Summary:

- Medtronic is undervalued compared to its long-term P/E ratio and has potential for strong returns.

- The company’s focus on innovation and product diversification positions it well for future growth.

- MDT’s strategic expansion into emerging markets enhances its revenue streams and market penetration.

Altayb/E+ via Getty Images

Introduction

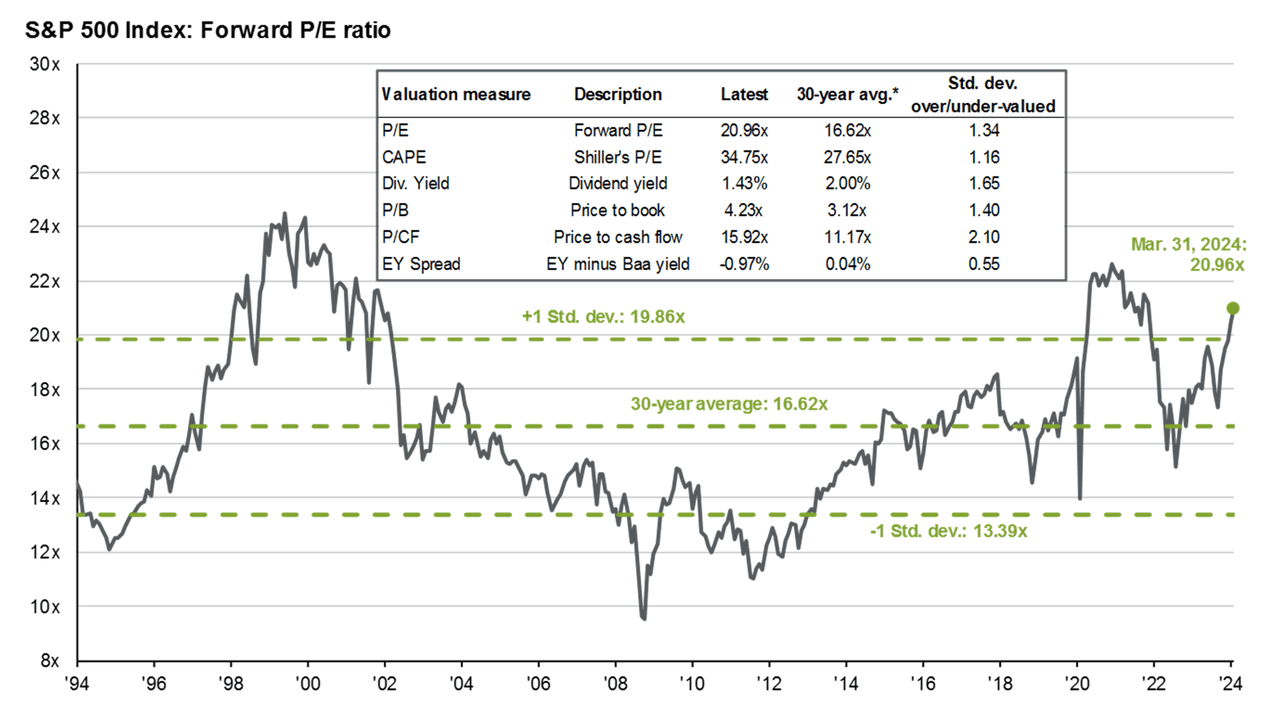

Allow me to start this article by showing you a chart I have used quite a few times in the past few months.

As we can see below, the market has a quite lofty valuation. The S&P 500 traded at 21x earnings going into this month. That’s 1.3x its long-term standard deviation. In fact, it’s the third-most expensive market since the early 1990s. Only the Dotcom and post-pandemic periods were more expensive.

JPMorgan

This does not mean that stocks are due for a massive sell-off. It could be possible, but that’s not the main takeaway here.

What I’m getting at is that it has become increasingly tricky to find good value in this market.

