Summary:

- There isn’t much to be positive on for 3M.

- Litigation risks and the macro environment have crushed the stock since I last wrote on it in 2017.

- The company’s upcoming spinoff will likely shore up the balance sheet, and uncertainty is close to its peak. 3M is likely worth a shot at this price.

josefkubes

Well, it’s a bloodbath out there. I’ve found it beneficial to my mental health to spend as little time as possible looking at my brokerage balances. However, I’ve found myself spending less time researching companies, as well. I think it’s human nature, but it could just be me. The problem with that is this is the most important time for investors to be actively looking to buy. The market turns before the economy does, and just when everything is at its bleakest, a face-ripping rally could start that takes all the best companies back up to nosebleed valuations.

It’s been said a million times before, but the stock market is the only place where people are excited to buy when things are most expensive and the most hesitant when things are on sale. With that being said, I want to take a look today at a stalwart dividend king, 3M (NYSE:MMM).

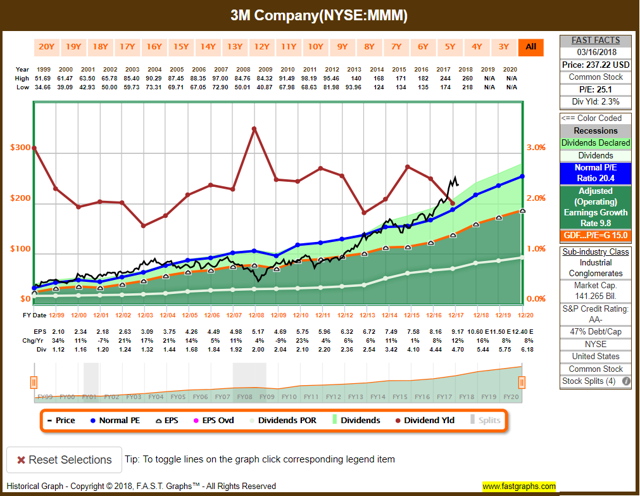

I’ve written on the company before, all the way back in 2017. At the time, I basically said this company is fantastic, but leave it on the watchlist. I’ll attach the chart I used in that article below:

fastgraphs.com

Look at that company crushing it, huh? It was on a real tear, all the way up at 25X earnings, down to a 2.3% yield, and well above its long-term running averages. I warned that if it just returned to its normal P/E with no significant changes in business performance, you could be looking at ~5% total returns over the medium term. Well, that didn’t happen.

fastgraphs.com

From its peak, it’s down in the ballpark of 45-50%. The yield is up to over 5%, and the P/E is down around 11X. Talk about a huge rerate in a matter of four years. So what happened?

There are a few major factors impacting the company right now.

Litigation Risk

This was in part a known issue when I last wrote on the company in 2017. 3M is currently dealing with litigation over PFAS contamination near its headquarters in Minnesota (the original company name was Minnesota Mining and Manufacturing). The company reached a settlement with Minnesota for $850M, but the PFAS issue has spread and 3M is now looking at likely paying out in other operating areas, as well, including Belgium and other states in the USA.

In a regulatory filing Wednesday, 3M said it plans to take a $360 million pretax charge for the second quarter of 2022 for PFAS. The agreement will “build the foundation for future certainty in 3M’s Belgium operations and address future potential liabilities,” John Banovetz, its executive vice president and chief technology officer, said in a statement.

While the new agreement gives 3M a path to move forward, officials in Belgium are focusing on the limits of the deal. The pact doesn’t prevent local residents from bringing civil claims against 3M, doesn’t stop an ongoing environmental-crime probe of the company, and doesn’t cap future liabilities for health harms to local residents, a representative for Demir said.

Source: Bloomberg, July 2022

That doesn’t sound great, and it’s not going to be fixed quickly. Setting aside the human element, which is terrible, this is not going to be a cheap problem for 3M to solve. Adding North Carolina and Michigan to the existing issues in Minnesota, compounding it with allegations that 3M knew about the issue before it came to light, and you’ve got a big, nasty problem that throws a lot of uncertainty on the stock. The company did begin to phase the chemicals out in 2000, but these “forever chemicals” look to be a continuing headache for the company.

