5 Reasons Algonquin Power Stock Is Down 25%

Summary:

- Macro factors, including the inverted yield curve indicator, being in a peak cycle, and rising interest rates, are weighing on stocks in general, including Algonquin Power & Utilities Corp.

- Capital-intensive utilities have heavy debt loads. So, rising interest rates will particularly dampen their growth.

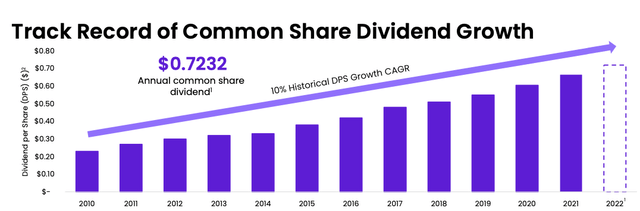

- 2022 is AQN’s 11th consecutive year of dividend increases.

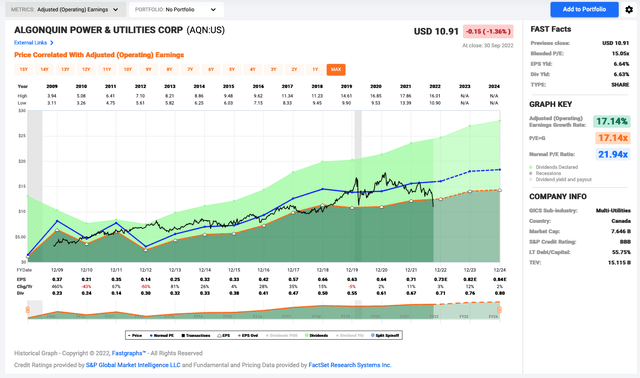

- The dividend stock trades at a meaningful discount of 32% and offers a high dividend yield of 6.6%.

Daniel Balakov/E+ via Getty Images

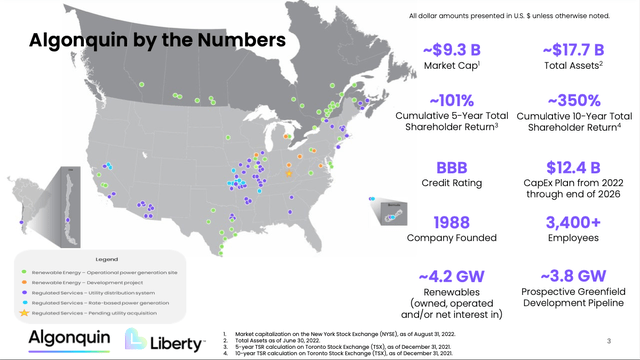

Algonquin Power & Utilities Corp. (NYSE:AQN)(TSX:AQN:CA) has a decently long history of operation. It was founded 34 years ago and has survived through the ups and downs of business cycles. After a few decades, it has grown its assets to about $17.7 billion.

[The utility reports in U.S. dollars, so the figures in this article are in USD unless otherwise noted.]

Its operations consist of about 70% in regulated utilities in natural gas, electric, and water across 16 jurisdictions and roughly 30% in non-regulated renewable energy across wind, solar, hydro, and thermal. About 82% of the generation in its non-regulated portfolio are under long-term power purchase agreements of approximately 12 years. Therefore, its earnings are fairly stable and predictable.

Importantly, management is committed to a growing dividend. 2022 is the 11th consecutive year it has increased its dividend. For reference, its 10-year dividend growth rate is 9.5%, while its last dividend hike in May was 6.0% year over year.

