Summary:

- Abbott’s 2013 AbbVie spinoff has generated two outstanding blue chip dividend growth aristocrats.

- Ten years later each has a bright future despite major challenges.

- Both are fully priced; both are excellent candidates for acquisition on pullbacks.

Thibault Renard/iStock via Getty Images

Abbott (NYSE:ABT) and AbbVie (NYSE:ABBV) are two long term favorites. I have covered each of them extensively over the years. My most recent Abbott article was 09/2022’s “Abbott’s Rough Patch: What Gives?” (“Rough Patch”). My most recent AbbVie article was earlier, 02/2022’s “AbbVie: Portfolio Topper – Try It You’ll Like It”.

As I explain in this article both Abbott and AbbVie are solidly situated. Each has carved out favorable spots in its respective industry. Each is a reliable dividend aristocrat with an exemplary record of raising its dividend. Each is a long term buy, albeit buying decisions in a treacherous market require careful attention to the particulars of each investor.

Miles White, Abbott’s now retired CEO, engineered the epic Abbott/AbbVie split.

Abbott was founded long ago towards the close of the 19th century by an enterprising physician with the goal of producing effective medicines for his patients. Over a hundred years later its then CEO Miles White determined that its business had become too concentrated in its fully-human monoclonal antibody Humira.

FDA approved in 2002, Humira had grown to become the world’s leading pharmaceutical product. White’s solution to this over concentration was to form a new company, AbbVie, to own Humira and a scattering of lesser therapies. He then spun this company off as a separate entity to be owned by Abbott’s shareholders.

Following the completion of the spin:

… 2013, its first full fiscal year as a separate company, AbbVie reported total product sales of ~$18 billion. Of these sales, ~$10.6 billion were from Humira. AndroGel at ~$1 billion was next. The next four, Kaletra, Synagis, Lupron, and Synthroid counted for a little over $3 billion. The balance of AbbVie’s sales were made up of a scattering of products, no one of which contributed more than $.5 billion to its revenues.

The division of Abbott has worked brilliantly. AbbVie has worn its label as the Humira company capably. It has maintained a dual focus. It has maximized its Humira revenues and has used them to acquire and develop additional therapies as described below.

In the meantime freed from the complexities of managing Humira, Abbott has issued a revised 2022 EPS guidance of $5.17-$5.23. At its midpoint this reflects a growth of ~128% from its actual EPS of $2.28 for 2014. AbbVie has grown its 2014 EPS of $3.31 to guided 2022 EPS at a midpoint of $13.86. AbbVie’s 10 year growth works out to a stellar ~318%.

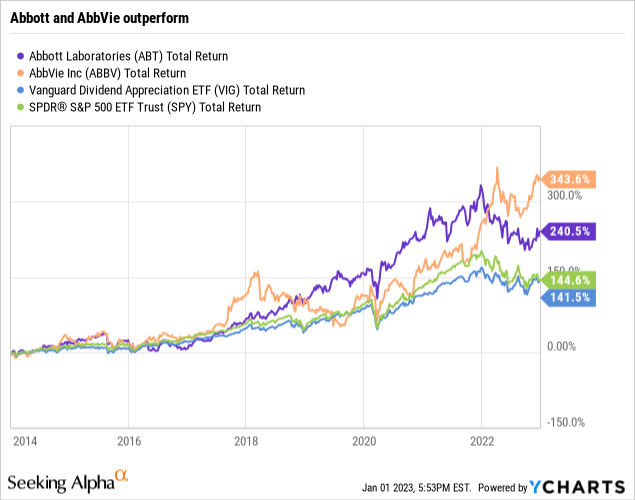

The market has rewarded their percentage increases in EPS as shown below:

In terms of decadal total return, they have both handily outstripped the market as reflected above. AbbVie has been the unquestioned star with a total return of >343%; Abbott clocked in with a total return of >249%. The SPY and Vanguard dividend appreciation ETFs were only able to muster total returns of ~144% and ~141% respectively.

The spinoff that Abbott’s exceptional CEO Miles White worked out has created two companies who have grown their combined market caps to ~$476 billion. Back before the transaction Abbott’s market cap was ~$110 billion.

Abbott and AbbVie have challenges but nonetheless are good selections for continued outperformance.

Abbott-General

In Rough Patch I noted that Abbott, on 09/12/2022 trading at $109.55, was down 30% from its Christmas season 2021 trading high of $142.60. I noted that it was a consummate blue chip and dividend aristocrat with a then average $124.89 price target of 22 analysts. I commended the situation as ripe for:

…those looking to start a position in a solid company likely to hold its value, this is a nice entry point.