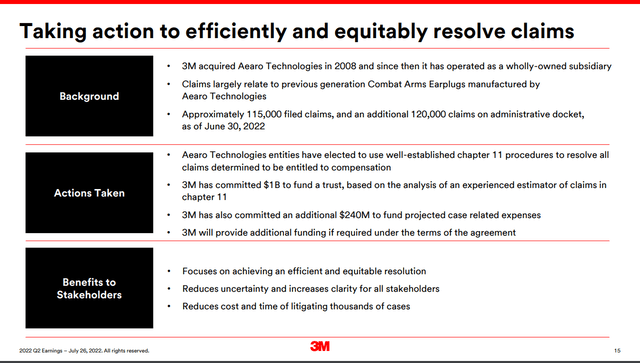

If that weren’t enough, one of 3M’s subsidiaries, Aearo, is facing significant litigation over its combat earplugs, with 115,000 claims filed and an additional 120,000 on the administrative docket. 3M management has chosen to send Aearo into Chapter 11 bankruptcy and has set aside $1.24B to settle claims. One of the most interesting quotes from a Reuters article is below:

The Florida judge overseeing the earplug lawsuits, U.S. District Judge M. Casey Rodgers, has admonished 3M for “naked duplicity” in attempting to dump its liabilities into a bankrupt subsidiary.

3M and Aearo have in turn criticized Rodgers for allowing the consolidated litigation to balloon, pointing out that earplug cases now account for a whopping 30% of all cases pending in U.S. federal courts.

The current decision is for litigation to continue forward while bankruptcy proceedings are ongoing for Aearo. Uncertainty is high here, and if 3M suffers a significant legal setback with its plans to effectively separate Aearo and settle vice going to court with each case, it could further impact the stock. I’ll attach a slide below from 3M outlining their update on the issue in the most recent quarterly presentation:

3M investor presentation

Shifts in the Business

Feeling optimistic about 3M yet? Neither is the market, obviously. Let’s take a look at the actual business. If you’d like a quick refresher on what the company produces and what has led to the company’s success, feel free to take a gander at my last article.

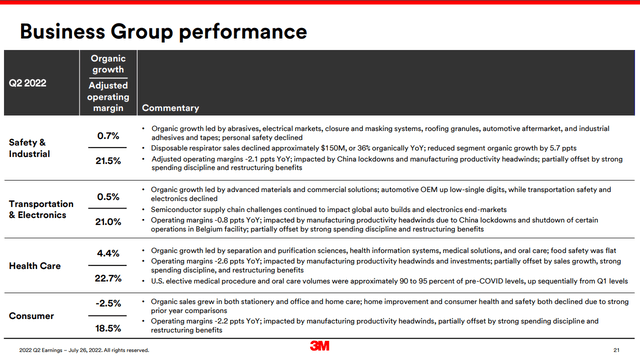

Coming out of COVID, 3M is facing some headwinds in respirators to the tune of 2% of sales this year. Backing this headwind out as well as a factory closure in China for COVID lockdowns, and the company saw 5% organic growth YOY in the most recent quarter. I’m not a huge fan of adjusted sales growth figures, so let’s stick with 1% growth on the year, adding those headwinds back in on top of 21% growth last year.

Earnings stand at $2.48 per share in the most recent quarter, and management is projecting $10.30-10.80 on the full year, which at the low end puts the stock right at 11X this year’s earnings. The company is looking at similar inflationary, supply chain, and forex headwinds as other large multinational companies that create actual physical products, which could continue to impact results in the near-to-medium term. Management didn’t provide earnings estimates, but analysts (using FAST Graphs) have earnings at $10.70 next year and $11.27 in 2024. There’s a lot of wiggle room in those figures based on some of the issues I’ve outlined above.