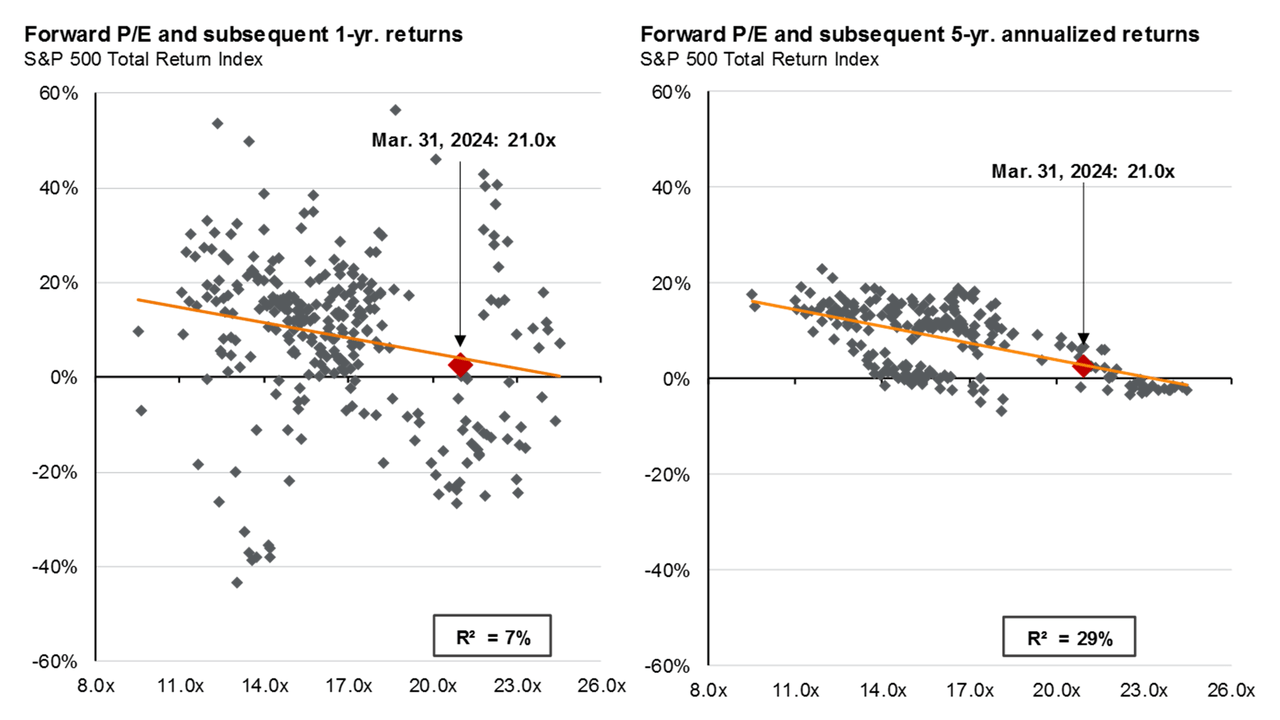

After all, the loftier a valuation, the lower the (expected) return in the years ahead.

Once the market’s valuation goes beyond 20x earnings, the odds of 0% annual average returns over the next five years start to rise dramatically.

JPMorgan

While future returns could be higher than expected, I’m increasingly focused on stocks that trade well below their fair value. Companies that the market underestimates.

To be honest, that’s tough when the overall market is expensive.

However, I have a few on my radar. One of them is Medtronic (NYSE:MDT). My most recent article on the stock was written on November 28, when I went with the title “3.5% Yield And Over 15% Annual Return Potential – I Really Like Medtronic.”

This is a part of my takeaway back then:

Medtronic stands out as a robust investment with a compelling blend of solid dividend yield, consistent growth, and innovative healthcare solutions.

Despite past challenges, the company’s strategic focus on innovation, global expansion, and operational efficiency is yielding positive results.

