Summary:

- 2022 was an immensely challenging year for investors.

- Yet we have excellent options heading into what promises to be another volatile year.

- Below, I’ll discuss my company criteria in 2023 and present some diversified ideas.

- Let’s take a look!

jittawit.21/iStock via Getty Images

I wish everyone a very happy New Year as we dive into 2023. It’s been a pleasure writing and interacting with you over the past year, and I can’t express enough my appreciation that you have taken a bit of your valuable time to read some of my articles.

Below I will quickly recap 2022, outline my criteria for 2023 stock picks, and present of few of my favorite companies for 2023 and beyond.

A brief look back at 2022

2022, eh? Optimism over the waning pandemic was short-lived as war, inflation, and increasing signs of a 2023 recession hit. All three major stock market indices entered bear market territory, and the losses may not be finished.

But some companies did outperform in 2022.

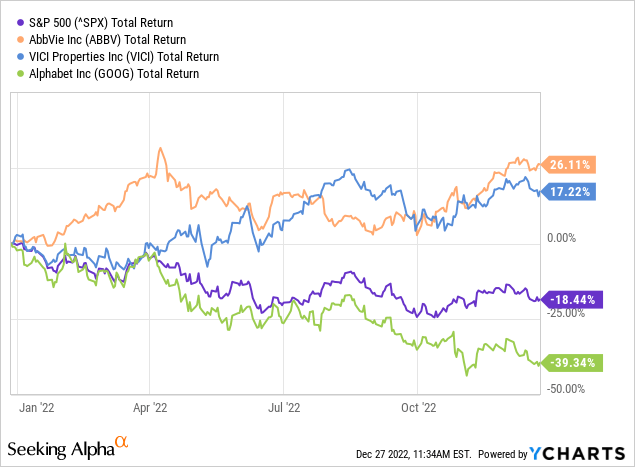

Last year at this time, I called out AbbVie (ABBV), VICI (VICI), and Google-parent company Alphabet (NASDAQ:GOOG)(NASDAQ:GOOGL) as the three best long-term stocks for investors in 2022. I recently updated all three in an article here.

As shown below, AbbVie and VICI crushed the market by 45% and 36%, respectively. Unfortunately, Alphabet was decimated and underperformed the S&P 500 by 21%.

In fact, Alphabet has experienced its most precipitous decline from its high since the Great Recession.

AbbVie and VICI still have tremendous futures and remain solid income-producing stocks with upside potential, but I’ve covered them heavily, so they aren’t on this list.

What to expect in 2023

A recession will most likely come in 2023. A hawkish Federal Reserve is determined to curb inflation by tamping down demand. Unemployment will probably rise marginally, and resilient consumer spending may pull back as sentiment continues to trough.

Keeping our eyes on long-term goals is vital despite the deluge of daily headlines.

The most important quality for an investor is temperament, not intellect. – Warren Buffett.

There are silver linings if we look beyond the doom and gloom.

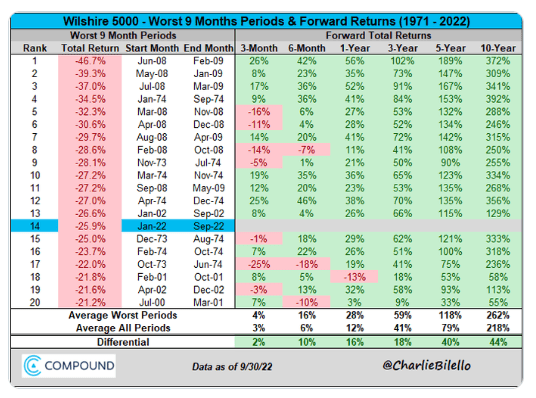

First, stock valuations are much more palatable now than they have been since the market recovered from the pandemic crash. Those who dollar-cost average, new investors, or those with cash on the sidelines have terrific options. This graphic sums up the history of long-term returns after significant declines:

Compound Advisors.

