Summary:

- Abbott is a well-diversified healthcare company with strong underlying revenue growth and a robust product pipeline.

- The company’s business lines are well-diversified, with direct consumer sales and revenue from healthcare systems.

- Abbott’s key growth drivers include diagnostics, continuous glucose monitoring systems, and the structural heart business.

Tim Boyle

Abbott (NYSE:ABT) is a well-diversified healthcare company developing and manufacturing nutrition, diagnostics, pharmaceuticals, and medical devices. I favor their diversified business lines with strong underlying revenue growth. Abbott has a robust and innovative product pipeline, which could drive future growth for the company. The stock is undervalued, and I assign a “Strong Buy” rating.

Business Diversification

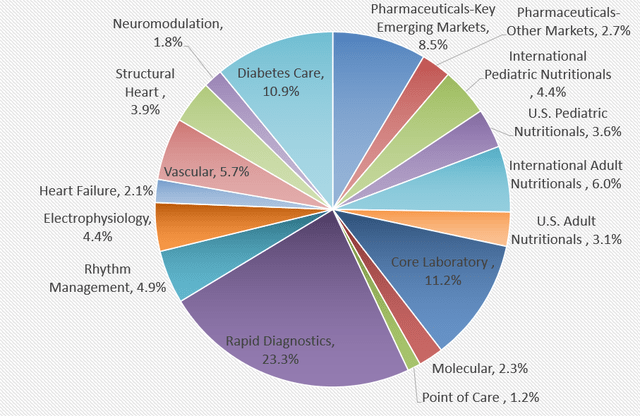

Abbott generated more than $43 billion in revenue in FY22, and their businesses are well-diversified. According to their management, 40% of the group’s revenue is generated from direct consumer sales, while the remainder is paid by overall healthcare systems, including insurance providers. As illustrated in the pie chart below, the Rapid Diagnostic business is the largest segment within Abbott, accounting for only 23% of the total revenue.

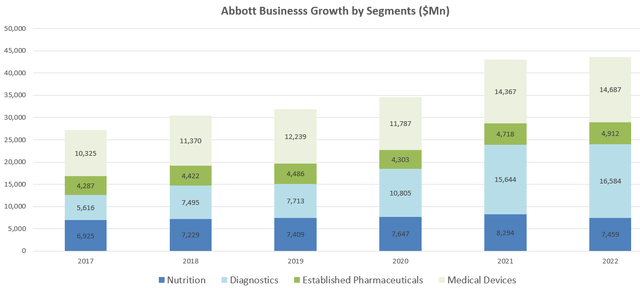

Over the past few years, Abbott has experienced solid growth across its four main segments: nutrition, diagnostics, established pharmaceuticals, and medical devices. The key benefits of their diversified businesses are as follows:

On one hand, end-market diversification helps offset volatility risks for the company. Certain consumer products, like pediatric nutrition items such as Pedialyte, PediaSure, or Similac infant formulas, demonstrate stable demand regardless of the macroeconomic environment.

On the other hand, Abbott’s earnings and growth are not reliant on any specific product category. For example, their diabetes care business sells the FreeStyle Libre platform of continuous glucose monitoring products, representing a rapidly growing market segment where Abbott and DexCom (DXCM) are the main players. However, diabetes care constitutes only 10.9% of the group’s sales. Notably, recent developments in GLP-1 drugs have had a lesser impact on Abbott’s stock price compared to Dexcom’s. I will delve further into the discussion of GLP-1 drugs in the risk analysis section.

Key Growth Drivers

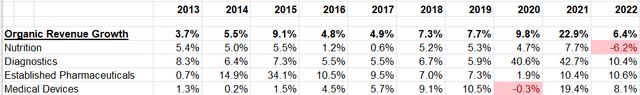

Diagnostics: Abbott’s Molecular Diagnostics and Rapid Diagnostics segments have experienced robust growth in recent years. These diagnostic services now cover infectious diseases, cardiometabolic diseases, and toxicology. Abbott has also introduced several new molecular in vitro diagnostic tests. According to Precedence Research, the global molecular diagnostics market size is expected to expand at a CAGR of 16.16% from 2022 to 2030, with the North American region anticipated to have the largest market share. Abbott offers Alinity m and m2000, which process DNA and RNA from patient samples. Additionally, Abbott’s Rapid Diagnostics division provides Covid tests, contributing significantly to the company’s revenue. In FY20, their diagnostic business saw a 40.6% organic growth, followed by another 42.7% increase in FY21.