With a diverse healthcare portfolio and a forward-thinking approach to technology, Medtronic is well-positioned for sustained growth.

Since then, MDT shares have appreciated 5%, lagging the market by roughly 830 basis points.

In this article, I’ll update my thesis and explain why I expect MDT to outperform the market going forward.

So, let’s get to it!

Innovation-Driven Undervaluation

Whenever the market is trading at a lofty valuation, one needs to be very careful with stocks that appear to be “cheap.” Sometimes, there’s a good reason why some stocks haven’t rallied. Sometimes, undervaluation does not lead to decent returns.

Usually, I do this at the end of my articles. However, based on what we are going to discuss next, let’s take a closer look at MDT’s valuation.

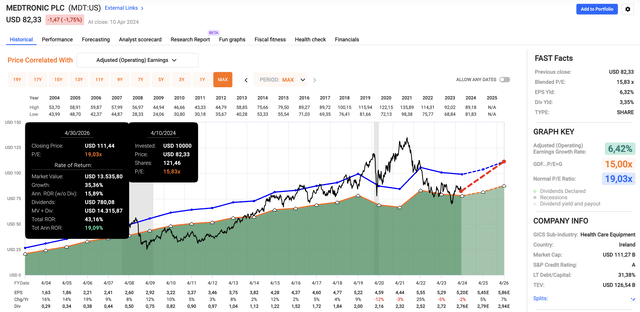

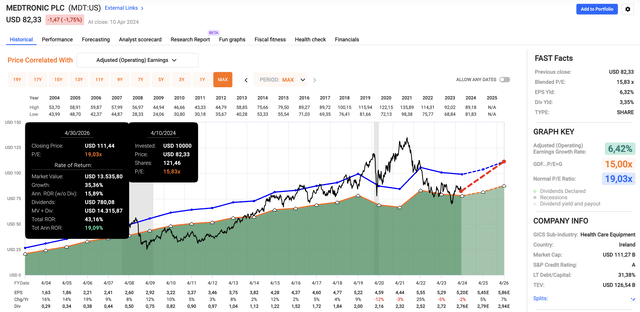

As we can see below, Medtronic trades at a blended P/E ratio of 15.8x, which is well below its normalized long-term P/E multiple of 19.0x (the blue line in the chart below).

FAST Graphs

On the one hand, the company deserved a lower valuation, as it has had very inconsistent EPS growth. In the 2020-2024 period, it had just one year of positive EPS growth.

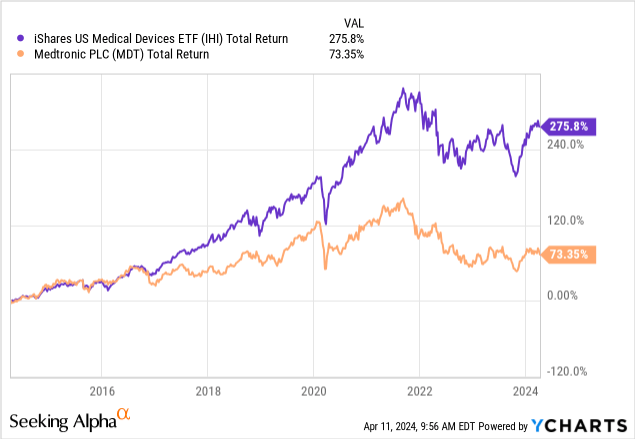

It also didn’t help that investors could buy so many other high-performing healthcare stocks.

For example, the iShares U.S. Medical Devices ETF (IHI) has returned 276% over the past ten years. This beat MDI by more than 200%! MDT has a 5% weighting in this ETF.

On the other hand, growth is expected to become more consistent.

After a 2% expected EPS contraction in 2024, 2025 and 2026 are expected to see accelerating growth to 7%. That’s not blockbuster healthcare growth, but a growth rate that should allow MDT to trade at least 19x earnings.

