Aadi Bioscience: Taking mTOR Inhibition To The Next Level

Summary:

- Shares have lost half their value since reverse merger with Aerpio Pharmaceuticals.

- Aadi aims to deliver on the broad potential of mTOR inhibition via nab technology to achieve wide therapeutic index and greater target suppression.

- Registrational data for Fyarro in PEComa showed impressive durability which is now translating into encouraging launch metrics out of the gate.

- Institutional clustering and extent of leadership’s relevant prior experience both stick out as green flags to my eyes.

- AADI is a Buy in my view, with key catalyst being initial readout of PRECISION1 trial in 2023. Risks include dilution in the near to medium term, disappointing data and delays in timelines.

Artur Plawgo/iStock via Getty Images

Shares of precision oncology upstart Aadi Bioscience (NASDAQ:AADI) have lost half of their value since reverse merger with Aerpio Pharmaceuticals was closed in August of 2021. Year to date return is slightly less negative at -45%.

I’ve been following this small biotech company since it arrived on the public market given the outsized opportunity for Fyarro (nab-sirolimus) in cancer patients with TSC1 and TSC2 inactivating alterations (10k+ patients in the US alone). However, I waited for additional derisking via Fyarro approval in the ultra-rare indication of PEComa as well as for further progress in PRECISION-1 tumor-agnostic registrational study before allowing myself to revisit.

Now that preliminary data is just a few quarters away and Q2 conference call revealed encouraging launch metrics out of the gate, I look forward to digging deeper and determining whether there’s sufficient rationale for us to initiate a position in the near term.

Chart

Figure 1: AADI weekly chart

When looking at charts, clarity often comes from taking a look at distinct time frames in order to determine important technical levels and get a feel for what’s going on. In the weekly chart above, we can see share price steadily decline to current lows at the $12 level. To my eyes it would seem that a bottom established as this level has held since May, but it’s always possible the decline continues. My initial take, being more familiar with this story from prior due diligence, is that investors (and catalyst traders for that matter) would do well to attain desired exposure at current levels ahead of the major data catalyst coming up in 2023.

Overview

Founded in 2007 with headquarters in Los Angeles (39 employees), Aadi Bioscience currently sports enterprise value of ~$150M and Q2 cash position of $118M providing them operational runway for ~5 quarters (will likely raise access more funding by the end of the year).

While I’m quite familiar with the story from previous due diligence, Morgan Stanley Healthcare conference webcast was helpful in bringing me up to speed on the present snapshot.

CEO Neil Desai reminds us that the story began in the Abraxis Bioscience days where the albumin technology platform was developed and Abraxane approval served as proof that you can get high tumor drug levels due to the mechanisms that albumin brings. I remind readers that Abraxis was bought out by Celgene in 2010 for $2.9 billion.

After this initial success, Desai and team worked on other molecules with the same technology and sirolimus (aka rapamycin) is the mTOR inhibitor they are working on now. They took sirolimus into this platform and developed it first for PEComa due to high prevalence of mTOR pathway mutations (worked quite well). Albumin technology carries a lot of drug into tumor and overcomes limitations of other mTOR inhibitors which can’t effectively suppress the mTOR target. Second and more importantly, they are developing the drug candidate in a tumor agnostic setting for TSC1 and TSC2 alterations.

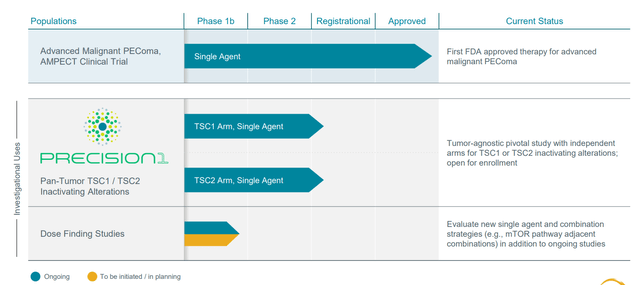

Figure 2: Pipeline

mTOR has long been known as an important target in cancer and drugs approved from this class include sirolimus, everolimus, etc. However, these drugs did not become as widely accepted as initially hoped for and limitations were driven primarily by poor PK (how the drug acts in the body), poor absorption (highly variable), narrow therapeutic index (can’t up the dose to get optimal amount of drug into tumor) and poor target suppression. Thus, with nab-sirolimus (Fyarro) management hopes to finally deliver on the broad potential of mTOR inhibition by overcoming all of these limitations (can get very high drug levels into the tumor and have a very wide therapeutic index and therefore greater target suppression and ultimately better efficacy).