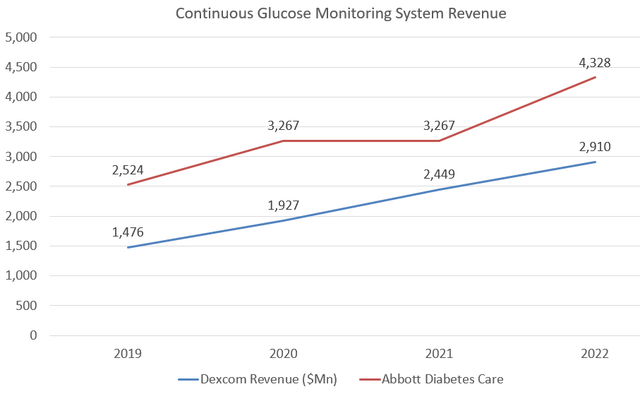

Continuous Glucose and Blood Glucose Monitoring Systems Under the FreeStyle Brand: Abbott and Dexcom are the primary players in the continuous glucose and blood glucose monitoring system market. Both companies have seen substantial growth in recent years and continue to launch new generations of CGM products. In 2022, Abbott received FDA clearance for their FreeStyle Libre 3 system, which offers up-to-the-minute glucose readings and 14-day accuracy in a wearable sensor. I believe CGM products will continue gaining popularity among diabetes patients due to their ability to enhance patients’ quality of life. Moreover, an increasing number of insurance companies are starting to cover CGM products. These monitoring systems help patients manage their glucose levels in real time, preventing serious health complications resulting from uncontrolled sugar levels. This proactive approach not only benefits patients but also reduces financial liabilities for insurance companies.

Structural Heart: Abbott’s Structural Heart business experienced a 13.0% growth in FY22 on a constant currency basis, primarily due to the success of MitraClip, a market-leading device used for minimally invasive treatment of mitral regurgitation. In the structural heart industry, Abbott, alongside Edwards Lifesciences (EW), stands as a key player. The market is expected to surpass $17.4 billion by 2027, according to estimates by GlobeNewswire. These non-invasive structural heart products offer patients an opportunity to enhance their survival rates, particularly concerning complex conditions. I am confident that these innovative products will continue to drive Abbott’s growth in the years ahead.

Strong Pipeline Opportunities

TriClip: In May, Abbott shared data demonstrating the benefits of their TriClip device and submitted it for FDA review. During the Q3 FY23 earnings call, Abbott’s management stated that CMS would review the device in parallel with the FDA. They anticipate this could represent another $1 billion-plus revenue opportunity for Abbott in the future. According to their postmarket study data, using the TriClip system resulted in a reduction of tricuspid regurgitation grade to moderate or less for 77% of the patients. TriClip has already received approval in Europe and Canada. If it gains FDA clearance, it could become a significant market for Abbott. The transcatheter technology offers treatment for patients with leaky tricuspid valves, providing a minimally invasive alternative to open-heart surgeries and reducing the associated health complications.

Eterna: Abbott achieved FDA clearance for Eterna in 2022, marking a significant milestone. Eterna is a rechargeable spinal cord stimulation system designed for the treatment of chronic pain, representing a new area of expertise for Abbott, as they hadn’t ventured into similar products before. In Q3 FY23, their neuromodulation business experienced a remarkable 19% year-over-year growth, largely attributed to the successful launch of Eterna.

During the Q3 earnings call, Abbott’s management expressed confidence in the company’s growth prospects for FY24, citing their robust pipeline of innovative products. Given their track record and ongoing commitment to advancing patient care and medical devices, I share this confidence in Abbott’s ability to continue launching cutting-edge products in the future.

Recent Results and Outlook

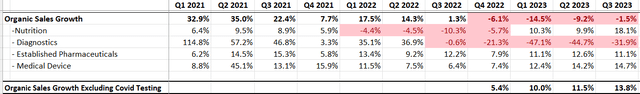

Abbott’s historical organic revenue growth has been remarkable. On average, they have achieved mid-to-high single-digit organic revenue growth across their diversified portfolio.

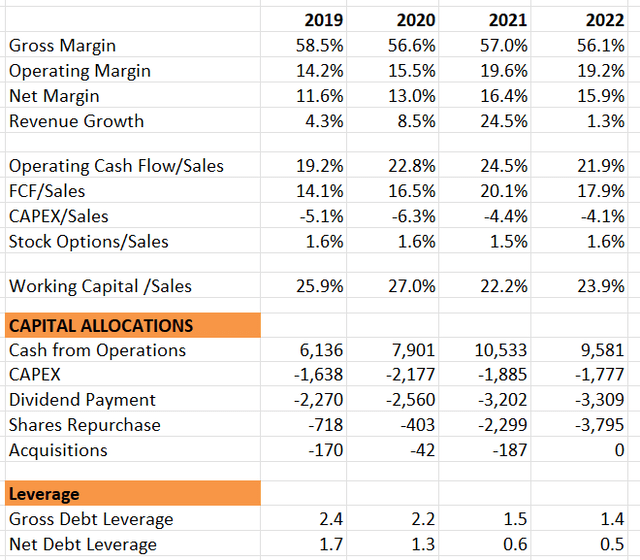

The table below examines Abbott’s financials over the past four years. Their operating margin stands out significantly compared to other medical device companies, likely due to the array of innovative products they have introduced in recent years. These innovations have contributed to the expansion of Abbott’s margins. Additionally, their balance sheet reflects a low gross debt leverage, standing at only 1.4x at the end of FY22.

