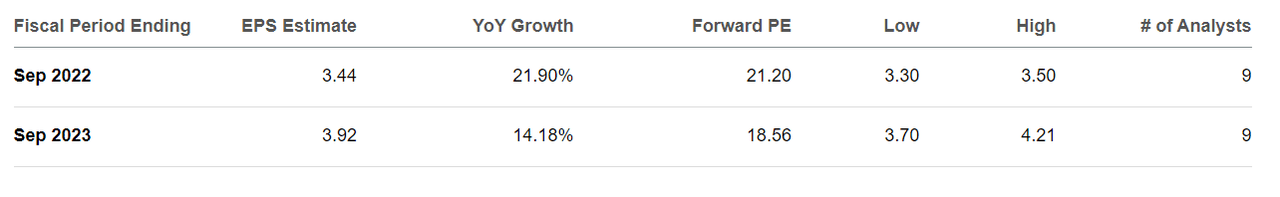

If we look at the current consensus EPS estimates, AECOM’s EPS is expected to increase 21.90% in the current year and 14.18% next year. The company is trading at a P/E of 21.20x FY2022 EPS and 18.56x FY2023 EPS.

AECOM Consensus EPS Estimates and Valuations (Seeking Alpha)

The current valuation is a premium compared to the company’s 5-year historical average P/E of 15.78x. However, AECOM is a much different company than it was five years ago thanks to a successful activist campaign by Starboard. The company has exited its risky construction business, moved away from value destructive merger and acquisitions strategy, and management is now focussed on organic growth and returning cash to shareholders through dividends and buybacks. So, I believe it deserves to trade at a premium to historical levels. One of the company’s peers – Tetra Tech (TTEK) – is trading at a forward P/E of 35.65x thanks to its past execution history and shareholder friendly management. If AECOM continues to execute well and management continues with shareholder friendly policies, I believe the company can continue to see its P/E multiple expand further from the current levels. Hence, I believe there is a good upside and have a buy rating on the stock.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.