360 DigiTech: New Momentum In Chinese Consumer Credit

Summary:

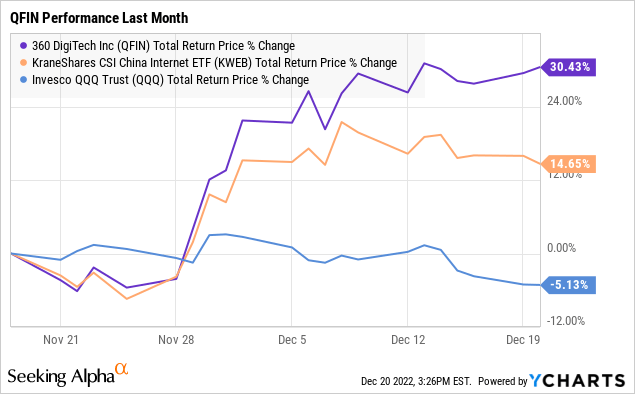

- QFIN is breaking out into a 10-month high on an improving outlook for Chinese consumer credit as “Covid-Zero” policies get rolled back.

- The company has reported impressive operating and financial trends that can accelerate into 2023.

- We are bullish on the stock, which is supported by overall solid fundamentals.

Birdlkportfolio

360 DigiTech, Inc. (NASDAQ:QFIN) is a China-based fintech lender offering credit services to consumers, and small and medium-sized enterprises. The stock has outperformed over the past year, with impressive momentum following the move by the Chinese government to roll back its Zero-Covid policies. Despite what are still volatile macro conditions, sentiment toward China has improved compared to the first half of the year which was marked by regulatory fears and deeper uncertainties while the sense now is that the government is moving to support economic growth.

The attraction here is a leading player from a high-growth market segment with a positive long-term outlook. We like QFIN which has presented overall solid financial trends and fundamentals with room for further upside in 2023 as operating conditions improve.

QFIN Key Metrics

The company last reported its Q3 earnings on November 12, with the headline earnings per American Depositary shares (EPADS) of $0.91, which beat expectations by $0.01. The result was based on the underlying adjusted net income of RMB 1.2 billion or approximately $170 million, which was down from RMB 2.0 billion in the period last year. The context here considers a -10% decline in net revenue at RMB 4.1 billion, from a particularly strong period last year during the early stages of the pandemic recovery in Q3 2021.

Credit-driven services, representing more than two-thirds of the business, maintained the growth momentum, with segment revenues up 13% y/y. This balanced a -40% decline in the smaller “platform services” which captures activities like non-credit referral fees that were more impacted by what management described as the challenging macro environment including local disruptions due to the Covid containment measures.

The sales mix shift along with changes to credit provisions reflected a lower operating margin and the bottom line, although the takeaway here is that the company remains profitable and generated positive cash flows in Q3.

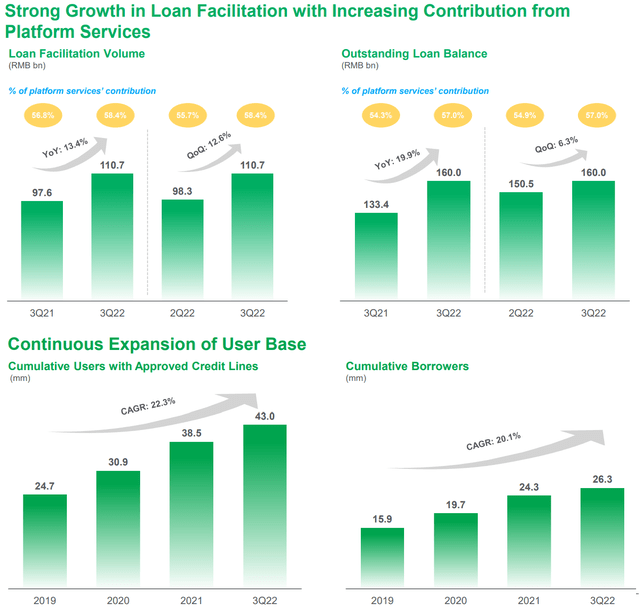

What we want to highlight is the overall impressive operating trends that have been climbing over the past year, and even accelerated compared to Q2. The outstanding loan balance at RMB 160 billion was up 20% y/y and 6.3% higher than the prior quarter. Notably, this metric has outpaced the broader Chinese financial sector, reflecting a capture of the market share at the margin. Loan facilitation volume as a percentage of the platform services contribution at 58.4% climbed 180 basis points from Q3 2021.