The market may not have hit bottom yet. But I am a huge believer in “time in the market” since I know I cannot consistently and accurately time the market. Some claim they can, but reputable studies show that trying to time in and out of the market is an excellent way to underperform over the long haul.

Inflation is easing. In November, CPI, Core CPI, and PCE came in softer than expected. The Personal Consumption Expenditures price index (PCE) is a gauge that the Federal Reserve watches closely.

The US Dollar Index (DXY) is coming back to Earth. The strong dollar has hurt profits for a lot of companies, like Big Tech, for example.

Does this mean we are out of the woods? Of course not. But it is progress.

Criteria for 2023 Top Picks

Know what you own, and know why you own it.” — Peter Lynch

I used several criteria for this year’s list, taking into account the current market and long-term opportunities.

They are:

Secular opportunity: Persistent tailwinds that contribute to future profits.

Substantial stock buyback program or dividend yield. Since the market may continue to decline, a significant buyback program will allow the company to take more shares off the table, leveraging our future gains.

Impressive free cash flow that feeds buybacks, dividends, a strong balance sheet, research and development, and more.

Let’s go ahead and get to it.

Builders FirstSource

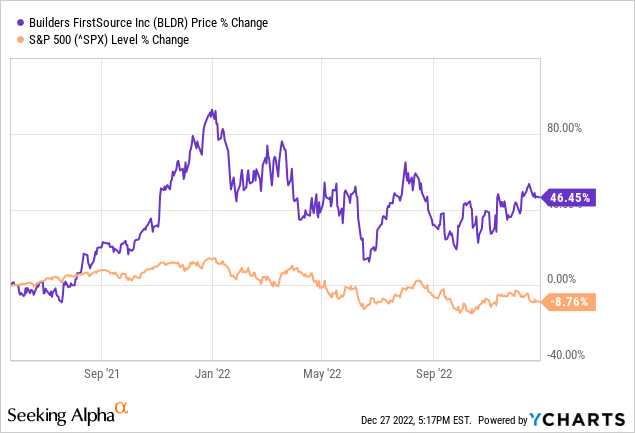

I first put a buy rating on Builders FirstSource (BLDR) in this article in May 2021. The stock has returned 46% to the S&P 500’s -9% since, as shown below.

This may seem contrarian as we head into a housing slowdown; however, bear with me.

Secular tailwinds

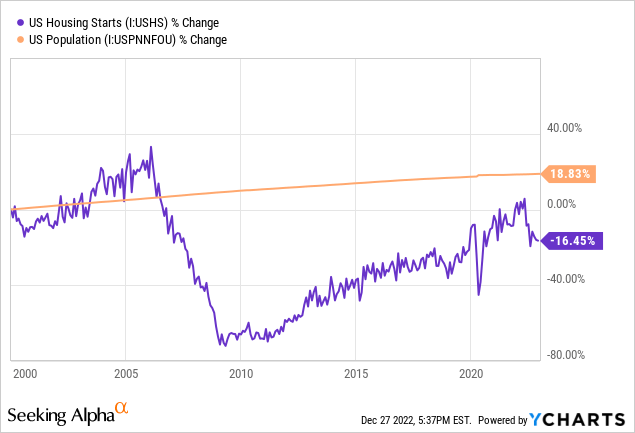

We may see some cyclical compression as the housing market readjusts to typical interest rates, but the long-term outlook is positive.

We have drastically underbuilt since the Great Recession, as shown in the chart below, and are short millions of homes – the only disagreement among experts seems to be how many million. It could take decades to catch up.

Dynamic company

With this in mind, Builders FirstSource has gone on a merger and acquisition (M&A) spree beginning with its blockbuster merger with BMC.

The company focuses on key geographical areas such as its acquisition of Cornerstone Building Alliance which serves rapid growth areas in Arizona; National Lumber in the New England area; and Fulcrum Building Group, which serves the Gulf Coast.

Several companies which support value-added offerings and digital software solutions were added. The company believes it has a $1 billion opportunity in the digitalization of homebuilding from modeling to quoting.

