Summary:

- KO has fallen nearly 20% from its April highs, despite being regarded as a defensive stock. Coca-Cola is not immune to recessionary risks, and KO was overvalued at those levels.

- Therefore, the market reminded investors about the perils of overpaying. Also, we discuss why investors should not rely solely on consensus price targets for their assessment.

- We discuss why we like KO at the current levels and believe the market has digested a significant level of over-optimism.

- Therefore, we revise our rating on KO from Hold to Buy.

JannHuizenga

Thesis

We cautioned investors in our previous articles (here and here) that The Coca-Cola Company (NYSE:KO) stock was overvalued and urged investors to be cautious.

However, we received brickbats for our caution, even though we thought its overvaluation was apparent. Coupled with ominous price structures suggesting the market’s forward intentions, the market drew in late buyers astutely before forcing a steep selldown.

As such, KO has declined nearly 12% since our June article, significantly underperforming the S&P 500 ETF (SPY). Investors may think a 12% decline seems relatively subdued relative to the battering in tech stocks in 2022. However, consider that KO is a consumer staple stock (so-called more defensive). Furthermore, considering KO’s 10Y total return CAGR of 7.44%, a 12% decline is a relatively big deal.

However, we like the de-rating of KO by the market, as we believe it has improved its valuations as Coco-Cola heads into its Q3 earnings release on October 25. We assess that the market gave KO investors their day of reckoning, given the increasing likelihood of a recession. Despite its defensive posture, it would have been unreasonable to expect KO to trade at unsustainably high valuations as we head into a recession.

Therefore, the broad de-rating in the consumer staples ETF (XLP) is well-deserved, helping to lower the execution risks of Coca-Cola moving ahead.

Notwithstanding, we postulate that the market could send KO tumbling further if it anticipates a worse-than-anticipated recession. Such a possibility cannot be ruled out, as the Fed’s aggressive rate hikes could trigger unintended consequences for the global economy. Hence, investors need to buckle up and prepare for a worse selloff.

However, we believe the battering from its April highs has improved KO’s valuations significantly for patient investors.

Accordingly, we revise our rating on KO from Hold to Buy.

KO Has Been Hammered

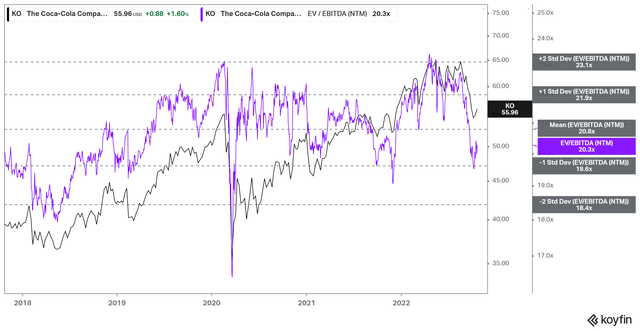

KO NTM EBITDA multiples valuation trend (koyfin)

As seen above, the market has finally sent KO spiraling down from its overvaluation zone in April 2022 (two standard deviation over its 5Y mean).

As a result, KO last traded at an NTM EBITDA multiple of 20.3x, just above its October lows of 19.6x (one standard deviation zone under its 5Y mean).

Hence, we are satisfied that a substantial level of over-optimism has been digested, easing the execution risks for management in its Q3 report card.

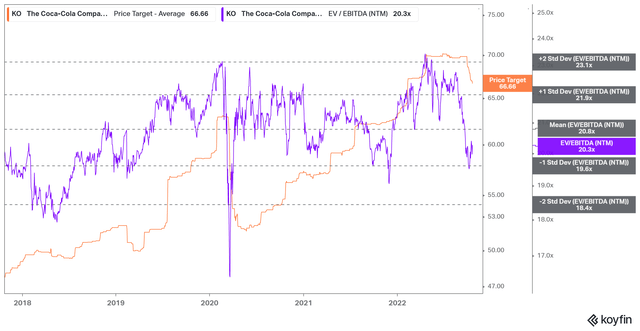

KO average price targets (koyfin)

Also, we urge investors to be wary about placing too much emphasis on the consensus price targets (PTs). The Street analysts have continued to raise their PTs on KO even as it headed into significantly overvalued zones. Moreover, they kept their average PTs at the $70 level until October (after KO fell from its highs), before realizing their faux pas. Hence, investors must make their assessment and not just rely on the consensus PTs.

Also, KO’s NTM earnings multiple of 23x is in line with its soft drinks industry multiple of 23x (according to Refinitiv data). Hence, KO’s valuation has normalized markedly from a 6M high of 27x.

However, the consensus estimates suggest that Coca-Cola could post an adjusted EPS growth of 3.7% for FY23, below the industry’s average of 6.8% (according to Refinitiv data). Therefore, we assess that the market has likely accorded more credence to the execution prowess and market leadership of Coca-Cola in delivering through the coming recession.

Consequently, we urge investors to parse management’s commentary carefully in the upcoming earnings call to analyze for any revisions in guidance.

Is KO Stock A Buy, Sell, Or Hold?

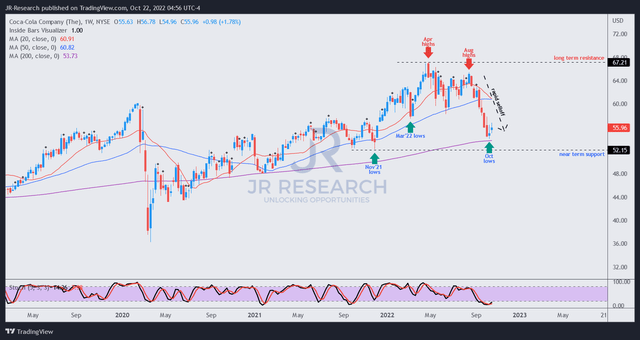

KO price chart (weekly) (TradingView)

KO fell nearly 20% from its April highs to its October lows, as the market reminded investors about the importance of not overpaying, even for defensive stocks like KO.

Notably, the “meat of the down move” happened over the last two months from its August highs, as the market forced holders to sell in panic.

As such, KO re-tested its 200-week moving average (purple line) at its October lows and appeared to have rejected further selling downside. We believe the 200-week moving average has likely attracted long-term buyers to enter and helped stanch further selling downside.

Notwithstanding, investors should expect further downside volatility as KO has already lost its medium-term bullish bias. Hence, a further re-test against its near-term support (down 6.8% from the current levels) should not be ruled out if the market anticipates worse-than-expected recessionary conditions.

Hence, investors are encouraged to layer in their exposure to capitalize on market pessimism. Still, we like the constructive price action at its October re-test, coupled with a more reasonable valuation.

As such, we revise our rating on KO from Hold to Buy.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Do you want to buy only at the right entry points for your growth stocks?

We help you to pick lower-risk entry points, ensuring you are able to capitalize on them with a higher probability of success and profit on their next wave up. Your membership also includes:

-

24/7 access to our model portfolios

-

Daily Tactical Market Analysis to sharpen your market awareness and avoid the emotional rollercoaster

-

Access to all our top stocks and earnings ideas

-

Access to all our charts with specific entry points

-

Real-time chatroom support

-

Real-time buy/sell/hedge alerts

Sign up now for a Risk-Free 14-Day free trial!