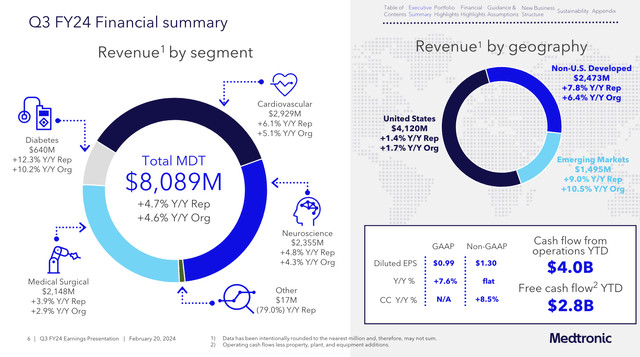

For example, in the company’s third quarter of FY2024, it saw 4.6% higher (organic) revenue. This was higher than the company expected and driven by growth in various areas, including the diabetes segment, core spine, cardiac surgery, structural heart, and cardiac pacing.

Medtronic

According to the company, it is increasingly attractive due to investments in the diversity of its product portfolio.

For example, the cranial & spinal technologies segment delivered high single-digit growth, driven by the adoption of the AiBLE ecosystem.

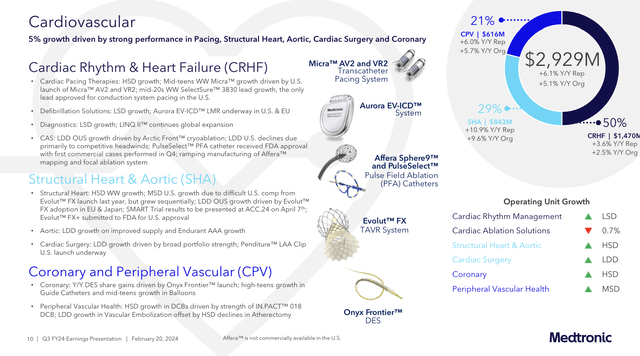

Meanwhile, in cardiac rhythm management, the company saw high single-digit growth driven by advancements in leadless pacemakers and conduction system pacing.

Medtronic

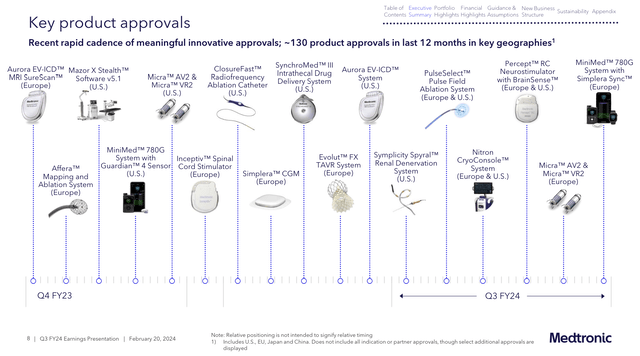

Additionally, the company is increasing the speed at which it brings new products to market, including with the help of advancements in robotics, artificial intelligence, and closed-loop systems.

We’re advancing innovative core technologies like robotics, AI and closed-loop systems. And with 5 AI products already FDA approved, we’re leading the way in bringing the tech into med tech. – MDT 3Q24 Earnings Call

Medtronic

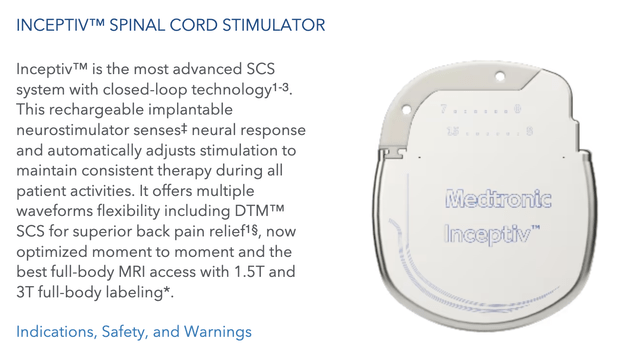

During last month’s presentation at the Barclays Annual Healthcare Conference, the company elaborated on growth drivers, noting strong growth in extravascular ICDs, pulse field ablation solutions for AFib, spinal cord stimulators (pictured below), deep brain stimulation devices, and advanced diabetes management systems like the 780G pump with Simplera Sync sensor.

