Summary:

- I’ll present a case study on how Toyota grew profits 22% per annum from 1995 to 2005, but saw its stock grow at just 7% per annum.

- While EVs have been the cool place to be, Honda’s dominance in the motorcycle market goes unnoticed.

- Tesla’s profit margins could shrink as cheaper EVs come online.

- Making a case for intellectual humility, I argue for owning Honda’s deep value over Tesla’s futuristic promise.

Getty Images/Getty Images News

The Thesis

Tesla’s (NASDAQ:TSLA) stock is up 600% over the past five years, while Honda’s (NYSE:HMC) stock is down 33%. Going forward, I see a changing of the tides. In the decade ahead, I project total returns of 5% per annum for Tesla and 13% per annum for Honda.

A Toyota Case Study

History holds important insights that we can use to make judgements about the future. Let’s take a look at the history of Toyota (From 1995-2005), and compare it to Tesla today.

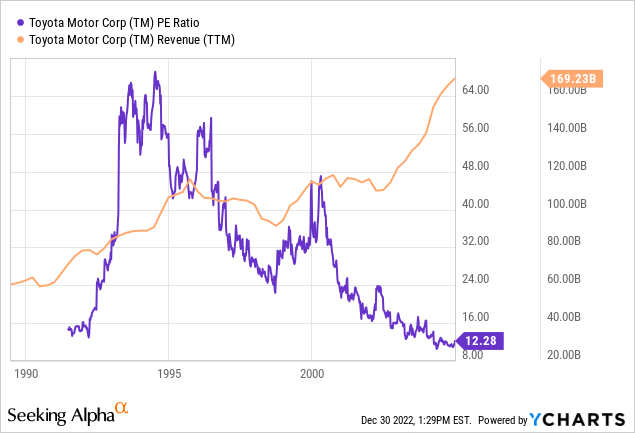

In 1995, everyone could see that Toyota was about to crush American automakers. And, over the next 10 years, it did. The company was selling reliable, fuel efficient cars at an affordable price. The problem was, this was already baked into the price. Toyota traded at a P/E of about 45x in 1995.

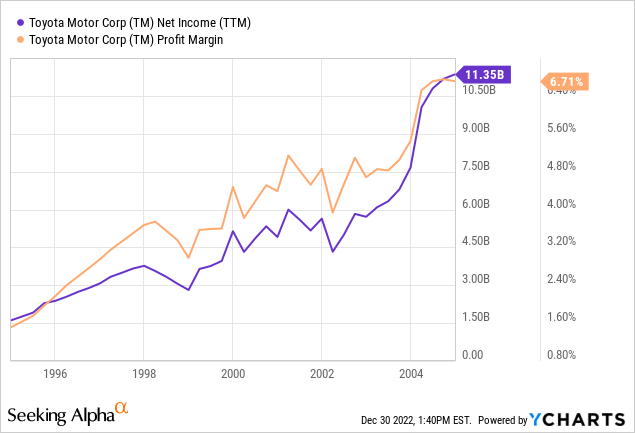

Over the next 10 years, Toyota went on to grow profits at 22% per annum despite much slower revenue growth. It did this by increasing its profit margin from 1.6% to 6.7%:

Despite this terrific financial performance, the market began pricing in slower growth and cyclicality in 2005. Toyota’s P/E decreased from 45x to just 12x:

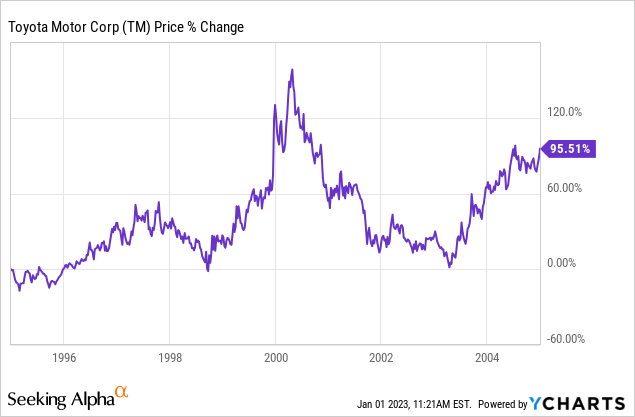

This is called multiple contraction and it has a real effect on stock prices. Toyota’s net income increased seven fold, but its stock increased less than two fold (Gaining just 7% per annum). Unbelievable, right?

