360 DigiTech: Cheap Shares And Now A 5.6% Dividend Yield To Boot

Summary:

- The company keeps on growing and shifting its business model to platform services where it doesn’t incur credit risk nor need for capital reserves.

- The company also remains remarkably profitable and generates excess cash, which affords them to start paying a dividend with a pretty lofty 5.6% yield.

- There are still important regulatory risks that are hard to assess.

- The shares remain remarkably cheap on any metric so much regulatory headwind is priced in already, but it could get worse.

monsitj/iStock via Getty Images

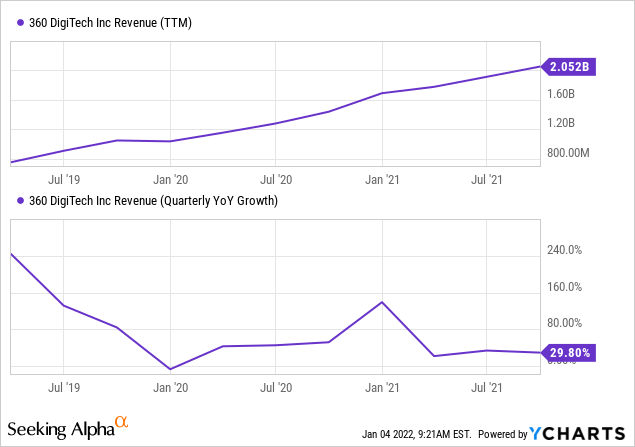

360 DigiTech (NASDAQ:QFIN) remains a remarkably cheap stock trading at less than 4x expected 2022 earnings per share of $5.86. The company also keeps on growing:

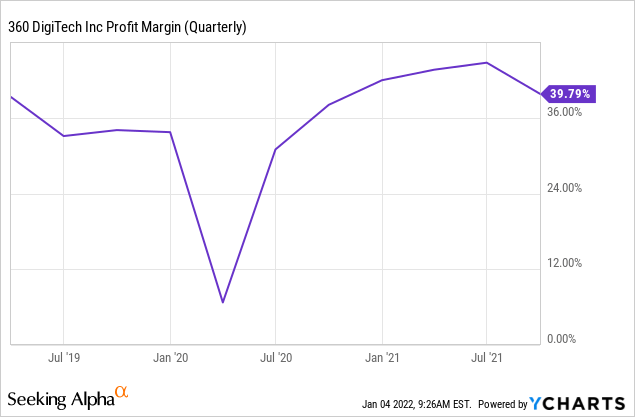

The shares are curiously cheap by any measure, selling for 1.2x revenue for instance, and just 1x EV/S. We say curiously cheap because the company is extremely profitable:

A GAAP profit margin of 40%, we haven’t seen that before, at least not that we can remember. This isn’t exclusive to QFIN but the whole Chinese fintech sector is this cheap, SA contributor EE Investing made a comparison.

The sector does face some regulatory issues but this can’t really explain the low valuations, as the regulatory angst is a relatively new phenomenon while the sector has always been cheap.

Shifting away from ‘fin’ towards ‘tech’

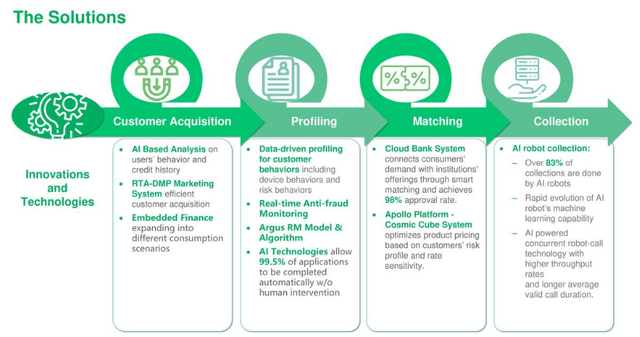

The core of the company is their AI platform that performs a series of functions nicely summed up here:

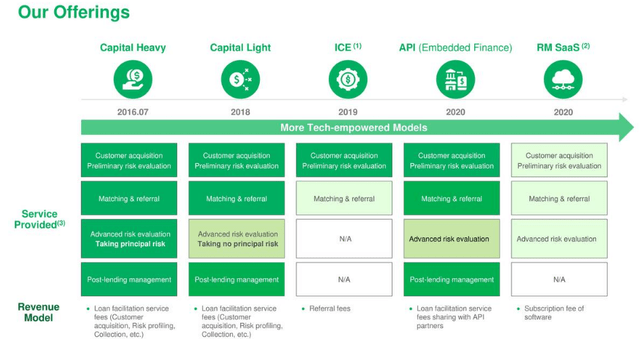

The only reason for the above-mentioned valuation disconnect can lay in the ‘fin’ part of the business model, which incurs credit risk and capital requirements. The company’s capital-heavy segment is where this capital requirement and credit risk resides, but they have quite a few other segments:

Source: earnings deck

As the above dateline suggests, they have moved progressively away from the capital-heavy segment or at the minimum, added additional segments that are pure fintech, that is, they don’t incur credit risk nor do they require capital reserves.