Reason 1: Inverted Yield Curve

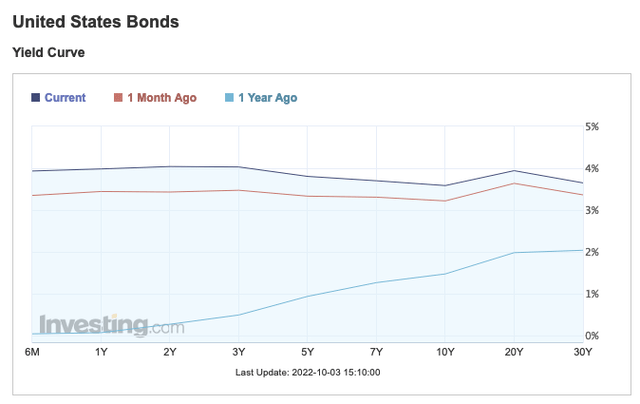

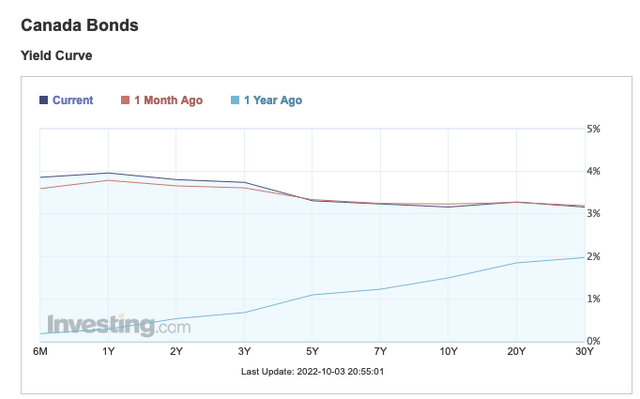

The inverted yield curve, which is occurring in the United States and Canada, Algonquin’s core geographies of operation, is unsettling. Essentially, short-term interest rates are higher than long-term interest rates for debt of the same credit quality.

The yield curve looks similar in Canada as well.

Both graphs show that a year ago, the yield curve (with a positive slope) indicated a normal and healthy economy. A normal yield curve makes sense because longer-term debt pay out higher interest rates for the greater risk in interest rate changes or the possibility of a default. (The longer the duration of the debt, the higher the probability interest rates will change and the higher the uncertainty in a potential default where partial interests or partial/all of principal is not repaid.)

Today, short-term interest rates are rising too quickly, which will drive bond prices lower. As well, historically, inverted yield curves have preceded recessions. The higher chance of a recession from high inflation and central banks (Bank of Canada and the Federal Reserve, respectively) raising the benchmark interest rates to curb inflation are what have been weighing on stocks, including Algonquin.

In fact, technically, the U.S. is already in a recession, as defined by two consecutive quarters of GDP decline. So far, it has been a mild recession. The central banks are generally aiming for a soft landing.

Algonquin’s performance in the past recession can be indicative of how it’d fare in this recession. Around the 2020 pandemic recession, Algonquin saw resilient earnings and continued to increase its dividend. This is as expected of the utility that has predictable earnings from a business that’s largely regulated or has cash flows supported by long-term contracts.

Reason 2: A Peak Business Cycle

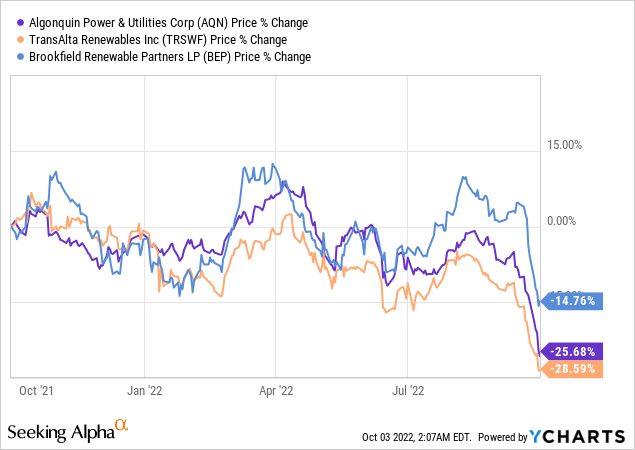

We may be in a peak business cycle, which is when even “defensive” utility stocks decline. Indeed, other renewable power stocks also sold off lately.

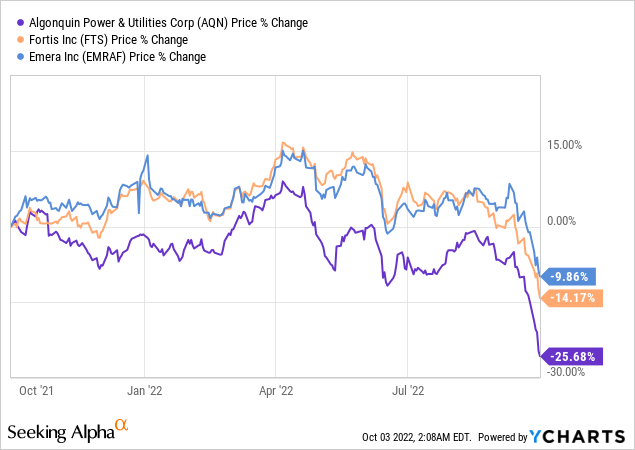

… as did regulated utilities. Though, Algonquin’s regulated utility stock peers have held up better.