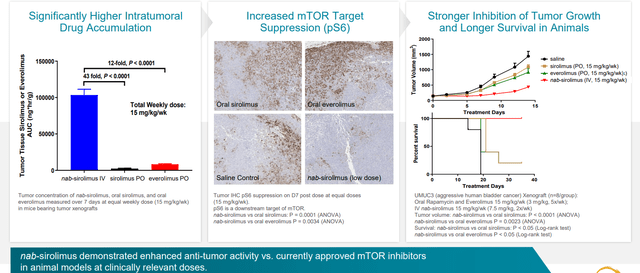

Figure 3: Higher intratumoral concentrations drive increased target suppression and tumor growth inhibition in bladder cancer xenograft

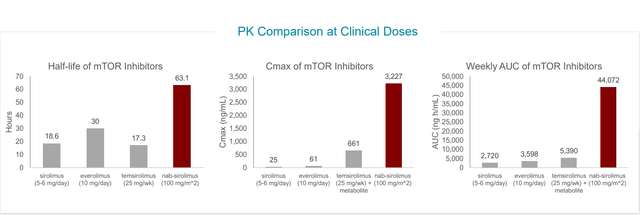

Versus other mTOR inhibitors, nab-sirolimus has a very long half-life and order of magnitude higher tumor penetration. At target level, they have almost complete suppression which is not possible to achieve with other mTOR inhibitors.

Figure 4: Nab-sirolimus achieves higher AUC, Cmax and longer half-life than other mTOR inhibitors

Moving on to the initial approved indication of locally advanced unresectable or metastatic malignant perivascular epithelioid cell tumor (PEComa), this is a very rare form of sarcoma and incidence numbers (new patients in US alone each year) are in 100 to 300 range with similar numbers elsewhere. PEComas occur near blood vessels and can occur at almost any location in the body. Highest prevalence is in the uterus, abdominal cavity in general but can also be in brain, colon, etc. There are no prior approvals for PEComa but some case reports for mTOR inhibitors showed activity which sparked their interest in pursuing this indication for initial approval.

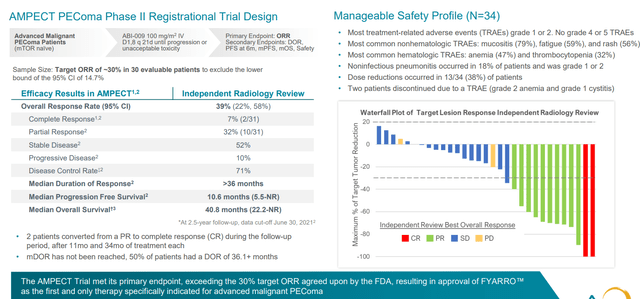

30 patient pivotal trial was pre-negotiated with the FDA (sufficient for such a rare disease) and study was designed to have 30% response rate as hurdle for approval (ended up with 39% response rate). A striking result other than ORR was duration of response (in excess of 36 months, median not reached with median PFS 10.6 months and survival of 41 months).

Figure 5: AMPECT PEComa registrational study met endpoints with manageable safety profile

Since then, drug is on the market as of February this year and launch is off to a strong start. Acceptance of clinical profile has been strong across the oncology community in the US (most differentiating feature is the durability of responses, which is not seen with first generation mTOR inhibitors). Safety profile is predictable and manageable (oncology community has substantial experience with mTOR inhibitors). They’ve had a nice tailwind via early NCCN recommendation as only preferred treatment option for PEComa which helped with adoption and reimbursement. In Q2 they saw north of 60 accounts ordering the drug (proxy for number of patients put on therapy) and reorder rate for those accounts is above 80%. Adoption in community setting is also encouraging (over 40% of prescribing accounts) and stronger than management would have predicted.