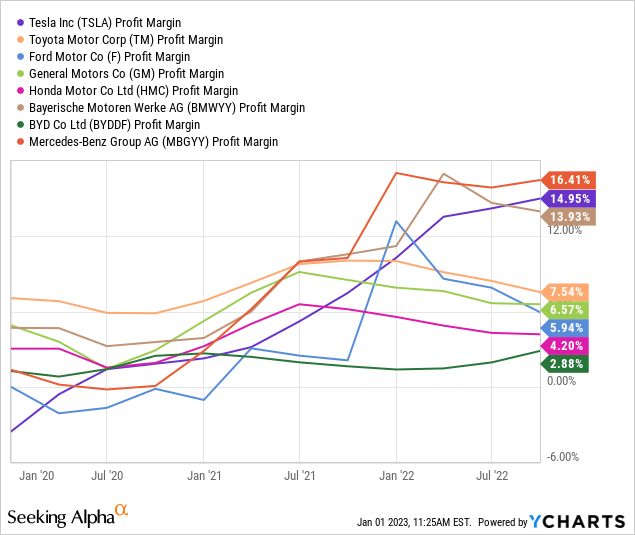

This is very reminiscent of Tesla (TSLA) today. But, Tesla has one problem Toyota didn’t, it sells luxury cars at an enormous premium. Tesla has a 15% profit margin, which is extremely stretched for the auto industry. Luxury car companies like Tesla, Mercedes-Benz (OTCPK:MBGYY), and BMW (OTCPK:BMWYY) have seen their profit margins explode over the past three years:

This is likely to reverse, in my opinion. Tesla will find it difficult to expand profit margins like Toyota did. You see, Toyota was gaining share rapidly by selling reliable cars, at a cheap price.

Once cheaper EVs enter the market, Tesla’s profit margins may need to fall in order to maintain sales growth in line with investors’ expectations. I don’t see Tesla growing profits at 22% per annum like Toyota did.

Deep Value Investing – An Exercise In Humility

Deep value investing is essentially about saying, “I don’t know what the future holds, but I can still get an outsized return.” Let’s not forget, in the above exercise, we were talking about the most successful car company of our generation in Toyota.

Will Tesla hold a leading EV market share in 10 years’ time? I have no idea. Thus, I’d rather buy a company like Honda (HMC), which sells for half its tangible book value (The value of hard assets owned by you, the shareholder) and has an investment grade credit rating. In Honda’s diversified business, you can be almost certain you’ll recover your principal. Honda has a P/E of 8.5x and a price to tangible book of 0.5x. If you bought Tesla’s entire business for $380 billion, would you recover your principal? Let’s hope so.

Why Buy Honda Over Tesla?

Honda dominates the motorcycle market, much like Tesla dominates in EVs. Honda has a mid-teens operating margin in motorcycles, while Tesla has a mid-teens operating margin in EVs. But, Honda’s dominated its market for decades, displaying a durable competitive advantage, whereas Tesla’s merely dominated its market for years, due to a first-mover advantage.

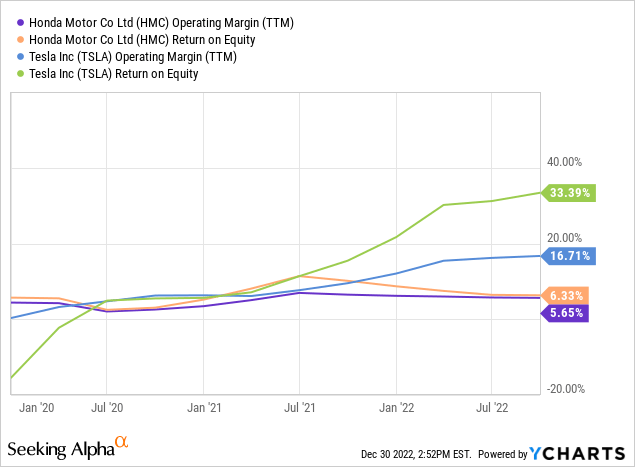

Yes, Honda is cheaper for a reason. Its overall margins and returns on equity are much lower than Tesla’s:

But, I’d expect Tesla’s profitability numbers to get worse from here, and Honda’s to improve. Howard Marks said in a recent interview, “Anytime there are [high] expectations, which don’t come true, the market is likely to have a very strong reaction.” Likewise, when expectations are extremely low and something positive happens, the market tends to react in a big way (In the opposite direction). Thus, I like to own things where expectations are low.

