Summary:

- The company’s return on capital still beats the competition despite major challenges recently.

- Leaner segments are highly profitable even with demand headwinds.

- Business headwinds — both demand & legal are temporary in nature.

- The Healthcare spin-off might prove to be an asset to 3M’s balance sheet and bring focus back to core business.

- Remedial actions are readily available should serious issues arise.

Editor’s note: Seeking Alpha is proud to welcome Bradyn Taylor as a new contributor. It’s easy to become a Seeking Alpha contributor and earn money for your best investment ideas. Active contributors also get free access to SA Premium. Click here to find out more »

3M Delivers on Restructuring Efforts Sean Gallup/Getty Images News

The Buy Thesis

In a world of high-flying AI ventures and software that draw all the headlines, 3M Company (NYSE:MMM) represents perhaps the least sexy investment proposal out there: an efficient, but aging conglomerate. In contrast to the market darlings, 3M’s management has drawn questions, its spin-off has left doubts, and its capital position – battered by significant legal expenses has led analysts to devalue the stock relative to its history rather than its current position among its peers. This presents a unique opportunity to buy a steady blue chip with a high yield that will buy you undervalued shares while you sleep.

Business Position

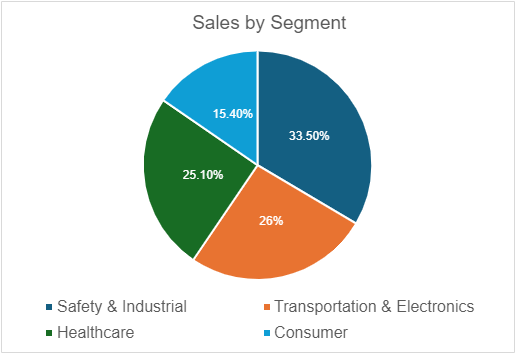

3M is a multinational manufacturing conglomerate through its exposure to four segments: Safety & Industrial, Transportation & Electronics, Healthcare, and Consumer (see Fig 4). It holds a market-leading position in many industrial and consumer applications from sponges to adhesives to tape (scotch) and office supplies (Post-it). Its competitors are other conglomerates/industrial manufacturers like Honeywell (HON) and General Electric (GE). 3M is branded as a company on the leading edge of science, its main differentiator.

Principal Risks

3M’s problems, however, do not concern its competition. Rather, the company has faced legal trouble related to innovation gone bad resulting in failed experimentation, manufacturing issues, and subsidiary issues. Currently, 3M is in litigation for PFAS or “Forever chemicals” and faulty combat earplugs produced by a subsidiary, Aearo Technologies, though some settlements have already been reached. In the case of the combat earplugs, a full settlement was reached for a total of $6 billion, while in the case of PFAS, a settlement was reached with municipal-level filers and public water utilities totaling 10.5 to 12.5 billion over 12 years subject to claimant participation.

It is speculated that other cases involving other chemical compounds 3M once produced might lie ahead beyond this settlement.

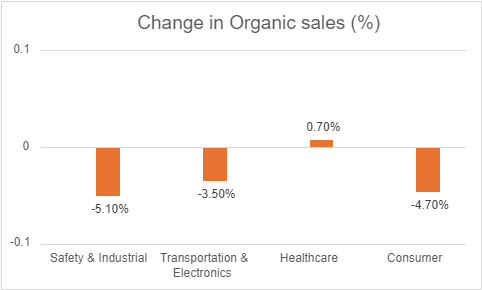

Further material impacts on 3M’s business concern the upcoming spin-off of its healthcare segment, the only segment to see organic sales growth in 2023 (Fig 3), which represents about a quarter of its net sales for the year that ended December 31 (Fig 4).

An Efficiency Push

3M had a rough year in 2023. It reached settlements on two massive pending lawsuits against it: combat earplugs and PFAS to the tune of $18.5 billion in total compensation driving its share price down more than half since the first settlements in April 2021. Analysts have questioned: How can investors trust management that put them in this poor position to begin with?

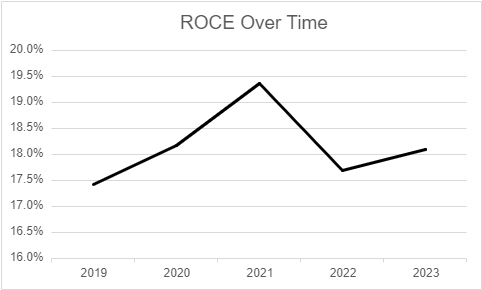

Ironically, the failures that led to their legal problems today were in search of creating value for the shareholder (especially PFAS, which has been its most expensive). But 3M’s new value push is in restructuring and better use of capital, so it follows to look at 3M’s ROCE (EBIT/total assets – total current liabilities) = (6,388/(50,580 – 15,297)) and get about 18 cents for every dollar employed. Compare this to the years following that announcement (2019-today, Fig 1) and despite having liabilities jump more than 65% over that time largely due to legal expenses, its return on capital has improved by almost 3% while the cost of outside capital has gotten more expensive. While this might not tell us how management will address a litigious future, it does tell us that 3M is running a good business despite its problems.