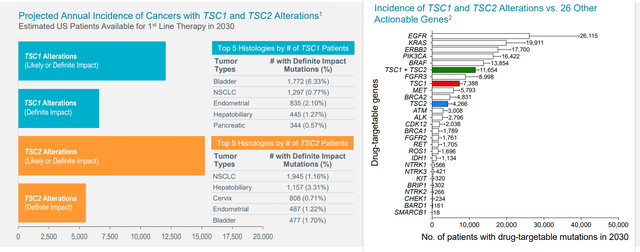

Moving on to targeting TSC1 and TSC2 mutations, this evolved from their PEComa experience (over 50 % of these patients sport such mutations). The mutation exists across all tumor types and averages out to just under 2% of all tumor types (fairly large population on annual basis, around 12,000 patients with advanced cancers in the US alone). In the PEComa study, the subset of patients with TSC1 and TSC2 mutations had much higher response rate than the overall population. Overall data from a few other types of tumors was presented at ASCO with encouraging response rate. Additionally, they reproduced this with PEComa patients who were previously treated with Gen 1 mTOR inhibitors and failed (had good response on Fyarro).

These pieces of the puzzle when put together formed the rationale for going after this larger population and so they initiated the PRECISION-1 tumor agnostic trial. As opposed to thinking about specific tumor types, the trial is all-comers all tumor types and all indications are being pursued broadly within the study as has been the case with other tumor agnostic therapies. As for different subpopulations, bladder cancer has relatively high expression as do some types of lung cancer and hepatobiliary cancers (endometrial as well). Patients should have been exposed to prior standard or approved therapy, so most of these patients come in 2nd line, 3rd or 4th depending on tumor type.

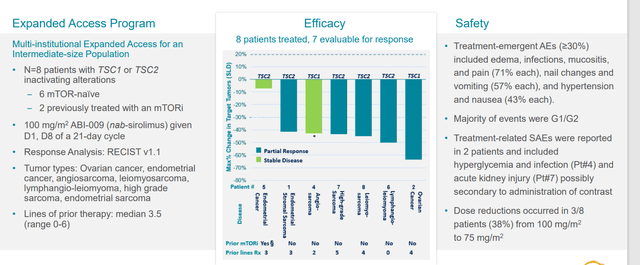

ASCO data last year in 7 or 8 patients included those with extensive prior therapy (ovarian, endometrial, sarcoma subtypes, etc). Common thread was they had to have TSC1 or TSC2 mutation (5 of those 8 patients had very good responses, a good indication that the drug can work outside of mutation in the right mutation).

Figure 6: Early clinical experience in other tumor types

Within PEComa itself, they had 14 patients with TSC1 or 2 mutations with response rate of 64% (formed basis of push into tumor agnostic indication).

mTOR inhibitors are already known and approved for certain indications such as kidney and breast cancer. So, data is important for where they see responses after another mTOR inhibitor has failed to really show differentiation (drug inhibits target at much greater level than predecessors). This helps them to think about other indications where mTORs have been used (looking at these for expansion potential in the future).

Registrational study was initiated in Q1 2022, so the plan is in 1H 23 release some preliminary data (however many patients enrolled by that point, sounds like it could be low). They will discuss response rate, safety information and whatever durability initially observed. Final data will be in 2024 after they complete enrollment of 120 patients (60 patients for TSC1 and 60 for TSC2). As for pivotal results, they hope to exceed the bar they’ve set with the FDA but few details are given. From what I recall with fellow precision oncology peer Merus (MRUS) and Zeno results in NRG1+ tumors, the bar for response rate was set around the 30% level. The current focus is getting a bunch of centers active and enrolling, but they are still in early phase (anticipate good enrollment rate as they also engaged NGS providers who do TSC1 and TSC2 testing, can do just in time enrollment through their networks). If they find a patient with TSC1 and TSC2, they can active center for that patient quickly. In addition, they are partnering with US Oncology (largest community network in the country). Data could be presented at scientific conference or via company event.

As of Q2, they had $119M in cash with runway into 2024 (still think they will access more funding in the next couple quarters). 2023 to 2024 is all about expansion of indications for Fyarro beyond TSC1 and TSC2 mutations (go after combinations with targeted therapies such as RAS, RAF or MEK). mTOR signaling becomes a resistance pathway for those drugs, so this would be a rational combination and perhaps by next year they kick off some new combo trials. They will complete evaluation by the end of the year and then announce which trials make the most sense to pursue (some company-sponsored, some investigator-initiated).

Other Information

For the second quarter of 2022, the company reported cash and equivalents of $118.7M, and a net loss of $18.3M. Management reiterates that they have runway into 2024, but I continue to believe we will see a financing in the next couple of quarters. Total revenue for Fyarro sales was an encouraging $3.4M out of the gate.