Should Honda improve its return on equity (ROE) to 10%, a very achievable feat, its stock would likely surge. This is because the market expects next to nothing of Honda. Likewise, if Tesla’s ROE were to decline to 20%, its stock would surely get crushed. The market still expects exceptional profitability and growth from Tesla.

Honda Vs. Tesla – The Businesses

Honda Motor Corp

Honda’s Business Segments:

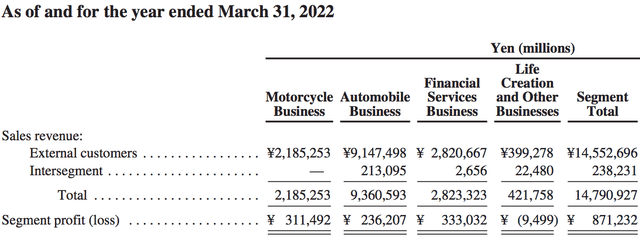

Honda’s Business Segments (2022 Annual Report)

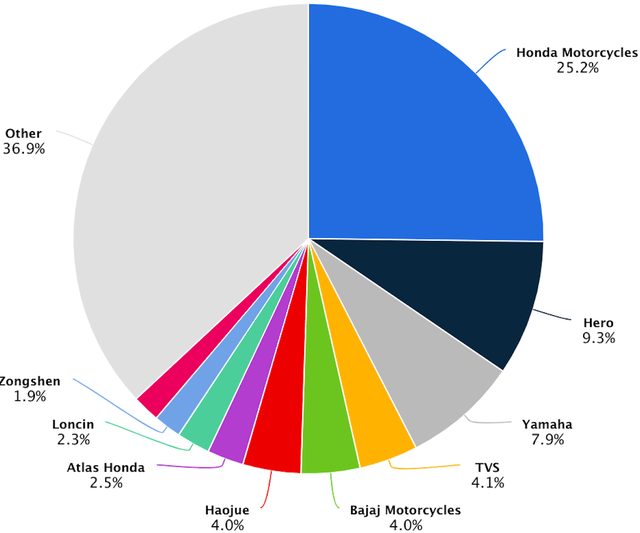

Honda sells a lot of cars, but makes a comparatively low amount of profits from doing so. Honda’s real profits come from its Motorcycle segment. This is because Honda has a terrific market share in Motorcycles:

Global Motorcycle Market Share (2022) (Statista)

In emerging market countries like India, motorcycles and mopeds are the choice method of transportation, and, this is unlikely to change in the decades ahead.

Also worth mentioning is Honda’s financial services segment. Traditional auto companies operate these segments to help customers finance their new car purchase. This makes it look like these companies have a lot debt, but this debt is also an asset, sort of like a bank. It gets really complex, so I’d recommend deferring to the experts at Moody’s or Fitch, the latter gave Honda a credit rating of A (Investment Grade). In other words, Honda has a fairly strong balance sheet.

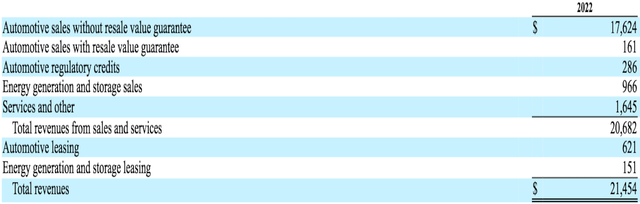

Tesla Inc

Tesla is still a car company first. To simplify, Tesla’s revenue comes from two sources, automotive (EVs) and energy generation and storage (Energy). The energy part of the business represents only 5% of revenue. 95% of the TSLA’s revenue still comes from automotive sales and its related products.

Below is a breakdown of Tesla’s Revenue for the 3rd quarter:

Tesla’s Revenue By Segment, Q3 2022 (Tesla 10-Q)

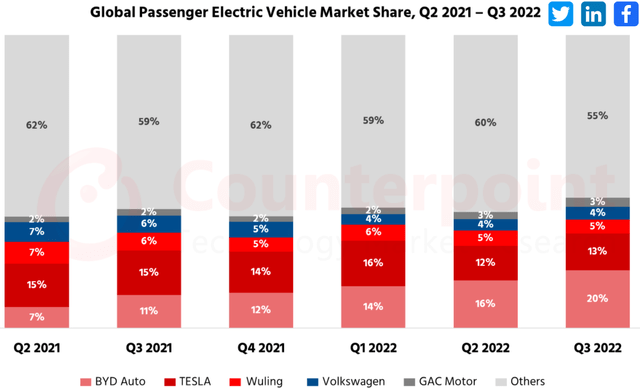

Over the past couple years, Tesla’s been losing market share. Namely to BYD Co. (OTCPK:BYDDF):

