Summary:

- Poor Q4 results, combined with weak 2023 guidance.

- Return on equity has shown no sign of improvement. The net profit margin, along with asset turnover, has remained depressed. At the same time, the inventory levels have kept increasing.

- While we expect the macroeconomic environment to improve in 2023, we would first like to see the impact of this improvement on 3M’s financial figures.

- For now, we maintain our “sell” rating.

Education Images/Universal Images Group via Getty Images

3M Company (NYSE:MMM) operates as a diversified technology company worldwide. It operates through four segments: Safety and Industrial; Transportation and Electronics; Health Care; and Consumer.

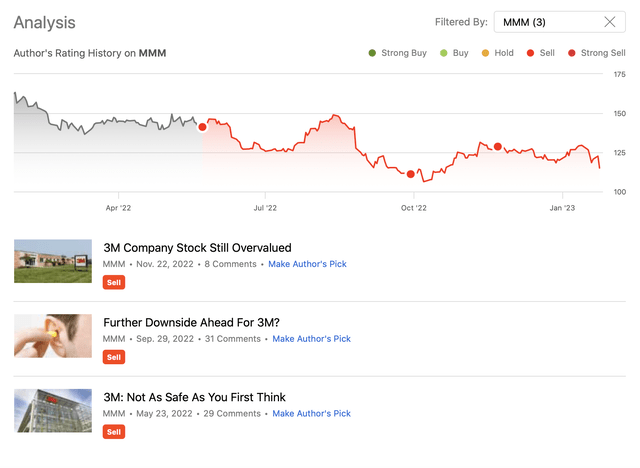

We have published three articles on the company in 2022:

3M Company Stock Still Overvalued

Further Downside Ahead For 3M?

3M: Not As Safe As You First Think

Each time we have rated the firm’s stock as “sell”.

Our main reasons for the unfavourable ratings were:

- Potentially significant costs may be related to litigations

- The unfavourable FX environment throughout 2022

- The high raw material and transportation costs

In today’s article we are going to take a brief look at the company’s latest earnings report and we will also analyse the firm’s profitability and efficiency and their developments over the past years.

Q4 earnings

3M has been struggling to deliver impressive results in the Q4, partially due to the challenging macroeconomic environment. Sales growth has codme in substantially under expectations and has fallen to $8.1 billion, which is a 6% decline year-over-year. (considers the impacts of -2% from divestitures and -5% from FX translation due to strength of U.S. dollar.

We posted organic growth of 0.4 percent – versus our expectation of 1 to 3 percent […]

Consumer facing markets have been one of the primary drivers of slower growth. In our opinion, consumer sentiment plays a large role in the demand for certain 3M products. While consumer sentiment has remained poor throughout 2022, it has started to increase in the second half of the year. We believe that this is likely to have positive impact on the demand for non-essential, durable products as well, which could result in improved sales figures for 3M in the second half of 2023.

The other main driver has been the Chinese market.

The slower-than-expected growth was due to rapid declines in consumer-facing markets – a dynamic that accelerated in December – along with significant slowing in China due to COVID-related disruptions.

As the Covid related restrictions have been largely lifted in China by now, we believe that 3M’s business is likely to get a substantial boost in the coming quarters.

Further, operating cash flow came in at $1.9 billion, declining 4 percent year-on-year, while adjusted free cash flow totalled in $1.7 billion, representing an increase of 3 percent year-on-year.

With regards to earnings per share, the company has reported GAAP EPS of $0.98, which accounted for a $1.15 per share pre-tax charge relating to PFAS manufacturing exit costs adjusted for in special items.

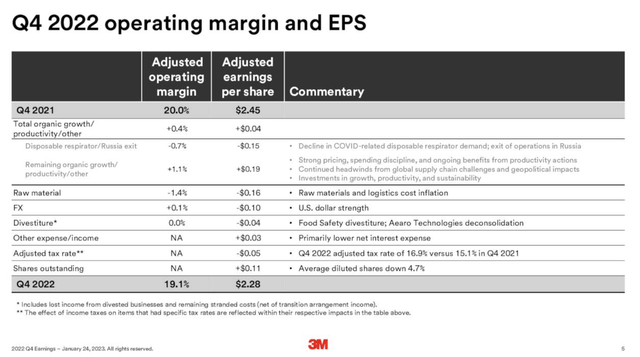

The following slide summaries the reasons for the contracting operating margin and the declining EPS year-over-year.