|

(in millions $) |

2019 |

2020 |

2021 |

2022 |

2023 |

|

EBIT |

6,174 |

7,161 |

7,369 |

6,539 |

6,388 |

|

Total Assets |

44,659 |

47,344 |

47,072 |

46,455 |

50,580 |

|

Current Liabilities |

9,222 |

7,948 |

9,035 |

9,523 |

15,297 |

Author’s calculation (Data collected from 3M 10Ks (2019-2023))

The Spin-off

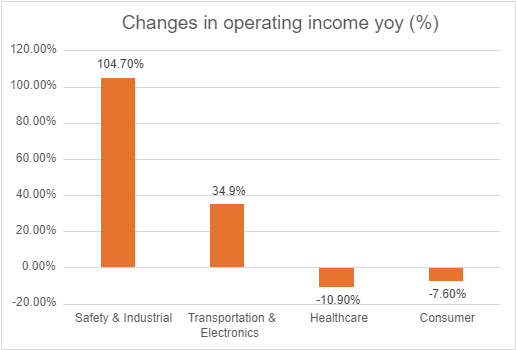

Analysts have countered that 3M’s business prospects will significantly decline after the spin-off of their fastest-growing segment: Healthcare. Perhaps this is true in terms of organic sales growth (see below) but it was the second smallest segment by sales (Figure 4) and divestiture costs have resulted in the segment performing worse than others at 3M (see Figure 5). In recent years, 3M has focused its attention on turning the segment into its key proposal for investment, making a significant turnaround effort.

As shown below, growth was tepid at best despite those efforts. So perhaps the core business lies elsewhere anyway. With the business divested, 3M’s position (19.99%) in that business could appreciate without having to pay its costs while receiving dividends until its planned monetization over 5 years. If the business is as good as analysts believe, it could be an asset to 3M’s future healthcare exposure and balance sheet.

3M 10K (2023)

Figure 4

3M 10K (2023)

This is speculation, but we do know what remains after the spin-off: leaner, better segments resulting from a restructuring push that have weathered the demand headwinds in end-market electronics, China (its largest market), and inflationary pressures on raw material costs in the recent past (fig 5).

Figure 5

3M 10K (2023)

Note: The gain in the Transportation and Electronics segment was a recovery from a 2022 loss of (48%) from 2021 resulting in a net loss of 13.1% for the segment. Ironically, this was mostly from impairment of the PFAS they’re in litigation for today (93% of that 2022 (48%) change according to their 2022 10K)

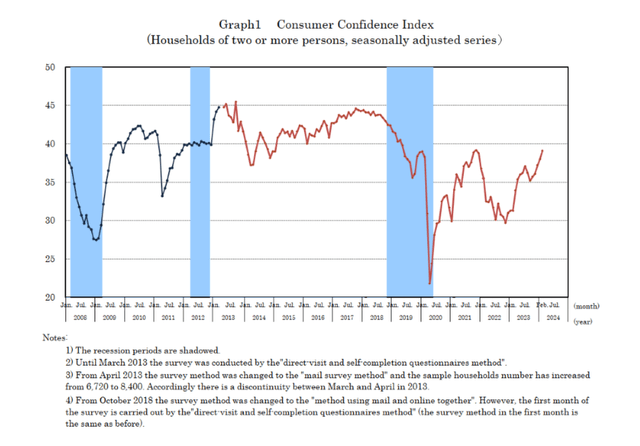

To be clear, the lagging organic sales over its other segments is a serious concern. However, the deceleration is mostly due to a 10.5% year-over-year decline in the Asia Pacific’s portion of organic net sales (represented ~29% of total organic net sales) largely driven by China (11%) and Japan (9%) widely attributed to weak industrial activity and soft electronics end markets in both countries. A rebound is a subject of speculation, but both rapprochement (through the US-China science accord) and competition (China’s continuing focus on renewables-related manufacturing as a national priority) are encouraging for 3M as is Japan’s strengthening yen (via monetary tightening) signaling a manufacturing rebound and renewed consumer confidence in the domestic economy.

Japanese consumer confidence stabilizing after a rough 5-year period (Cabinet office, Japanese Government)

Doomsday

Many analysts have speculated that 3M’s legal issues might spell its demise since the PFAS settlement almost a year ago.

Often assumed in these analyses is a Marlboro-like settlement. Based on their similar premises (public safety) and their respective places on the largest settlements in US history list (1 and 4 respectively) most concede that the science related to personal injury tort (where future cases are most likely to arise) is hard to prove. It would thus be difficult to see a litigious future as a concrete concern beyond the issues they have today.