In terms of capital allocation, Abbott has historically focused on repurchasing their own shares to counter stock options dilution. However, a shift occurred in FY21 when they actively began repurchasing their shares, investing $2.3 billion in FY21 and $3.8 billion in FY22. Additionally, Abbott allocates nearly 50% of its profits towards dividends. Overall, I believe Abbott’s financial strategies reflect a respectable and healthy financial position.

ABT 10Ks – Author’s Calculations

In Q3 FY23, Abbott achieved an impressive 13.8% underlying organic revenue growth, excluding Covid testing sales. However, adjusted earnings before tax decreased by 6.5% year over year, primarily due to robust Covid testing revenue recorded in the previous year. The key highlight from their earnings call was the positive tone set by the management team for FY24 growth. They attributed this growth to the investments made during the pandemic period and the introduction of new product innovations.

For their FY23 guidance, Abbott raised the midpoint of their full-year adjusted earnings per share guidance and narrowed the range to $4.42 to $4.46. They also maintained the double-digit underlying revenue growth guidance for FY23. I find their Q3 FY23 earnings to be quite remarkable.

Key Risks

GLP-1 Drugs: As mentioned earlier, Abbott’s diabetes care segment represented 10.9% of the group’s revenue in FY22. The introduction of Novo Nordisk’s (NVO) GLP-1 inhibitors, a popular weight-loss therapy, raised questions about its impact on Abbott’s continuous glucose and blood glucose monitoring systems under the FreeStyle brand. Abbott’s management addressed these concerns during the Q3 earnings call, stating that a growing number of patients are adopting a companion therapy approach, combining CGM and GLP-1 medications to manage their diabetes. They do not consider these GLP-1 drugs as significant threats to their FreeStyle products.

Moreover, Abbott indicated that it might take 4-5 years for these innovative drugs to reach about 10-15 million Type 2 diabetes patients, a relatively small percentage compared to the half-billion people living with diabetes globally. From Abbott’s perspective, the risk associated with GLP-1 drugs appears to be immaterial. I agree with this assessment; the likelihood is higher for Type 2 diabetes patients to take medications and use sugar level monitoring concurrently. These drugs are designed to assist patients in managing their sugar levels rather than curing diabetes. Therefore, continuous monitoring remains essential. Furthermore, since diabetes care constitutes only 10.9% of the group’s sales, it is manageable from the group’s overall perspective.

China Exposure: Abbott’s exposure to China comprises approximately 5% of their group sales. In this market, Abbott sells infant formulas, medical devices, diagnostic tools, and some established drugs. The company’s management considers China to be a crucial market, both historically and in the future. They acknowledge potential short-term challenges due to geopolitical risks and the local healthcare anti-corruption campaign. However, given that the revenue exposure is relatively small, around 5%, these challenges are perceived as manageable, and I am comfortable with that perspective.

Valuation

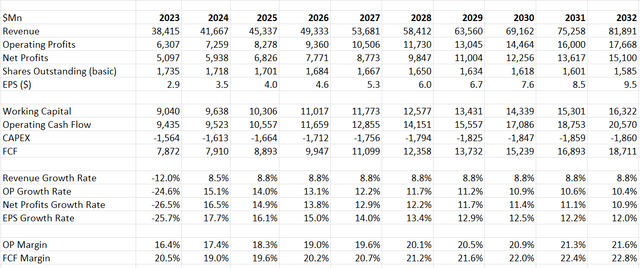

Abbott’s organic revenue growth averaged approximately 7%, excluding their COVID testing revenue contribution. I assume this 7% as the normalized organic revenue growth rate in the DCF model. Additionally, I consider Abbott spending 5% of revenue on acquisitions, contributing 1.8% to the top-line growth. When combined, the top-line growth rate in the model totals 8.8%.

The expansion of their margins is primarily driven by operating leverage and their new product offerings. According to my calculations, their margin expansion is around 40-60 basis points annually if their operating expenses grow at a rate of 6-8% annually.

ABT DCF Model – Author’s Calculations

The model employs a 10% discount rate, a 4% terminal growth rate, and a 14.5% tax rate. Based on my estimation, the fair value of their stock price is $105 per share.

Conclusions

In conclusion, Abbott has demonstrated robust quarterly results with double-digit underlying revenue growth. Their diversified portfolio, coupled with innovative new product offerings, is commendable. Considering the undervalued stock price, I assign a “Strong Buy” rating to Abbott.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of ABT either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.