As for the conference call, management notes for launch that as of July 1st the Centers for Medicare and Medicaid Services (CMS) has assigned a permanent J-code for Fyarro. Regarding enrollment of the PRECISION-1 study (most material to our thesis here), the stated goal is to open the trial in at least 20 major cancer centers and 120+ treatment sites in the US by the end of the year (already underway in Memorial Sloan-Kettering Cancer Center City of Hope, The Barbara Ann Karmanos Cancer Center, Roswell Park Cancer Center and UCLA). As noted prior, NGS platforms allow them to routinely identify patients with TSC1 or TSC2 inactivating alterations who are eligible for treatment. This is a pretty nifty process, as patients out of network can be identified and referred to a locally participating center in a rather streamlined process. Management believes this multifaceted approach to patient finding will allow them to achieve full enrollment within 24 months (still quite a long time to wait). Also of interest to me is progress for nab-sirolimus in other opportunities via monotherapy or more likely combo trials. Both the problem and opportunity for a small company of this size is that there is a “broad swath of indications” to choose from where mTOR signaling is a prevailing driver or even resistance mechanism and they should not tackle too much all at once (carefully evaluate indications for best rationale and optimal chances of success).

Looking over my prior notes to determine if there’s anything else I missed, it’s worth noting that the board of directors is quite stacked (representatives from Avoro Capital and former Chairman of Immunomedics, bought out by Gilead for $21 billion, as well as heads of KVP Capital and Acuta Capital as well). I view this clustering as a green flag.

As for which indications in the basket study could prove most interesting, from TCGA information, PEComa is the most highly mutated with 50% of patients sporting TSC1 or TSC2 mutations. Other indications express in lower amounts but are still significant (lung cancer half to 1%, gynecological cancers 2.5% to 3%, breast cancer 2.5% to 3%, liver cancer 5% to 7%, bladder as high as 9% for TSC1, etc.

Figure 7: TSC1 and TSC2 inactivating alterations across all cancers

As for institutional investors of note, clustering here is a good sign including Avoro Capital with 10.7% stake, Acuta Capital with 7.3% stake and Venrock with 7.3% stake. On the other hand, Orbimed has sold down its stake to a negligible level, RA Capital sold out of its 2.4 million share stake completely and BVF appears to be steadily selling down its stake as well (currently at 4%). As for insiders, it’s nice to see the CEO has significant skin in the game with 1.9 million share ownership.

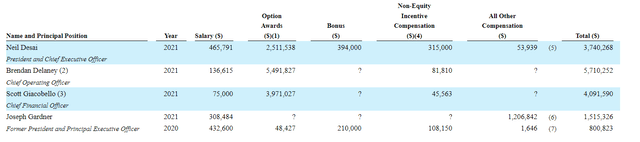

As for relevant leadership experience, as noted prior Dr. Neil Desai is the company’s CEO and founder (invented nab technology and created value at Abraxis Bioscience when it was acquired by Celgene, also worked at Celgene for 6 years including as VP of Strategic Platforms). COO Brendan Delaney served prior as CCO of Constellation Pharma before it was acquired by MorphoSys for $1.4B and prior to that as CCO at Immunomedics until it was acquired by Gilead. CFO Scott Giacobello served prior as CFO of GW Pharmaceuticals until it was acquired by Jazz Pharmaceuticals for $7.2 billion (and prior to that as CFO of Chase Pharmaceuticals which was sold to Allergan). CMO Loretta Itri served prior as CMO at Immunomedics and prior to that as EVP Regulatory Affairs at The Medicines Company.

Moving on to executive compensation, cash portion of base salary is quite reasonable at sub $500k. On the other hand, option awards for CEO, COO and CFO appear on the high side ranging from $2.5M to ~$5.5M.

Figure 8: Executive compensation table

The important thing is to avoid companies where the management team is self-enriching instead of creating value for shareholders and looking at compensation is one of several indicators in that regard.

Moving onto useful nuggets from members of the ROTY community, MikeCriv provided the following thoughts back when AADI initially made it onto the public market:

Sanofi bought out Ablynx for $4.8B and it had a nab drug as well. Here is a very good article on nab. PEComa is a rare indication but it gets AADI through the front door in order to explore the rest of the mTOR cancers after approval via the sNDA process which is less costly. Peak sales could be in excess of $2B across multiple indications (Abraxane achieved peak sales of $1.25B). Regarding longer half-life, the albumin shell has to catabolized to release the active drug component. The accumulation in the cancer cell with the albumin nanoparticle intact is the key to the bullish thesis!