The continuous expansion of the user base, with the company now counting on 26.3 million borrowers and 43 million users with approved credit lines implies both strong brand recognition and a roadmap for further growth going forward. The delinquency rate at 4.5% has trended lower compared to 5.1% in the period last year, with the company citing higher overall credit quality among borrowers. Similarly, the 30-day collection rate at 86.4% has been historically steady.

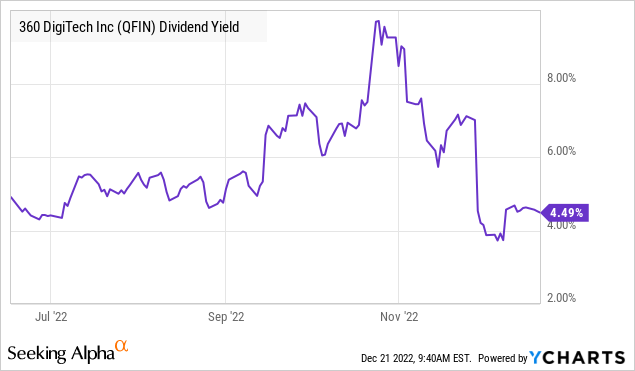

Finally, we note that the company’s balance sheet remains solid, ending the quarter with an equivalent of $1.4 billion in cash with only a small financial debt position of $91 million as notes payable. Considering $224 million in operating cash flow this quarter, we view the $0.16 quarterly dividend for QFIN shares as representing a payout of approximately $50 million as being well-supported for the foreseeable future. Notably, this amount has been variable, although it appears the company is targeting a payout ratio on earnings to average around 20%.

What’s Next for QFIN?

In terms of guidance, management is targeting Q4 loan facilitation and origination volume between RMB 102.5 and RMB 112.5 billion, representing a year-over-year growth of 6% to 16%. Keep in mind that when this estimate was made back in November, China was dealing with a new round of Covid disruptions and isolated quarantine measures that added to an otherwise cautious approach.

The latest development has been the apparent 180-degree turn in the official policy of the government’s Zero-Covid approach, by easing several key restrictions. The change reflects a recognition of leading health officials in the country that the current strain of Covid is less likely to cause clinical hospitalization and fatalities, a sentiment shared by other developed nations.

The result is an expectation that economic indicators in the region should get a boost, including consumer spending and credit demand. In this regard, 360 DigiTech is poised to benefit from what is a low baseline of expectations.

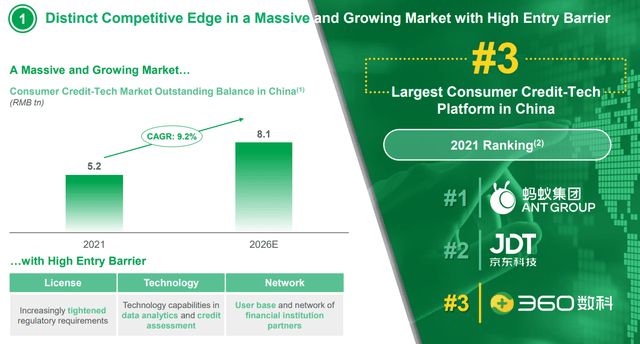

From a high-level perspective, consumer credit tech in China is a segment driven by several tailwinds in a market that is expected to grow by over 9% per year through 2026. Recent updates suggest lending is getting a lift from Chinese Central Bank programs in what could be a broader effort towards supporting the economy in an attempt to lift it past the pandemic setbacks.

360 DigiTech notes that its leading position as a top-3 credit tech platform in China has key advantages, being its established presence and customer recognition compared to what are high barriers to entry for any new potential competitors. We particularly like the fact that QFIN is less exposed to the real estate market, which is one sector in the country that is struggling.