Value-added offerings, like manufactured products, and windows, doors, and millwork are vital to success since they have higher margins than lumber. These account for 48% of sales, with specialty products accounting for another 20% in Q3.

Cash flow feeds the massive buyback program

Free cash flow has grown from $286 million in 2020 to an estimated $3.2 billion in 2022, and most of the company’s debt is due in 2030 or later.

The company increased its buyback program by another $1 billion last month. There is $1.5 billion, or 16% of the $9.6 billion market cap, remaining on the current authorization.

Since August 2021, $3.8 billion in shares have been repurchased.

The easy button is to glance at rising interest rates and dismiss Builders FirstSource, but it’s essential to dig deeper. Long-term investors should give this company a closer look.

Texas Instruments, the cash flow kings

Semiconductors have been in the news a lot recently. The CHIPS Act of 2022 provides incentives to increase domestic manufacturing and puts the spotlight on this need.

Demand for semiconductors will continue to increase, especially in the industrial and automotive industries. Today’s vehicles require more chips than ever, and electric cars use even more.

Texas Instruments (TXN) is a well-managed, diversified, profitable company that is easy to own.

The company makes 62% of its revenue from Industrial and Automotive customers, so it isn’t heavily reliant on the more-cyclical Consumer Electronics market. It also has a global manufacturing footprint, including several U.S. locations and a massive customer base.

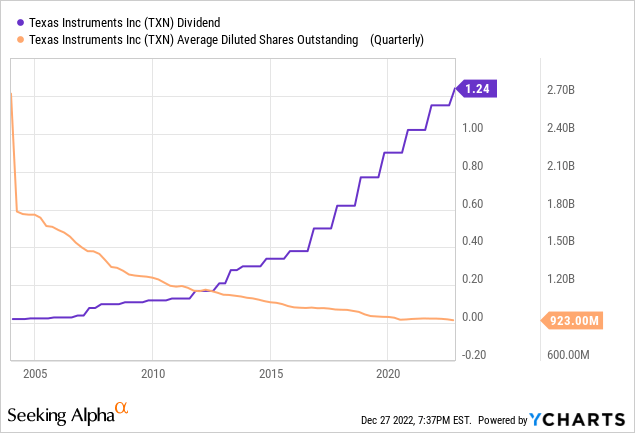

It invests heavily in manufacturing and technology to support future growth and returns the rest to shareholders. The dividend history and shrinking share count are shown below.

Since 2004: 12% annual growth in free cash flow per share, 25% compound annual dividend growth, and more than 46% reduction in share count – that expert cash management is tough to beat.

The dividend yields 3% currently, and the company has a price-to-earnings (P/E) valuation of 17, which is well below the ten-year average of 23.

The combination of secular demand, outstanding management, and dedication to shareholder returns make Texas Instruments an excellent pick for long-term investors.

Visa: Pick and shovel play on online retail

Secular opportunity

We’ve all probably heard that the best way to get rich in a gold rush isn’t digging; it’s selling the tools to the dreamers who are. And this is the case with payment processing giant Visa (V).

Online sales are massive but only make up a small portion of total retail transactions (around 15% in the U.S., according to YCHARTS). The pandemic accelerated the trend, and there is still a long runway. In addition, many businesses are going cashless, and Visa is increasing its value-added offerings.

Visa is also investing to accelerate digital transformation in developing regions like Africa.

Buybacks and dividends

Visa’s profit margins make investors’ mouths water at 64% (operating) and 51% ((net)).

$12 billion, or 3% of the current market cap, worth of shares were repurchased in fiscal 2022, and the company has $17 billion to spend from current authorizations.