Global EV Market Share (Counterpoint)

Prospective Returns

Honda Motor Corp

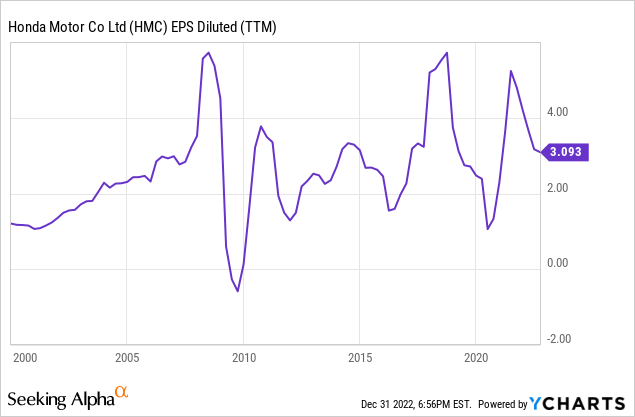

Over the past couple years, global auto sales have been depressed due to supply chain issues and shortages. At the same time, profit margins have been stretched. But, Honda’s automobile segment hasn’t taken part in these stretched margins. Honda earns a low margin on its auto sales, much like Toyota did in 1995. The company’s a cyclical, slow growth business, but has managed to grow its earnings per share at 4.2% per annum since 2000. Honda slowly but surely reduces its share count to achieve this growth.

Given Honda’s strong position in motorcycles (A market expected to grow at 7.4% per annum) and quality reputation, there’s little reason to believe Honda can’t maintain this growth. I actually expect Honda to increase its growth slightly due to the amount of shares it can buy back at these cheap prices, and the potential for margin expansion in its auto business. For this fiscal year, the company should have a dividend yield of about 4.3%. Honda said:

“With respect to dividends, the Company will strive to pay stable and continuous dividends aiming at a consolidated dividend payout ratio of approximately 30%. The Company may also acquire its own shares at a timing that it deems optimal.”

My 2033 price target for Honda is $52 per share, implying a return of 13% per annum with dividends reinvested.

- If we grow HMC’s $2.89 of EPS at 5.5% per annum, we get $4.94 per share in 2033. I’ve applied a terminal multiple of 10.5x.

Tesla Inc

Unlike Honda, Tesla’s increased its share count over time. I expect Tesla’s share dilution to come to an end over the next decade. The EV market is projected to grow at 17% per annum through to 2027. Tesla has an opportunity to grow its autonomous drive, EV semis, and energy generation businesses at rates exceeding 17% per annum. But, because 95% of Tesla’s sales come from its EV business and related services where the company’s losing share and may see margins contract, I expect EPS to grow at a slower pace.

My 2033 price target for Tesla is $208 per share, implying a return of 5% per annum.

- Tesla has earnings per share of $3.23. If it can grow that at 15% per annum, it will earn $13 per share in 2033. I’ve applied a terminal multiple of 16x.

In Conclusion

As you saw in the Toyota case study, remarkable earnings growth is often offset by multiple contraction. This is because extremely high rates of growth cannot be sustained over time. If I’m going to buy a share of a business, I’m thinking “would it make sense to purchase the entire business at this price?” I want to be sure I’ll recover the purchase price through the company’s earnings as soon as possible. And, it’s even better if you already own tangible assets worth more than the market cap.

When we look at Tesla’s $380 billion market cap, shrinking market share, and stretched profit margins, I can’t say for sure you’ll recover the purchase price. Luxury car companies may soon see their profit margins contract. Thus, I believe Honda is a better buy at 0.5x tangible book. Using base-case estimates, it should return 13% per annum vs. Tesla’s 5% per annum. If Honda’s not for you, there are plenty of traditional ICE companies trading below tangible book. If you know the industry well, perhaps you can predict who’s about to gain share, like Toyota did in the 1990s, and make a remarkable return. Just be sure to drop your ideas in a comment down below. Until next time, happy investing.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in HMC over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: This article includes base-case scenario estimates, using known facts and economic projections. The future is uncertain, and investors must draw their own conclusions.