Reason 3: Rising Interest Rates

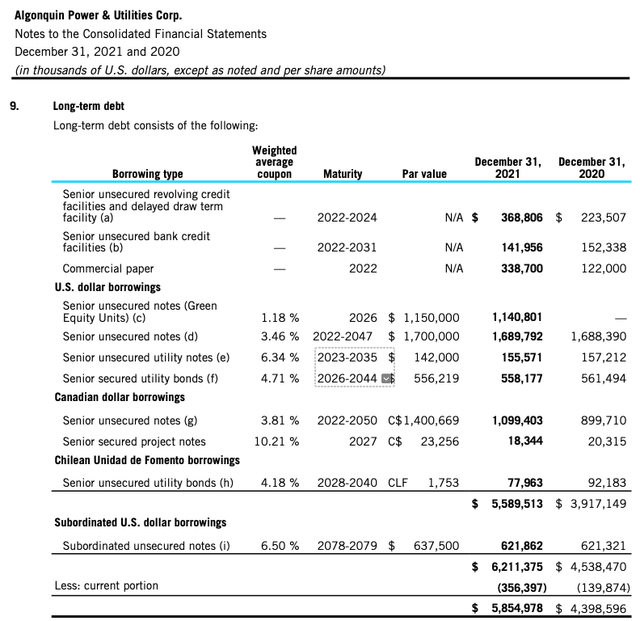

Rising interest rates don’t bode well for utilities like Algonquin that inherently have lots of debt on their balance sheets. Here’s an overview of the utility’s long-term debt at the end of 2021. Most of the debt — debt that has par value of north of $1 billion — has low interest rates.

Specifically, at the end of Q2, the utility had almost $7.3 billion of long-term debt on its balance sheet, resulting in a long-term debt to equity ratio (“D/E”) of 1.30.

So, from the 2019 base year, the long-term debt doubled from $3.7 billion. Also, compared to the lower long-term D/E of 0.96 in 2019. (We chose 2019 as the base year, viewing it as a normalized year before the pandemic.)

Notably, though, its 2019 interest to debt ratio was 4.2%, while its recent interest to debt ratio is 3.1%. (The interest to debt ratio is calculated from Interest Expense ÷ (Current Debt + Long-term Debt).)

It appears the effective interest rate isn’t so bad for Algonquin right now. However, cost of capital is still set to rise should it push out new debt in the near term. As well, its long-term D/E is higher, making it a slightly riskier company in this perspective. Overall, Algonquin has an investment-grade S&P credit rating of BBB.

Reason 4: Dividend Safety

Algonquin’s trailing-12-month (“TTM”) net income available to common shareholders is $196.3 million, while its dividends paid in the period was $362.8 million, making its payout ratio 185% of earnings. Its TTM operating cash flow is $732.6 million, making its payout ratio under 50% of operating cash flow. However, after accounting for capital spending, its free cash flow is -$617.9 million (before even accounting for dividends).

But Algonquin’s track record of increasing its dividend for a decade stands.

What if we do a similar calculation by using cumulative numbers from 2018 to 2021? In this period, its payout ratio was 55% of net income available to common shareholders, 53% of operating cash flow, while cumulative free cash flow was -$1.37 billion.

It’s not surprising that the utility is capital intensive, given this is the nature of the business. Specifically, from 2018 to 2021, for capital investments, Algonquin spent almost $3.2 billion, which was 76% higher than the operating cash flow it generated in the period.

Investors could argue that the company has been borrowing to invest for the long-term business versus borrowing to pay for its dividends. In either case, the company does not generate sufficient operating cash flow to cover both.

This is not to single out the possibility of Algonquin’s dividend being unsafe, as it seems like it’s a scenario that’s common among its utility peers.

Reason 5: Kentucky Power Acquisition

Some investors may view negatively in the Kentucky Power acquisition, which will add more debt to Algonquin’s balance sheet in a rising interest rate environment. However, acquisitions are a part of what Algonquin does to grow.

In fact, the company just managed to revise the agreement to pay $200 million less for Kentucky power for an enterprise value of almost $2.65 billion, including the assumption of US$1.22 billion in debt. AQN management expects to maintain an investment-grade credit rating.

The addition of Kentucky Power will boost AQN’s regulated electric utility operations, increasing its business mix to almost 80% in regulated utilities, which can further increase the stability of its business performance. Management expects the acquisition to be accretive to adjusted net earnings per share in the first full year and provide mid-single digit percentage accretion after that.

Algonquin is still waiting for final regulatory approvals. If that goes smoothly, the transaction will close in January 2023.

Investor Takeaway

Algonquin stock has declined meaningfully. Interested investors should find it to be priced at a value compared to a year ago. At the recent quotation of $10.91 per share, it trades at a nice discount of 32% from the consensus price target of $16.20 across 12 analysts. It also offers a high yield of 6.6%.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in AQN:CA, over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: Disclaimer: This article consists of my opinions and is for educational purposes only. Please do your own research and due diligence and consult a financial advisor and or tax professional if necessary before making any investment decisions.

There’s one TSX-listed utility we like better than the rest. It’s so good that we’ve been keeping the outperformer in DGI Across North America’s core holdings. Ask us about it in the service!