As for IP, the company exclusively licensed 10 patents from Celgene relating to Fyarro. 4 issued US patents are concerning the composition of matter and method of use claims, with first issued patent expected to expire in 2029 and other three to expire in 2030, 2036 and 2037. The company also licensed 174 pending U.S. applications and related pending applications in Europe, Australia, North America, South America, Africa, and Asia. Lastly, they also licensed two pending PCT patent applications directed to composition of matter and new uses related to this product, which if granted, are expected to expire in 2040.

As for other useful nuggets from the 10-K filing (you should always scan these in your due diligence as many companies like to sweep undesirable elements under the rug), it’s important to note that the company has no internal manufacturing capacity nor plans to do so. They rely on third parties to manufacture Fyarro (potentially entails more risk in the sense of any supply disruptions or simply having less control over the overall process). In fact, they obtain Fyarro directly from Fresenius-Kabi (at least it’s a very well-established company).

Final Thoughts

To conclude, highly experienced management team at this targeted oncology company continue to steadily make progress in the PRECISION TSC1/2 study as well as with initial commercialization of Fyarro in lead indication. Sales out of the gate are encouraging, and peak sales estimates of $1.5B or more in the TSC1 and TSC2 tumor agnostic setting contrasts nicely to current enterprise value of $150M. It’s been said that 40% of all drug development is dose and PK, and so it appears that Aadi might finally be able to deliver on the promise of mTOR inhibition where all predecessors have failed or solely achieved a sliver of what’s truly possible here regarding broad potential (thanks to wide therapeutic index and greater target suppression). My key caveat to readers again is that this is a “single asset” story, so portfolio weighting and exposure should be kept lower than other holdings in companies that have multiple shots on goal in the clinic.

For readers who are interested in the story and have done their due diligence, AADI is a Buy. One potential strategy is to purchase only a small pilot position, from there waiting for a potential secondary offering by year end and then adding more exposure after that overhang is cleared.

From an ROTY perspective (focus on next 12 months), I can see the rationale for accumulating up to a 4% or 5% portfolio weighting at maximum (no more than that considering this is a single drug story). From my end, I wish to wait until data readout (likely mid to late 2023) is closer before considering for the ROTY portfolio. Also, I would like to wait until the necessary financing is out of the way.

Risks include additional dilution in the near to medium term, delays to clinical timelines (data being pushed out to 2024 if recruitment of PRECISION study is not at sufficient pace), smaller market opportunity than originally estimated and disappointing data (unexpected safety signals or efficacy not at the level of prior results).

Author’s Note: I greatly appreciate you taking the time to read my work and hope you found it useful. While I post research on many companies that interest me, in ROTY (clinical stage) and Core Biotech (commercial stage) portfolios I own just 15 or fewer names in order to focus on stories that are highest conviction for me.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: Disclaimer: Commentary presented is NOT individualized investment advice. Opinions offered here are NOT personalized recommendations. Readers are expected to do their own due diligence or consult an investment professional if needed prior to making trades. Strategies discussed should not be mistaken for recommendations, and past performance may not be indicative of future results. Although I do my best to present factual research, I do not in any way guarantee the accuracy of the information I post. I reserve the right to make investment decisions on behalf of myself and affiliates regarding any security without notification except where it is required by law. Keep in mind that any opinion or position disclosed on this platform is subject to change at any moment as the thesis evolves. Investing in common stock can result in partial or total loss of capital. In other words, readers are expected to form their own trading plan, do their own research and take responsibility for their own actions. If they are not able or willing to do so, better to buy index funds or find a thoroughly vetted fee-only financial advisor to handle your account.

Take a 2 Week Free Trial and Join 500+ biotech investors and traders in the ROTY Biotech Community!

- Participate in a Live Chat where members generously share due diligence, top holdings and genuinely wish to see each other profit.

- Get access to JF’s highest conviction ideas, trades & updates for model portfolios, personal DCA account and all my archives for DD purposes

- Trade to Live, NOT Live to Trade philosophy (low maintenance, follow our thesis and make changes to positions only as merited)