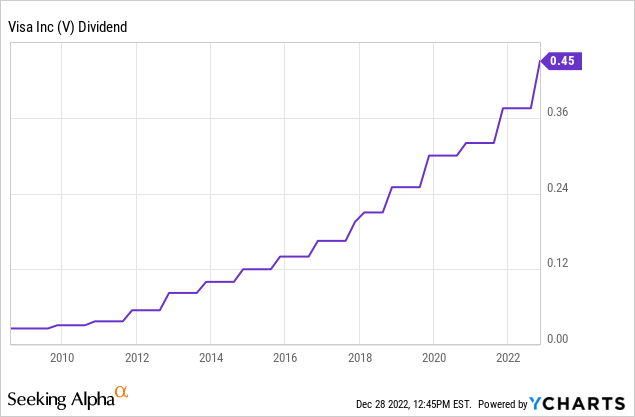

The dividend yield is small at just 1%; however, the dividend is rapidly rising, so our yield on cost should increase over time, as shown below.

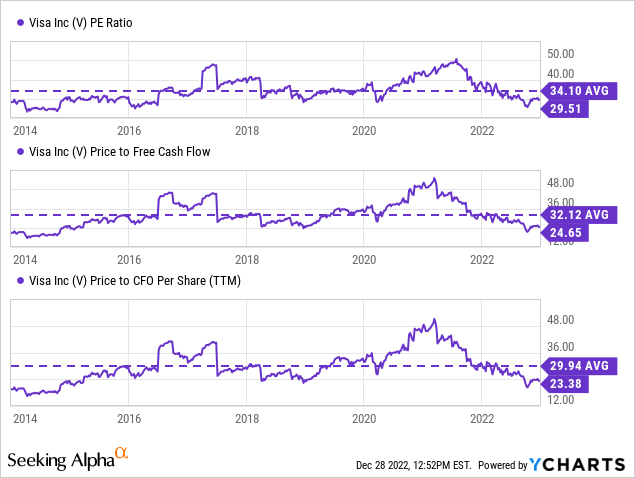

The stock is 16% off its average P/E ratio since 2014 and trades below its cash flow ratios, as shown below.

Visa stock won’t make us rich overnight, but it will likely increase our wealth significantly as a buy-and-hold investment.

Sticking with Alphabet; here’s why

After agonizing and studying intently, Alphabet stock clears the hurdle despite challenges, and its massive stock price decline could be an excellent long-term opportunity.

Google Search

Google Search is the straw that stirs the drink and will be for some time. Major advertisers cannot afford not to be on page one. Newer features such as Google Lens, which enable searches and translation based on pictures, are exciting. For instance, travelers can snap a photo of a street sign or menu and have it translated from the image. Shoppers can take pictures of items or clothing, and purchasing options for similar items are shown.

YouTube

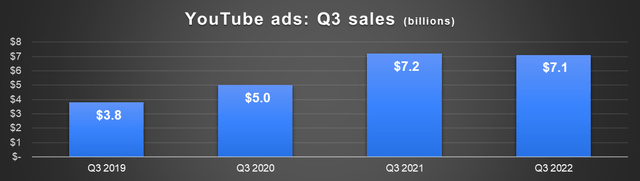

YouTube is a tremendous brand that the company needs to kick into high gear. Revenue for Q3 2022 declined from Q3 2021, causing some consternation, as shown below.

Data source: Alphabet. Chart by author.

However, context is important here. The sales increase in 2021 was gigantic, so this long-term growth trend is still intact.

YouTube Shorts (1.5 billion monthly average users) is ramping up its competition with embattled TikTok. Alphabet has spent heavily to lure popular content creators and is introducing revenue sharing in early 2023.

YouTube TV has 5 million subscribers, and the exclusive rights to the NFL Sunday Ticket should provide a boost. Amazon (AMZN) saw a wave of Prime subscribers from its Thursday Night Football broadcast.

Google Cloud is a central focus, and revenue growth (39% so far in 2022) is impressive, although operating income lags. The segment is innovating, and the acquisition of cybersecurity company Mandiant makes security offerings more robust.

Buybacks, cash flow, and valuation

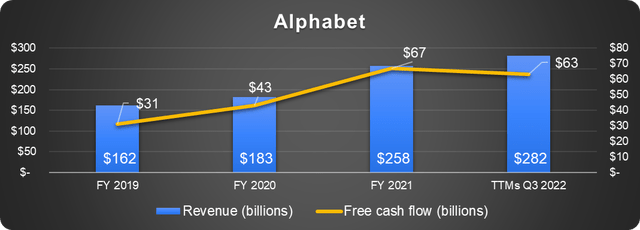

As shown below, despite the challenging environment, Alphabet generates a ton of free cash flow.