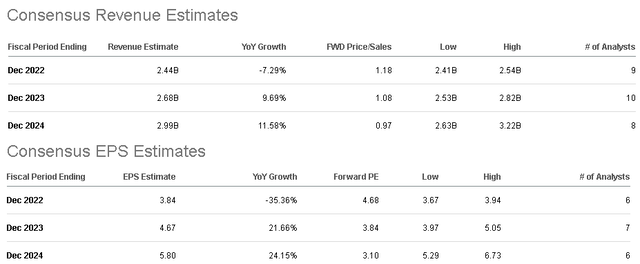

According to consensus, the forecast is that growth rebounds following the more volatile 2022 with earnings lifted by higher margins. For 2023, the estimate is that revenue reaches $2.7 billion, up 10% y/y, while EPS of $4.67 compares to the forecast of $3.84 including the yet-to-be-reported Q4 results. The bullish case for the stock is simply that there is an upside to these estimates.

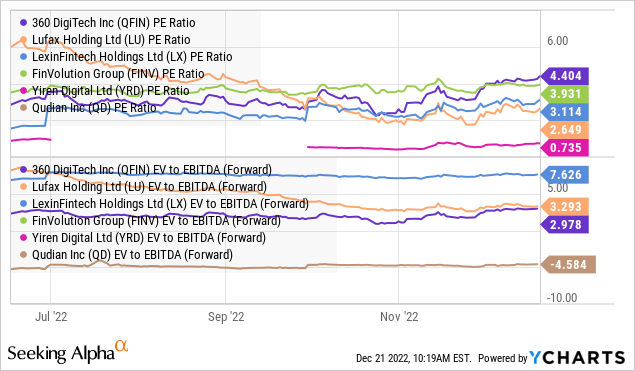

We’ll note that there are several other Chinese fintech name players, although most companies are not directly comparable as they operate in different segments with varying business models. LexinFintech Holdings Ltd. (LX), for example, is active in the buy-now-pay-later (BNPL) consumer finance market. There is Lufax Holding Ltd (LU) which is larger than QFIN but focuses more on wealth management services. There are many other smaller players with unique profiles like Yiren Digital Ltd. (YRD) or Qudian Inc. (QD) highlighting the diversity of the segment.

Generally, we are bullish on this entire group as a macro play, but view QFIN as a higher-quality name with its strong fundamentals and dividend, possibly making it a better investment on a risk-adjusted basis. As it relates to valuation, some of the smaller names are not currently profitable or have generated more volatile earnings, which is one reason QFIN justifies a premium at a forward P/E ratio of 4.9x compared to top LU at 3.8x and LX at 2.9x. On the other hand, QFIN is at a discount in terms of its EV to forward EBITDA metric at 3.0x while LX stands out as relatively expensive at 7.6x on this measure.

Overall, in a scenario where the macro condition materially improves with stronger sentiment towards equities, the call we make is that QFIN has room for a significant multiple expansion which would carry shares higher.

QFIN Stock Price Forecast

The setup right now with QFIN is that shares are trading above $18.00 and breaking out into the highest level since late February. We are bullish on this momentum and rate shares as a buy, with an initial price target of $24.00 which is a level the stock last traded at in Q4 2021. The upside here of nearly 30% represents a 6x multiple on the current 2023 consensus EPS, which is compelling given the long-term growth opportunity as the leader in Chinese consumer credit tech.

As long as shares remain above $16.00 as a level of technical support, we believe the bulls are in control. The main risk to watch would be for a deeper deterioration of the global macro environment or disappointing economic data from China. The Russia-Ukraine conflict remains volatile and has the potential to undermine optimism for a rebound in equities for 2023. Monitoring points for 360 DigiTech over the next several quarters include its operating margin and loan balance trend levels.

Disclosure: I/we have a beneficial long position in the shares of QFIN, YRD either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Add some conviction to your trading! Take a look at our exclusive stock picks. Join a winning team that gets it right. Click here for a two-week free trial.