Q4 operating margin and EPS (MMM)

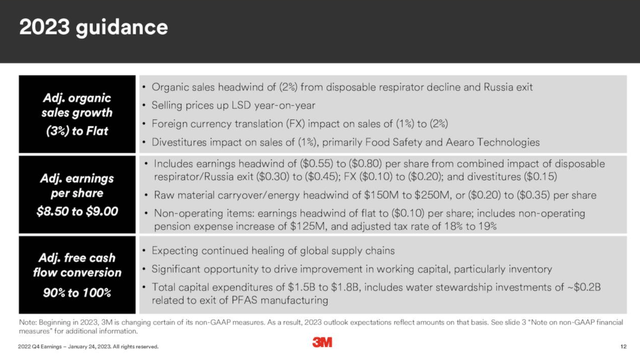

While we expect a slight improvement in the macroeconomic environment in 2023, especially considering the reopening of China and the weakening of the USD relative to other currencies, 3M has issues a relatively conservative guidance.

Overall, we believe that these results and the guidance does not justify updating our previously established bearish rating.

Profitability and efficiency

As the firm’s latest results were once again largely disappointing, we have decided to dig a bit deeper into the topic and analyse the company’s return on equity (ROE).

In this section, we will be analysing how ROE has been changing over the past years. We will decompose this ratio to three parts, and examine how the different components, namely the net profit margin, the asset turnover and the liquidity, have been impacting this ratio. We will also try to highlight underlying causes for the observations.

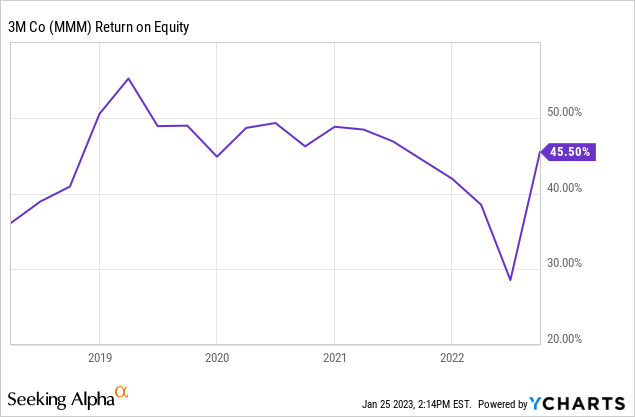

Return on equity

While 3M’s ROE appears to be relatively stable in 2020 and before, in 2021 a substantial decline has begun. This decline has been continuing up until the latest earnings report, when the ROE has jumped back to its 2020.

To understand what is the reason behind the decline and the recent jump, let us continue examining the three components, which contribute to the ROE.

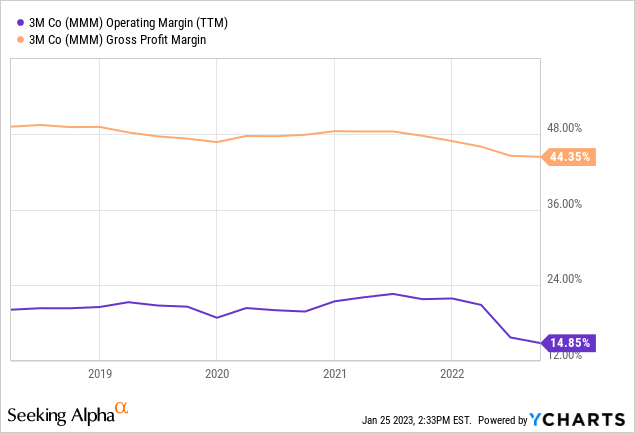

ROE decomposition (investopedia.com)

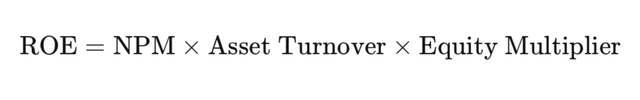

Net profit margin

Net profit margin measures how much net income or profit is generated as a percentage of revenue. The profit margin has peaked in 2021, reaching 17.5% and then gradually declined to below 12.5%. However, it has seen a substantial jump in the third quarter, reaching 18.9%, meaning that it is likely to be the component, which is significantly influencing the overall ROE.

Let us see what could be behind this shape jump.