As I write on 01/05/2023 Abbott’s price hovers around $110.80, little changed from what it was then. Over this same period the S&P 500 has declined slightly. Analysts have tempered their price targets down to a current (01/05/2023) $117.93. Rough Spot cited a package of challenges that were dogging Abbott.

They included macroeconomic issues such as inflation, supply chain, strong dollar, recession risk, and healthcare worker labor shortages. These issues continue for Abbott as they do for every other company in the economy at large. They are issues which effective management accepts while it works to mitigate them.

I have always considered effective management as an Abbott strong point. Accordingly, I figure it will come out in the leading pack, whatever macroeconomic challenges come its way. Unfortunately Abbott also has some issues that are specific to its business.

Abbott-Baby Formula

The two that are drawing the most attention are its baby formula travails and its erratic COVID-19 testing revenues. These are very different kinds of problems. Its baby formula issues are the most concerning.

They first came to light in 02/2022 with an Abbott press release advising that it had voluntarily recalled formula from its Sturgis MI plant. According to the release Abbott voluntarily recalled:

…products after four consumer complaints related to Cronobacter sakazakii or Salmonella Newport in infants who had consumed powder infant formula manufactured in this facility.

Although Abbott’s testing of finished product from the plant detected no pathogens, it took precautionary measures by recalling the powder formula manufactured at Sturgis with an expiration of April 1, 2022, or later. No Abbott liquid formulas, powder formulas, or nutrition products from other facilities were impacted by the recall.

Abbott’s release also stated:

Cronobacter sakazakiiis commonly found in the environment and a variety of areas in the home. It can cause fever, poor feeding, excessive crying or low energy as well as other serious symptoms. It’s important to follow the instructions for proper preparation, handling and storage of powder formulas.

The issue had been percolating in the bowels of the FDA and CDC based on a handful of consumer complaints dating back to 09/2021. The complaints were related to infants with Cronobacter infections who consumed formula produced at the Sturgis, Michigan facility before they got sick; two of the infants subsequently died. The CDC closed its investigation in 05/2022.

Its closing report was written in turgid bureaucratese. I interpret it as essentially clearing Abbott of any causal connection to the illnesses based on whole genome sequencing of available samples. Appropriately, Abbott has never acknowledged any fault on its part in connection with the recall.

The infant formula shortages that followed the plant closing have etched Abbott infant formula into public consciousness with a scarlet letter. Unfortunately this type of issue seems destined to repeat. In 10/2022 Abbott voluntarily recalled certain lots of formula produced at its Columbus, Ohio manufacturing facility.

This time the problem was a small number of bottles from the plant had caps that didn’t seat properly. The problem was not discovered until the problematic product had been widely distributed in the US and around the Caribbean. The plant continued to make formula using other production lines.

As for Sturgis it reopened in 06/2022, only to close on 07/01/2022 due to flooding. It reopened again on 07/10/2022. The billion dollar formula market is important for Abbott. It is unabashed by the recalls.

During its Q3, 2022 earnings call (the “Abbott Call“), CEO Ford advised that Abbott had shipped equivalent amounts of formula into the US market as it did before the recall. He also advised that based on market dynamics Abbott was well on its way to site selection for a new $0.5 billion state of the art infant formula plant.

Abbott-COVID-19 tests

Abbott’s response to the pandemic has rivaled that of the RNA vaccine developers. It developed a variety of testing techniques. It did so quickly and got emergency approvals for them along with gearing up manufacturing to meet the huge demand.

It generated billions of dollars of revenue as follows:

- 2020 — $3.9 billion;

- 2021 — $7.7 billion;

- 2022 — $5.6 billion through Q2, 2022 plus $1.7 billion in Q3, 2022 as stated in the Abbott Call with $0.5 billion forecast for Q4;

- total so far – $18.9 billion.

No one has been able to accurately predict the course of the pandemic as the years roll by. Certainly CEO Ford ruefully recognizes its unpredictability. During the Abbott Call he threw up his hands stating:

…COVID remains as unpredictable as ever with intermittent surges continuing throughout the world.

In response to a wide open question about where he thought Covid revenues were going in 2023, CEO Ford responded:

… if you look at our Q4 number, our Q4 number that we are forecasting is really what I would call an endemic state, right? So about $0.5 billion across the world, across all of our platforms, in a winter season without necessarily forecasting the kind of surge that we saw last year, in that number, we do not have any significant government contracts.

