Summary:

- Nike reports Q3 earnings on March 21st.

- Gross margins, China and fledgling competition could impact the company in a positive way.

- After a year of flatline results, Nike could restart the growth.

winhorse

Nike (NYSE:NKE) reports Q3 earnings on March 21st and today we’ll take a look at three items investors should look for in the upcoming report.

Here are the top line expectations for Nike:

Revenue Estimate: $11.43B +5.18% Y/YEPS Estimate: $0.54 -38% Y/YSource: Seeking Alpha

Gross Margins

Over the past few years gross margins at Nike have been under pressure. Shipping, logistics, foreign exchange rates, and more recently bloated inventory numbers have impacted Nike’s gross margins in a negative way.

| Fiscal Quarter | Gross Margin |

| Q2 2023 | 42.9% |

| Q1 2023 | 44.3% |

| Q4 2022 | 45% |

| Q3 2022 | 46.6% |

| Q2 2022 | 45.9% |

| Q1 2022 | 46.5% |

Some of these challenges are outside of Nike’s control and could ultimately turn into tailwinds in the coming months.

The dollar index has retreated from the highs it made during October and shipping rates from China to the West Coast have fallen a reported 90% over the past year.

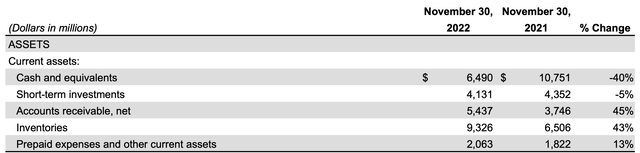

Nike’s bloated inventory levels were still an issue during Q1 when the company showed a 43% increase Y/Y in inventory build.

Nike Q2 Press Release

Somewhat concerning is this inventory total ran through the end of November, which spans Black Friday and other key holiday shopping days.

So while it’s likely Nike sees improvement in shipping, logistics and currency headwinds – it remains to be seen how the inventory (and subsequent promotion activity) will impact margins. This will be the first thing I look at when the Q3 earnings report crosses next week.

China

The second item investors will closely be monitoring is the China region in terms of revenue and EBIT.

From a revenue perspective, the China region had been under pressure largely because of China’s “zero Covid” policy. In Q1 from a constant currency perspective, sales were down 13% Y/Y. During Q2 Nike saw a significant bounce back with sales in China increasing 6%.

| Quarter | China Revenue | F/X Neutral Growth Rate |

| Q2 2023 | $1.79B | 6% |

| Q1 2023 | $1.66B | -13% |

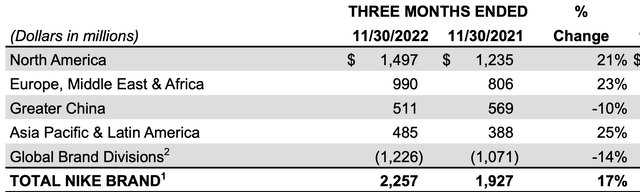

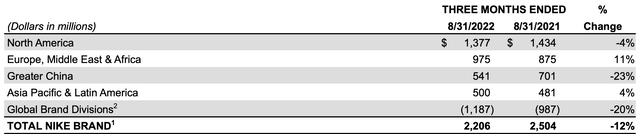

Nike also reports earnings before interest and taxes, or EBIT, for each region as well. Similar to sales, earnings in the China region were also under pressure as the country experienced Covid related shutdowns.

Nike Q2 Press Release

During Q2 China was the only region which saw EBIT decline Y/Y. However, when you compare it to Q1, the 10% decline was actually an improvement over Q1 where the China region saw a 23% decline.

Nike Q1 Press Release

Couple this recovery in revenue and EBIT with the fact the CEO sounded bullish on China in a January interview on CNBC, investors will be paying close attention to the China region.

Competition

Nike won’t likely mention competition explicitly on a conference call, in part because the company has a long track record of obliterating it for decades. If a Nike shareholder had a dollar for every time a bearish argument was made because of Reebok, adidas (OTCQX:ADDYY), or Under Armour (UA) (UAA), that shareholder would be much richer.

Recently Adidas had to slash a dividend and sales outlook because of the elimination of the Yeezy brand. This actually might end up being slightly tangible to Nike in the long run as the Yeezy brand was widely popular and certainly sucked up dollars that would have likely gone to Nike.

Under Armour’s issues run deeper as the brand itself has no momentum. I wrote about Under Armour back in January recommending a sell rating and shares are down 29% since that publication date.

Other footwear brands like Allbirds (BIRD) tend to pop up for a short period of time, only to flame out rather quickly.

What Nike has done, and continues to do is extraordinarily rare in both the stock market, but also the fashion industry. The combination of timeless designs in footwear and timely marketing has consistently kept the brand hot for decades.

Conclusions

Over the past year Nike stock is essentially flat. This is likely because the bull case revolves around gross margins getting a lift from a weaker dollar, shipping rates declining and rightsizing inventory. Most evidence points to two out of three on the way to improvement. The upcoming Q3 results will give us clues on how inventory levels remain at Nike.

China is obviously tremendously important to the company’s growth. The last two quarters show signs of life and with the country reopening, more upside might be reported.

Finally, Nike competitors feel weak compared to years prior. Adidas and Under Armour have experienced contraction – which ultimately should show up on Nike’s revenue line to a certain degree.

Overall this remains a world class company and there are catalysts that could help propel the stock higher after a year of flat results.

Disclosure: I/we have a beneficial long position in the shares of NKE either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.