Summary:

- AbbVie’s stock has outperformed the market over the past decade, with a 248.90% appreciation.

- Despite losing patent protection for Humira, which accounted for 37% of revenue in 2022, AbbVie remains undervalued and continues to grow its dividend.

- AbbVie’s recent acquisitions and robust pipeline position the company for future growth and expansion.

PM Images

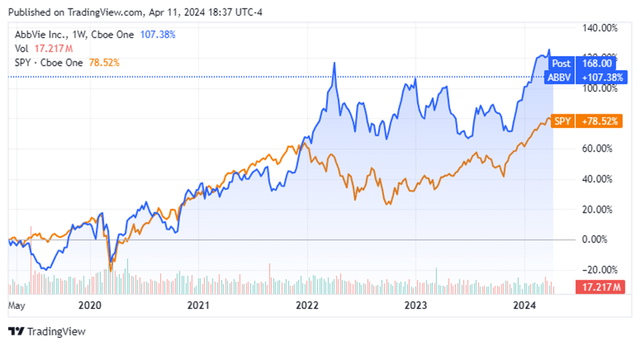

Shareholders of AbbVie Inc. (NYSE:ABBV) should be thrilled with its overall results, as just the appreciation over the past decade has outperformed the market. Shares of ABBV have appreciated by 248.90% over the past decade and by 104.87% over the past 5 years. The SPDR S&P 500 ETF Trust (SPY), which is what I use to track the market, has appreciated by 78.52% over the past 5 years, and by 175.83% over the past decade. ABBV is one of those companies that continues to outpace the market, and when the dividend is factored into the equation, shareholders are able to either generate modest income or boost their gains by reinvesting the quarterly dividend. ABBV lost its patent on Humira in 2023, which accounted for 37% of the revenue ABBV generated in 2022. Despite a relatively flat year, I am still bullish on ABBV as shares look inexpensive in terms of earnings while still growing the dividend at a strong pace. I think ABBV will continue higher while growing the dividend for years to come.

Following up on my previous article about ABBV

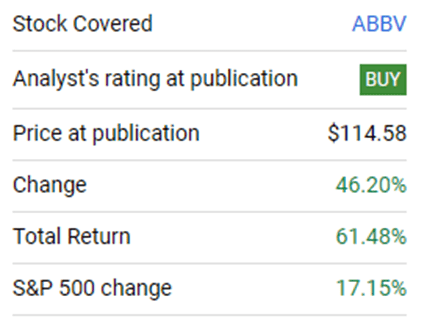

It’s been a while, but ABBV has appreciated by 46.20% since my last article on 8/9/21 (can be read here), while the S&P 500 has increased by 17.15%. ABBV has paid 11 dividends since then, and when they are accounted for, ABBV’s total return is 61.48%. I discussed why I felt ABBV was undervalued and how they generated more than enough cash flow to continue future dividend increases. While ABBV’s revenue and free cash flow (FCF) declined in 2023 as Humira came off patent, I still feel that ABBV is undervalued even while it’s trading around all-time highs. I am following up with a new article as I want to provide an analysis as to why I am still bullish and plan on adding to my position at some point in 2024.

Seeking Alpha

Risks to my investment thesis on ABBV

ABBV’s revenues are strongly protected by patent protection, as generic versions are unable to be circulated in the market until the exclusivity provided by the patent expires. While there are a number of strong competitors from Amgen Inc. (AMGN) and Regeneron Pharmaceuticals, Inc. (REGN), when a drug comes off patent, the competition expands from being first to market as anyone can replicate the product. As we witnessed in 2023, ABBV generated less revenue and FCF after Humira lost its exclusivity. The biotech field continues to expand, and ABBV faces additional competition as new breakthroughs in modern medicine occur. ABBV can also face litigation on the scope of their patents, and if one of their products ends up causing harm, they could face large civil suits, which could impact the bottom line. While ABBV has generated strong results for their shareholders, there is no guarantee that it will develop new drugs that will secure future growth.

Humira came off patent, but ABBV still looks attractive from a valuation and income perspective