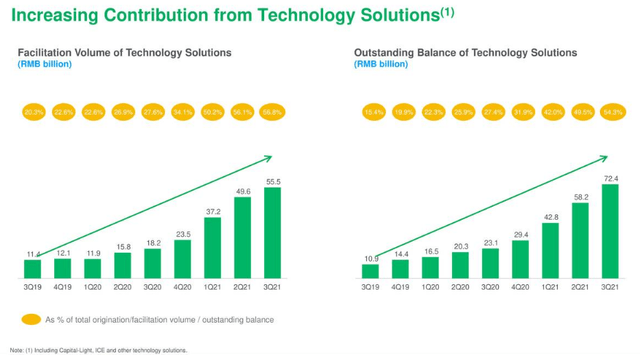

Despite the increasing importance of these technology solutions now constituting over half of facilitation volume and outstanding balance (see graph above) and our opinion last year that the company should be valued more on the basis of being a fintech platform, rather than a bank, that hasn’t happened, for three reasons that we can think of:

- The capital-heavy segment is still substantial

- Cyclical nature of the business

- New regulatory demands have been made on the sector

Progress in the shift away from the capital-heavy model seems to be stalling as loan originations from the capital-light and other technology solutions increased from 56.1% in Q2 to 56.8% in Q3.

One might keep in mind that this still constituted a growth of 205% y/y though. But the somewhat surprising thing is that the capital-heavy segment rebooted growth with revenue at $2.62B in Q3 compared to $2.4B in Q2, and $2.96B a year ago.

Revenue-wise, capital-heavy is still larger than platform services (capital-light and other technologies). The latter raked in $1.99B, compared to $1.6B in Q2 and $748M a year ago. But that’s quite a growth trajectory y/y. The shift towards capital-light/technology brings other benefits (Q3CC):

With strong operating results and increased contribution from cap-light model, our leverage ratio, which is defined as risk-bearing loan balance divided by shareholders equity, further declined to 4.3 times in Q3 from 4.9 times in Q2 and 7.4 times a year ago. We expect to see continued de -leveraging in our business driven by further movement towards cap-light, and solid operating results.

Cyclicality

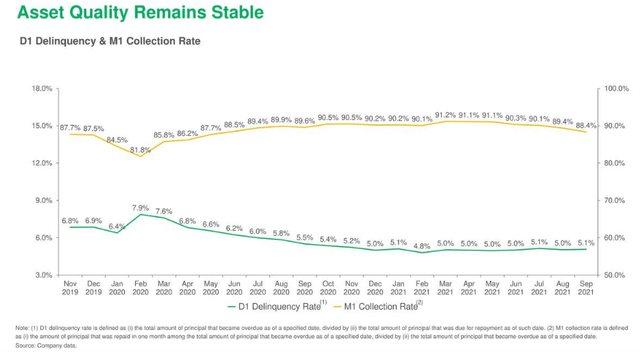

In an economic downturn, borrowers that tend to default on their loans go up and the company has to increase reservations for bad credits. However, China had experienced such a period, albeit briefly in H1 2020, when the country was gripped by the pandemic.

Perhaps that period was too brief, as the economy quickly recovered when they got the pandemic under control but you still see a pronounced effect on collection rates (upper yellow line) and delinquency rates (lower green line).

A more pronounced economic downturn would surely do more damage, but China hasn’t had one of these for a long time, although this time the risks have increased with the property market in trouble. Management doesn’t seem too worried though when asked about 2022 (Q3CC):

We don’t think next year, the situation or we’re we more severe than the previous regulation cycle or pandemic cycle. Therefore, we are confident.

Regulation

There are several regulatory issues plaguing the company:

- Issues related to data security and privacy, which seems to have been settled with the company’s apps returning to the app stores.

