Summary:

- We remain bullish on Disney.

- We expect Iger’s turnaround plan to pan out well into 1H24 and are more constructive on Disney shifting much-needed focus to profitability.

- We expect the company’s restructuring and cost-cutting measures to help drive profitability, amid a challenging macroeconomic environment.

- Disney stock is relatively cheap, trading at 2.3xEV/C2024 sales versus the peer group average of 4.5x.

- Under Iger, we believe Disney provides a favorable risk-reward profile and recommend investors begin looking for entry points at current levels.

Razvan

We continue to be buy-rated on Disney (NYSE:DIS). We’re more constructive on Disney as we expect Bob Iger’s turnaround plan to shift more focus to profitability. The stock is down nearly 27% over the past year and trading near its 52-week-low of $84. We believe Disney stock provides a favorable risk-reward profile at current levels. We last wrote on Disney in late November with a bullish sentiment driven by our belief that the company would boost revenue growth and increase Disney+ subscriptions with the return of Iger. While we remain constructive on revenue growth rebounding, our current bullish thesis is driven by Disney’s focus on profitability and reducing expenses amid the rough macro environment.

Disney’s 1Q23 earnings results highlight the company’s efforts to zoom in on profitability. Iger states that management is working to “reshape our company…reducing expenses, which will lead to sustained growth and profitability for our streaming business.” The company’s earnings report beat top and bottom lines but still reported slower segment growth. Total revenue grew 8% Y/Y this quarter, and total segment operating income was $1,773M up 5% Y/Y. While we’re bullish on Disney’s position within the media and entertainment industry, we believe the company is facing a much-needed restructuring to regain profitability more meaningfully. Disney Media and Entertainment Distribution segment, accounting for 62.8% of total segment revenues, only grew 1% Y/Y and reported operating income loss. We see Disney having more pricing power toward 2H23 when it comes to its streaming business and expect to see the company reshape its business to improve its streaming profits. We recommend investors buy the stock pullback over the past year and brace for a more profitable company going forward.

Improving streaming profits.

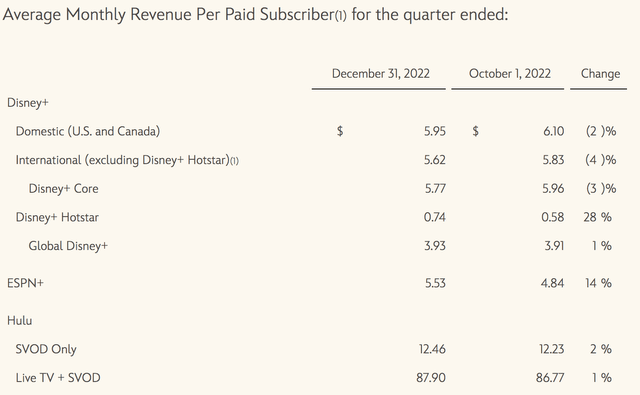

While Disney’s subscription growth in 1Q23 was somewhat lackluster, we’re not too concerned as we believe the company is shifting focus from subscription numbers to revenue. We saw something similar happen with Netflix (NFLX) earlier this year. The macroeconomic environment pressures media and entertainment companies to focus on maintaining revenue growth before figuring out how to bolster subscription numbers. We believe Disney+ is causing a slight dent in operating income, and there is an impending need for Disney to figure out how to make its streaming services more profitable. Disney+’s average monthly revenue per paid subscriber in the U.S. this quarter is $5.95 compared to $6.10 in the October quarter of 2022, which accounts for a 2% decrease. The following table outlines Disney’s average monthly revenue per paid subscriber this quarter.

Disney 1Q23 Earning results

Disney’s Direct-to-Consumer revenues increased by 13%, but operating loss increased by $0.5B to $1.1B, mainly due to higher losses at Disney+ and weaker results at Hulu. We’re more constructive on Disney with Iger’s turnaround plan as we expect the company will be able to leverage its steaming services more meaningfully.

We also believe the weaker ad spending environment fuels Disney’s increased focus on cost reductions. Ad firms are predicted to reduce advertising spending in 2023 due to the economic slowdown. So even if the company grows its ad-supported subscriptions, we expect it’ll experience softer spending from advertisers amid the rough macro environment, further necessitating cost reduction measures. The stock price remains volatile in the near term amid an uncertain macro environment, but we believe Disney is well-equipped under Iger to rebound towards the end of the year.