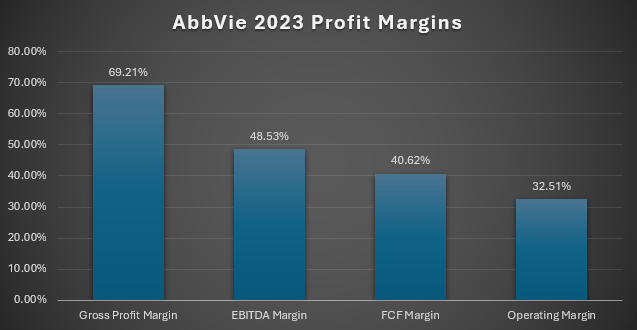

Despite Humira coming off patent, it still accounted for more than 25% of ABBV’s total net revenue in 2023. When I look at ABBV from a financial standpoint, this is still a juggernaut that is enticing. The fact is that 2023 wasn’t optimal, as revenue decreased by -6.44% YoY. This caused ABBV’s gross profit to decline by -9.48% and its gross profit margin to compress by -2.32% as they generated $37.39 billion in gross profit for a 69.21% margin. From a profitability standpoint, ABBV’s EBITDA declined by -16.12% to $26.36 billion, their FCF dropped -9.02% to $22.06 billion, and their operating income fell -23.07% to $17.66 billion. While 2023 was a down year across the board, ABBV is still very attractive. In addition to operating at a 69.21% gross margin, they have an EBITDA margin of 48.53%, an FCF margin of 40.62%, and an operating margin of 32.51%. At today’s levels, this is enticing as ABBV is still a cash-generating machine, and if they can get back to growth, more than $0.40 on every dollar is FCF.

Steven Fiorillo, Seeking Alpha

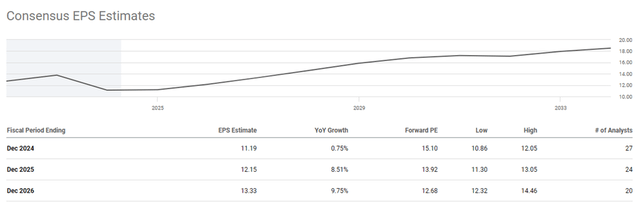

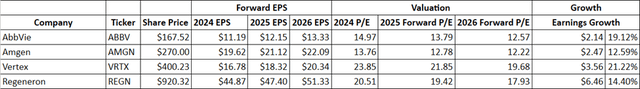

When I look at ABBV from a forward perspective, it looks as if there is still room in the rally for shares of ABBV. There are 27 analysts projecting that ABBV will generate $11.19 in EPS for 2024, then 24 analysts see $12.15 of EPS being generated in 2025. Going out to 2026, 20 analysts see ABBV generating $13.33 in EPS. From the end of 2024 through 2026, ABBV is expected to grow its earnings by 19.12% as it adds $2.14 of EPS. ABBV is trading at 14.97 times 2024 earnings and 12.57 times 2026 earnings. For a company that is producing this much cash, paying under 15 times 2026 earnings looks like an opportunity.

I compared ABBV to AMGN, REGN, and Vertex Pharmaceuticals Incorporated (VRTX) to see if the entire group was trading at a discount, or if it was just ABBV. I look at two things: how much I am paying for forward earnings and the current price to FCF. This allows me to see how much earnings growth there is and what multiple I am paying while seeing how many years it would take for the company to generate its entire market cap in FCF. ABBV and AMGN are neck and neck when it comes to the forward P/E. REGN and VRTX trade between 20 – 24 times 2024 earnings and between 17 – 20 times 2026 earnings. ABBV and AMGN both trade under 15 times 2024 earnings and 13 times 2026 earnings.

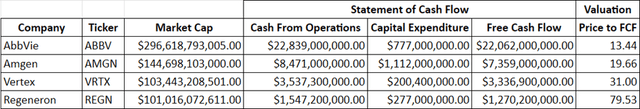

EPS only shows the amount of earnings each share produces, but I want to know the multiple on FCF. This is because FCF is used to pay down debt, buy back shares, pay dividends, and make acquisitions. Looking at the second table below, ABBV is generating much more cash from operations and FCF than its peers. Today, ABBV trades at 13.44 times its FCF, while the closest peer in AMGN trades at 19.66 times. Hypothetically, if ABBV didn’t pay a dividend, it could repurchase every share on the market in less than 14 years from its current level of FCF. This opens up a lot of options for ABBV, and as we can see from their recent headlines, ABBV is putting its profitability to work by acquiring a couple of companies.

Steven Fiorillo, Seeking Alpha Steven Fiorillo, Seeking Alpha

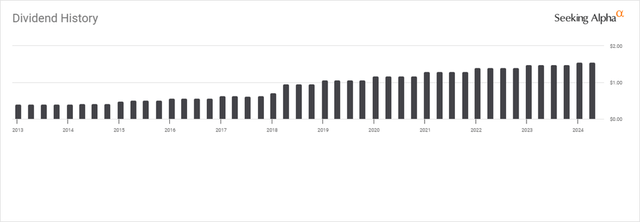

Shareholders of ABBV have been handsomely rewarded through their growing dividends over the years. ABBV has paid a dividend since 2013, and shareholders have benefited from the quarterly dividend increasing by 287.5% as it has grown from $0.40 to $1.55. Since the dividend program was implemented, ABBV has distributed $42.55 of income over the past 11 years. Currently, ABBV has a dividend yield of 3.67% while providing 10 years of annualized dividend increases. Over the past 5 years, ABBV has had a dividend growth rate of 8.68%. ABBV has been a dividend growth machine, and with a 53.92% payout ratio, there is a lot of room for future dividend increases.