While they’re certain to affect its short-term earnings significantly, legal expenses are expensed pre-tax, so they are tax deductible. This reduced their total attributable net loss for legal expenses in 2023 by almost 24% (see pg 24 of the linked 10K), so if they do occur, future settlements, if taken at face value by the market, could be discounted by the astute investor to their gain.

Combine these concerns with fledgling sales growth and there is cause for concern. But stabilization is likely to occur in foreign markets in a lower global rate cycle; and with bolstered consumer confidence specifically in the Asia-Pacific, 3M’s business prospects will be much improved.

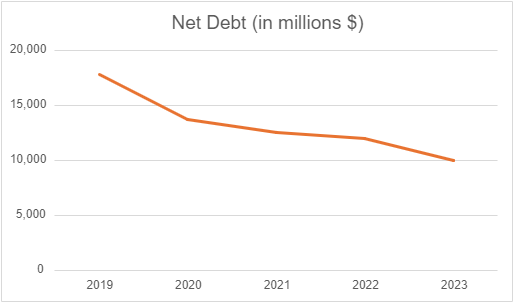

However, should such a doomsday scenario arise where demand headwinds are persistent and larger settlements come up driving down the value of fundraising with equity, I believe 3M’s strong capital employment supplemented by a decrease in net debt (below, driven by lower total debt and higher cash reserves) and increases in total assets should put 3M in a good position to weather the storm (should it arise) with access to further credit facilities.

3M 10K (2019-2023)

A Dividend Cut

Analysts have recently suggested a dividend cut might bring more confidence in 3M to address these risks. I tend to agree, seeing that the earnings picture would be better when cut (consider below). But if that’s the bull case, buy-and-hold investors could collect a market-leading yield while management debates cutting it with that contingency promising greater upside for the stock price.

(in billions $)

|

Net Income (2023) |

5.12 |

|

Legal costs (current portion) |

(11.6) |

|

Divestiture |

(.38) |

|

Dividends (2023) |

(3.3) |

|

Total earnings |

(10.16) |

|

Total excluding dividends & divestitures |

(6.86) |

Author’s compilation from 3M 10K (2023)

Evaluation

Rated by risk, I think the concerns surrounding 3M are overblown. Legal expenses are the least predictable expense a company could have, so DCF evaluation probably won’t serve any good, nor will multiples of earnings based on its negative cash flow. So, I will rate 3M relative to its peers based on capital allocation to judge management’s focus on the business, price/sales to compare competitors’ stock relative to revenue (thereby comparing the underlying businesses), R&D to judge its focus on the future of the business outside of its current (temporary) issues, and its debt load relative to its assets to determine its access to credit facilities should all else fail.

|

GE |

Honeywell |

3M |

Grade |

|

|

ROCE |

10.1% |

18.4% |

18.1% |

B |

|

P/S |

2.69 |

3.65 |

1.59 |

A+ |

|

R&D (% of net sales) |

5.2% |

4% |

5.6% |

B+ |

|

Total debt: Assets |

12.9% |

33.2% |

31.7% |

B |

Author’s calculation (data collected from HON, GE, 3M 2023 10Ks)

Despite weathering a perfect storm of unfavorable operating conditions, high legal expenses, and a high dividend yield, management has held a steady hand and kept 3M in a viable position relative to its peers evidenced by its disciplined capital allocation. Investors should also note that 3M has not resorted to cannibalization by leverage or dividend cuts as analysts have proposed for months. This analyst-driven fear has led to an undervaluation relative to its peers when the actual underlying business is considered. Indeed those analysts have been solely reacting to negative news and extrapolating historical data to show that this is not a $200 stock anymore. It may not be, but it is certainly worth a competitive valuation relative to its peers based on underlying revenue. Should overseas revenue rebound at Asia Pacific’s nominal GDP growth estimate of 4.2% for 2024, conservative for a region based on manufacturing prowess and with growing consumer confidence, a P/S of 2 (assuming the same number of shares and all other sales being equal) and discounting total healthcare sales 80% with 100% net conversion (no cost to 3M) gives a 1-year share price target of 119.68, a 14% undervaluation. Once legal concerns die down, this multiple could be valued significantly higher, especially considering how well they’ve weathered demand headwinds against their revenues. From the investor’s perspective, the 5.9% yield offers an excellent opportunity to take advantage of the undervaluation in the meantime.

Conclusion

Overall, 3M stock is a Buy due to its high grades relative to peers related to its core business. It is not a Strong Buy lacking further information about how the healthcare spin-off will be structured and 3M’s total beneficiary position in it, as it is hard to evaluate how the valuation figures above will be affected.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of MMM either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.