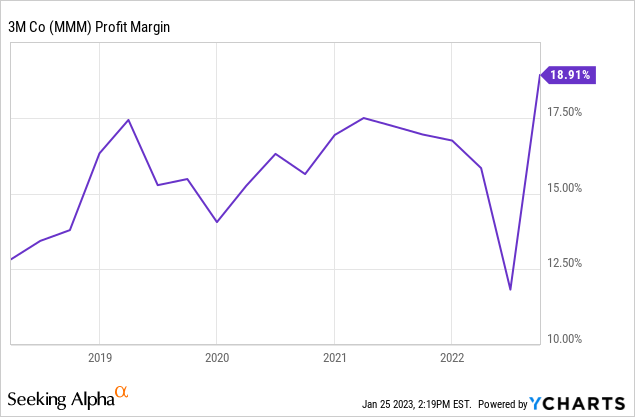

Neither the gross profit margin, nor the operating margin has exhibited similar behaviour to the net profit margin. In fact, since 2021, both of these margins have been gradually declining. On a positive note we have to mention that 3M has recently announced the cutting of 2500 manufacturing jobs, which could have a positive impact on the operating margin.

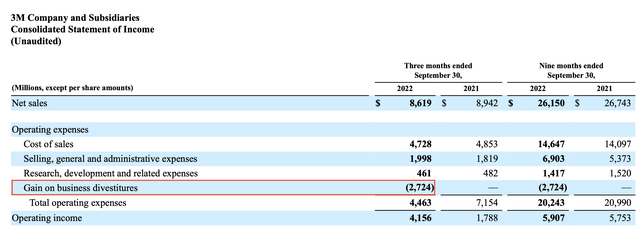

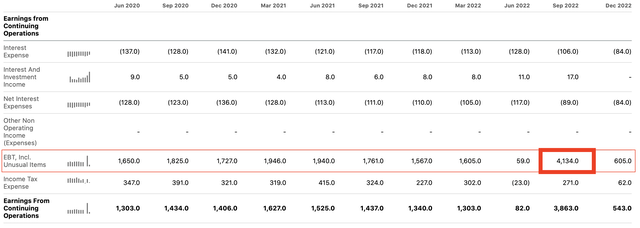

When looking at the income statement, on the earnings from continuing operations section, we can see that the EBT including unusual items has skyrocketed in the third quarter.

Income statement (Seekingalpha.com)

In our opinion this is the sole reason for the rapid improvement of the return on equity. As this is an unusual items, investors should adjust for it and understand what is the likelihood that such an event would happen again. In Q3 the firm has realised a gain on business divestitures, which resulted in a significant improvement of the results.

In Q4, however, the net margin has continued its decline. While the likely improvement of the macroeconomic environment in 2023 may have a positive impact on the ROE going forward, we would first like to see the trend changing, before starting a new position or adding to an existing one.

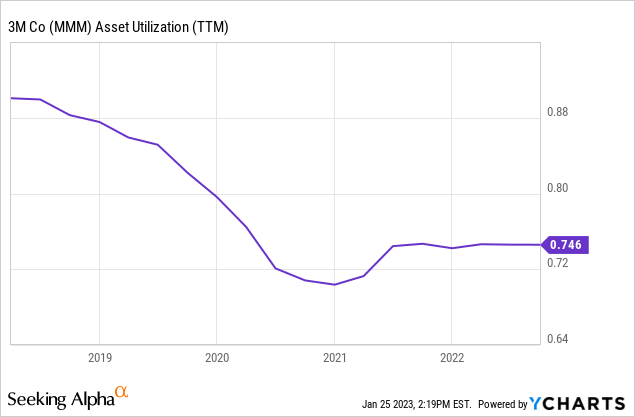

Asset turnover

The asset turnover ratio (or sometimes called asset utilisation) measures the value of a company’s sales or revenues relative to the value of its assets. It indicates, how effectively the company is using its assets to generate sales. A decline is generally considered bad, as it means that 3M is using its assets less efficiently for sales generation. This ratio has seen a sharp decline in 2019-2020, but has stayed relatively flat over the past quarters. This is definitely not contributor to the sharply increasing ROE.

One of the likely reasons for the low asset turnover is the relatively poor demand for consumer-facing products due to the challenging macroeconomic environment. This might improve in the near term, however the litigations and their potential impact on 3M’s reputation could lead to depressed demand for certain products for a longer period.