The wildcard that could increase Abbott’s testing revenues would come from government contracts.

AbbVie-General

The big question for AbbVie investors is how it will perform when it faces the full weight of Humira’s US LOE. This is no longer a future issue; it is very much here and now. I have discussed it at length in several recent articles, most comprehensively in 06/2021’s “AbbVie: Beyond Humira, Framing A Bright Future” (“Bright Future”).

Bright Future set out:

- Humira’s multiple approved indications.

- Humira’s revenue trajectory over the years.

- The identity and timing of incoming US Humira competition.

- AbbVie’s long term guidance for 2023 (expects total company sales to decline), 2024 (modest top-line growth expected in 2024), 2025 (rapid return to strong top-line growth), balance of decade (high-single digit compound annual growth rate).

As I write on 01/05/2023, the final word on post LOE expectations has yet to be given. During AbbVie’s Q3, 2022 earnings call (the “AbbVie Call“), CEO Gonzalez advised:

…we anticipate strong [formulary] access for U.S. Humira throughout 2023, and project biosimilars will share access as they become available. We will provide sales guidance for Humira on our fourth quarter call.

While we’re not issuing 2023 guidance today, it is important to note that when we issue our EPS outlook, we expect the lower end of the range to represent for earnings. So while it’s possible 2023 could outperform our guidance regardless of the shape of the erosion curve, we don’t anticipate 2024 earnings will be lower than the initial 2023 EPS guidance given the momentum and growth from another year of our ex-Humira portfolio, which is expected to more than offset any incremental Humira erosion in 2024. We know that many investors have an interest in the timing of AbbVie’s trough earnings, whether that would be 2023 or 2024. The guidance range will provide and give investors additional clarity regarding our expectations for the company’s core EPS.

Earnings for AbbVie’s Q4, 2022 are expected 02/09/2023; so the situation will clarify then.

AbbVie-pipeline highlights

AbbVie’s pipeline is huge. It consists of multiple therapeutic areas including Immunology, Neuroscience, Oncology, Virology, Aesthetics, Eye Care, and Other. In addition to multiple therapies at all stages of development,: it includes the following which have been submitted to the FDA:

- RINVOQ (Upadacitinib, ABT-494) a selective JAK1 inhibitor in treatment of Crohn’s Disease;

- QULIPTA (atogepant) in treatment of chronic migraine;

- VRAYLAR (cariprazine) in adjunctive treatment of MDD;

- Epcoritamab (Gen3013; DuoBody®-CD3xCD20) in treatment of relapsed refractory large B-cell lymphoma;

Its Q3, 2022 10-Q (pp 23-24) lists quarterly revenue of $14.8 billion generated by the dozens of approved therapies in its pipeline with total quarterly revenue contributions >$1 billion:

- from Humira – $5.559 billion,

- Skyrizi – $1.397 billion, and

- Imbruvica – $1.135 billion.

As for Imbruvica notice disappointment below.

AbbVie-pipeline disappointments

Not surprisingly in an operation as advanced and broadly based as AbbVie, all projects do not fare as well as might be hoped. For AbbVie, disappointments reported during the AbbVie Call include:

- Full year aesthetics forecast adjustment to reflect the moderating market growth over the near to medium term, which is expected to predominantly impact Juvederm as well as body contouring portfolio products, which represent higher price points for consumers. While it’s difficult to predict the duration of these economic dynamics, we expect these conditions to persist into 2023.

- Imbruvica’s CLL market, with new patient starts down approximately 20% relative to pre-COVID levels. Given the U.S. CLL market has been consistently lower than our expectation in the past several quarters, we are now reducing our view of the total size of the addressable patient population for this indication going forward. The situation is exacerbated by the recent unfavorable change to the NCCN guideline preference for Imbruvica in CLL, as well as increasing existing and new competition.

- AbbVie is dropping consideration of ABBV-154, its anti-TNF steroid conjugate in treatment of RA; which it is still evaluating it in several other indications.

- AbbVie is stopping its clinical studies and development for ABBV-157, its RORγt inverse agonist. This decision was made due to a new finding.

AbbVie- secession

AbbVie started out on its journey 10 years ago with no corporate operating history. During his opening report for its first Q1, 2013 earnings call its new CEO Richard Gonzalez, a thirty year Abbott veteran and former Abbott President and COO, hit three key points. These have resonated with and endeared him to shareholders and the investment community ever since.

- First and foremost, maximize Humira’s revenues.

- Second, develop a credible pipeline behind Humira.

- Third, grow AbbVie’s dividend.