Strategy: Cost reductions & restructuring

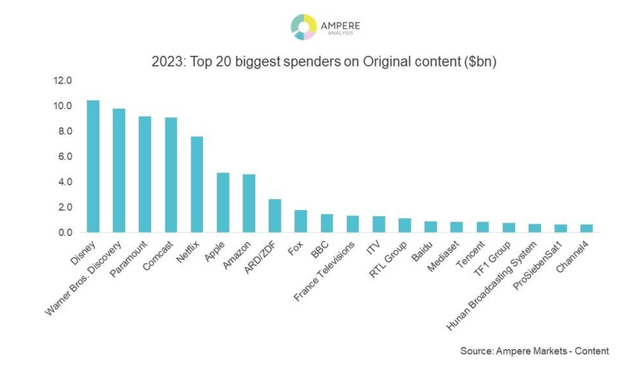

Iger showed a strong sentiment toward cost reductions and restructuring plans in the 1Q23 earnings call. The company announced it’ll cut 7,000 jobs, 2% of its employees, and “slash $5.5B in costs as part of a larger reorganization.” Around $3B of the $5.5B will be made from content, while the other $2.5B will be non-content cuts. Disney’s not taking on cost reduction measures alone; Warner Bros. Discovery (WBD) is also pulling back on content spending to boost profitability in its streaming business. Ampere Analysis expects the global content expenditure to increase a slight 2% Y/Y in 2023, which would mark the lowest growth in a decade, excluding the pandemic slump in 2020. We believe Iger’s cost reduction plan boosts investor confidence in how the company will maneuver the macroeconomic environment with a looming recession.

The following graph outlines the top biggest spenders on original content for 2023.

Ampere Markets

Valuation

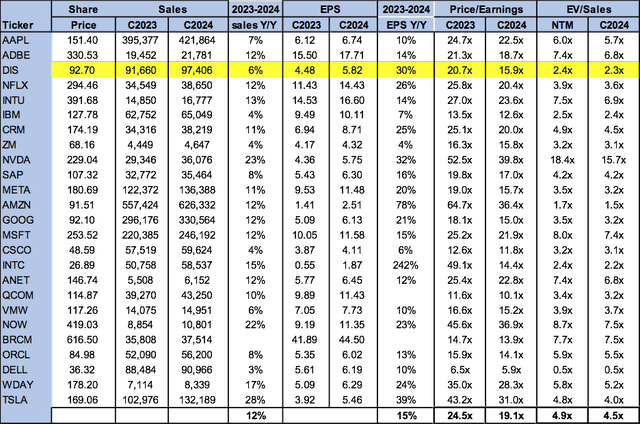

Disney stock is trading well below the peer group average. On a P/E basis, the stock is trading at 15.9x C2024 EPS $5.82 compared to the peer group average of 19.1x. The stock is trading at 2.3x EV/C2024 Sales versus the peer group average of 4.5x. We recommend investors buy the pullback as we see significant upside potential for the stock in the mid-to-long term.

The following graph outlines Disney’s valuation compared to the peer group average.

TechStockPros

Word on Wall Street

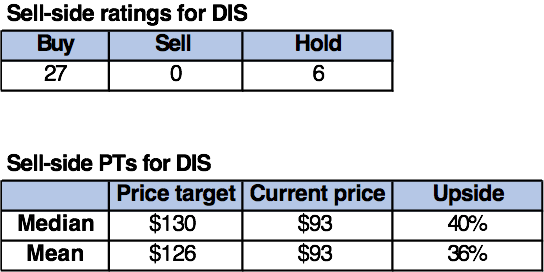

Wall Street shares our bullish sentiment on the stock. Of the 33 analysts covering the stock, 27 are buy-rated, and the remaining are hold-rated. The stock is currently trading at $93 per share. The median sell-side price target is $130, while the mean is $126, with a potential upside of 36-40%.

The following tables outline Disney’s sell-side ratings and price targets.

TechStockPros

What to do with the stock

We continue to be buy-rated on the stock. Disney, alongside the broader media and entertainment market, has had a rough year in 2022, and we expect the macro challenges to spill into this year. We’re more constructive on Disney rebounding as Iger’s cost reduction and restructuring plan focuses on improving streaming profitability. We believe Disney is well-positioned to take a bigger slice of the streaming market in the mid-to-long term. We recommend investors buy the stock at current levels as we see Disney stock rallying in the mid-to-long term.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.