These are fantastic areas to be in, as Medtronic targets high-demand medical needs that require advanced solutions.

Medtronic

Its focus on growth also includes emerging markets using emerging products.

For example, products like the Hugo surgical robot (I love this niche as it targets minimally invasive surgery demand) focus on emerging markets and offer flexible financing options to meet the needs of both new and existing customers.

These moves are expected to expand the geographic reach and improve market share.

On top of that, the company is exiting low-margin businesses, including the unprofitable ventilator segment. This includes a consolidation of the remaining businesses into high-growth areas named Acute Care and Monitoring.

Essentially, this decision allows the company to better distribute resources, benefitting its competitive position and shareholder value.

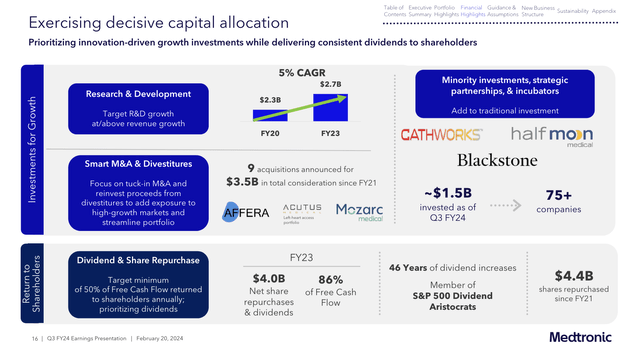

It is also accelerating R&D (research and development) growth. Going forward, the company expects to grow R&D spending at or above the rate of revenue growth.

Medtronic

Adding to that, MDT is increasingly focused on SG&A (selling, general and administrative) costs. While accelerating R&D, it is reducing SG&A to remain streamlined. That makes sense, as it is also getting rid of low-margin products.

And then we’re going to be focused on driving leverage in our SG&A. And we’ve had really strong disciplined headcount management across the company. Took headcount — indirect headcounts down at the beginning of last year. We’ve been focused on making that stick and we’ve been focused on every time we have attrition, not backfilling that attrition. – MDT At Barclays Conference

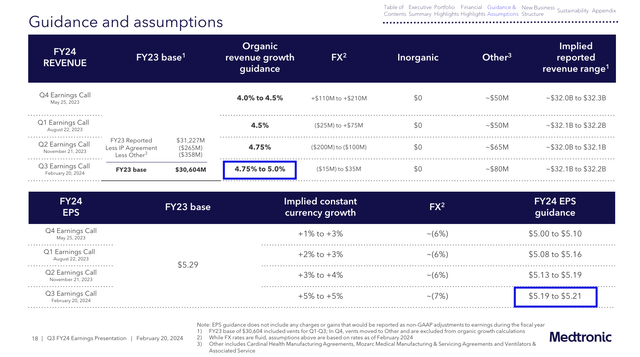

With all of this in mind, the company expects full-year organic revenue growth to be in the range of 4.75-5.00%, with an acceleration in the fourth quarter driven by the ramp-up of recent product launches.

Moreover, in terms of earnings, Medtronic raised its full-year EPS guidance by $0.04 at the midpoint to a new range of $5.19 to $5.21.

Medtronic

This increase was attributed to the stronger-than-expected revenue growth numbers I mentioned in this article and improved margins, partially offset by currency impacts.

Even better, the company expects growth to be durable.