After perfunctory introductions he opened this first call as follows:

During the quarter, we executed on AbbVie’s key priorities. We drove continued growth of HUMIRA with more than 17% global operational growth. We advanced our pipeline with continued progress across our mid and late state R&D programs. This includes our Phase III HVC program, which is well underway and enrolling rapidly. And we delivered return to our shareholders through a strong dividend.

He then spent the next 10 years, 39 earnings calls, far expanding on these themes. Born in 1954 he is currently 68 years of age. As shown above, shareholders who stuck it out for the whole ride have received a total return of 340%.

During the AbbVie Call, an analyst noted how important Gonzalez had been as architect of AbbVie’s success; he cited the interest in the investment community on his future plans and how succession would occur. Gonzalez made the following points in response:

- AbbVie has a very experienced Board, and an active approach on succession going back to about 2016, 2017.

- The process has proceeded extremely well in developing internal candidates to ultimately assume the CEO.

- There are no plans at all for me to retire in 2023.

- The appropriate time for me to retire is when the business is performing exactly as we expect going forward.

- We’re not going to make any transition until we’ve gone through the biosimilar event, and we’re confident in the performance of the overall business.

- Assuming it’s an internal candidate, the transition will essentially work where we will name a new CEO. And at that point, I will assume the role of Executive Chair for a period of time thereafter.

This response was typical of Gonzalez; it was comprehensive and comforting.

Both companies are highly priced; both are excellent candidates for acquisition on pullbacks.

Abbott-Investment thesis

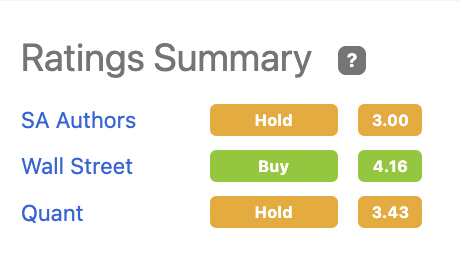

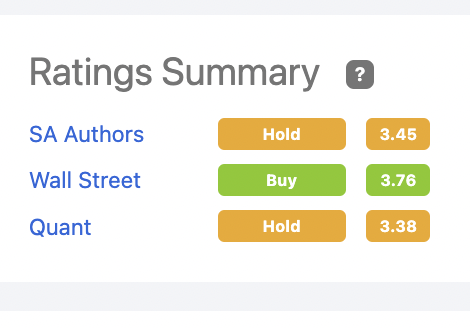

Providentially I have held Abbott shares since before the split, far fewer than I wish had been the case. I have traded around the edges, maintaining a core position. Today as I look at Abbott I see the following on its Seeking Alpha Ratings Summary:

seekingalpha.com

As I pointed out, its Wall Street Analysts Ratings, the only one of the three showing Abbott as a buy, reduced their average price target (from $124.89. to $116.63) since September.

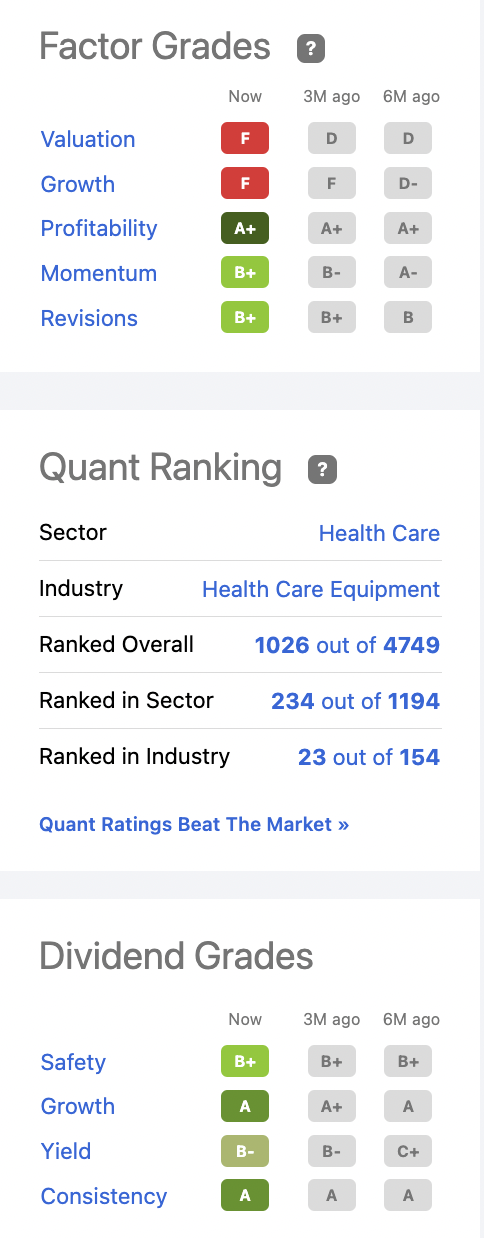

The problem as I see it is that Abbott’s COVID-19 testing revenues have skewed its numbers. This is particularly true for Abbott’s downbeat Quant Ratings per the panel below:

