Summary:

- Nvidia’s aggressive growth guidance has led to high valuations and a small margin for error, potentially causing a significant stock price drop if growth expectations are not met.

- High P/E multiples in the tech sector have dragged the S&P 500 P/E ratio to almost 25x, making for a poor risk-reward on the index.

- The author expects a broader market rotation away from tech and recommends considering investments in financials and real estate, which offer better value.

Aleksandra Zhilenkova/iStock via Getty Images

Dear readers/followers,

You’re not used to getting tech-oriented articles from me, but I think it’s important to address the recent tech-driven market rally and consider the possibility that a rotation away from tech might be coming soon. And what better company to illustrate this on than Nvidia Corporation (NASDAQ:NVDA).

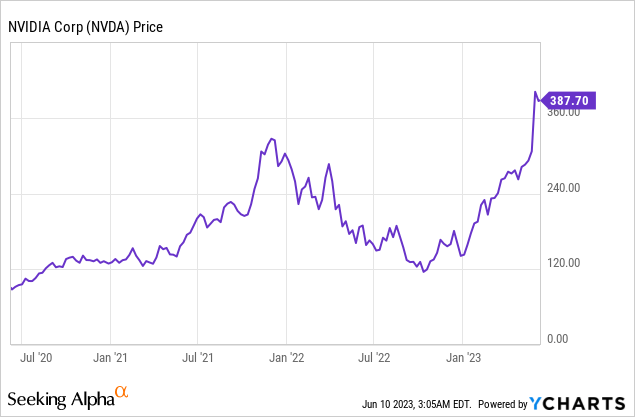

Nvidia recently reported their Q1 2023 earnings and stunned most investors. The company reported quarterly revenue of $7.2 Billion, up 13% YoY and well above the expected $6.5 Billion. On top of this strong growth, the company also delivered a very solid gross margin of 66.8% – the highest over the past 12 months. Quarterly diluted EPS totaled $0.85, up 28% YoY and 44% QoQ.

The results were essentially great, beat expectations by a mile, and there really wasn’t anything bad. What really shocked everyone, though, was management’s guidance for quarterly revenue of $11 Billion in Q2 of this year. That’s this quarter, and it’s up 52% from Q1! The company says that it expects this extreme growth to be driven primarily by their data center segment, which is currently experiencing massive tailwinds due to AI. Moreover, management also expects to improve their gross margin to 68.6%.

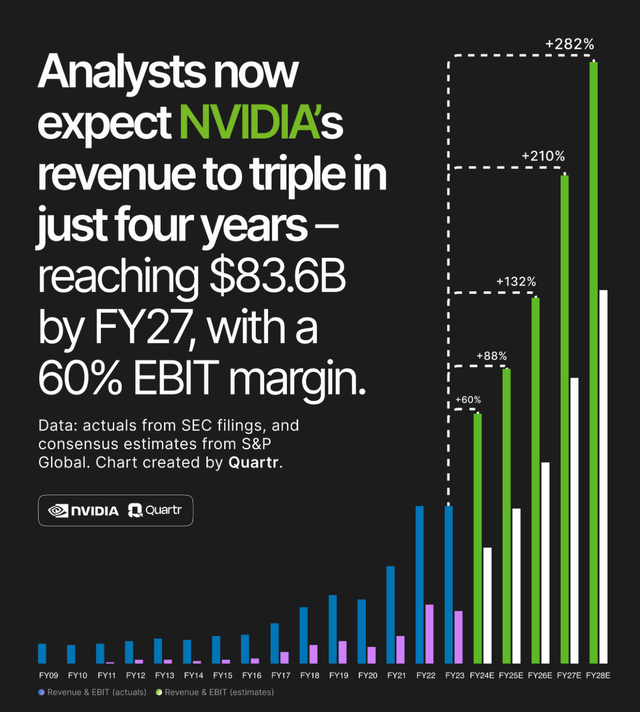

Such aggressive guidance is unheard of, even in tech, and shows that management has very high confidence that they can deliver exponential growth over the next several quarters to years. This guidance has understandably caused a re-rating of the stock, price jumped up by 25% in pre-market and analysts updated their forecasts for the company. As of now, the consensus on S&P Global is for revenue and EBIT growth to go exponential (see chart below). EBIT is expected to almost double this year alone and this growth is now forecasted for the next five years, with revenues tripling by 2027.