3M Investor Presentation

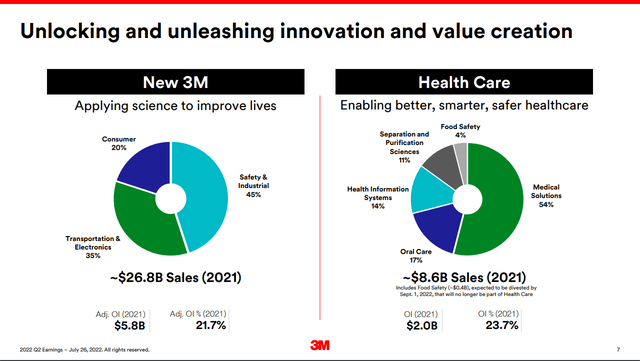

So, looking above, Health Care stands out. I suppose it does for management, as well, because they are planning on spinning it off next year. The segment currently accounts for $8.6B in sales with an EBIT margin of 31%, and it’s growing organically at 4.4% YOY. 3M will maintain a 19.9% stake in the new company. 3M is also sending it on its way saddled with debt to the tune of 3.0-3.5X EBIT leverage, which the new company will work to pare down. Although the company is growing organically, likely helped by recent acquisitions in the past few years, this seems like a strategic decision to refocus the company while shedding some debt and shoring up the balance sheet.

3M Investor Presentation

This breaks out a pretty significant portion of the business, and removes part of what I’ve loved about 3M for years. Specifically, the company is built on innovation, and in many cases innovations in one group are applied across the company to find additional use cases. Post-it notes is the ultimate example, where an adhesive invented elsewhere in the company was applied to office products, and a legend was born. That has to factor into an investment decision in the company today.

Dividend Safety

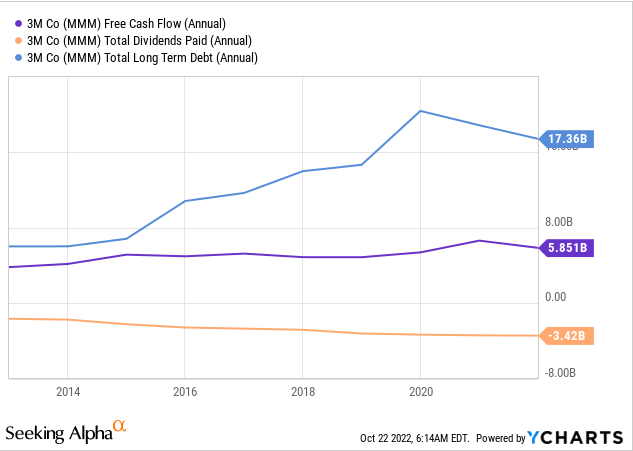

YCharts

3M is currently carrying long-term debt of $17.4B, and most recently paid out $848M in dividends in Q2. Free cash flow covers the dividend relatively well, and its payout ratio is ~82%, which doesn’t leave a ton of room for growth off of its current 5.1% yield. Management is committed to the dividend, and the company has an incredibly long history of dividend hikes. The debt figure will be interesting to see post-spinoff.

Valuation and Closing Remarks

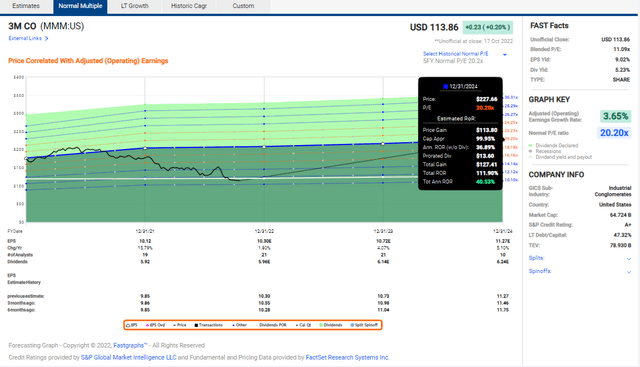

FAST Graphs

I’m torn on 3M. The chart above shows the best case scenario for returns if the company just returns to its normal P/E ratio of around 20X based off of earnings projections that are relatively stable in the mid-single digit growth range. However, there are significant legal overhangs for the stock, and it’s unclear how well the business will be able to grow once the healthcare segment is spun off. The best case is likely “GDP-plus”, but investors are paid to wait with a safe 5.1% dividend yield that has been maintained and grown for over half a century with full management backing to that continuing.

The uncertainty and financial risks from litigation and the economic environment are likely priced in at this point, although of course the company could drop further. Shrewd investors may be able to see through the short-term noise surrounding 3M and get a substantial discount on a best-in-class dividend aristocrat.

Disclaimer: This article is for informational purposes only and represents the author’s own opinions. It is not a formal recommendation to buy or sell any stock, as the author is not a registered investment advisor. Please do your own due diligence and/or consult a financial professional prior to making investment decisions. All investments carry risk, including loss of principal.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in MMM over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.