seekingalpha.com

This panel is indicative of a solid company that is overvalued. In Abbott’s case we have a company that operates in four segments. These four are nutrition, diagnostics, medical devices and established pharmaceuticals. All are positioned for long term growth with short term results clouded by temporary conditions as previously discussed. Each plays an important role in advancing the overall Abbott investment thesis.

Former Abbott CEO White pegged Abbott’s longstanding attraction which holds as true today as it did back in 2017 when he described the company as:

…[occupying] strong sectors that are very well positioned in their respective product markets and their respective geographic markets. Our challenge, or at least opportunity now looking forward for the next few years is integrate St. Jude [now 01/05/2023 fully and successfully integrated] and, frankly, focus on the organic pipelines of new products coming, and execute so that we can see the growth benefit of the strength of these four segments around the world.

Abbott has fully lived up to White’s hopes for its new product pipeline and is now a worldwide leader or top contender in key healthcare markets such as diabetes devices, heart devices, diagnostics, and nutrition.

AbbVie-Investment thesis

AbbVie is equally attractive as a long term investment as is Abbott. Its Seeking Alpha Ratings Summary is not an exact mirror of Abbott’s but very close:

seekingalpha.com

As is true for Abbott, Wall Street Analysts are the only group rating AbbVie as a buy. In doing so they are even more dour for AbbVie than for Abbott in terms of average price target of $160.32 on 01/05/2023 as I write calling for a downside of 1.94% from its current price of $163.48.

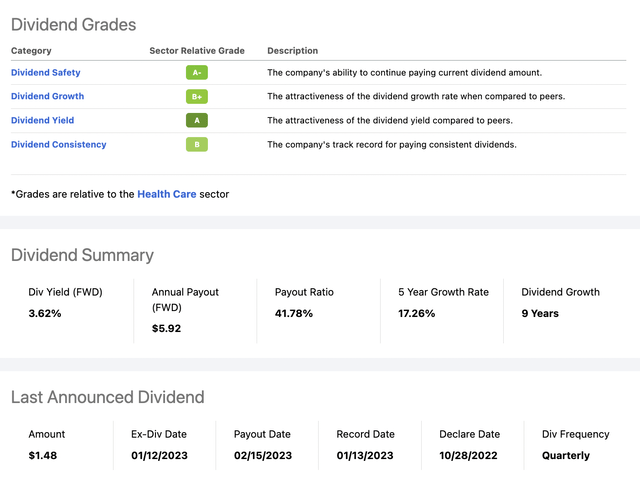

With its upcoming challenges as I described above, AbbVie does indeed seem poised to shed some of its bulky share price. On the other hand, CEO Gonzalez has deftly guided AbbVie for its entire existence. He has set AbbVie’s dividend, currently at 3.62% with a 5% raise announced for 02/2023. Despite AbbVie’s well understood risks, shareholders keep on coming back for more even though it trades within spitting distance of its all time high of $175.91.

AbbVie’s quant dividend scorecard below tells a happy story:

Its dividend scorecard is out of sight. I would wager that this is a situation without match in the S&P 500 in terms of AbbVie’s overall dividend metrics. Not only are the metrics good, we have a stable company with a lengthy positive performance record.

There is however an elephant marring the situation. The elephant’s name is Humira. Will AbbVie’s matchless metrics hold up if Humira has more problems than expected? We will have a better understanding in little more than a month when it issues its new guidance.

Conclusion

Abbott and AbbVie are both great companies. Each has issues that are dogging it. Investors looking to buy a small starter position do not need to be too concerned about overpaying; both companies are likely to grow in the long term sufficiently to cover any downdrafts along the way.

That said, if AbbVie stumbles it may take it several years to recover. Abbott’s near to midterm future looks less risky than does AbbVie’s. I have rated them neutral despite their potential as bulwarks to all dividend growth portfolios. They are prime wish list candidates.

Disclosure: I/we have a beneficial long position in the shares of ABT, ABBV either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: I may buy or sell interests in any company mentioned over the next 72 hours.