- License issues

- Interest rate cap

- Issues related to ADS listing in the US

Quite frankly, we found it difficult to analyze the license issues as we’re no specialist on the Chinese financial regulatory regime and the earnings CC isn’t clear at places (the CEO talks through a translator, for starters).

So we’re not quite sure what the problem with licenses is, but management argues they’re on top of them (Q3CC):

Currently, we are progressing based on the regulatory timeline. This includes enhancing corporate revenues, adjusting operation on the various license, and optimizing user experience, et cetera. We are very confident to complete these compliance-related items by the regulatory deadlines.

As an illustration of the problems making the discussion intelligible (Q3CC):

Firstly, for our credit rating agency we will participating actively in applying for the Neil credit rating license. Secondly, for the current existing financial license on-hand, we will now consider carefully to inject capital into the license that can’t entities. Of course, we have abundant capital reserve to inject. Thirdly, according to the regulator requirement for the financing Company. That way — nowadays, we have shareholders in 2 guarantee companies. In the discussion we might need to exit from 1 guaranty Company, but there will be very muted impact to our operations.

Good luck making sense of that. The ‘Neil’ credit rating should be a ‘new’ credit rating, but that’s as far as we got, apart from the fact that they have abundant capital to fund any new license, should they be required to do so (they’ve just started a dividend this quarter, buttressing this point).

They have to consolidate their two financial guarantee licenses into a single one, per new regulation but that’s not a demanding order (Q3CC):

we just need to move the registered capital from one license to another, from the scale — in terms of scale, the business we can do with this license, there’s no impact.

And with respect to licenses for their facilitation segments (capital-light and other technology services), from the Q3CC:

First, we can actively cooperate with the current existing credit rating agencies. Secondly, the microfinance license can also play a vital role in the loan facilitation business.

A new regulatory proposal

Then there was an article appearing in China which, as far as we could make out through the Google translate version, suggests more serious proposals:

- Loans must be issued directly through the bank. We don’t think that’s a problem for 360 DigiTech.

- The diversion of technology companies must pass through personal credit reporting agencies, this could be a considerable risk, see below.

- The guarantee fee is limited to about 2%, this affects their capital-heavy business

With respect to the collection of personal information for financial businesses, it seems that this can only be done by organizations with personal credit information licenses, and at present, there are just two organizations that have such licenses (Baixing and Park Dao).

However, this is just a proposal, and there is nothing here that suggests that 360 DigiTech could not apply for such a license. There is also no guarantee they will be successful in getting it, but would the Chinese authorities really strike down businesses like 360 DigiTech at the stroke of a pen?

So it’s really quite difficult to assess these proposals and the chance of these to become law, the shares are dearth cheap for a reason.

Pricing

A more serious issue appears to be the 24% interest rate cap, which starts operating by June this year. Average pricing was 26.1% in Q3, compared to 27.2% in Q2 and 25.9% a year ago.

Management argues that over 60% of their portfolio already is below the 24% cap, and expects pricing to decline by about 1% a quarter until mid-2022. Management spoke of 2022 in terms of a transition year and the consequences for their take rate are substantial.

An internal simulation showed that this would reduce their take rate from 4% to 3%, which is a substantial decline, but there are some offsets (Q3CC):

Meanwhile, the hedges that benefit of lower prices are gradually showing. We start to attract better quality customers and the larger financial institutions. New customers’ risk profile appears better than existing ones, meanwhile, our operational efficiency is also enhancing.

One might wonder what if regulators won’t stop at 24%, but introduce 23% next year?

- We’re a little surprised the company’s take rate will be so affected by the 24% cap. This seems to suggest that the company takes most of the hit, rather than the borrowers or lenders.

- But given the substantial effect, would the authorities continue to squeeze this lower? Do they want to kill off the sector?

American listing

The listing on US exchanges can be in trouble both from the US side, as well from the Chinese side. The US wants access to auditor data and could delist the shares in three years without this. The Chinese condone the VIE ownership structure, for now.

But there is a shortcut to these risks, a Hong Kong listing. They are considering and even preparing for this (Q4CC):

And then, in terms of the Hong Kong listing, we are still in the process of dealing with some technical kind of problem solving. As you know, the requirements by Hong Kong Exchange VIE structure, voting power and everything is slightly different than the U.S. So we need to make some changes, in some cases some small restructuring under these new requirements, we are doing it as we speaking, and those process take time because some of them needs government time to sign up on that. Once we finish these technical issues we will be more kind of sort of the push, the official push for the listing. Right now it is still in the, what they call the pre A1 [ph] stage there. I think we’re almost running out of time. We can take one more question.