It’s obvious that the company is doing well, but anytime the forecast calls for an aggressive acceleration in growth, I’m a bit skeptical if the company can truly deliver this level of growth. I’m probably in a minority, though, because following the recent increase in price, the stock now trades at extremely high valuations. Vs 2022 earnings, the stock trades at a P/E of more than a 100x. Vs forward 2023 earnings (if the forecast materializes and that’s a big if in my opinion) the P/E is closer to 50x.

But the thing is those multiples are extremely high, meaning the margin for error for the company is extremely small. If they cannot deliver and grow half as fast as expected, which would still be amazing, the stock could very easily re-rate to a 30-40x multiple on much lower-than-expected earnings, which would cut the stock price in half. This in my opinion is not investing.

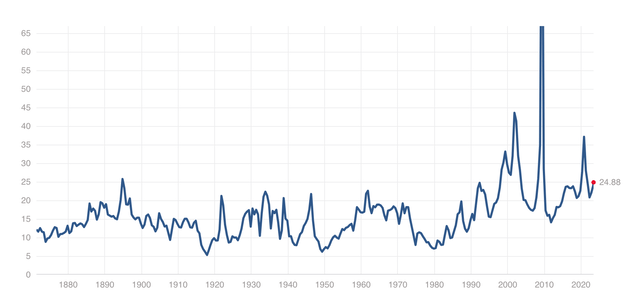

Of course, Nvidia is not alone. Most of tech is now trading at high P/E multiples, which has dragged the S&P 500 P/E ratio to almost 25x. Just look how far this is from the long-term average that was formed during a period when we had high interest rates. Sure, after 2000 the average is closer to 20-25x, but that was during a time with no inflation and zero interest rates. And although I’m a long-term bull and do think that things will get back to normal, such high P/E leaves very little space for multiple expansion and makes for a terrible risk-reward on the index. I mind you that things are the way they are due to tech, so really the risk-reward on tech is even worse than that of the broader index.

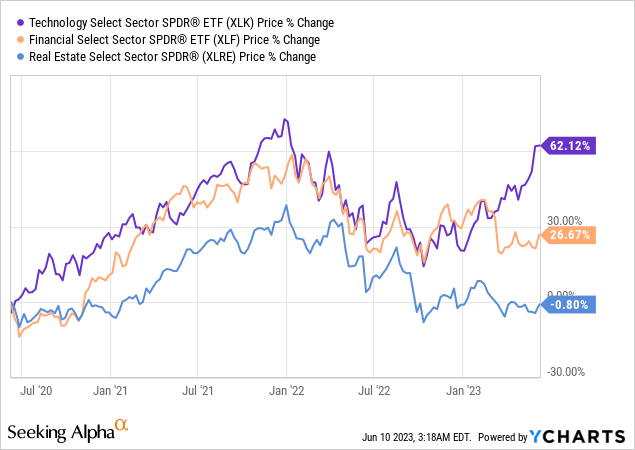

This is why, I personally sold all of my tech positions recently, including my two largest tech holdings Microsoft (MSFT) and Alphabet (GOOGL) and now have zero exposure to the sector. The reason why lies in the chart below. The tech sector has decoupled from the rest of the market, which should really only happen in calm economic conditions and loose monetary policy (i.e., the start of a bull market). Currently, we have neither, which is why I expect this decoupling to be temporary.

In particular, I expect a broader market rotation to start taking place as institutions rotate away from tech, which has now got too expensive. Of course, it’s hard to know where they will rotate their money to, but my two favorite options are Financials and Real Estate, which is where I’m primarily positioned at the moment.

The question you need to ask yourself is whether you want to pay 50-100x earnings for growth that may or may not happen or if you would rather invest based on value today into real estate which trades at a 30-60% discount to net asset value. For me, the former is speculating, and the latter is investing, but I look forward to hearing your comments below. Oh, and regarding my rating of Nvidia, it’s a STRONG SELL here for me for the reasons discussed.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

If you want full access to our Portfolio and all our current Top Picks, feel free to join us at High Yield Landlord for a 2-week free trial

We are the largest and best-rated real estate investor community on Seeking Alpha with 2,500+ members on board and a perfect 5/5 rating from 500+ reviews:

![]()

You won’t be charged a penny during the free trial, so you have nothing to lose and everything to gain.