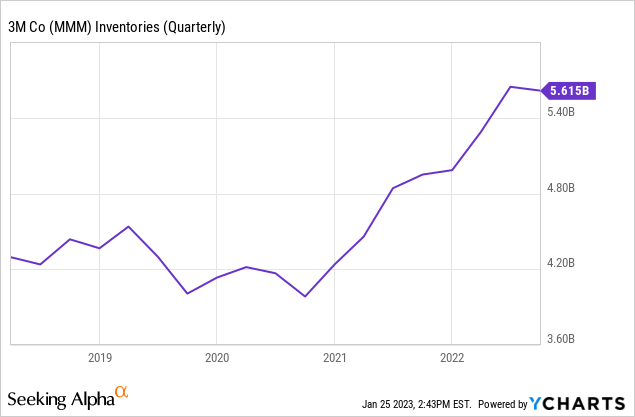

Also important to appreciate that inventory levels have been rising since late 2020, potentially as a result of the lower demand. We have to keep in mind that 3M may need to use promotions in order to reduce excess/obsolete inventory, which could have a negative impact on the margins.

Equity multiplier

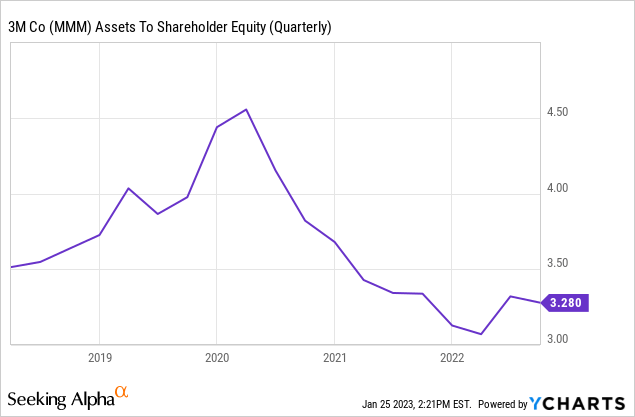

The last part of the three step decomposition of the ROE is the equity multiplier, which is simply the ratio of assets to shareholder equity. A higher ratio indicates more leverage, meaning that the firm is using a larger amount of debt to finance its assets.

So is a declining trend good in this case?

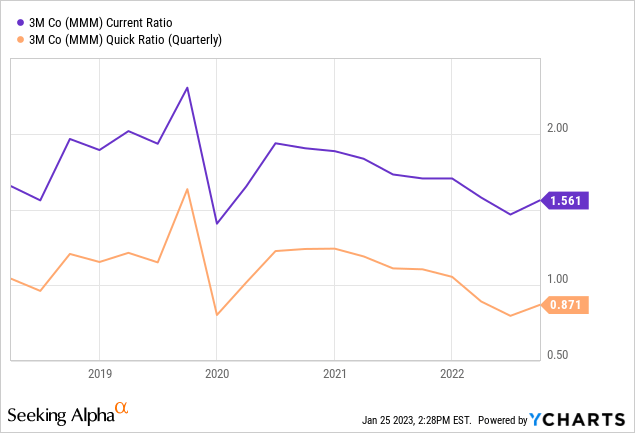

Often lower levels of debt can be more advantageous, especially during times of macroeconomic uncertainty and downturns. To answer this question, whether for 3M it is good or not, we have to take a look at the firm’s liquidity ratios, namely the current- and quick ratios.

The current ratio is a ratio between current assets and current liabilities. If the ratio is above 1, it means that the firm has enough current assets to cover its current liabilities. The quick ratio is a somewhat narrower measure, as it excludes the inventory from the current assets.

While in the current years both of these ratios have been declining, they remain at acceptable levels. From this perspective, we believe that it was important and right that 3M lowered its leverage, so that it can maintain its liquidity, solvency and financial flexibility.

Key takeaways

The weak Q4 performance and 2023 guidance have led to sell-off. We believe that this sell-off is justified. Based on the latest results, we do not see any justification to update our previously established “sell” rating.

Despite the sharp increase of the ROE in Q3 2022, caused by a gain on business divestitures, ROE has kept declining, along with the net profit margin. The asset turnover has stayed relatively stable in the previous quarters, however inventory levels have kept rising, which may be a concern.

In our previous writings, one of the key reason for rating the stock as “sell” has been the potential costs related to legal claims. This risk remains high until today. In fact, BofA has also recently issued that it maintains its “underweight” rating, as mediation talks were being halted between 3M and plaintiffs.

Before we would upgrade our ratings, we would like to see:

- the risks and uncertainties related to legal claims decreasing

- inventory levels normalising

- ROE consistently improving

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: Past performance is not an indicator of future performance. This post is illustrative and educational and is not a specific offer of products or services or financial advice. Information in this article is not an offer to buy or sell, or a solicitation of any offer to buy or sell the securities mentioned herein. Information presented is believed to be factual and up-to-date, but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. Expressions of opinion reflect the judgment of the authors as of the date of publication and are subject to change. This article has been co-authored by Mark Lakos.