Data source: Alphabet. Chart by author.

Here is the lowdown on stock buybacks:

- $50 billion executed in 2021.

- $70 billion additional authorization issued in April 2022.

- $43 billion, or ~4% of the current market cap, completed through Q3 2022.

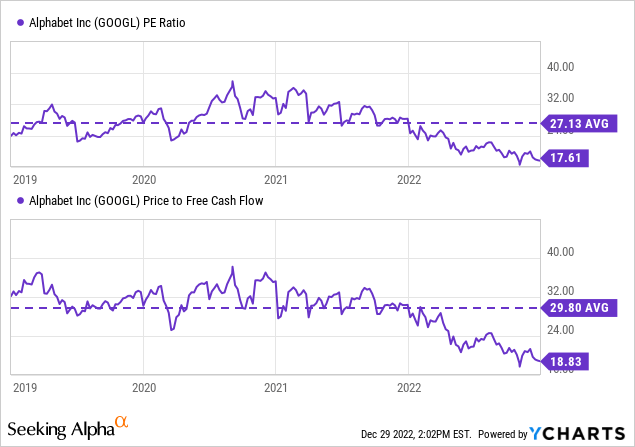

The stock’s valuation is historically low, as shown below.

The market is pricing in a significant decline in earnings. However, management finally appears committed to lowering costs and slowing the headcount growth, so profits may not suffer as much as advertised.

There is a tough road ahead with a challenging economy, increased advertising competition, antitrust headaches, and more. But these challenges can spur urgency, innovation, and efficiency, creating an opportunity for patient investors.

Breaking the rules with CrowdStrike

Cyber breaches are the most significant threats businesses, governments, and infrastructure providers face daily. CrowdStrike’s (CRWD) cloud-based platform is dedicated to defending against them. I’ve long been a fan of the company, but the market hasn’t seen it my way lately, with the stock down 50% over the past year.

It goes without saying that the company has a fantastic market opportunity, but the rest is murky.

It is many years away from returning cash to shareholders through buybacks or dividends, has no GAAP profits, and its free cash flow (which is getting impressive) is propped up by stock-based compensation.

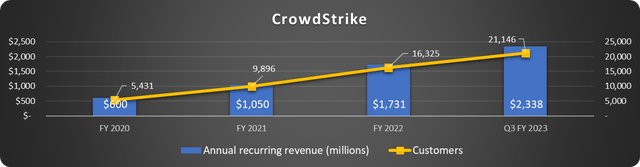

What CrowdStrike does have is ridiculous growth in customers and revenue (shown below), a 76% subscription gross margin, and fantastic customer retention rates.

Data source: CrowdStrike. Chart by author.

CrowdStrike’s valuation has come down significantly to a more palatable 11 times sales.

CrowdStrike is a bit risky; however, it has excellent long-term potential and could rebound swiftly and steeply once investors regain their appetite for growth stocks.

The wrap-up

A new year is an excellent time to reaffirm our long-term investment objectives and keep them in mind when the market gets volatile. What qualities do you look for in a company you will own a piece of?

We are venturing into what will undoubtedly be an eventful economic period. Each of these companies has many attributes of successful enterprises and profitable investments, although not every stock is appropriate for each investor.

Happy New Year!

Disclosure: I/we have a beneficial long position in the shares of GOOG, ABBV, VICI, TXN, V, BLDR, AMZN, CRWD either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: SHORT ABBV FEB2023 $170 CALL, SHORT VICI MAR2023 $35 CALL

Investors’ goals, financial situations, timelines, and risk tolerances vary widely. The stocks mentioned may not be suitable for all. As such, the article is not meant to suggest action on the part of the reader. Each investor should consider their unique situation and perform their own due diligence.