It hasn’t been mentioned on more recent CCs though.

Cash

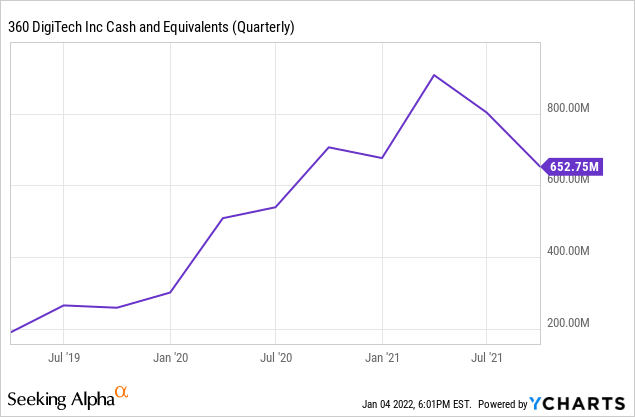

There has been a notable decline in cash holdings despite the company generating over RMB1.78B cash from operations (which was up from RMB1.42B a year ago):

Much of that is actually the dollar appreciating against the RMB as cash holdings in RMB only declined from RMB4.4B at the end of last year to RMB4.2B at the end of Q3. Also (Q3CC):

The decline in cash was mainly due to more proactive deployment of cash in our operations to support ABS and a pre -ABS assets, which generate higher returns.

ABS are asset-backed securities, which they also use as an alternative funding mechanism (RMB4B last year at less than 6%).

Let’s just recap

Here are some fun financial facts from the company:

- Their cap-light/technology segment is growing revenue by 166% with the loan balance increasing by 213.6%.

- The company has reduced its leverage ratio from 7.4x a year ago to 4.3x in Q3 2021.

- Their new SME business increased credit to RMB8B in Q3, a 12% increase on Q2.

- Operating margin was 41.1% in Q3 with non-GAAP operating margin at 42.6%.

- Net income margin was 33.9% in Q3 with non-GAAP net income margin at 35.4%.

- The company generated RMB1.78B in cash from operations in Q3.

- The company started to pay a dividend of $0.28 per ADS and a payout ratio of 15%-20% going forward. This implies a pretty lofty 5.45% yield.

Valuation

Given these above metrics, by all means, the shares are very cheap at $20. With a market cap of $3.25B (on 160M shares, diluted) and an EV of $2.6B, the shares are selling at an EV/S multiple of 1x. With an expected 2021 EPS of $6.10, the shares sell at less than 4x earnings.

These multiples seem pretty absurd to us, although slightly less so than say 6 months ago as there has been quite some regulatory headwind.

Conclusion

By all metrics, the company is growing really fast, although that is actually hidden to a considerable extent by the negative growth in the capital-heavy segment (even if that segment showed signs of life in Q3).

The company has sophisticated technology solutions, large customer data sets (mostly from parent company 360 Group), and innovative customer acquisition strategies like embedded finance, which supplied more than half of its customers already, and has introduced SME lending which is quickly growing already.

Moving away from capital-heavy reduces capital requirements, and as a result the leverage ratio almost halved in a year. By all available metrics, the company is very profitable and generates lots of cash, has a strong balance sheet, and the shares are really cheap. Remarkably cheap.

The shares have always been cheap and so are the shares of competitors, hence the reason for this isn’t the recent regulatory onslaught, even if that clearly doesn’t help and news reports on proposed new legislation look ominous.

The company seems to be on good terms with regulators and in constant communication with them. Apart from circulating new proposals, the biggest risk to us seems to be the pricing cap. The one that will be introduced in June is 24% and that is having a considerable effect on the company’s take rate, declining 25% even if there is some compensation.

The only serious risk seems to be the pricing cap, which will have a considerable effect on their take rate.

Disclosure: I/we have a beneficial long position in the shares of QFIN either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

If you are interested in similarly small, high-growth potential stocks you could join us at our marketplace service SHU Growth Portfolio, where we maintain a portfolio and a watchlist of similar stocks.

If you are interested in similarly small, high-growth potential stocks you could join us at our marketplace service SHU Growth Portfolio, where we maintain a portfolio and a watchlist of similar stocks.

We add real-time buy and sell signals on these, as well as other trading opportunities which we provide in our active chat community. We look at companies with a defensible competitive advantage and the opportunity and/or business models which have the potential to generate considerable operational leverage.