Lastly, while we’ll give our fiscal year ’25 guidance on our earnings call in May, after we finish our planning, I want to share our early thoughts. You’ve seen us deliver durable revenue growth for several quarters, and we expect that to continue. Down the P&L inflation, currency and tax are currently headwinds to earnings growth. And we expect to continue to increase our investments in R&D. – MDT 3Q24 Earnings Call

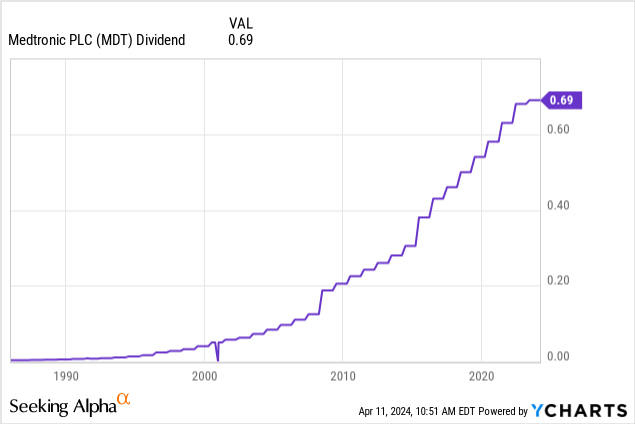

Moreover, the company remains committed to its dividend.

This Dividend Aristocrat has hiked its dividend for 46 consecutive years. It currently pays $0.69 per share per quarter. This translates to a yield of 3.3%.

The five-year dividend CAGR is 6.7%. The dividend is protected by a 53% payout ratio, using the lower bound of its 2024 EPS guidance range.

The dividend is a big part of its attractive total return picture, which brings me back to its valuation.

Using the same chart I used at the start of this article, the company has a fair price target of $111 if it finds a way to its normalized 19.0x multiple. This price is 35% above the current price.

FAST Graphs

The current consensus price target is $94, which I expect to be boosted in the months ahead.

All things considered, I really like MDT and believe it is working on an impressive turnaround that could turn this laggard into a company capable of outperforming the S&P 500 on a prolonged basis – especially considering the valuation advantage it has over the market.

Takeaway

In today’s lofty market, finding value is like searching for a needle in a haystack.

While the S&P 500 trades at historically high levels, opportunities for robust returns are scarce.

Hence, I focus on companies undervalued by the market, like Medtronic.

Despite recent underperformance, MDT has a diverse healthcare portfolio and a forward-thinking approach to technology, positioning it for sustained growth.

With an innovative product pipeline, accelerating growth, and a commitment to shareholder value through dividends, MDT presents an enticing investment opportunity.

Trading below its fair value, MDT has the potential to outperform the market, making it a compelling choice for investors seeking both stability and growth.

Pros & Cons

Pros:

- Undervaluation: MDT trades below its normalized P/E ratio, offering a potential bargain for investors.

- Innovation: The company’s focus on innovation and product diversification positions it well for future growth.

- Global Expansion: MDT’s strategic expansion into emerging markets enhances its revenue streams and market penetration.

- Dividend History: With 46 consecutive years of dividend increases, MDT offers a reliable income stream for investors.

Cons:

- Historical Performance: MDT’s past inconsistent EPS growth may raise concerns about its ability to deliver consistent returns.

- Market Competition: Intense competition within the healthcare sector could pressure MDT over time. This includes MDT’s move into emerging markets.

- R&D Investments: While crucial for innovation, MDT’s accelerated R&D spending may impact short-term profits. It also comes with innovation risks, as higher R&D spending does not automatically generate “better” innovation.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Test Drive iREIT© on Alpha For FREE (for 2 Weeks)

Join iREIT on Alpha today to get the most in-depth research that includes REITs, mREITs, Preferreds, BDCs, MLPs, ETFs, and other income alternatives. 438 testimonials and most are 5 stars. Nothing to lose with our FREE 2-week trial.

And this offer includes a 2-Week FREE TRIAL plus Brad Thomas’ FREE book.