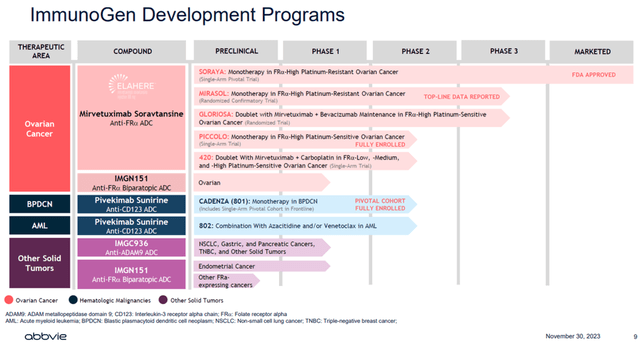

ABBV is investing for the future and expanding their prospective pipeline

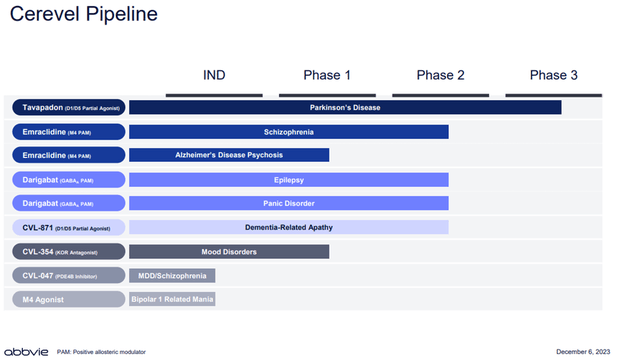

What I like is that ABBV isn’t letting Humira define its legacy, as they recently acquired ImmunoGen and Cerevel Therapeutics. Both companies that ABBV acquired will benefit from accessing ABBV’s international infrastructure and commercial capabilities. ABBV acquired Cerevel for $8.7 billion and ImmunoGen for $10.1 billion, which is less than 1 year of FCF. The Cerevel deal is expected to negatively impact EPS in 2024 and 2025 based on increased R&D and operating expenses, but it will generate a positive operating margin in 2028 with EPS accretion in 2030. The ImmunoGen deal is also likely to negatively impact EPS in 2024 and 2025, but be neutral in 2026 and accretive starting in 2027.

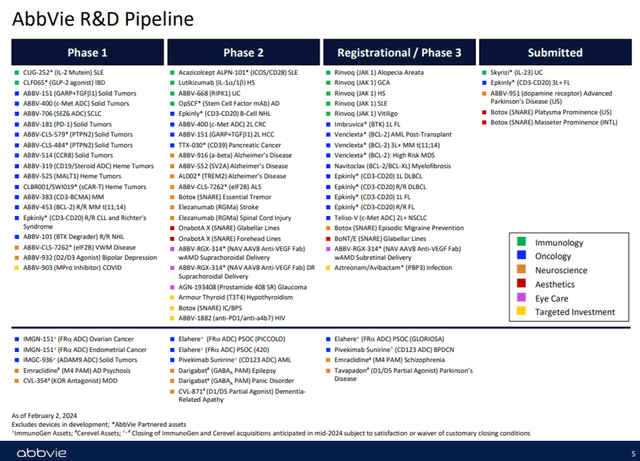

ABBV now has a robust pipeline throughout all FDA trial phases, which spans across several areas, including oncology and immunology. ABBV is projecting that it will return to top-line growth in 2025 with a high single-digit CAGR through 2029. ABBV has increased its guidance from Skyrizi and Rinvoq to generate $27 billion in sales during 2027, which is up from the $16 billion they are projected to generate in 2024. ABBV’s current pipeline could carry them into the 2030s with forward growth, and they are producing more than enough cash flow to add additional growth organically and through acquisitions. ABBV operates in some top sectors, and ABBV could be conservative when it comes to the oncology segment, as the majority of the pipeline is still in the FDA trial phases.

Conclusion

If you have a long-term time horizon, ABBV looks very interesting. ABBV has a long track record of generating appreciation and dividend income for shareholders, and at the end of a relatively flat year, ABBV made 2 big acquisitions that strengthened its pipeline for years to come. ABBV trades at just 12.57 times 2026 earnings and has a current FCF multiple of 13.44x. I think that ABBV trades at an inexpensive valuation for the company it is today, and an even cheaper valuation for the company it will become as the backlog of products in its pipeline hits the market. Investors can sit back and collect a growing dividend that currently yields 3.67% as the next leg of its growth story plays out. I am still bullish on ABBV and looking for them to add both appreciation and income to my portfolio.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of ABBV either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Disclaimer: I am not an investment advisor or professional. This article is my own personal opinion and is not meant to be a recommendation of the purchase or sale of stock. The investments and strategies discussed within this article are solely my personal opinions and commentary on the subject. This article has been written for research and educational purposes only. Anything written in this article does not take into account the reader’s particular investment objectives, financial situation, needs, or personal circumstances and is not intended to be specific to you. Investors should conduct their own research before investing to see if the companies discussed in this article fit into their portfolio parameters. Just because something may be an enticing investment for myself or someone else, it may not be the correct investment for you.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.